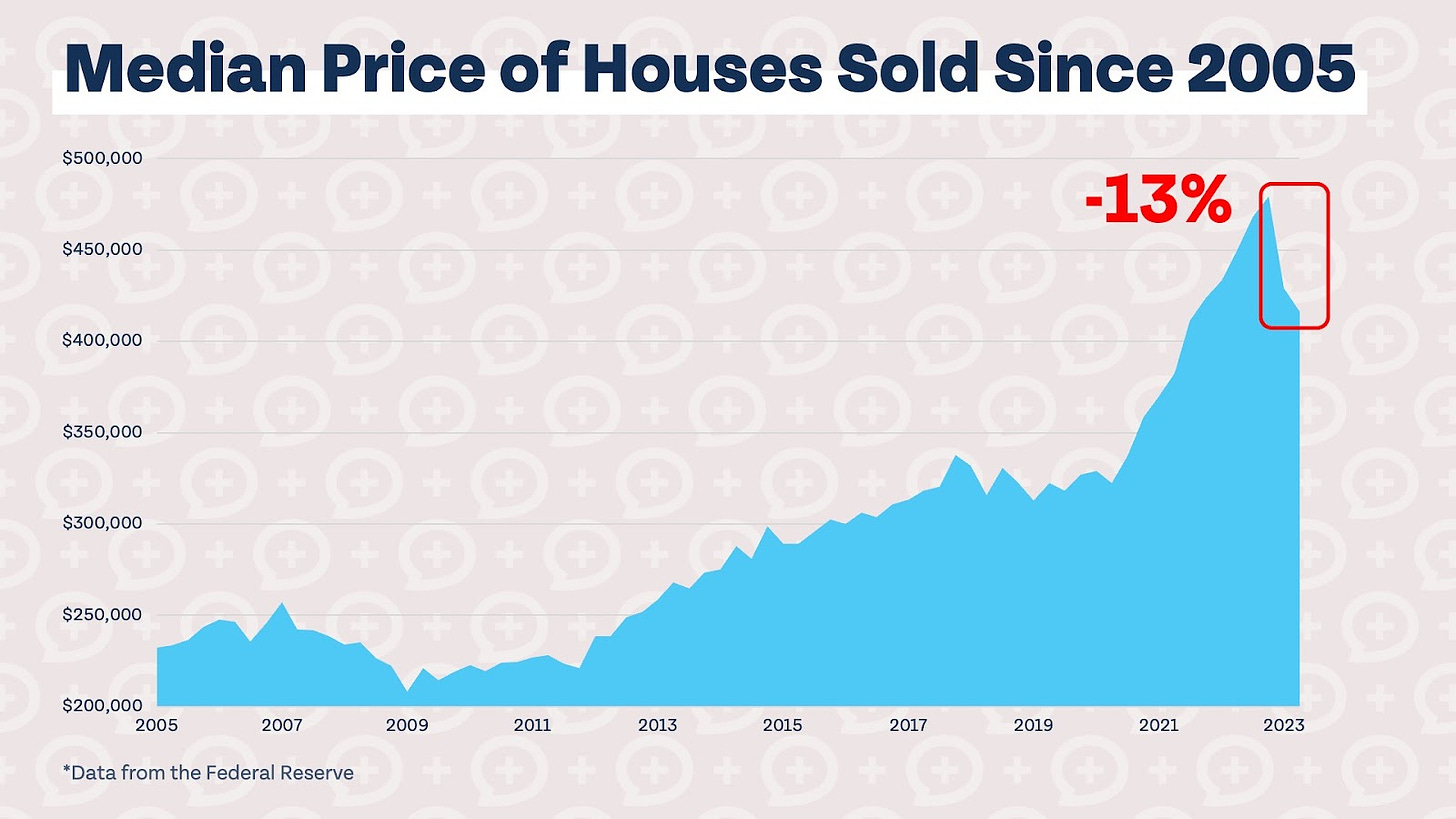

Housing prices skyrocketed during the pandemic. The median price of a home sold in the US went from just over $300,000 to nearly $500,000. With low interest rates, the housing market was doing very well even at higher prices. Now we are beginning to see higher interest rates take a toll on home prices across the country. Median home prices are down 13% from their peak in the fourth quarter of 2022.

Buyers can not afford to pay the same prices they were paying in 2021 or 2022; with mortgage rates at 7.49% as of August 22nd (levels not seen since December 2000), a family with a $400,000 mortgage would owe $2,794 each month in principal and interest alone. That’s 47% of the median household income of $70,784. The market has been dropping, but will it continue to drop? What do buyers and sellers need to be keeping an eye on?

Inventory is still a problem

The drop in home prices can not be attributed to more inventory. There are currently about 646,698 homes for sale in the United States, give or take a few. Before 2020, the number of homes for sale had not dipped below one million, according to Federal Reserve data. However, the monthly supply of homes, as related to demand, has been very high (at levels not seen since 2009, in the aftermath of the housing crisis). It is very unusual to see a low absolute number of houses for sale, but a high amount of homes for sale when measured against demand. It just means that sellers are not selling and buyers are not buying: everyone is waiting it out. With 62% of outstanding mortgage rates below 4%, it is not hard to see why many are staying put.

When will this end?

The stalemate we are currently experiencing will likely come to an end when mortgage rates drop. The number of homeowners with mortgage rates under 6% has only dropped from 93% to 92%; buyers are staying put and potential sellers are staying locked into low interest rate mortgages. Mortgage rates were under 4% at the beginning of 2022, and interest rates at those levels may spur increases in demand and supply. It is difficult to say what effect this could have on the housing market. If both supply and demand increase significantly when interest rates drop, prices might not change substantially.

What should you do as a homeowner?

If you currently own a home but are interested in moving, it might be difficult to come to terms with losing out on a low interest rate mortgage. Assuming you can upgrade to a new home for the same price as your current home, which is a very big assumption, going from an interest rate of 3% to 7% would increase your total mortgage payment by 58%. Your current home probably seems a lot nicer if a comparable new home will cost 58% more!

Waiting to buy a home might be a good option if you can afford to wait, but not everyone has that option. If you have a growing family or other needs, you might need to buy whether it’s a “good” time to buy or not. Just make sure to familiarize yourself with our housing guidelines to help ensure buying a home doesn’t negatively affect other areas of your financial life.

What should you do as a buyer?

While home prices are dropping, higher interest rates mean housing is still out of reach for many potential first-time home buyers. The average age when Americans buy their first home has risen to 36, and only 26% of homebuyers last year were first-time homebuyers. This is the lowest percentage ever recorded, so first-time buyers are clearly struggling to get into homes.

Just because it is a “bad” time to be a first-time homebuyer does not mean it’s a bad time for you! Buying a house is not an investment decision but one based on a need for you and your family. Our guidance on purchasing a home for first-time homebuyers is largely the same as for those looking for a new home: now might be the right time to buy if you need a home. Just make sure you download our home-buying checklist and don’t let a home keep you from achieving your other financial goals.

The housing market was turned upside-down during the pandemic, and rising interest rates have certainly not helped the market return to “normal.” We do not know when interest rates will decrease or if housing prices will continue to decrease or reverse course. We do know that buying a home is usually a needs-based decision and should not be primarily driven by trends in the market or what direction you think the housing market is headed in.

This is definitely a “measure twice, cut once” moment with housing decisions. The more time you can commit to living in a new home, the less these uncertainties will matter over the long-term. On the other side of the coin, if you are going to live in the home for a short period of time, you may find yourself on the wrong side of this unique time to be buying and selling a primary residence.