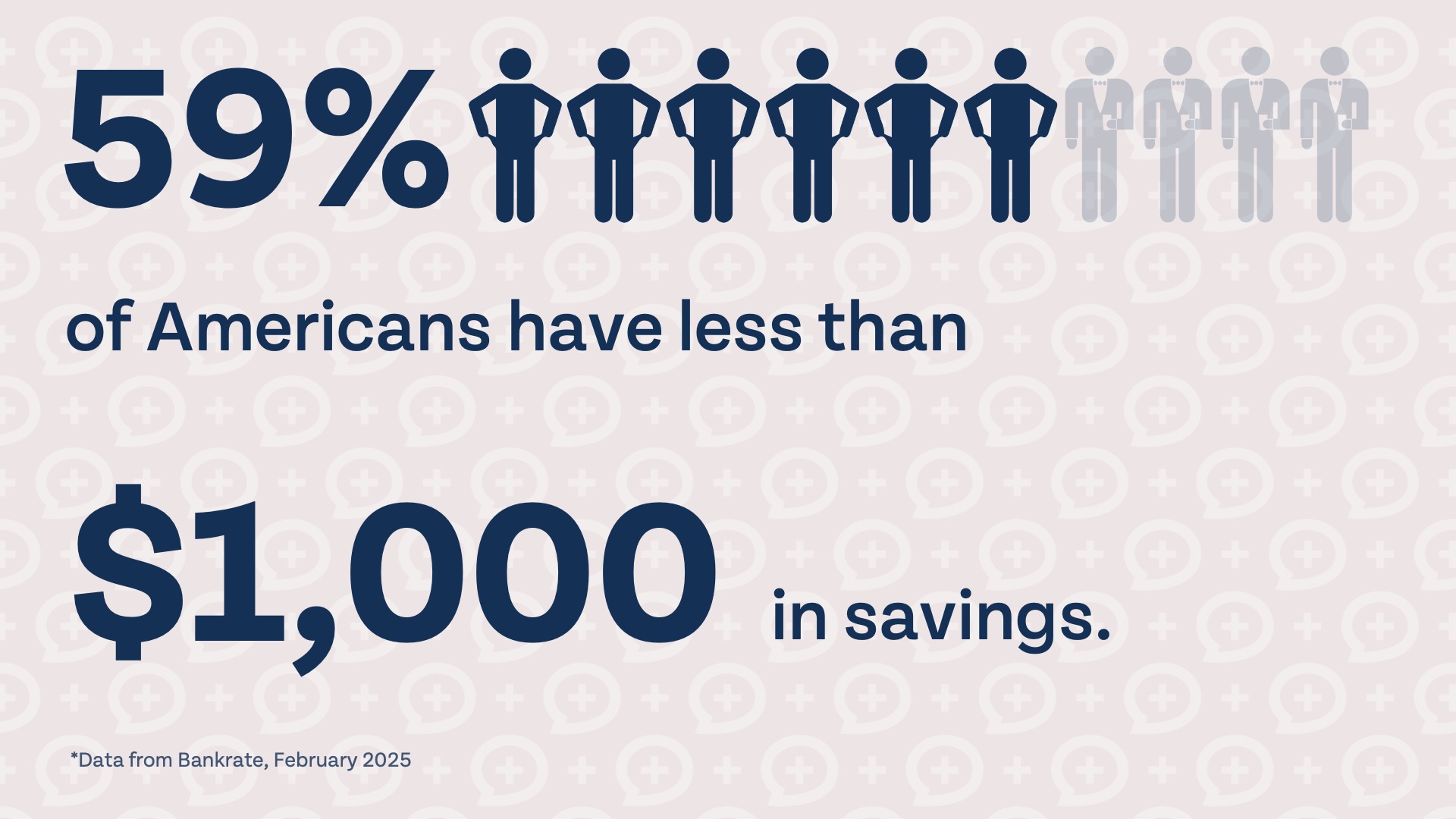

Emergency funds: everyone needs one, but few Americans have one, and even less have the amount of savings they actually need. According to a recent Bankrate survey, 59% of Americans would not be able to pay for an unexpected $1,000 expense with savings.

It’s safe to say that just about everyone should have more than $1,000 in savings, but how much do you actually need? The often-repeated general rule of thumb is to save 3-6 months’ worth of expenses for emergencies, which is a great benchmark, but might not be the right guidance for everyone.

Is it the right time to build an emergency fund?

An emergency fund is a priority to building financial stability, but it shouldn’t always be the first priority for your dollar bills. Following the Financial Order of Operations, before building a full emergency fund, you should first cover your highest insurance deductible. Next, you should invest enough to get your full employer match in your retirement account, if you have an employer match. After that, you should pay off all high-interest debt (credit cards, other consumer debt, and some high-interest student loans). It is only then you should consider building a full emergency fund. Covering your highest deductible before building a full emergency fund makes sense, but why invest in your workplace retirement account and pay off debt before building a full emergency fund?

We believe the opportunity cost of missing out on your employer match is simply too great to ignore. If you get a dollar-for-dollar employer match, that’s an instant 100% rate of return on eligible money invested in your retirement account. It makes sense to pay off high-interest debt before building a full emergency fund since the punitive interest rate on your debt is likely much higher than any interest rate on your savings account. Since your highest insurance deductible is already covered, you do have some level of protection before beginning to build a full emergency fund.

Does covering my highest deductible count towards my emergency fund?

The short and sweet answer is yes, saving for your highest deductible in Step One of the Financial Order of Operations does count towards your full emergency fund. Depending on how high your largest insurance deductible is, you may have a while to go before building a full emergency fund or not long at all; in some cases it could even be possible for your highest insurance deductible to be more than what you need in a full emergency fund. If this is the case, you should always have the higher of your largest insurance deductible or a full emergency fund in savings.

How much do I need in an emergency fund?

The general rule of 3-6 months’ worth of expenses is great general guidance, but isn’t always right for all situations. Everyone should maintain at least 3 months’ worth of expenses, but in some cases more than 6 months’ worth of expenses may be necessary. When determining how much you should have saved in an emergency fund, ask yourself the following questions:

- How many sources of income are in our household?

-

- If you and your spouse are both working, and/or one person has multiple sources of income, you may not need as large of an emergency fund as a single-income household. If a single-income household experiences job loss, the household income drops to $0, so a larger emergency fund would be wise to help compensate for this risk.

- If you have more than one income source in your household, how similar are they?

-

- There is a greater risk of losing both or all of your sources of income if they are very similar. If you and your spouse are both working for tech startups, it may be wise to have a larger emergency fund than a household with two very different occupations.

- How quickly would you be able to find a new job?

-

- If you were to lose your job, how quickly could you find a new job with similar pay? Some occupations have very high demand, and you could get a new job with similar pay as soon as you’d like. Other jobs are more specialized or don’t have much demand.

- In the worst-case scenario, do you have other funds that could be used for emergencies?

-

- We wouldn’t ever want you to take money out of your retirement accounts or use high-interest debt to pay for expenses unless it is the last resort, but it is something to consider when building an emergency fund. If your emergency fund is the only money you have available for an emergency or in the case of job loss, a more significant savings reserve may be warranted.

What if my emergency fund runs out?

Sometimes we experience needs for our emergency fund that last much longer than 3-6 months. 1 in 8 workers will become disabled for more than 5 years during their lifetime. What do you do if you become disabled and are unable to work in a similar job or unable to work at all? Long-term disability insurance offers coverage for disabilities that last an extended amount of time. The typical elimination period, or period of time before you start receiving benefits from a long-term disability policy, is 90 days. Benefits usually pay about 40% to 70% of your pre-disability income, depending on the policy you choose.

You may also be eligible for Social Security disability benefits if you are unable to work due to a medical condition that is expected to last at least one year or result in your death. It’s important to note that Social Security disability benefits and “any occupation” long-term disability insurance policies only pay out if you are unable to work any job.

This could be a problem if, for example, you are a surgeon that suffers permanent damage to your hand and are unable to perform surgeries. You could get another job that doesn’t require very precise motor skills, but it might be unlikely you could find another job that paid as much, at least in a reasonable period of time. In many cases it may make sense to opt for what is called an “own occupation” long-term disability insurance policy. These policies are typically more expensive, but offer coverage if you are unable to do your specific job, which could be a great benefit to those in certain occupations.

Nobody likes to predict what unexpected events could cause them to need their emergency fund, but it is important to build a full emergency fund, and often a long-term disability insurance policy, to protect yourself from unexpected events. Losing your job or experiencing a financial emergency is never pleasant, but it is much easier if you are prepared with a full emergency fund.