Last Updated

October 20, 2025

Read Time

Share

Key Takeaways

Buying a house is likely the single largest financial decision you will ever make. It is almost certainly a six-figure decision and in some cases is a seven-figure decision. Making a smart financial decision when you buy your home does not mean timing the market, buying at the “right” time, or even making a great financial investment. It does mean buying a home that meets your family’s needs, doesn’t blow up your budget, and still gives you margin to invest for the future.

In this Money Guy Ultimate Guide, we will cover our Money Guy housing rule, when it makes sense to buy a home (and when it doesn’t), how to buy in a crazy market, common concerns for buyers, and some creative ways to beat the system.

Free Home Buying Tools & Resources from Money Guy

Copy link to this section: Free Home Buying Tools & Resources from Money Guy

Copied the URL to your clipboard!

We know you want to be smart about one of the biggest purchases of your life. Check out our popular, free resources for potential home buyers. Share them with friends or family members trying to navigate today’s crazy real estate market.

Free Tools & Downloads

- Run the Numbers with our free calculator:

How Much House Can Your Afford? (Calculator) - Download and share our free checklist:

Money Guy’s free home buying checklist (PDF)

Popular Videos, FAQs, & Articles for Buying a House

- What It REALLY Takes To Buy a Home Today (Video)

- Is Homeownership Officially Overrated in 2024? (Video – Cost Breakdown)

- Everything You Need to Know About Mortgages! (Video)

- How do I Buy a House in a Smart Way? Do I Have to Put 20% Down? (FAQ)

- Should I Prepay My Mortgage or Invest More? (FAQ)

- 7 Lessons I Learned From Buying My First House (Article)

From our June 2025 Live Stream - What It Really Takes To Buy a Home Today

Copy link to this section: From our June 2025 Live Stream - What It Really Takes To Buy a Home Today

Copied the URL to your clipboard!

Watch this segment from our popular June 2025 live stream about smart home buying.

Buying a home can be tough these days

Copy link to this section: Buying a home can be tough these days

Copied the URL to your clipboard!

Let’s face it, it’s simply not an ideal time to buy a home.

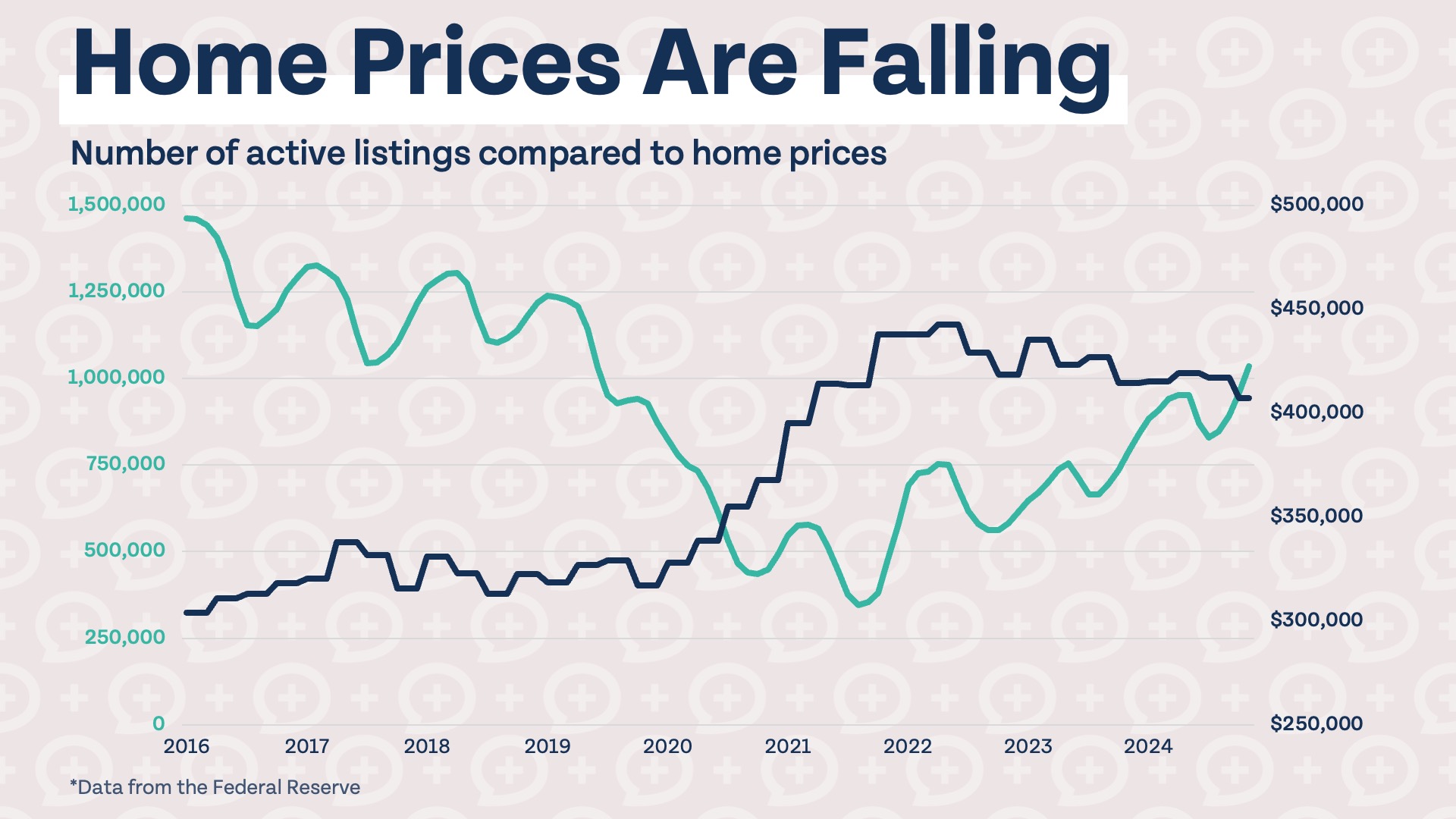

Home prices rose at an annual rate of nearly 20% during the pandemic, the fastest home prices have risen in recorded US history. While home prices are no longer rising at that extreme rate, rising at an annual rate of about 6.4% most recently, higher mortgage rates have made homes increasingly expensive for buyers that finance.

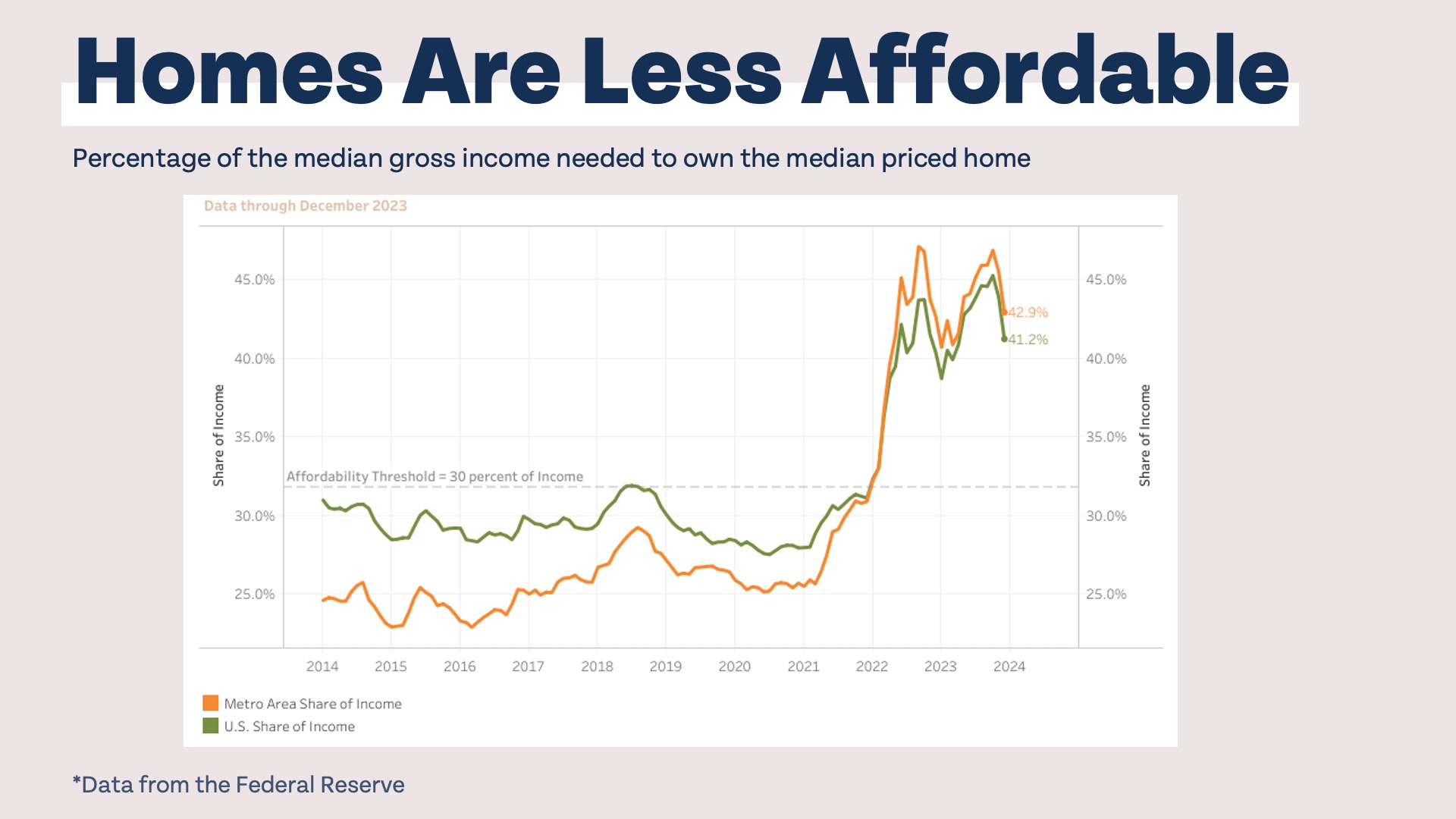

Buyers are getting sticker shock looking at how much homes cost and how much their monthly mortgage payment is going to be per month. Homes that were affordable just a few years ago are suddenly out of reach for many home buyers. The percentage of the median income needed to afford the median home, a great indicator of home affordability, skyrocketed from under 30% in 2021 to above 45% in 2022. While there have been some ups and downs, Americans still need over 40% of their income to buy the median-priced home today.

How are people buying homes in this crazy market?

Copy link to this section: How are people buying homes in this crazy market?

Copied the URL to your clipboard!

Housing inventory has been steadily increasing over the last few years and is now higher than at any point since 2020. Mortgage rates have come down a little from their highs and are now averaging just above 6%. While still much higher than they were several years ago, home prices have remained flat or even declined in some areas.

It’s definitely a better time to buy a house now than it has been for several years, but it’s still a struggle for many Americans trying to buy a home. Here’s how some people are getting creative to get in their dream home.

1. They are using equity from their current home.

The percentage of home buyers buying their first home has dropped significantly, to 26% in 2022 and rebounding a bit to 32% last year. This is well below the long-term average of 38%, and the average age of a first-time home buyer is now 35. It’s hard not to imagine that rising home prices and mortgage rates have caused the portion of first-time home buyers to decline, as existing homeowners have a significant leg up. High mortgage rates hurt everyone, but elevated home prices may be a net neutral to homeowners using equity in their current home to buy a new one. If existing homeowners move to a cheaper area or state, which many have, the rise in home prices could be a net positive for them after it is all said and done.

2. They are making sacrifices.

If you could afford your dream home a few years ago but waited until now to buy, what do you do? In many cases the answer is to make sacrifices. It’s clear that Americans are making sacrifices, with 93% saying they have regrets about their recent home purchase. Not all sacrifices are bad, though, and making concessions could help you get on the home equity train sooner rather than later. Making sacrifices could mean you buy a slightly smaller home, slightly farther away from where you want to be, and not as modern as you wish.

3. They are spending more money.

The percentage of income Americans are spending on housing has gone up significantly in the last few years, which shouldn’t be too surprising. With the increase in home prices and mortgage rates, it would be almost impossible for Americans not to be spending significantly more on housing. Both homeowners and renters are spending a greater portion of their income on housing, which means something has to give. Unfortunately it appears instead of cutting back in other areas, people are choosing to go into more and more debt, with total household debt up over $2.5 trillion since 2020. In addition to the overall rise in debt, more Americans are defaulting on credit cards and auto loans.

Does it make more sense to rent or buy a home?

Copy link to this section: Does it make more sense to rent or buy a home?

Copied the URL to your clipboard!

The current state of the housing market may have you wondering if it even makes sense to buy a home at all right now – and frankly, for some people, the answer is no.

The dream of owning a home has long been a staple, and maybe the staple, of the American Dream. It is viewed as an indicator of success and something people want to obtain, sometimes regardless of whether or not home ownership makes financial sense or not. While we love home ownership, we don’t always love what people do in order to buy a home of their own.

A record share of Americans, 85%, say that now is a bad time to buy a home. In many cases, they aren’t wrong. It is currently cheaper to rent than buy a starter home in all 50 of the largest metros in the United States. Almost everywhere, the cost to own a home is more expensive than the cost to rent a comparable home or apartment. However, the current monthly cost is not the only factor that should be taken into consideration when deciding between renting and buying a home.

While buying a home may be more expensive now, that same home could cost less than renting over time. That’s because when you buy a home you lock in a price and interest rate (typically for 15 or 30 years). Your monthly principal and interest payment do not go up and may even go down if you have the opportunity to refinance at a lower rate. You don’t have a landlord that can decide on a whim to raise your rent by 25%. There are often overlooked housing costs that do go up over time, though, such as property taxes and homeowner’s insurance. Some states are even undergoing a crisis due to how expensive home insurance has become.

If you plan to live in a home for a long time and know you have the cash flow and emergency fund to comfortably afford your home (more on this later), it may be the right time to buy for you even though it doesn’t feel like it. We created a home buying checklist with a list of questions to ask yourself before you make the leap and buy your next (or first) home.

Common concerns for recent home buyers

Copy link to this section: Common concerns for recent home buyers

Copied the URL to your clipboard!

So you found a home you love and the seller has agreed to your offer. Happily ever after, right? Not so fast, my friend. There are several pitfalls to watch out for before and after you close on a home.

1. Inspection

If a deal to buy a home is going to fall apart, there’s a great chance it’s due to the inspection. It turns out there’s a good reason for that – 86% of buyers find a new issue with the home through the inspection. 46% use an issue with the home found during inspection to negotiate on price, although some sellers may be hesitant to negotiate due to defects found during the inspection. After all, they have been living in the home for years and they haven’t experienced any issues with (fill in the blank here). The most common issues turned up during inspection include problems with the heating or air conditioning unit, hot water heater, foundation, roof, chimney, garage, insulation, electrical, pest problems, and plumbing.

Getting an inspection done as a buyer may not be fun, but it is absolutely necessary. Your home will likely be the most expensive asset you ever buy or own and you need to know exactly what you are getting. While more and more buyers are getting inspections done now, when prices were skyrocketing a few years ago, nearly one-third of home buyers waived the inspection when purchasing a home. Sure, many homes probably don’t have any major issues, but there’s no doubt that waiving inspections cost some buyers dearly and may have even ruined their financial life.

2. Home dropping in value

Just like with the stock market, it is impossible to predict the direction of the housing market with any degree of certainty. This means you need to be prepared for the possibility of your home dropping in value after you make the purchase. How do you prepare for that? Don’t buy a home if you aren’t planning on living in it for at least five to seven years, and if this isn’t your first home, put at least 20% down to help protect against any declines in value. While home prices rise the majority of the time, again, just like the stock market, declines can be sharp and unpredictable.

3. Property taxes and insurance costs rising

One of the biggest mistakes new homeowners make is assuming their property taxes and insurance rates won’t rise much over time. That could be true, or it could be very untrue. Principal and interest costs are fixed over the life of your loan, if you have a fixed mortgage rate, but property taxes and insurance costs are not. Property taxes rose nearly 31% in some parts of the country from 2022 to 2023, an increase many homeowners were likely not expecting or prepared for.

4. Maintenance and repairs

You can expect to spend anywhere from 1% to 4% of your home’s value on maintenance and repairs every single year. If you live in an older home you may be paying more in maintenance and repairs than someone that lives in a newly-built home. While maintenance and repair needs can be predicted with some degree of accuracy, expect the unexpected when it comes to your home. Instead of budgeting for what you think will need to be repaired or replaced in a given year, try budgeting for what reasonably could need to be replaced or repaired in a given year.

The future of home buying

Copy link to this section: The future of home buying

Copied the URL to your clipboard!

Will homes continue being less affordable for many Americans for the foreseeable future? Will prices continue to rise or could they drop? Unfortunately our crystal ball stopped working just yesterday, which is very poor timing. While we can’t predict the future of home prices or affordability, we do know a thing or two about the future of buying homes.

Will interest rates drop and make homes more affordable?

It is likely that interest rates will drop at some point in the future. When that is and how much they drop remains to be seen, but whenever that happens, mortgages, and homes, may get more affordable. Current homeowners that locked in higher rates may be able to make their home more affordable by refinancing their mortgage, and new buyers could save money on a home as long as the drop in mortgage rates is not offset by a subsequent rise in home prices.

How to buy a home the right way

Copy link to this section: How to buy a home the right way

Copied the URL to your clipboard!

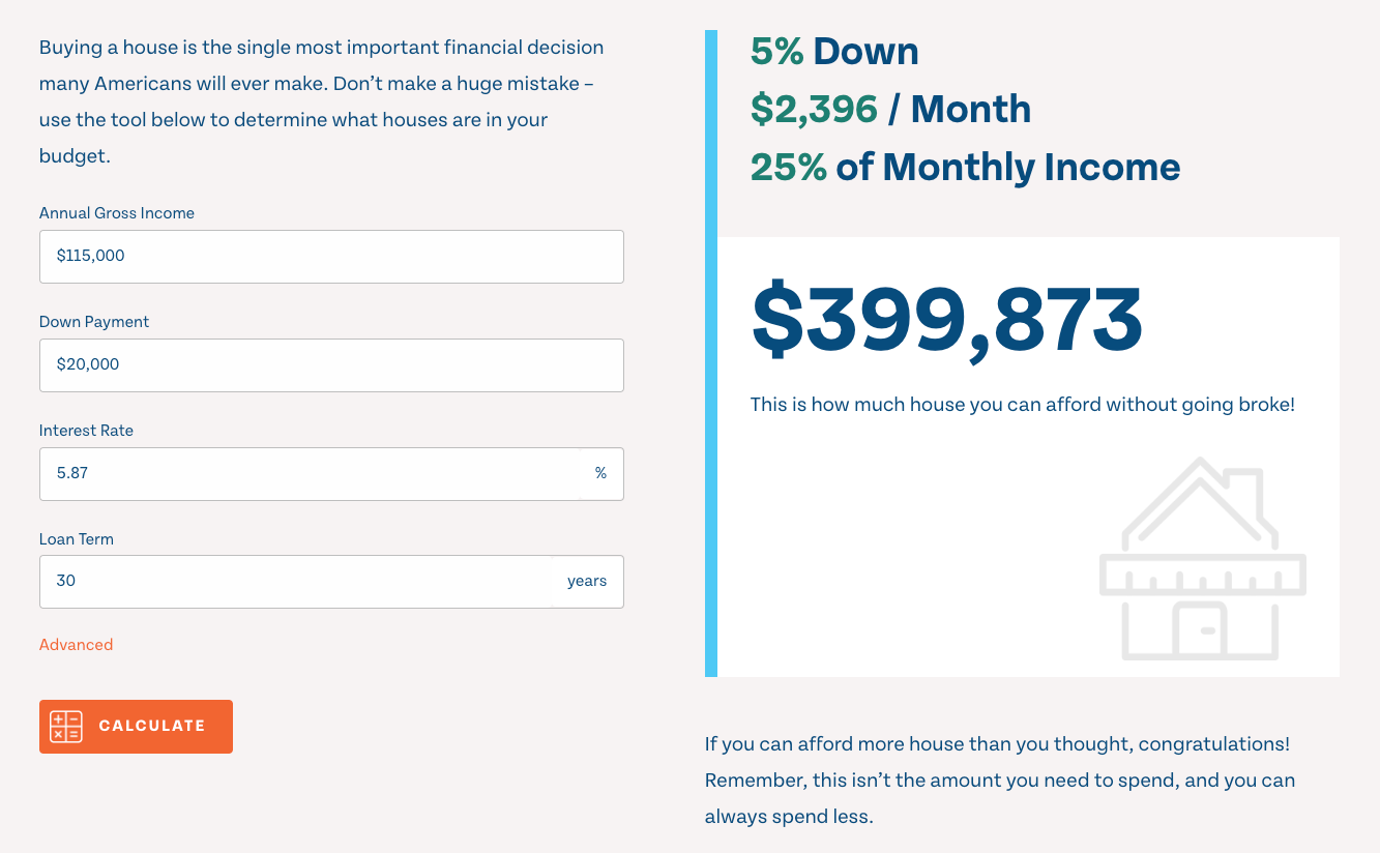

To make sure your financial life is not derailed by purchasing a home, we created our 3/5/25 Housing Rule. On your first home, you should put down at least 3% (and at least 20% on subsequent homes). Plan to live in the home for at least five years to reduce the odds of being underwater on your mortgage when it’s time to move. Lastly, keep your total monthly mortgage cost (payment, interest, taxes, and insurance) at or below 25% of your gross income.

Share image

While we do believe it is great to put 20% down when you buy a home, we realize that it is especially difficult for first-time homebuyers to do so. And sometimes, home prices rise faster than you can save for a down payment.

If you are buying your first home, we give you some grace to put down 3% to 5% on your first home. If you put down less, it is especially important to plan to be in your home for the long-term. You will likely be underwater on your home right after you buy if you consider the cost of selling the home again.

If you are not buying your first home, you should put down at least 20% on all home purchases. If you have accumulated enough equity to put down more than 20%, it may be wise to do so.

To make sure you aren’t buying too much house, we believe you should aim to spend no more than 25% of your gross household income on PITI (principal, interest, taxes, and insurance). If you can keep your total housing costs below 25%, that’s great – but not a requirement.

While 30-year mortgages have higher rates, we believe it makes sense for many home buyers to choose the longer term to make their home more affordable. Financing a home over 15 years just isn’t possible for many Americans unless they make significant sacrifices when purchasing a home. If you do choose a 30-year mortgage, though, you should have the mortgage completely paid off by the time you retire.

How does the Money Guy rule compare to other rules?

Dave Ramsey’s 25% Rule

Many other home buying rules are similar to our rules. Dave Ramsey, for example, advises listeners to keep mortgage payments below 25% of income – but he prefers using net income instead of gross income. Using net income is more conservative and means you will have less money each month to spend on a house. Dave Ramsey also believes in choosing 15-year mortgages instead of 30-year, which is again more conservative and means you will not be able to buy as much house.

Financial Samurai’s 30/30/3 Rule

While Dave Ramsey’s home buying rules are more conservative, the Financial Samurai’s 30/30/3 home buying rule is more liberal in some ways. They believe you should spend no more than 30% of your gross monthly income on your mortgage payment, have at least 30% of the value of your home saved up in liquid or semi-liquid accounts, and look for houses no more than 3x your annual household income.

The 5/20/30/40 Home Buying Rule

The 5/20/30/40 rule differs quite drastically from our Money Guy rule. This rule says to purchase a home around 5x your income, pay the mortgage off within 20 years, make a down payment of 30%, and keep your mortgage payment to 40% or less of your net income. This strategy advocates a higher downpayment and quicker payoff than our rules, but spending a higher percentage of your income on housing.

How much home can I afford?

While most home buying rules have some differences, some big and some small, the end goal is the same: to help you buy a home that meets your needs and fits within your budget. We created a Money Guy Home Buying Calculator interactive tool to help you determine what you may be able to spend on a home based on your income, down payment, interest rate, and loan term. There are also more advanced variables, such as PMI and homeowner’s insurance, that you can alter to get a more accurate estimate of the amount of home you can afford.

Share image

Run your numbers right now on Money Guy’s free home affordability calculator

Ways to beat the system

Copy link to this section: Ways to beat the system

Copied the URL to your clipboard!

If you are struggling to afford a home, you are not alone. The dramatic rise in home prices and uptick in interest rates has decreased affordability for those looking to buy a home. However, there are some unique and creative ways to buy a home even when they may not seem affordable.

1. Move to a cheaper area.

Moving to a cheaper part of the state or even of the country is a great way to buy an awesome home at an affordable price if you have the ability to do so. Some areas are often more expensive partially because of the job opportunities available to residents, so it may be difficult to move to a cheaper area and keep making the same amount of money that you currently make. However, if you have the ability, it’s a great way to make a home more affordable.

2. Find a roommate or house hack.

Finding a roommate or house hacking can make buying a house more affordable even in expensive areas. A roommate can split costs with you and house hacking essentially means buying a property, living there yourself, and renting out part of the house to someone else. Both involve bringing someone else on to live with you and saving costs. While sharing a house with someone else may not be ideal, it could be a great way to make a home more affordable.

3. Work remotely.

Depending on who you ask, between one-quarter and one-half of the US working population works remotely at least part of the time. The pandemic changed what work looks like for many, and if you are fortunate enough to be able to do your job remotely, it might be easier to find an affordable home. There may be restrictions on where you live, and you may have to live within a certain proximity to work or in the same state, but any amount of flexibility with where you live will allow you to look for housing in more affordable parts of your state or of the country.

4. Become a DIYer.

Owning a home is significantly more expensive for some people than it is for others. If you don’t like fixing things around the house or performing routine maintenance, owning a home will be much more expensive for you than it is for someone that doesn’t mind unclogging the toilet, mowing the lawn, installing shelves, going down in the crawlspace to check out the air conditioning unit, or maybe even taking care of a few rats in the attic. If you are able to perform more of the home’s maintenance and repairs yourself, you can save money and maybe afford more home.

Conclusion

Copy link to this section: Conclusion

Copied the URL to your clipboard!

Buying a home is an amazing but stressful process full of potential pitfalls and financial mistakes. We are committed to providing you the tools and resources to make sound financial decisions and perhaps make the home buying process a little less stressful. Check out our free home buying checklist for a list of questions to ask yourself before purchasing a home, and plug your numbers into our home buying calculator to get an idea of how much home you can comfortably afford.