Tax-free Roth accounts are possibly the most powerful retirement savings vehicle available to most Americans, and they are a fairly recent creation. The idea of a retirement account with tax-free growth and tax-free qualified distributions was initially proposed in 1989 as an “IRA Plus,” but did not become reality until the Taxpayer Relief Act of 1997, championed by Senator William Roth. The Act of 1997 ushered in Roth IRAs with an initial contribution limit of $2,000, but it wasn’t until 2006 that employers were able to implement Roth options in 401(k) accounts. Now, 74% of 401(k) plans offer Roth contribution options. Most investors can make Roth IRA contributions, and also make Roth contributions to their 401(k) account, but how do you know when to choose Roth?

When to contribute to a Roth IRA

Almost everyone that has the ability to contribute to a Roth IRA should do so. Choosing the tax deduction of a traditional IRA over contributing to a Roth IRA rarely makes sense (or is not even possible in many cases). The full deduction for pre-tax IRA contributions is only available to those without a retirement plan at work or those with income below a certain level, who may benefit more from contributing to a Roth IRA. Those with higher incomes (currently over $76,000 for single individuals and $125,000 for married couples) covered by qualified retirement plans at work are not eligible to make pre-tax IRA contributions.

Eligibility for Roth IRA contributions is determined solely by income, and it does not matter if you are covered by a retirement plan at work. Even if your income exceeds the threshold to make direct contributions, you may still be able to build Roth assets. There are no income limits for making non-deductible IRA contributions, and there are currently no income limits for converting eligible assets to Roth (although if you have pre-tax IRA assets, the IRA aggregation rule may make this strategy unfeasible or more complicated; this is something you want to get right on the front-end since there can be unexpected tax consequences, and reaching out to a tax professional or financial advisor may make sense). The window for conversion opportunities may be closing soon for those with higher incomes. If you are currently able to use this strategy you should give it a good look, as it may not be there in the future.

Roth IRAs have a few other advantages over pre-tax IRAs besides just tax-free qualified distributions. Roth IRAs also have no required minimum distributions (RMDs), which can make them an ideal vehicle for transferring wealth to heirs, and you are allowed to withdraw contributions at any time with no penalty (although you would never want to).

Should I make pre-tax or Roth contributions to my 401(k)?

Unlike pre-tax and Roth IRA contributions, pre-tax and Roth 401(k) contributions are not restricted based on income. Higher income individuals with a qualified retirement plan are excluded from making pre-tax IRA contributions, but may want to consider making pre-tax 401(k) contributions. Tax rates are the biggest factor to consider when deciding between pre-tax and Roth 401(k) contributions; if your combined marginal tax rate (state + federal + local) is under 25%, consider Roth, and if above 30%, it may make sense to consider traditional. The decision is often more nuanced, though, and there are other factors you should consider as well.

1. How does your current marginal tax rate compare to your future rate?

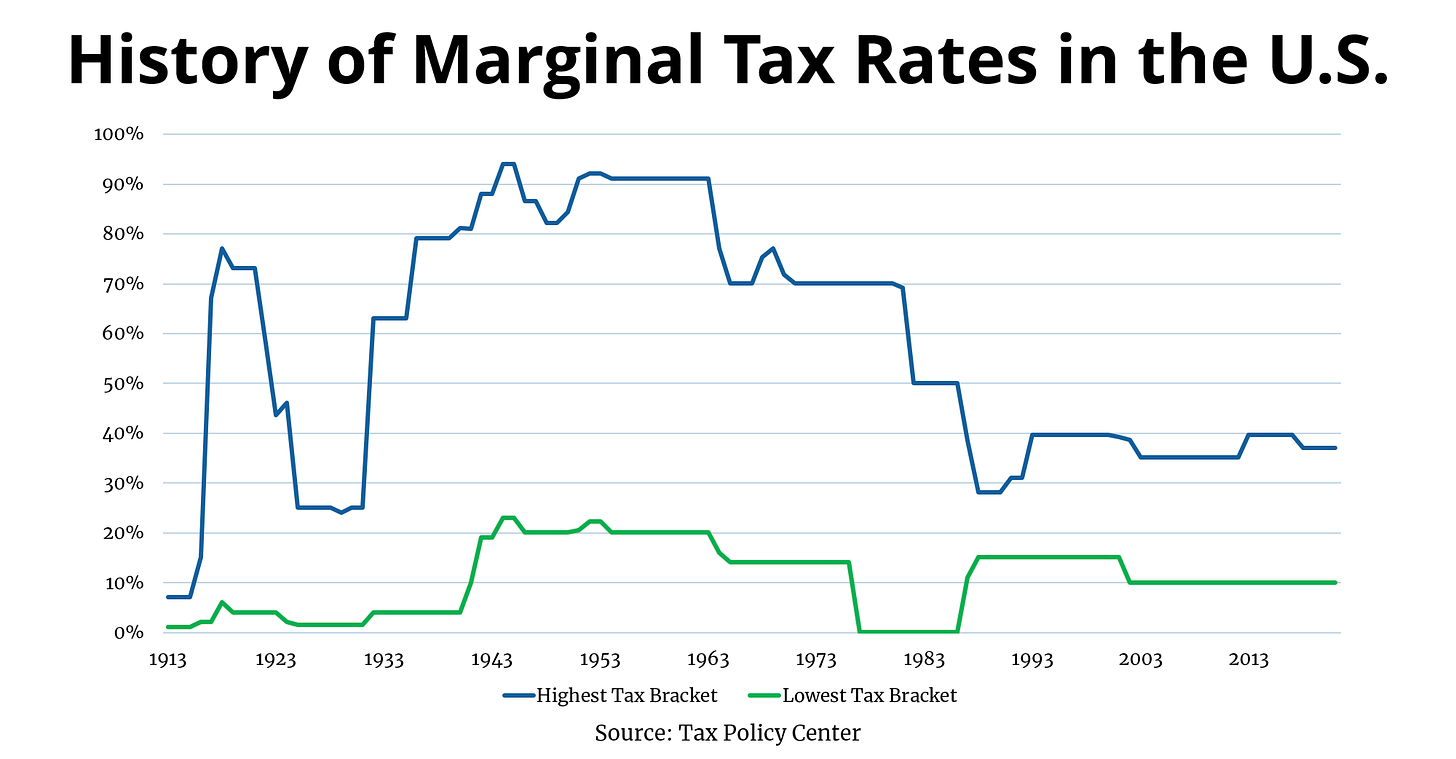

If you are in a higher tax bracket now, it may still make sense to make Roth 401(k) contributions if you expect to be in an even higher tax bracket in retirement. No matter your age or current tax rate, if your tax rate will be higher in retirement, it makes mathematical sense to get dollars in Roth while you’re taxed at a lower rate. There’s a case to be made that tax rates will be higher in general in the future; the chart below shows both the highest and lowest federal income tax rates throughout U.S. history, and as you can see we are currently enjoying historically low tax rates. Building tax-free Roth assets now is a hedge against tax rates going up in the future. It’s worth keeping in mind that even if you choose to make Roth 401(k) contributions, employer contributions (match or profit sharing) always go in pre-tax, so your pre-tax bucket is building either way.

On the other hand, if your combined marginal tax rate is below 30% right now but you expect it to be even lower in retirement, pre-tax 401(k) contributions may be more beneficial.

2. Do you plan to max out your 401(k)?

Roth dollars are worth more than pre-tax dollars; $100,000 in a Roth account is equivalent to $100,000 after taxes if taken as a qualified distribution, but $100,000 in a pre-tax account could be worth significantly less after taxes. If you plan on maxing out your 401(k), making Roth contributions is worth considering since you can essentially get more money in. Even if you invest the tax savings from making pre-tax 401(k) contributions in a taxable brokerage account, the tax drag on the account means it won’t grow at the same rate a Roth account would. If you are maxing out your 401(k) and expect your tax rates to be nearly identical now or in the future, or if you don’t have the discipline to invest the tax savings from making pre-tax 401(k) contributions, maxing out your Roth 401(k) may be more beneficial.

3. How are your accounts structured?

If you already have a large amount of pre-tax retirement assets, such as a pension or other employer-sponsored plans, it may be wise to consider making Roth 401(k) contributions and building your tax-free assets. The amount of pre-tax assets you have will affect not only your income tax rate in retirement, but also the taxability of Social Security benefits and the amount you pay in Medicare premiums. Your account structure is very important to having a tax-efficient retirement, and all three buckets, tax-deferred, taxable, and tax-free, have a place in your retirement plan. If you are interested in learning more about the three tax buckets, check out this clip from the show: “How to Have a Tax-Efficient Investment Strategy.”

Nobody can predict the future, and it can be difficult to know whether your tax rate will be higher or lower in retirement. Good financial planning isn’t about knowing all of the answers, but about making informed and educated decisions while taking into account all information available to you. There are going to be some curveballs along the way; taxes might go up by more than you expect, or your taxable income in retirement may be much higher than you were expecting.

There are quite a few factors that go into this nuanced decision, and bringing a financial co-pilot on the journey with you is worth considering if you feel like you don’t have enough hours in the day, can’t keep up with the rapidly changing financial landscape, and worry about what happens to your loved ones when you are no longer around to steer the financial ship. If you are wondering if the time is right to reach out to a financial advisor, check out this episode of the show: “How and When to Hire a Financial Advisor!” We offer free education through The Money Guy Show and FYI by FTE, and fee-only financial advisory services for those who are ready to take the relationship to the next level. You can visit our “Work With Us” page to learn more and submit a form.