Attitudes about college have shifted dramatically over the past decade. In 2015, Gallup found that 57% of Americans had a “great deal” or “quite a lot” of confidence in higher education. When Gallup surveyed Americans last year, they found the share of Americans with a great deal of confidence in our higher education system had dropped from 57% in 2015 to 36%. Pew Research uncovered similar attitudes about college, with 49% of Americans believing a college degree is now less important than it was 20 years ago, compared to 32% who believe a degree is now more important.

The changing attitudes about college have had a significant impact on college enrollment. From 2010 to 2021 (the most recent available data), enrollment has declined 15% across the board. That may sound like a modest decrease, but equates to 2.7 million fewer college students now than there were a decade ago.

I enrolled in college in 2011, right at the peak of college enrollment in the US. I felt that college was a requirement to getting a good-paying job and most of my classmates felt the same. I believe high school graduates today feel like they have more options after graduation than I did, which is a great thing. There are good-paying jobs available that don’t require a college degree and, maybe more so than in the past, those jobs are not looked down on. 70% of white-collar workers say that blue-collar jobs are more respected now than they were 10 years ago, and over 90% of blue-collar workers are proud of the work they do.

There are many paths to financial success that don’t involve a college degree, but I believe the pendulum has swung too far in the opposite direction. Not only is college still worth it for many students, the data shows that, while attitudes about college have shifted over the last decade, college is now a better value.

Why college is a bargain (on average)

The shifting attitudes about college are understandable. For decades, tuition costs have been rising much faster than inflation. As costs have risen, so has student loan debt. When you think “recent college graduate,” what image comes to your mind? Is it a successful white-collar professional or a struggling Starbucks barista? For many Americans, the latter image has firmly taken over and “recent college graduate” has become synonymous with “struggling young adult.”

Why is this? I blame the decline of thoughtful journalism and the increased prevalence of clickbait, sensational headlines. You simply aren’t going to see many headlines that read: “Most College Graduates Doing Good, Data Shows,” or “Lauren, 22, Graduates with Little Debt and Receives Great Job Offer.” Instead, you often see headlines such as “Woman’s Dream of Being a Nurse Leaves Her $110,000 in Debt” or “Why Today’s Graduates Are Screwed.

If you look beyond the clickbait headlines, college actually looks like a bargain. Over the last few years, inflation-adjusted tuition costs have fallen. It is now cheaper, in real dollars, to attend college in 2025 than it was when I enrolled in 2011. If you think that college costs are moderating because earning potential is decreasing for college grads, well, you’d be wrong. College graduates have historically made significantly more than those without a degree. Instead of shrinking, that gap is widening.

For young workers aged 22 to 27, the average high school graduate without a college degree makes $36,000 per year, compared to $60,000 for the average college graduate. The unemployment rate is twice as high for those without a college degree. Self-reported financial wellbeing for college graduates is 87%, compared to 67% for those without a degree. Median lifetime earnings for college graduates are $1.2 million higher than non-graduates. All of the data shows that, on average, attending college is a great decision.

College offers economic mobility

I wasn’t poor growing up, but I didn’t have many advantages that wealthier kids often have. I attended (and graduated from) a Title I high school. I could only afford to take the SAT and ACT one time each, and I didn’t have any tutoring or material to study to prepare. The exams also weren’t offered in my county, so I had to wake up at the crack of dawn and drive 45 minutes to an unfamiliar high school to take them. My 1996 Buick Century that got me there was the worst looking car in the parking lot. I often felt embarrassed to drive it.

Growing up, my mom took us to the public library at least twice a week. I loved learning and I was always a good test taker in school. I had advantages over many of my friends. Neither of my parents were on drugs and both were present. We always had food to eat and never went hungry. I didn’t have to worry about providing for my household at a young age. My parents made it clear that doing good in school was the most important thing for me growing up.

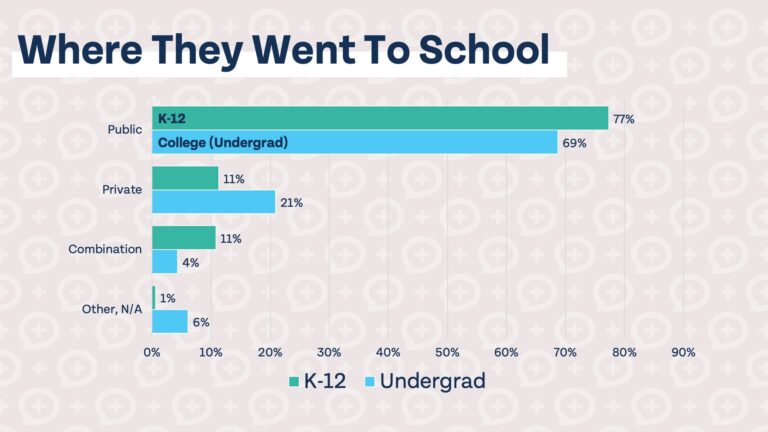

Those advantages in life helped me do very well on the ACT, which got me into a great college, which led me to where I am today. Although I didn’t realize it until I was older, my parents knew that a college education could allow me to move up the economic ladder. High school students today considering college actually have greater potential for economic mobility than I did, not less. In fact, an analysis of the outcomes of over 30 million students found that public universities offer the greatest economic mobility. For most kids, college is your best chance at climbing the ladder.

It is worth repeating that college is by no means the only way to achieve financial success, however you measure it. Some of the wealthiest individuals in the country never graduated college. It isn’t a golden ticket and you must be very careful deciding which college to attend, choosing a major, and paying for school (check out this article for some tips on how to do college the right way, and read up on the best (and worst) college degrees here). However, my story, and the millions of stories just like mine, are proof that public education and public universities are a great path to becoming financially secure.