Last Updated

January 29, 2026

Read Time

Share

What Should Your Net Worth Be?

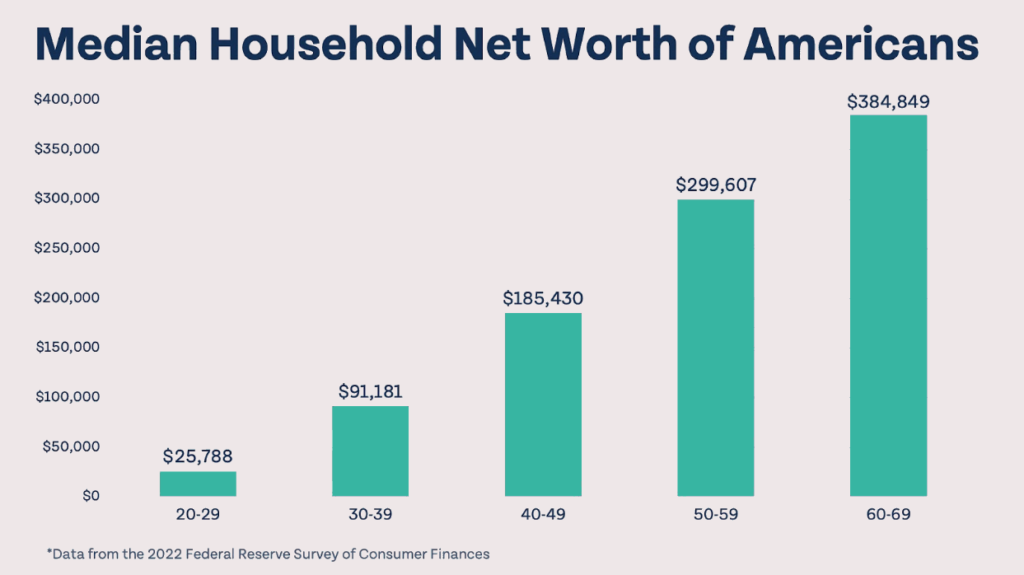

There is no simple number to aim for in regards to your net worth. Your target net worth depends on your age, income, financial assets, and retirement goals. Below is the median net worth of Americans at different ages.

- Age 20-29: $25,788

- Age 30-39: $91,181

- Age 40-49: $185,430

- Age 50-59: $299,607

- Age 60-69: $384,849

Whether you are above or below the median can you give you somewhat of an idea of how well you are doing, but it certainly doesn’t tell the full story. If someone in the top 1% of income is barely above the median net worth, they probably aren’t doing too well. On the other hand, if someone is in the bottom 10% of income and above the median net worth, they are likely doing a fantastic job.

To get a better idea of how you are doing based on your income, we created a scale of how much you should have invested by age, based on your income.

- Age 30: 1.0x income

- Age 40: 3.0x income

- Age 50: 6.4x income

- Age 60: 13.7x income

- Age 65: 20.0x income

What is Net Worth?

Copy link to this section: What is Net Worth?

Copied the URL to your clipboard!

Net worth is simply what you own minus what you owe (your assets minus your liabilities). Everything that you own is included in your assets: your home, car, investment accounts, furniture, personal belongings, and more. For use assets, we suggest using a conservative estimated value. Bo and Brian value their homes at purchase price on their net worth statements.

Share image

Average vs. Median Net Worth Explained

You might see the terms “average net worth” and “median net worth” used interchangeably, but they are very different. The average is a sum of the net worth of all Americans divided by the number of Americans. The median net worth is the net worth of the person in the exact middle of the data set.

In the United States, there is a great disparity between average net worth and median net worth.

According to the Credit Suisse Global Wealth Report, the United States ranks #2 of all countries for average net worth at $551,350. The United States ranks #13 of all countries in median net worth at $107,740.

How Often Should I Calculate My Net Worth?

Have you ever heard the phrase “a watched pot never boils”? Of course watching a pot of water doesn’t mean it takes longer to reach the boiling point, but it makes it feel much longer. The same is true for your net worth. If you are calculating your net worth constantly, it may feel like your net worth isn’t changing much at all.

We suggest calculating your net worth on an annual basis, typically at the beginning of the year. This is a long enough time period to drown out some of the noise (short-term market fluctuations, for one) and short enough to steadily track your progress over time.

How Do I Calculate My Net Worth?

Copy link to this section: How Do I Calculate My Net Worth?

Copied the URL to your clipboard!

What to include

Assets

- Investable assets, like your 401(k) and Roth IRA

- Cash, including checking and savings account balances

- House (consider including it at purchase price for a more conservative estimate of net worth)

- Vehicles (include at fair market value, not purchase price)

- Valuable personal assets, like jewelry, antique furniture, and collectibles

- Other real estate

- Business interests

Liabilities

- Mortgage balance

- Credit card debt

- Student loans

- Car loans

- Medical debt

- Any other liabilities you may have

What NOT to include

- Income

- Expenses

- Inexpensive personal items

Calculating your personal net worth is easy. Simply tally up everything you own and everyone you owe and the difference is your net worth.

Download our free Money Guy Net Worth Spreadsheet to get a head start on calculating your own net worth.

We created our Money Guy Net Worth Tool calculator to take your net worth tracking to the next level. This calculator goes beyond our free, basic template and includes spreadsheets to track your net worth each year and a home dashboard.

Why Should I Know My Net Worth?

Copy link to this section: Why Should I Know My Net Worth?

Copied the URL to your clipboard!

If you are younger or don’t have a large net worth, tracking it may seem pointless or even counterproductive. Why is it good to know that your net worth is so low? There are several benefits to tracking your net worth, even if you are just starting out and your net worth is negative.

- Know where you’ve been, where you are now, and where you’re going

Imagine if you didn’t start tracking your net worth until you hit $1,000,000. You’d miss the most important part of your journey, the trek from $0 (or less) to $1,000,000! Your future self will thank you for starting to track your net worth as early as possible, even if it isn’t impressive.Knowing exactly where you’ve been and where you’re at can help determine where you’re going and the best path forward to get there. - Awaken the invisible hand

21% of Americans don’t know if they have credit card debt, and 30% don’t know how much they pay in credit card interest every month. If more consumers knew how much debt they had and what it was costing them, they’d likely be more motivated to get out of it.The same is true with net worth. 51% of Americans don’t know how to calculate their net worth, and many of them probably don’t want to learn. The simple act of calculating your net worth helps keep you motivated and highlights areas where you are doing well and areas where you may do better.

Net Worth By Age: 2026 Breakdown

Copy link to this section: Net Worth By Age: 2026 Breakdown

Copied the URL to your clipboard!

The Federal Reserve net worth data is only collected every 3 years, and data from the 2025 survey won’t be available until later in 2026. But we can still look at how household net worth has changed over the years using the most recent data available from 2022.

The Federal Reserve Survey of Consumer Finances data is available from 1989 onwards, which allows us to analyze both long-term and shorter-term changes in household net worth. The median household net worth has increased 37% since 2019, after inflation, the sharpest increase recorded in the history of the survey and the highest household net worth ever recorded (adjusted for inflation).

Much of the increase in net worth is being driven by home prices increasing in the United States. From the first quarter of 2019 to the first quarter of 2022, the median price of houses sold in the US went from $313,000 to $433,100, an increase of 38%. Over the same period of time, from 2019 to 2022, American financial assets (excluding things like homes and cars) are still up 29%.

While overall net worth is at an all-time high, household financial assets, such as 401(k) balances, savings accounts, and Roth IRAs, are still below peaks in 2001 and 2007 when measured in inflation-adjusted 2022 dollars.

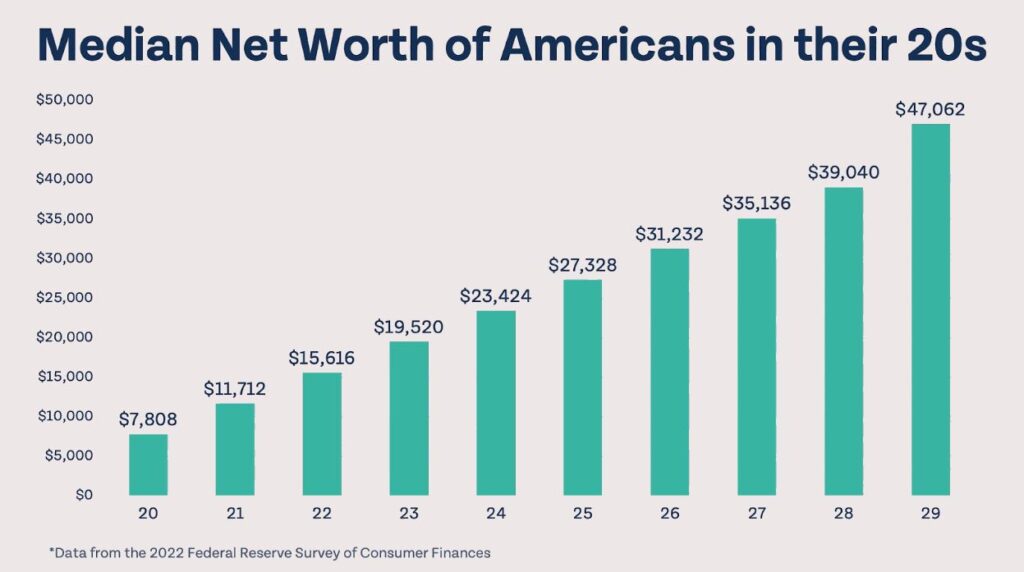

All data for the median net worth of Americans by age comes from the Federal Reserve Survey of Consumer Finances. This survey is conducted every three years, and data is released the following year. Current data is from the survey conducted in 2022 and data released in 2023. The Survey of Consumer Finances provides data for age ranges instead of specific ages; to determine median net worth at each age, we extrapolated the data linearly to fill in the gaps.

Median Net Worth of Americans

- Age 20-29: $25,788

- Age 30-39: $91,181

- Age 40-49: $185,430

- Age 50-59: $299,607

- Age 60-69: $384,849

Early Career: Median Net Worth of Americans 20 to 29 Years Old

Americans in their 20s are just starting out: some haven’t yet had a job and are still in college, while others are early on in their careers. Most do not own homes, and their most valuable asset may be their car. Retirement accounts are likely small or non-existent, and cash savings may also be low.

The Messy Middle: Median Net Worth of Americans 30 to 39 Years Old

We often call the decade of the 30s the Messy Middle because obligations and stress are high while time and money may be at a premium. Americans in their 30s are often buying their first home or having a child, so accumulating a large net worth may be difficult.

Mid-Career: Median Net Worth of Americans in Their 40s

Those in their 40s have had a good amount of time to see significant asset accumulation. They may have a house, 401(k), emergency fund, Roth IRA, and other assets on their net worth statement. As we can see below, median net worth balances increase significantly throughout the 40s.

Later Career: Median Net Worth of Late-career Americans in Their 50s

As Americans get closer to retirement, they may start saving more to their retirement accounts and see larger increases in their net worth.

Pre-Retirement & Retired Americans: Median Net Worth for Seniors 60 to 69 Years Old

Those in their 60s are likely already retired or on the verge of retirement. We would think their net worth would be higher, and the data shows it is higher than any other age group.

Net Worth of Financial Mutants

Copy link to this section: Net Worth of Financial Mutants

Copied the URL to your clipboard!

The net worth of the average American is, frankly, not too impressive. If you own a median priced house in the US outright, you have a higher net worth than every single age group. It’s only fair for Financial Mutants to compare themselves to other Financial Mutants, and that’s just what we’ve done with our most recent survey show.

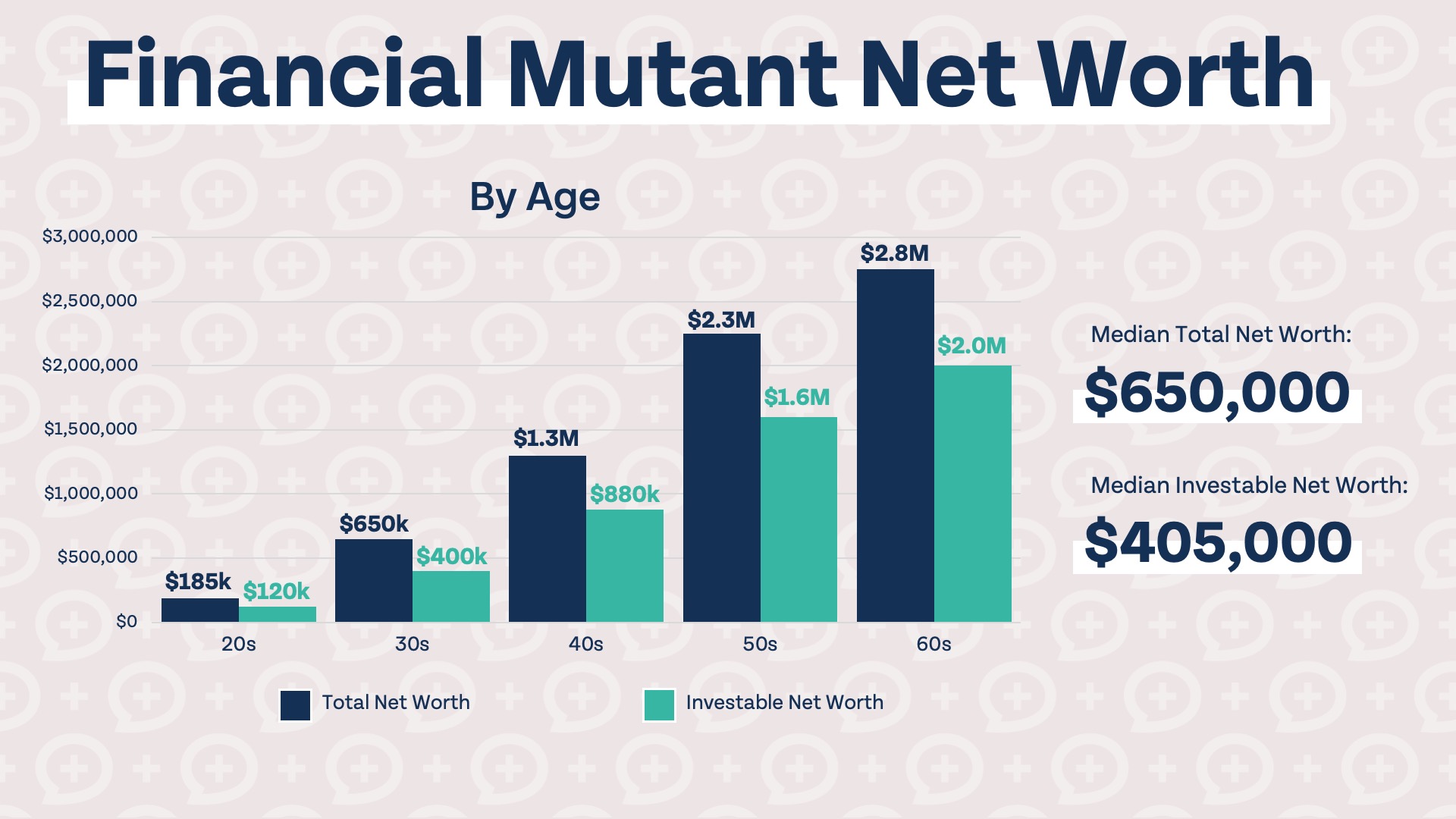

Even those in their 20s have accumulated a significant amount of net worth, with the median mutant at $185,000 total net worth or $120,000 investable net worth. Things really pick up in the 30s and 40s as mutants near $1,000,000 in median net worth, and by retirement the median mutant has $2 million in investable net worth (that’s investable net worth, not including homes or other assets).

Share image

Our Financial Mutant survey show is chock-full of data from our survey of over 25,000 Financial Mutants just like you. We asked about savings rate, income, student loans, and so much more. Check out the full show below.

How do I become a Financial Mutant?

Becoming a Financial Mutant is simple: you need to live on less than you make and invest a little bit of today for a better tomorrow. We believe everyone should aim to invest 25% of their gross income, especially after age 30. In addition to saving 25% or more of their gross income, there are several other traits Financial Mutants tend to share.

- They don’t take out too many student loans (for 85%, their first-year salary exceeded their total student loan balance).

- 81% drive their cars for more than seven years before getting a new one.

- Nearly 90% do not have any credit card debt.

- 85% of Financial Mutants have a fully funded emergency fund.

Use the Financial Order of Operations as your blueprint to becoming a Financial Mutant!

Other Factors Impacting the Net Worth of Americans

Copy link to this section: Other Factors Impacting the Net Worth of Americans

Copied the URL to your clipboard!

Median Net Worth by Family Structure

How does having children affect your net worth?

Unsurprisingly, the data shows that a couple with no children has a higher median net worth than any other group with or without children. However, having children should obviously not be a decision based on how much your net worth may increase or decrease.

While kids are expensive, they do not have to be a hindrance to building wealth.

Median Net Worth by Employment Status

The Federal Reserve broke the Survey of Consumer Finances data down by employment status, and the results are very interesting. Americans not working have the lowest median net worth, while employed Americans have the next lowest net worth. Retired Americans are in a distant second place to self-employed Americans.

Starting your own business and being an entrepreneur can be very rewarding and lucrative, as the data shows self-employed Americans with a higher net worth than any other demographic.

Median Net Worth by Educational Attainment

Is college still worth it? The Survey of Consumer Finances shows that it is absolutely worth it. The median net worth of Americans with a college degree is significantly higher than other educational demographics.

While obtaining a college degree can certainly increase earning potential, we believe it is very important to do college right and ensure your degree is worth the investment. It is very possible to build wealth without a college degree, and going to college isn’t always the answer.

How To Increase Net Worth

Copy link to this section: How To Increase Net Worth

Copied the URL to your clipboard!

If you are lagging behind the numbers above, don’t get discouraged. There is always time to increase your net worth. While a high income isn’t necessary to grow your net worth, it certainly helps. If you are still working on growing your net worth, contributing to retirement accounts and paying off high-interest debt are the best things you can do.

Once you have assets growing in a retirement account, they’ll increase your net worth automatically! High-interest debt does the opposite, by decreasing your net worth automatically, so get any high-interest debts paid off as quickly as possible.

At the end of the day, any activity that increases your assets or decreases your liabilities will increase your net worth.

Here are some easy ways you can increase your own net worth.

- Invest in retirement accounts (check out our ultimate guide to investing)

- Build an emergency fund

- Pay off your credit cards

- Pay off your student loans

- Pay off your car loan

- Increase your savings rate

FAQs

Copy link to this section: FAQs

Copied the URL to your clipboard!

When am I considered wealthy?

Wealthy is subjective and what “wealth” means for you may be completely different than what it means for someone else. If you have enough invested to stop working entirely and pay for all of your needs and wants, most would consider you wealthy.

Should I include my home?

Yes, include your home in your net worth. Brian and Bo include their own homes at purchase price instead of market value to give a more conservative estimate of their net worth.

What about my car?

Yes, you can include large assets like your car in your net worth. Since vehicles are quickly depreciating assets, make sure you use the latest value of your car.

How do I factor in my 401(k)?

Simply include the current balance of your 401(k) in your net worth.

What if my net worth is negative?

It is not uncommon at all for younger people to have a low or even negative net worth. When you have a lifetime of earning and saving ahead of you, there isn’t necessarily a reason to be worried about a negative net worth. The important thing is to start investing as soon as possible and prioritize paying off high-interest debt.

What’s more important – net worth or cash flow?

Net worth and cash flow tell you different things about your financial situation. Net worth tells you how good you have been at building wealth in the past, and cash flow tells you about your ability to build wealth in the future.

Do Pokémon cards count towards my net worth?

Collectibles can be included in your net worth if they have an established market, a relatively stable value, and aren’t illiquid.

Why is net worth important?

Your net worth is important because it is a measure of how successful you have been at building wealth.

What is the biggest net worth mistake?

The biggest mistake people make with their net worth is either waiting too long to start investing or allowing high-interest debt to erode their net worth.

Is Social Security included in net worth?

Social Security counts as income and is not included as net worth, but the money received from Social Security can be used to purchase or invest in assets that count towards your net worth.

Resources

Copy link to this section: Resources

Copied the URL to your clipboard!

The median net worth of Americans is constantly changing. You can see how the new data compares to previous data by checking out our Average Net Worth By Age show from earlier this year and previous years.