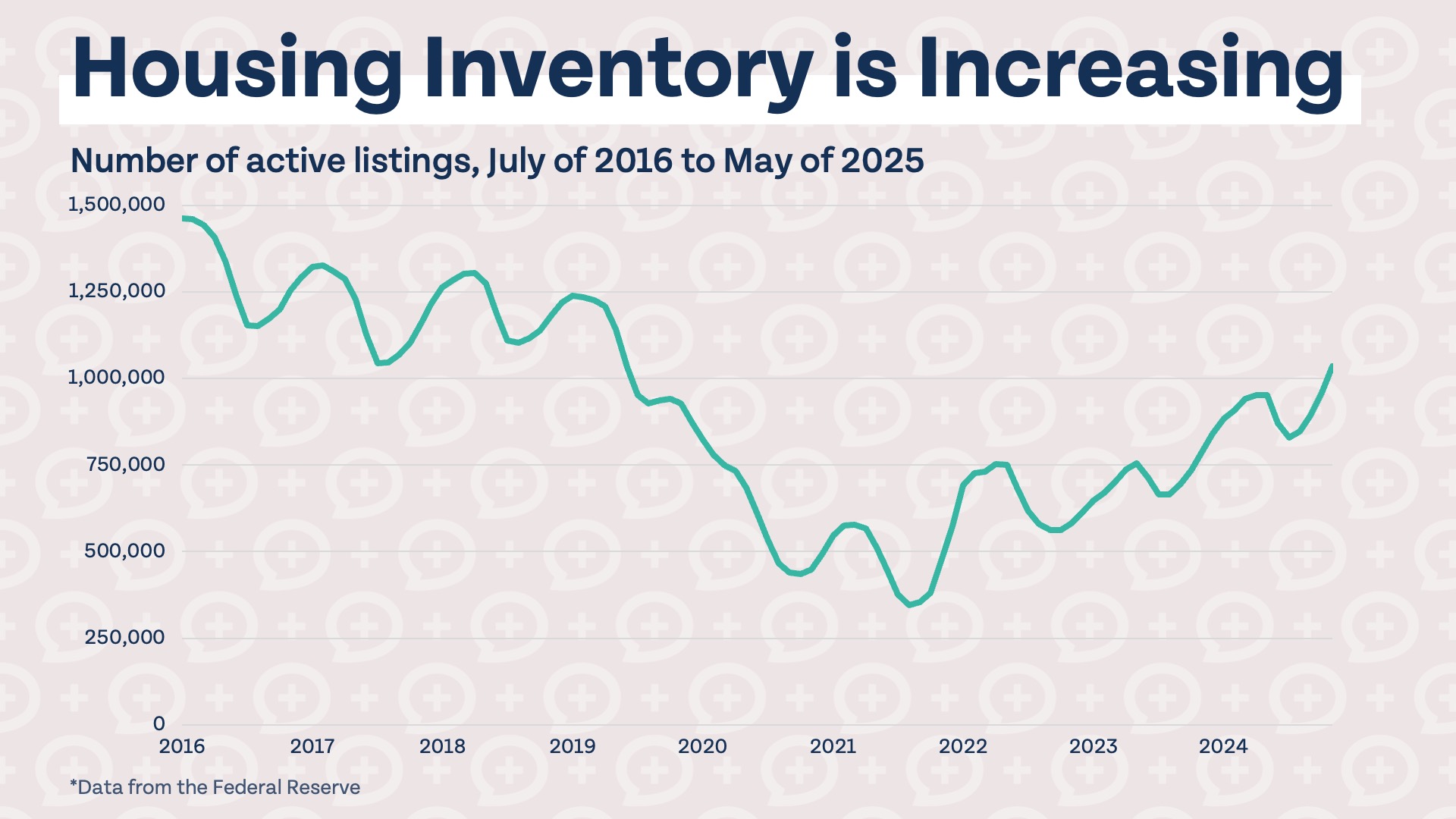

As mortgage rates have held relatively steady over the past few years, with average fixed 30-year rates between 6% and 8% since September of 2022, housing supply has steadily increased. We now have more homes for sale than at any point since the pandemic. Inventory could be at levels we consider “normal” very soon.

At the same time, the share of first-time homebuyers has decreased to a historic low of 24%, and the average age of those same first-time buyers has reached an all-time high of 38. There is one very simple explanation for the sharp increase in inventory and lack of first-time homebuyers: houses are too expensive for most buyers.

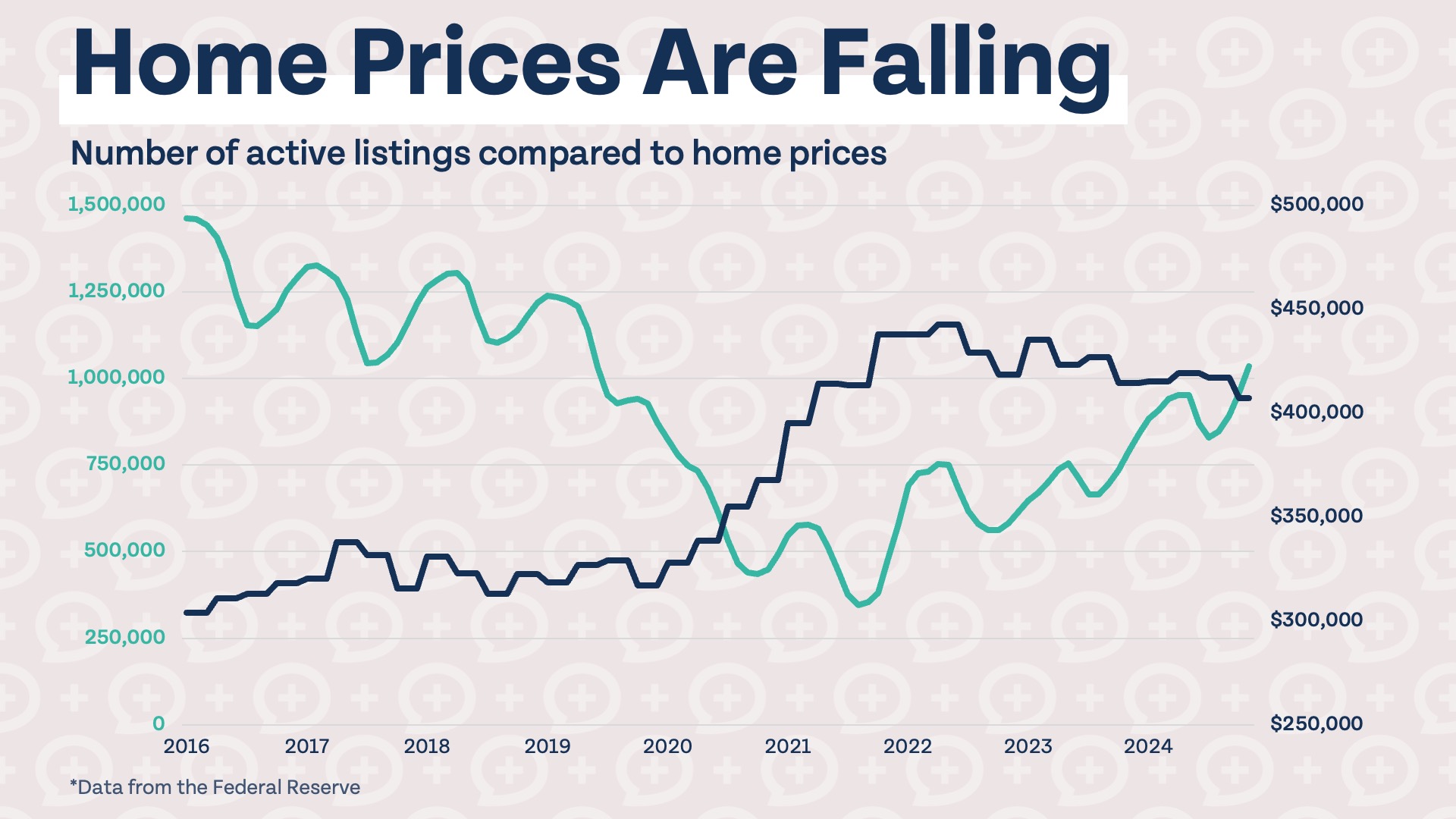

If you’re even remotely familiar with basic theories of economics, you know that, all else being equal, an increase in supply without an increase in demand will normally lead to a drop in prices. The housing market has been no exception, with prices dropping slowly but steadily since 2022.

Should you buy a home in 2025?

The rise in inventory and decrease in home prices is good news for those looking to purchase a home. Real estate is very location dependent, but broadly speaking, it is now more of a buyer’s market than it has been in over 5 years. If you are in the market to buy a home, you now have more options, more leverage to ask for concessions from the seller, and more room to negotiate on price. However, this doesn’t necessarily mean it is a good time for you to buy a home.

Housing inventory could continue to increase and home prices could continue to drop. If you are buying a home, you need to be prepared for that to be the case. Plan to own your home for at least 5 to 7 years to help protect yourself against any drops in price. Mortgage rates have been over 6% for the last several years now, so this shouldn’t come as a surprise, but don’t count on being able to refinance your mortgage at a lower rate anytime soon. When you purchase a home, you need to marry the house and the rate.

My wife and I purchased our first home last year. If we had to move tomorrow, I think we would have to sell our home for less than we bought it for. There are more homes for sale in our neighborhood than there were a year ago, and comparable homes priced similarly to ours aren’t selling. Is part of me disappointed our largest asset didn’t immediately skyrocket in value after purchasing? Sure. But we plan to be in this house at least another 10 years. We bought at a price we could afford. We don’t need the price to go up; if our home dropped in value by 30% tomorrow, we would still be very happy with our decision to buy this home.

I know when it comes to a net worth statement, homes are listed as assets. After purchasing ours, though, I don’t think “asset” is an appropriate term. The value of our home is in the utility, security, and happiness it provides, not the amount of money it is worth on paper. If or when you make the decision to buy a home, any appreciation in value should be viewed as a potential cherry on top, not a driving force of your decision to purchase.

It’s good practice to consider what would happen if everything went wrong after you purchased a home. If you can feel good about your answers to the questions below (from a previous article that you can check out here), there’s a good chance you can successfully purchase a home.

Will I be okay if my home is worth less in 5 years?

Home prices don’t drop often, but they typically take longer to recover than the stock market. If you are purchasing a home, you need to be prepared for the worst-case scenario of your home dropping in value. This usually means planning to stay in the home at least 5-7 years, or longer if you put down less than 20%, to ensure you are never in a situation where you are forced to sell when you are “underwater” on your home (owing more than the home is worth).

What if mortgage rates don’t drop anytime soon?

It is very difficult to predict the future of mortgage rates, and if you are purchasing a home, it should be a financially smart decision regardless of whether interest rates drop, go up, or stay steady. Would it be great if rates dropped significantly over the next few years and you could suddenly cut your mortgage payment by 50%? Absolutely. While that is a possibility, you should not count on being able to refinance anytime soon when buying a home. You should be able to afford your monthly mortgage payment on the day you buy (which means it should be no more than 25% of your gross income).

What if the home requires more repairs than I thought?

Certain major home expenses can be planned for, but many are unexpected and can be devastating if you aren’t prepared. What happens if you need to replace your HVAC unit in the first few months of buying a home? That happened to me. How soon will you need to replace your roof? What is your plan if major appliances fail? Make sure you are financially prepared for the unexpected before buying a home.

How stable is your household income?

Preparing for the unexpected means thinking about the possibility of uncomfortable events; what would happen if you or your spouse lost your job after buying a home? Do you have multiple sources of income in your household? How easy would it be for you or your spouse to find a new job with a comparable income?

Will the housing market crash?

I don’t have a crystal ball, so I can’t tell you for certain whether or not the housing market will “crash,” but there aren’t currently any signs of impending doom. Prices are dropping slowly, but are still much higher than they were pre-2020. Available inventory is increasing steadily, but is still slightly below what we would have considered “normal” before 2020.

Right now, mortgage rates and available inventory are the primary drivers of home prices. If mortgage rates stay steady and inventory continues to increase, I would expect prices to continue to decrease. If mortgage rates drop significantly, available inventory could decrease and prices could rise. There are other factors that could come into play, but aren’t currently having much impact. A recession and rise in unemployment could certainly have an impact on prices. Inflation is currently 2.4%, but an increase in the rate of inflation could also impact home prices.

If I were in the market to buy a home today, I think I would feel more excited and optimistic than at any point since 2022. Mortgage rates are higher than you’d like them to be, but the amount of homes currently available for sale and slight decrease in home prices over the last few years is encouraging news for anyone looking to buy a home.