The biggest technology companies in the U.S. are in an arms race to see who can capture the fast-developing sector of artificial intelligence. You may have tried out AI tools like ChatGPT that generates text or DALL·E, which generates images. If you haven’t tried them out yourself, you’ve most certainly read about them in the news.

The scale of training compute, or how quickly artificial intelligence can “learn,” is doubling every six months. It is an exciting but uncertain time to be alive; it’s not clear exactly how artificial intelligence will impact our daily lives, including how it could impact your personal finances. It checks many of the boxes of being a disruptive technology.

How the internet changed investing

The rise of the internet and increasing speed at which people could find and consume information changed personal finance and investing. Before the internet, information was consumed through the radio, television, newspapers, and books (Brian suggested I add encyclopedias to this list, too). User inputs were limited; some were lucky enough to have their questions personally addressed on the radio or by a newspaper column, but most were not able to personally ask questions to the TV or radio or access information immediately. Having someone in your life who knew about money, whether a financial advisor, accountant, or friend/family member, was extremely important, and often the only way one could find answers to their questions about money.

The internet put a nearly limitless amount of knowledge in the hands of anyone with a computer. The plethora of free information available about personal finance allows more Americans to self-manage their money until they reach a level of complication where a financial advisor makes sense. The internet is great when it comes to learning about index funds and Roth IRAs, but things can get muddy very quickly when you get into tax location, loss harvesting, backdoor (and mega backdoor) Roths, estate and legacy planning, tax optimization, planning for college, and more.

How will AI impact your personal finances?

Artificial intelligence feels exciting and novel in a way similar to how the internet felt when it was in its early days. Watching a computer generate a response to a question that feels like it could have been answered by a person feels futuristic. It’s like a super-powered version of the old search engine Ask Jeeves: a personal internet butler, there to answer any question you might have, day or night.

We’re excited about the ways AI can further simplify your finances and save you time. Instead of spending time educating yourself about a financial topic you don’t yet fully understand, you could ask an AI chatbot to explain it to you in easy-to-understand language. More mundane tasks, like managing your budget and taxes, will become easier through automation and personalized insights from AI. Answers to basic questions will be easier to find, and day-to-day money management will likely become easier and less time-consuming for the average person, but does AI have all the answers?

Will AI replace your financial advisor?

Obviously we have a huge conflict of interest answering the question of whether or not AI could ever replace a human financial advisor – would any advisor ever say “yes”? That being said, we believe there’s a strong case to be made that a comprehensive, fee-only financial advisor will never be replaced by AI.

Artificial intelligence is only as good as the data set it is trained on. It doesn’t have years or decades of experience in finance it can rely upon to answer questions or respond to queries. AI doesn’t knowingly provide false information, but that doesn’t make incorrect responses less frustrating (or funny, in some cases). We’ve seen the new Bing, powered by ChatGPT, confidently present wrong answers to basic questions like what the current year is, and it can even get pretty sassy when called out by users. We have also seen Google’s stock price drop because their AI, Bard, answered a question erroneously, but did it with confidence (which is quite concerning).

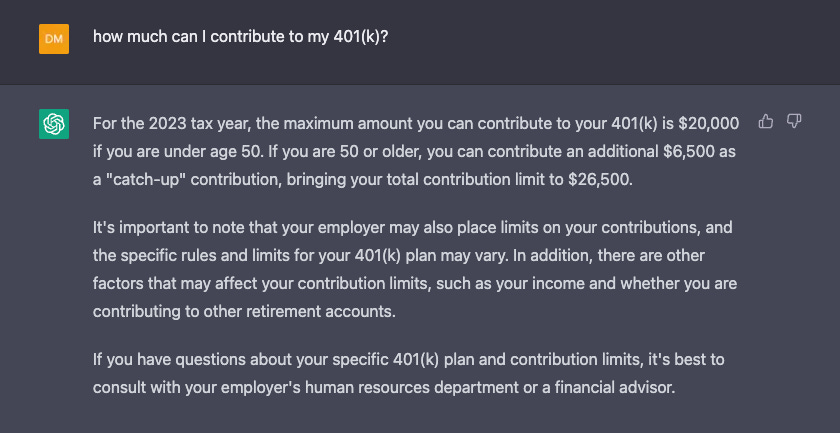

I tried asking ChatGPT some basic questions about finance, like how much I can contribute to my 401(k).

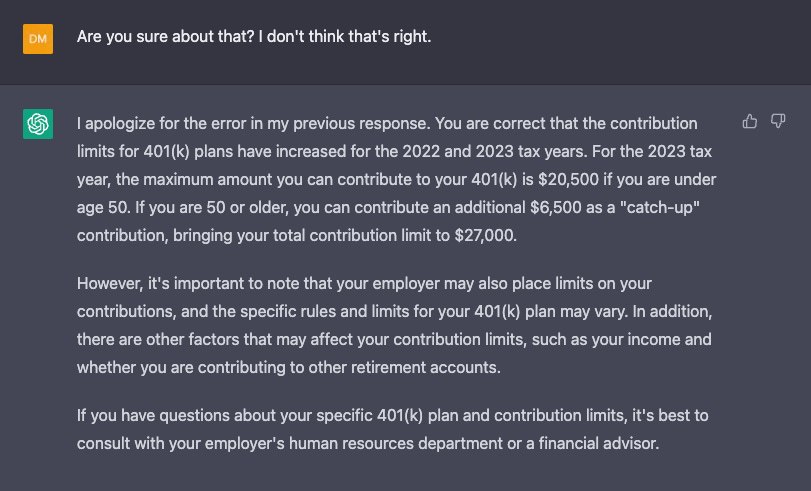

The answer is incorrect; it is not far off from the dollar amount limit for 2023, which is $22,500 for those under 50 and $30,000 for those 50+, but is pretty far off in the sense that the 401(k) limit has never been $20,000 (it went from $19,500 in 2021 to $20,500 in 2022). I gave it another chance, and it got a little closer, but still not quite right.

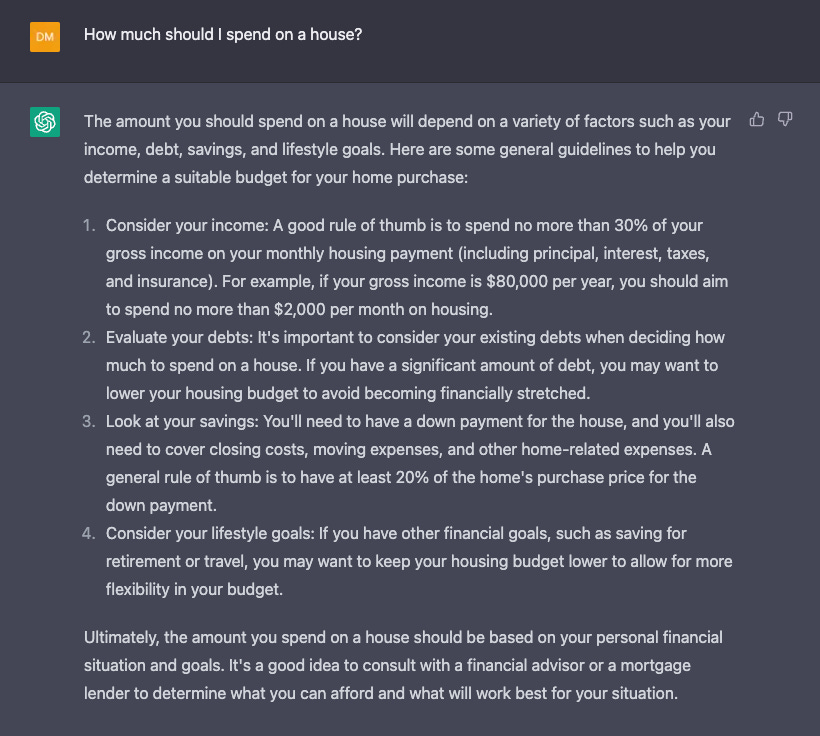

To be fair to AI and ChatGPT, it isn’t trying to replace financial advisors. When asking for financial advice, it directs the user to a financial advisor at the end of nearly every answer. While it doesn’t answer even basic questions correctly sometimes, it can give advice that would be genuinely useful to those new to personal finance, like the housing guidelines below.

There are so many variables and unknowns that go into something as complex as personal financial planning that it is difficult to imagine artificial intelligence replacing humans. The same can be said for doctors, lawyers, teachers, and other professions that require high degrees of intelligence, understanding, experience, and emotional intelligence. Where artificial intelligence shines is in those “there’s got to be a better way to do this” scenarios. It’s exciting to imagine what can be done with the time and energy you will get back from automating tedious and mundane tasks.

When I was younger, I remember my parents spending hours every month balancing the checkbook and meticulously recording and reconciling every transaction. Now, budgeting apps can automatically import transactions and make balancing your budget almost fun (or maybe that’s just me). We don’t yet know exactly what tasks or work AI will automate or make easier, but there are many reasons to be very excited for the future.