Last Updated

May 15, 2025

Read Time

Share

Who Needs to Read This?

Paying for college should be a team effort–not just a burden placed on the student alone.

Only 5% of the population of the US is currently enrolled in college, but the cost of going to college, and determining how to pay for college, affects much more than 5% of the population. From future college students, parents and grandparents who want to help their child or grandchild pay for college, graduates paying back their student loans, and even the employers of those graduates, the impact of the cost of a college education reaches far and wide.

Who is this for?

- College students

- Future college students

- Recent grads

- Parents and grandparents

- Employers

Is College Still a Good Investment?

Copy link to this section: Is College Still a Good Investment?

Copied the URL to your clipboard!

See also by Money Guy: Does It Still Make Sense To Go to College?

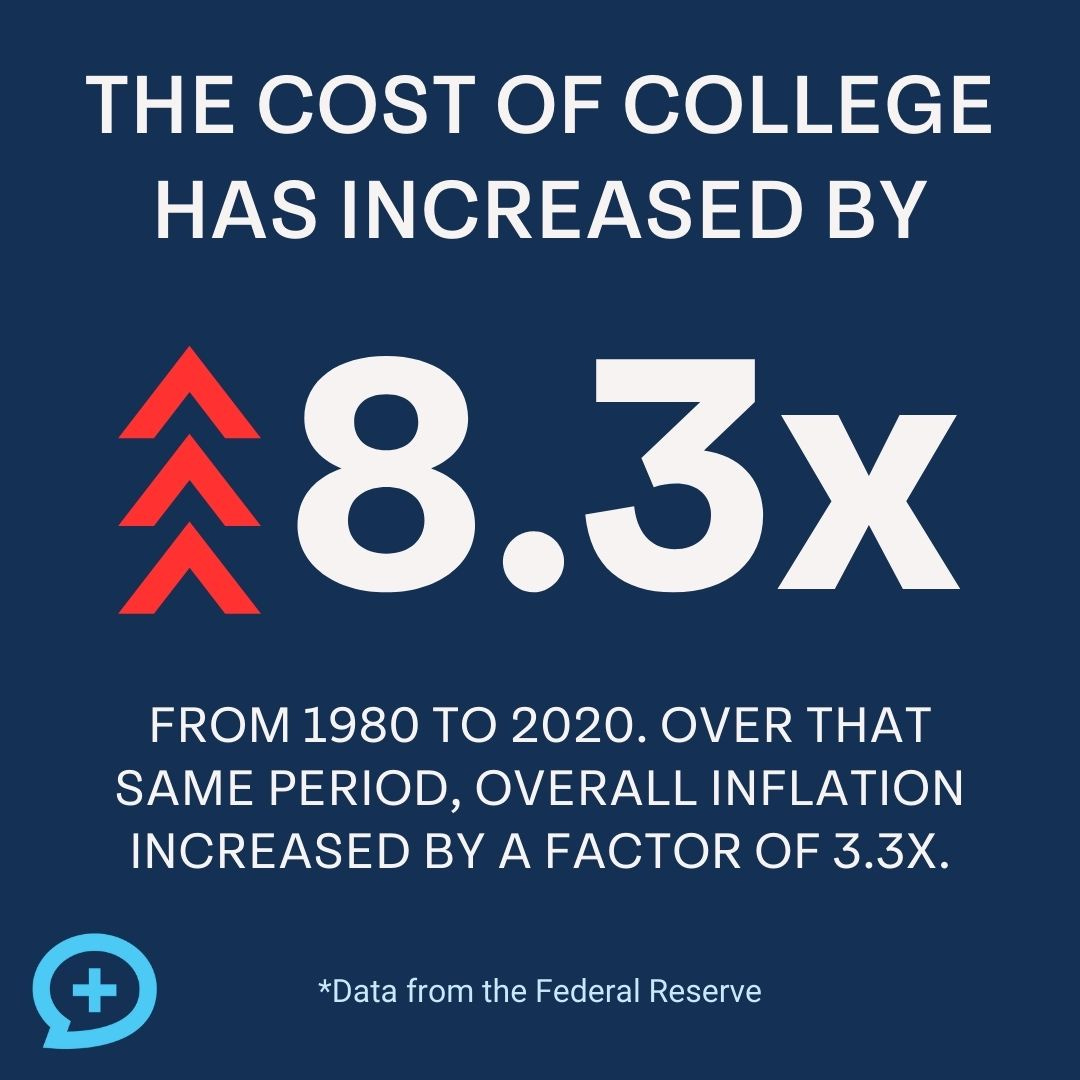

Everyone knows that the cost of college has risen significantly since 1980. While the cost has gone up by a factor of 8.3x, it doesn’t necessarily mean that college is no longer worth it. Let’s dive into the numbers to see exactly how much extra income you would need to make for college to be worth it financially.

Share image

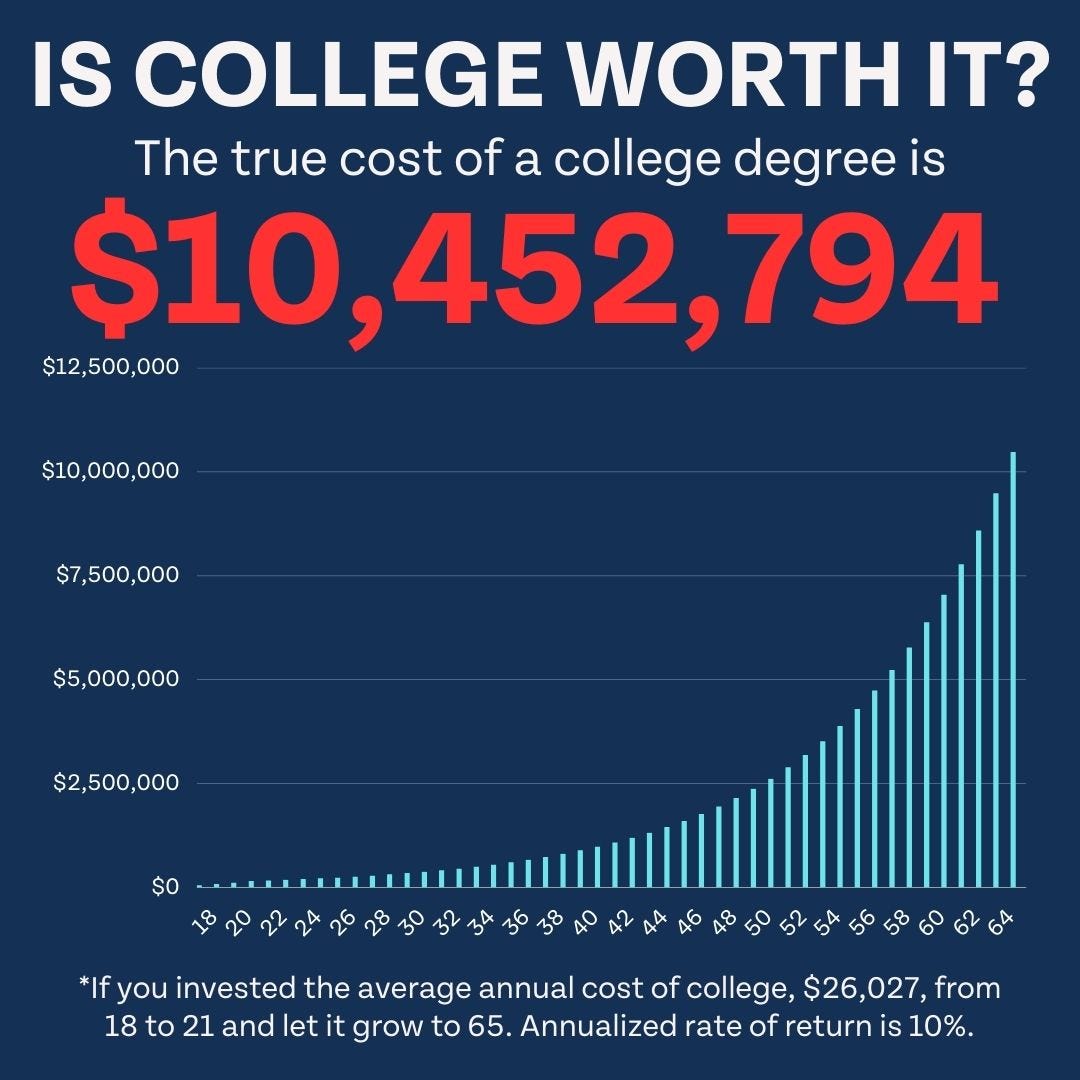

The average cost of attending college for one year is $26,027. If someone instead invested that amount each year from ages 18 to 21, for a total of $104,108, they would have $10,452,794 invested by age 65 (assuming a 10% annual rate of return).

The opportunity cost of spending the average annual cost of college attending rather than investing could be over $10 million by retirement. It’s a number that sounds almost incomprehensible and impossible to overcome – but starting at such a young age makes it more attainable than you would think.

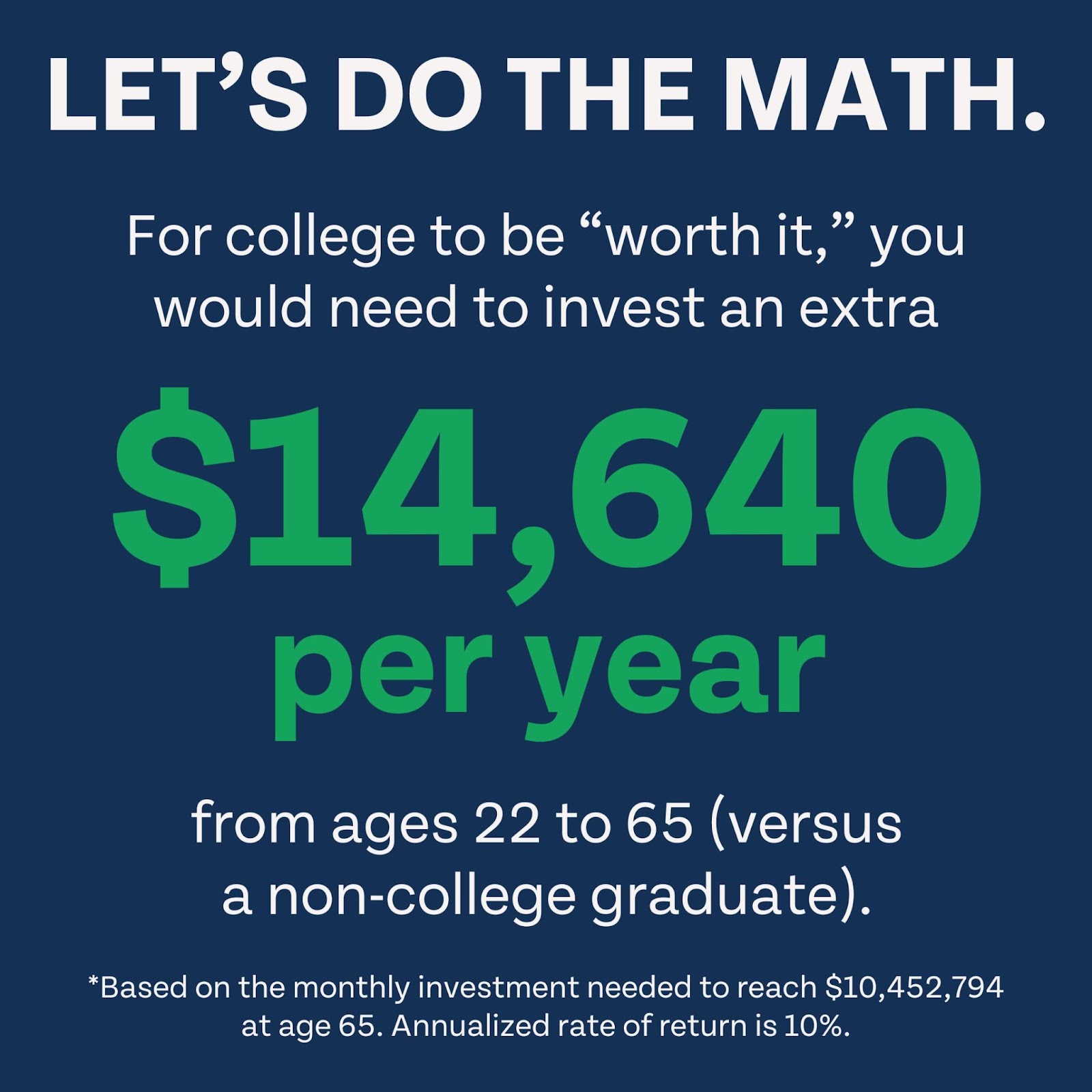

To reverse engineer the math we just did, let’s assume someone graduates college at 22 and wants to invest an amount per month to catch up to the person who did not attend college. To reach $10,452,794 by 65, the college attendee would need to invest $1,220 per month every month from age 22 to 65. In other words, their college degree would need to earn them an extra $14,640 per year for it to be “worth it.”

Share image

That’s certainly not a small number, but it’s much smaller than $10 million. It’s very possible for a college graduate to earn $14,640 per year more than someone who didn’t attend college, and many DO, which makes college worth it in many situations. Ultimately, college being a smart decision often hinges on choosing your major wisely. Check out the list of the top 5 highest-paying college degrees below.

- Petroleum Engineering

- Industrial Engineering

- Computer Science

- Interaction Design

- Public Accounting

Should You Go To College?

Copy link to this section: Should You Go To College?

Copied the URL to your clipboard!

See also by Money Guy: Top College Degrees – Money Guy

If you attend a college with an “average” cost of attendance, mathematically, you should go to college if you will make at least $14,640 more per year than if you did not go to college. However, there are so many different factors that determine whether college is a good decision.

Not everyone attends a college with an “average” cost of attendance. If the school you attend is less expensive, it may be an easier decision to go to college; if you attend a private college with a more expensive cost of attendance, it could be harder to justify.

How They Did It: 80/20 Parent-Student Split

“My parents agreed to pay 80% of the cost with a 529 plan, leaving me to pay or get scholarships to cover 20%. My scholarships covered more than 20% so I didn’t personally pay anything out of pocket. I opted for a cheaper school because of that even though all of my friends went to the more expensive one I was considering. So it ended up dictating where I went to college.”

– Grace, Class of 2020

Graduates with certain degrees, such as those in STEM-related fields (science, technology, engineering, and mathematics), have an easier time paying off student loans. If you want to be an engineer or accountant, yes, college is probably worth it, and your degree may not be too expensive if you attend a public school (or even better, a community college for at least the first few years). Your earning potential will be high, and you’ll likely have the capacity to pay off any student loans you may have accumulated while in school.

For many other potential college attendees, the cost of college can be difficult to justify. Some universities have started adding thousands of new majors, hoping niche degree programs will increase enrollment. Some are useful, like cybersecurity and data analytics. Someone graduating with a cybersecurity degree will likely increase their odds of getting hired into the field. Others, such as casino management and peace education, sound far less lucrative (well, less lucrative for graduates; they sound very lucrative for the colleges offering them).

Just because college is a good or bad financial decision on paper doesn’t necessarily mean it will be a good or bad decision in practice. If you go into a field that makes great money and don’t take out much debt, that should be a great decision on paper. But what if you are miserable in your career field and end up leaving for a much lower-paying job after a few years?

It’s difficult to quantify some of the non-financial benefits of attending college. At its best, a college degree shouldn’t just be a ticket to a higher-paying job. It should be a comprehensive education that improves your life in many different areas. The decision on whether or not to attend college, and where to attend college, depends not just on money but your overall experience on campus, non-tangible factors like how much you learn outside the classroom, and more.

How They Did It:

Good Ol’ Fashioned Hard Work“Just your classic case of working an average of 100 hours a week (between 2 different jobs) for 2.5 years. I had no access to student loans or scholarships and parents paying was not an option. In total all three degrees (associate degree, bachelor’s degree, and master’s degree) cost me around $40,000 over the course of four years.”

– Yochanan, Class of 2022

College Alternatives

Copy link to this section: College Alternatives

Copied the URL to your clipboard!

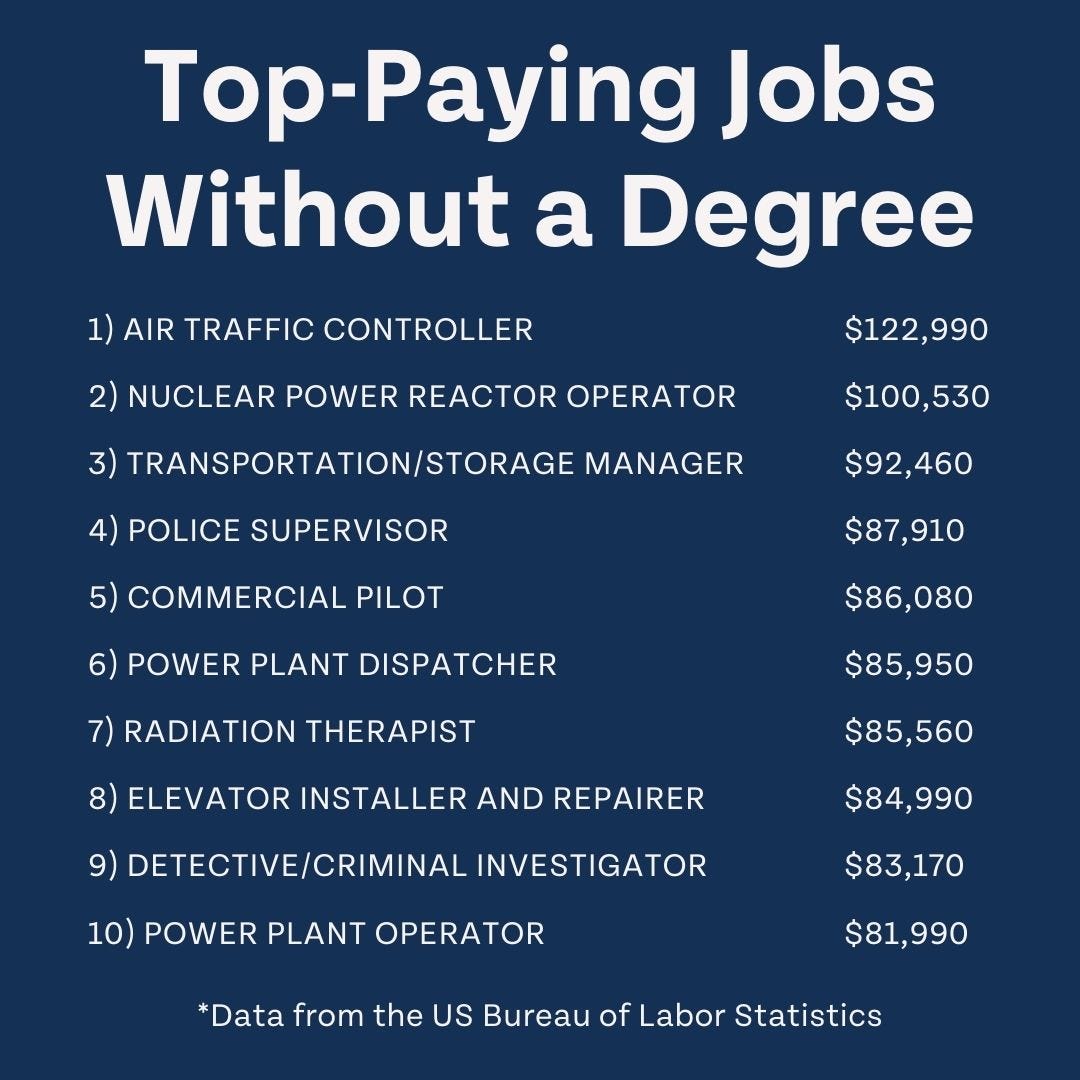

Not everyone needs to attend college! There are plenty of good-paying jobs that don’t require a four-year college degree. These jobs still require highly-skilled, trained employees, but can be a less costly path for those that don’t believe college is for them. The list below shows the top 10 highest-paying jobs that do not require a college degree.

Share image

In the not-so-distant past, the jobs most commonly associated with not going to college were what we traditionally think of as “dead-end” jobs, such as in fast food, customer service, or other similar industries.

Fortunately, attitudes about college are slowly changing. The rising costs have certainly been a catalyst for change. Just 35% of Americans 25 and older have a four-year college degree or higher, and 3 out of 10 billionaires do not have a college degree. In 2023, 55% of companies removed bachelor degree requirements for some positions. Many technology companies, including Apple, IBM, and Google, are among those that no longer require traditional degrees. College can be a great tool to increase your earning potential, and makes sense for many, but there’s no shortage of extremely smart and talented individuals that are successful without ever attending college.

Ultimately, the path you choose is up to you – becoming successful and wealthy can be possible if you go to college and take out student loans. It can be possible if you never attend college. Understanding the value of your time and return on your investment can help you build wealth no matter how your journey begins.

College Affordability Plan – Expenses

Copy link to this section: College Affordability Plan – Expenses

Copied the URL to your clipboard!

First, Let’s talk about budgeting & planning!

See also by Money Guy (episode): Why (and How) You Need to Plan for the Cost of College

If you start planning how to pay for college and how you will budget your money, you are already doing better than many of your peers. Before you decide where to go to college, you should know the total cost of attendance, including not just tuition but everything else you’ll need to budget for while you’re in college.

How They Did It:

Husband Wife Tag Team“Before I got married, my college was primarily paid for by my parents through a 529 and an academic scholarship that I had. After I got married, the next couple of years were funded primarily by my wife and I working and Pell grants. The last couple of years, including my master’s degree program, were mostly through both of us working, education tax credits, and student loans.”

– James, Class of 2022

Student Budget – What’s it Going To Cost to Go To School?

You can use tools like the College Board Net Price Calculator to help you determine the total cost of going to college based on your school of choice. No matter where you choose to go to school, you’ll need to account for all of these expenses.

Tuition

Tuition will likely be your single biggest expense while attending college. Tuition is usually least expensive at public, in-state universities, and most expensive at private universities. Outside of choosing a different school or qualifying for more financial aid, there’s nothing you can do to lower the burden of paying for tuition, but planning for and around how much you will owe can greatly improve your college experience.

How They Did It:

In-State Tuition + Grandparents’ 529 = Zero Student Loan Debt!“I was very blessed and privileged that my grandparents paid for my college education. They began saving for me in a 529 plan the year I was born. I chose to go to a cheap in-state school. Their benevolence led to the total value covering all four years for me; I am incredibly grateful. I did not receive scholarships, nor did I take out student loans.”

– Grant, Class of 2023

For information on how to reduce the burden of tuition through scholarships, work programs, and other financial aid, see our Top 5 Ways to Fund College, below.

Room

The cost of living on-campus at college is likely much more expensive than living off-campus. Some colleges have restrictions on who is and is not allowed to live off-campus, but if you are allowed to live off-campus, you can save a lot of money by doing so. If you are willing to make sacrifices and live with multiple roommates in apartments that may not be the best in town, you can save a significant amount of money on room. If you are fortunate enough to have family members that live close to the college you are attending, living with family may be an option worth considering.

How to save on room

- Live off-campus.

- Get roommates.

- Live rent-free with your parents.

Board

Where you choose to dine while in college can save you (or cost you) a lot of money. On-campus meal plans are a luxury and can be a great and convenient option, but are not usually cost-effective. Fortunately, restaurants in college towns usually have specials aimed to attract broke college students. When you buy groceries, shopping at lower-cost retailers like Aldi can allow you to eat healthy while sticking to a tight budget.

How to save on board

- Avoid expensive on-campus meal plans.

- Shop at discount grocers.

- Take advantage of specials aimed towards college students.

Transportation

How do you plan to get around campus? Driving a car usually means you are paying for parking, gas, and maintenance on your car. If your college offers public transportation, this may be a much more cost-effective way to get around than driving everywhere. If you go to a smaller college you may not need transportation to class at all, but at bigger colleges you may end up taking the bus everywhere.

How to save on transportation

- Use public transportation when available.

- Carpool to class or work.

- Don’t drive a gas guzzler.

Books & Materials

Books and supplies for your classes can be very expensive, but there are some great ways to save money. Ask your professors if it is possible to get by using an earlier edition of the textbook required. Earlier versions of textbooks are often substantially cheaper. If you do need to buy the most recent version, see if you can share the cost with a classmate or buy the book from a student that had the class last semester.

How to save on books and materials

- Use earlier editions of textbooks if possible.

- Buy books and supplies from former students.

- Share with a classmate.

How They Did It:

A Great Scholarship and Help from Grandma“I had a sizable academic scholarship, and then my grandma paid for the rest.”

– Clay, Class of 2020

Personal Expenses

If attending college is your first time living without your parents, you may be shocked at how much it costs to just live. Cutting corners on personal expenses where you can may help ease some of the burden of paying for college. No, you shouldn’t go without soap or deodorant, but try shopping at discount retailers for all of your personal needs and avoiding luxuries whenever possible.

How to save on personal expenses

- Buy in bulk whenever possible.

- Try using the value brands.

- Shop at discount retailers.

Fun Money

College is a short season in life and you should do what you can to make it enjoyable and memorable. If you are working while in school or have another source of income, set aside a modest amount every month to enjoy. Having fun doesn’t have to cost a lot of money, and something as simple as taking a walk in a new place can make for an enjoyable day.

How to save and still have fun

- Take advantage of student nights.

- Use free amenities like parks.

Budget After Graduation

Your budget is going to change significantly after you leave college. There are no more scholarships, grants, or parents to provide financial support. You may experience a significant increase in income, but that could all be eaten up by all of your new expenses in the real world.

If your budget is looking tight after graduation, there’s no shame in living like a college student for a few more years if it helps you save more for the future. Having roommates, not dining out as often, and keeping frivolous purchases to a minimum can make all the difference in the world after college.

You Can Do It: Top 5 Ways To Fund College

Copy link to this section: You Can Do It: Top 5 Ways To Fund College

Copied the URL to your clipboard!

If you’ve decided you want to pursue a career that requires a college degree and it makes financial sense for you to go to college, there are a few things you can do to make your time in school cost-effective. Here are the top ways we’ve found to reduce the burden of paying for college.

1. Scholarships, Grants, and Other Aid

Scholarships offered by states and colleges can help pay for the majority of the costs of attendance. Grants are often offered to students as need-based financial aid. For more information on merit-based financial aid offered outside of your school or state, check out Scholly, which has helped students get over $100 million in scholarships total.

2. Tuition Reimbursement

Many companies offer tuition reimbursement for employees. Some of the big ones include Chipotle, Starbucks, and Home Depot, jobs which are very attainable for college students. The benefit of tuition reimbursement can be so large that it may be worth basing your employment decision on which employer can offer you tuition reimbursement in return.

3. Work-Study Programs

Other jobs, typically on-campus, may qualify for federal work-study programs. These jobs are available to students with a financial need and allow them to earn money to pay for school.

4. Working

It’s probably difficult to work a high-paying job while also attending college, but there are some jobs that may help you pay for school more than others. Servers and bartenders can earn higher wages than most other jobs available to college students, but they can be very competitive.

5. Family Wealth

It goes without saying that not everyone receives help from their family to go to college, but if you are in a position to receive financial assistance from family members, take advantage of it! The burden of paying for college can be lightened or eliminated entirely with help from wealthy family members.

Share image

The Final Frontier: Student Loans

Copy link to this section: The Final Frontier: Student Loans

Copied the URL to your clipboard!

See also by Money Guy: This Student Loan Statistic Will Blow Your Mind!

Sometimes you do everything you can to pay for college without taking out loans and it just isn’t enough. We don’t believe you should avoid college altogether if you must take out student loans, but if loans are required, aim to keep your total student loan balance below your expected first year salary out of college.

How They Did It:

Never Leave Money on the Table“I paid for my college education with an unwieldy combination of grants, scholarships, state and federal aid, federal loans, and cash earned from waiting tables at my neighborhood pub. Working for my education deprived me of some time, energy, and social occasions, but today I’m very happy I don’t have an enormous amount of loans to pay off.”

Christopher, Class of 2024

The Student Loan Debate

Copy link to this section: The Student Loan Debate

Copied the URL to your clipboard!

Student loans have become one of the most popular ways to pay for college, and the US now has nearly $2 trillion in total student loan debt. We believe that student loan debt should be avoided if possible, but it doesn’t have to ruin the rest of your financial life. If you do need to resort to student loans, keep your total student loan debt below your expected first year salary out of school to ensure your loans are manageable. The day you start repaying loans may feel far away while in school, but it will arrive much sooner than you think and you need to be prepared.

Federal loan forgiveness has undergone a lot of change over the last few years, and for many borrowers it may now be easier to get some or all of your student debt forgiven. If you are eligible for federal programs that can reduce your debt, take advantage of them as much as possible!

Share image

Not sure which student loan repayment plan to select? Check out this free online student loan calculator.

So, is it worth it?

Copy link to this section: So, is it worth it?

Copied the URL to your clipboard!

The value college can provide is different for almost everyone. There’s nothing wrong with recognizing college isn’t right for you, and there’s nothing wrong with paying for a college degree if you find that the cost is justified by the return (not just financial, but non-tangible). If you do college the right way, choose a school that won’t break the bank, look for every opportunity to cover the cost of attendance without taking out student loans, and apply yourself in class, college can be well worth the cost. It’s never too soon to start planning for college, and the earlier you and your family start thinking about those decisions, the better.

Related: Popular Money Guy Videos about Saving & Paying for College

Copy link to this section: Related: Popular Money Guy Videos about Saving & Paying for College

Copied the URL to your clipboard!