So, we’re going to be discussing the five biggest ways to help you legally avoid taxes. Number one, the low-hanging fruit: retirement plans. Yeah, Brian, this is an exciting one, and I think this is one that’s tried and true. People are aware of this, and it almost seems old hat, but we forget that this might, in fact, be one of the very best legal ways to hide money from the government.

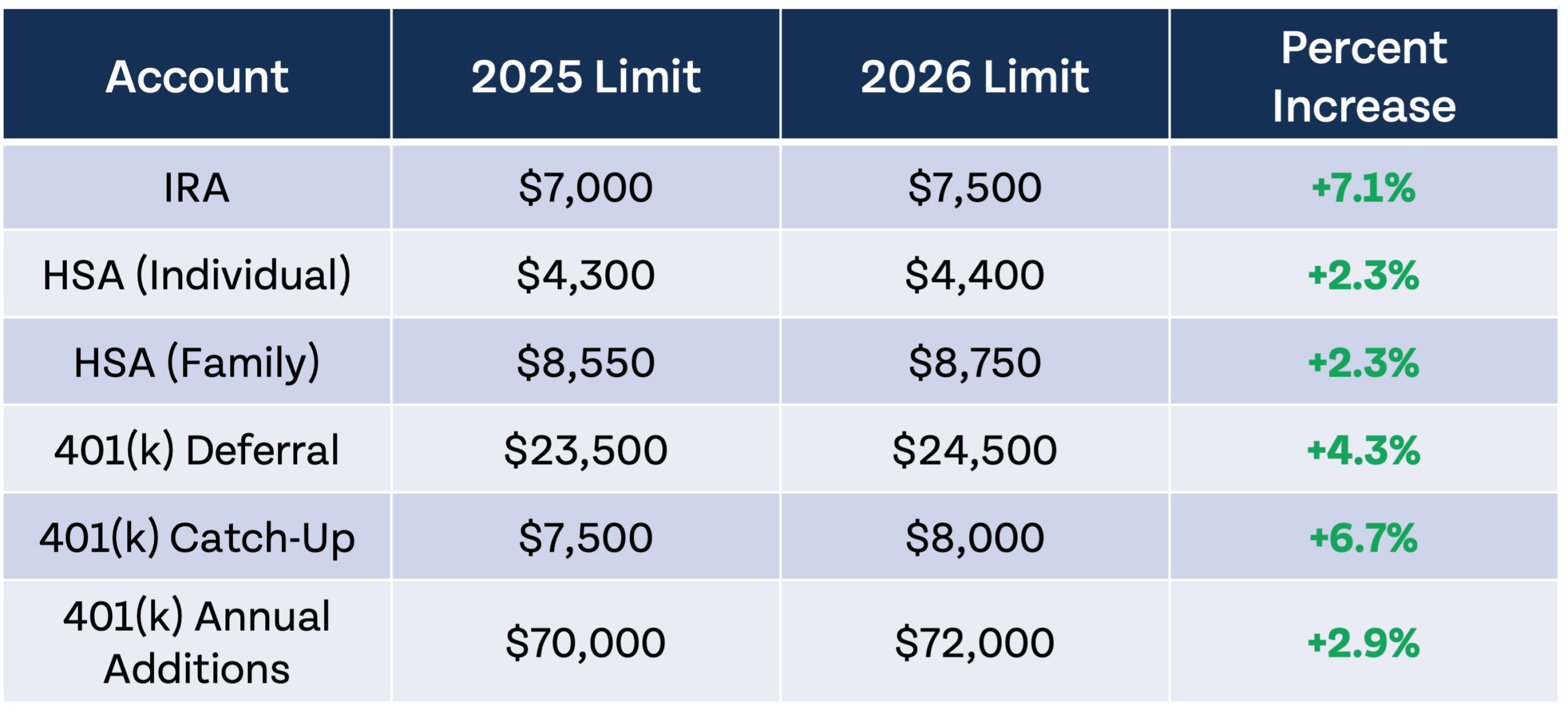

Yeah, whether it’s you avoiding taxes now by taking a current deduction when you fund your IRA or your health savings accounts, or if it’s avoiding taxes in the future when you fund your Roth IRA, there are all kinds of opportunities to do Roth contributions. Specifically, around $6,500 a year in 2023. And then, if you are 50 and older, it actually goes up another $7,500.

But we’re talking about IRA contributions. Obviously, there are Roth contributions, but there are income limits. And even if you’re going to do traditional IRA contributions, there are income limits there depending on if you have a retirement plan available and whether or not you can deduct it. However, even if you are someone who falls above the threshold to be able to contribute directly to a Roth IRA, that doesn’t necessarily mean that you can’t still do it. You can still do backdoor Roth conversions where potentially you can fund a traditional non-deductible IRA and convert those dollars to Roth. So, even if you’re above the income limits, there is a, I don’t want to say a loophole, but there is a strategy in which you can still build Roth dollars. You can definitely do backdoor Roth conversions.

Now, look, it does sound somewhat shady, but the government’s very aware of it. So much so that when we had tax negotiations in the last few years, this has potentially been on the chopping block as the loophole they were going to close. But it’s still open, so you might as well take advantage of this legal way to do Roth contributions even if you have a higher income. Now, recognize there are some limitations. If you have other IRA accounts, beware, and you need to tread carefully because you need to worry about isolating the basis and other things. It’s better if you just make sure that your account is structured properly so you can do a clean Roth conversion strategy.

So, we love building Roth assets because of the tax-free nature, but they’re not the only tax-free account that’s available to you out there. Most people don’t realize that health savings accounts can actually be pseudo-retirement accounts. If you’re one of the 4% of people that recognizes you can put money in, you can then invest those dollars to grow for the future, and then you can pay for qualified medical expenses completely tax-free. This could be a huge benefit when it comes to your overall financial planning on how you’re going to build tax-free dollars inside of your financial plan.

Now, I love that you just covered the triple tax advantage. All that is what you do to make your qualified medical expenses not only deductible when you make the HSA contribution but also when you pull it out at a future time. Highly appreciated for those qualified expenses. A lot of people, and it’s exactly what you kind of led up to, if you are 65 and older, these can be retirement withdrawals as well. You just don’t get to have to pay some income taxes on that part. But it’s still worth noting it’s a closet retirement account. So, it’s a great opportunity to legally avoid some taxation.

So, we talked about traditional IRAs and Roth IRAs and HSAs. These are all accounts that you can open up on your own. But another great way that you can legally hide money from the government is through your employer-sponsored retirement plan, whether it be a 401(k), 403(b), 457, etc. The defined contribution plans that Bo just covered. Think about this. You get to usually defer up to $22,500, and if you’re 50 and over, you actually get a $7,500 catch-up contribution that allows you to do $30,000 a year. That’s pretty incredible. And you get to choose, like I talked about earlier, you’re going to take the tax deduction now with traditional 401(k) or qualified retirement contributions, or are you going to let it be tax-free in the future by doing Roth contributions? Both of them are great if you just know exactly where you are in your tax journey.

Now, what you just said is something: know exactly where you are in your tax journey. There’s a lot of things you have to know between income and contribution amounts and how much can I do and what kind can I do. If you’d like a guide to help you navigate some of those tax circumstances, we have an amazing resource for free out at moneyguy.com/resources. This is our 2023 tax guide that will walk you through, ‘Okay, how much can I make into a Roth, or how much do I need to have to be able to deduct my traditional, or how much can I put into a 401(k)?’ If you have tax questions, this quick free resource is a great tool for you to use to navigate finding those tax answers.