Dave Ramsey has helped millions of Americans with debt, which is no easy feat. Over five million have participated in Financial Peace University, and four million high school students have participated in Dave’s personal finance program for high schoolers. Dave Ramsey has been able to help so many people get out of debt because he was formerly deep in debt himself, and he has a great understanding of the psychological impacts of debt, how it impacts our behavior, and how to overcome them.

Like debt, investing also has many behavioral and psychological aspects. Dave does a great job guiding investors through the psychological minefield of investing. He believes in keeping a long-term perspective, and not getting caught up in day-to-day swings in the stock market. Much of his investment strategy is sound, but there is some room for improvement in a few key areas.

1. Dave isn’t a huge fan of index investing.

Dave Ramsey does believe it’s important to consider a fund’s expenses when searching for a suitable investment, but encourages investing in more expensive actively managed mutual funds. Dave recently said that “it’s fairly easy to study mutual funds and pick them that outperform.”

It would be easy to pick mutual funds that beat the market if the same actively managed funds beat the indexes year after year. Over the long-term (15-20+ years), index funds beat active funds around 85-90% of the time (or more, in certain sectors of the stock market). If the same 10% of actively managed funds beat the market year after year and decade after decade, it would be easy to pick actively managed funds that outperform.

A recent study from Yale analyzing data from 1994 to 2018 found that “a fund’s past performance is completely unpredictive of its returns in the future.” In other words, you’d have the same odds of beating the market in the future by investing in past losers instead of winners. This is what makes it so difficult to beat the market; not only do a small fraction of actively managed funds beat indexes over the long-term, the active funds that do beat the market don’t have better odds of continuing to do so in the future. It seems very difficult, if not impossible, to study mutual funds and pick those that will beat the market in the future.

Later in the call, Dave went on to say that, of first-generation millionaires, “almost all of them did it with their 401(k) with actively managed funds.” The stat Dave is referencing is from their own National Study of Millionaires, which found that “8 out of 10 millionaires invested in their company’s 401(k) plan.” 401(k)s and similar tax-advantaged employer-sponsored plans are extremely powerful vehicles for building wealth. Limits are higher than for IRAs and HSAs, and often employers offer “free money,” or matching contributions. Dave is right to cite 401(k)s as an important factor in creating first-generation millionaires, but his study does not provide data on which funds millionaires are invested in within their 401(k).

We do know that fund options in 401(k) plans can be limited and expensive. The average number of investment options offered in a 401(k) plan is just 28, and the average asset-weighted expense ratio for domestic equity funds across 401(k) plans is 0.43%. Even with limited options and funds with moderately high expense ratios, index funds in 401(k) plans are booming. 17% of all assets in 401(k) plans were invested in index funds back in 2006, and by 2017, 36% of all 401(k) assets were invested in index funds. While the majority of millionaires invest in their 401(k), and most might invest in at least some active funds, it is misleading to imply that first-generation millionaires reached that status because of actively managed funds. The vast majority of actively managed funds underperform indexes, so most millionaires that invested in active funds inside of their 401(k) likely would have been better off investing in index funds instead.

2. Dave’s balance of risk and reward isn’t for everyone.

In general, investors are willing to accept more risk for a greater reward, or greatly reduced risk for a slightly smaller reward. Dave’s investment philosophy doesn’t do a great job of balancing risk and reward. He suggests dividing mutual fund investments equally between four types of funds: growth, growth and income, aggressive growth, and international funds. Growth and income is synonymous with domestic large-cap, growth with domestic mid-cap, aggressive growth with domestic small-cap, and international is international.

We did a deep dive on Dame Ramsey’s investment advice last year, which you can watch below. In the show, we compared a theoretical portfolio of four funds, one in each of Dave’s suggested categories, to the S&P 500. We generously chose low-cost index funds for the Ramsey Portfolio instead of actively managed funds. We found that in good times, performance was similar; the best three-month, one-year, and three-year returns were nearly identical between the Ramsey Portfolio and the S&P 500, but the worst periods were much worse for the Ramsey Portfolio than the S&P 500. A closer look at the Ramsey Portfolio revealed it is riskier than the S&P 500, but there are no excess returns to justify any excess risk; in fact, the S&P 500 outperformed the Ramsey Portfolio over the last one-year, three-year, five-year, and ten-year time period.

Are we really being fair by comparing the Ramsey Portfolio to the S&P 500? Sure, the Ramsey Portfolio is riskier than the S&P 500 and underperforms, which means the risk is not justified, but how does an all-stock portfolio compare to a more diversified portfolio with a large allocation to bonds? Perhaps in that situation the excess risk will generate a comparable excess return.

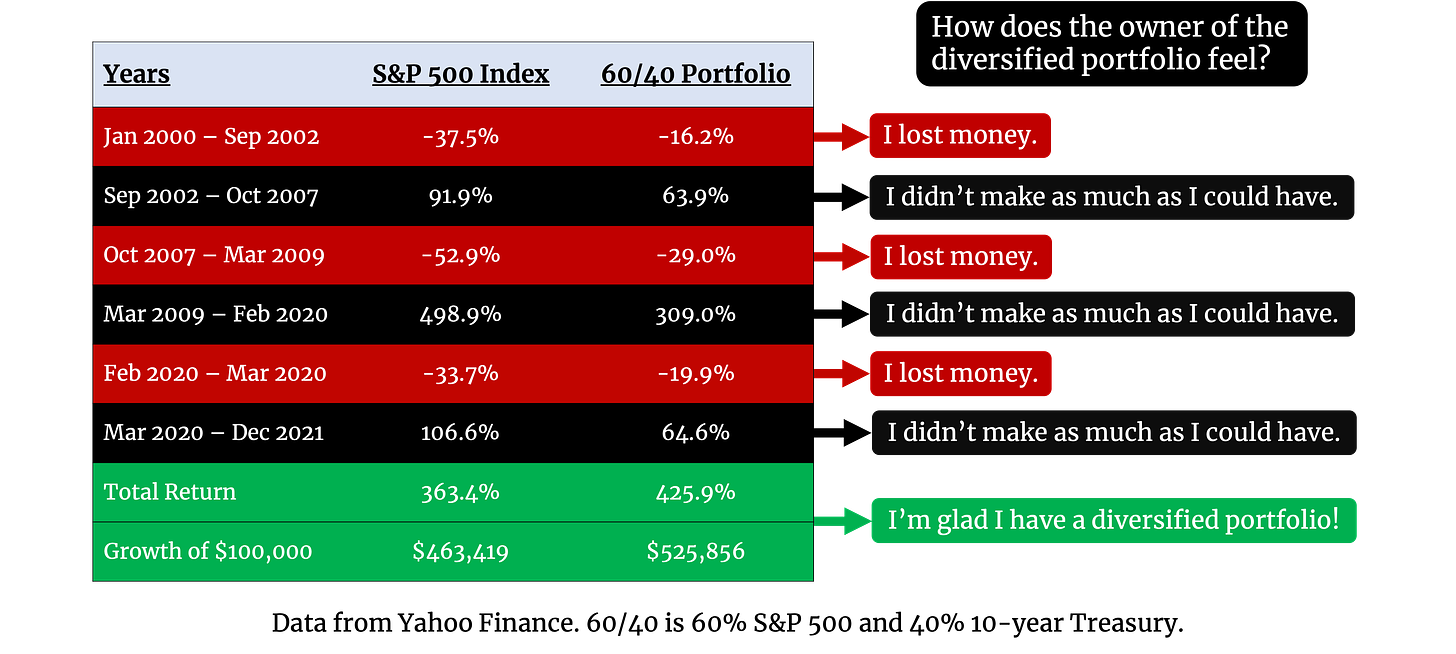

We recently showed an illustration on the show, which I’ve inserted below, comparing the S&P 500 (which beats the Ramsey Portfolio) to a more diversified portfolio consisting of 60% stocks (we used the S&P 500) and 40% bonds (here we just used the 10-Year Treasury).

Over the last 20+ years, a portfolio consisting of bonds and stocks outperformed the S&P 500. It wasn’t as exciting, though, and owning a diversified portfolio often feels disappointing. When the stock market goes down, your portfolio likely goes down as well, albeit hopefully by less than the total market. In good times, you don’t make as much as you could if you were invested completely in stocks. It may feel like you shouldn’t invest in risk-off assets at all, and instead invest everything in the market. Capturing all of the upside may feel better, but over the last couple of decades we’ve seen that diversifying your portfolio can potentially decrease the volatility of your portfolio and increase returns.

3. Dave has a one-size-fits-all approach to investing.

As you get older and closer to retirement, your portfolio will likely change to reflect your reduced capacity for risk. At younger ages, in the accumulation phase, you can afford to take on a greater amount of risk because you have a greater amount of time to make up for any potential losses. In retirement, you don’t have that luxury; one really bad year could derail your entire retirement, which is why reducing risk is so important. The money you take out of your portfolio to live on needs to be there when you need it, which is why retired investors typically have more cash on hand and have more invested in risk-off assets such as bonds.

A riskier allocation, like being 100% allocated to the S&P 500 or the Ramsey Portfolio, could be detrimental to an older investor. It would be much easier if there were a one-size-fits-all portfolio for everyone, like the Ramsey Portfolio, but there isn’t. Everyone has different goals, time horizons, capacities for risk, life expectancies, expenses, the list goes on. For investors just starting out, target-date index funds may be worth considering, and as your finances mature, you might feel the need to reach out to a fee-only financial advisor for a more personalized portfolio.

Dave Ramsey has done so much good in the personal finance space and has taught basic financial concepts and the importance of discipline to millions of Americans. There’s no doubt he’s helped make a significant number of lives meaningfully better, and it’s impossible to count the number of people impacted by his show, books, and classes. If you follow Dave Ramsey’s investment strategy by investing in actively managed funds and holding them for the long-term, you’ll still get to experience the magic of compounding interest. With a few key changes – investing in low-cost index funds, optimizing your portfolio’s balance of risk and reward, and opting for an investment allocation based on your personal goals and needs – your Army of Dollar Bills can work harder and more efficiently to build your Great Big Beautiful Tomorrow.

Correction: In the original version of the chart comparing the S&P 500 to a 60/40 portfolio, the total return values were calculated incorrectly for both the S&P 500 and 60/40 portfolio. The result is the same, the 60/40 portfolio outperformed the S&P 500 over this period of time, but the total return values and growth of $100,000 values have been updated. The S&P 500 return data was calculated using adjusted close values (including dividends and splits) of SPY, and 10-Year Treasury data is from Macrotrends.net.