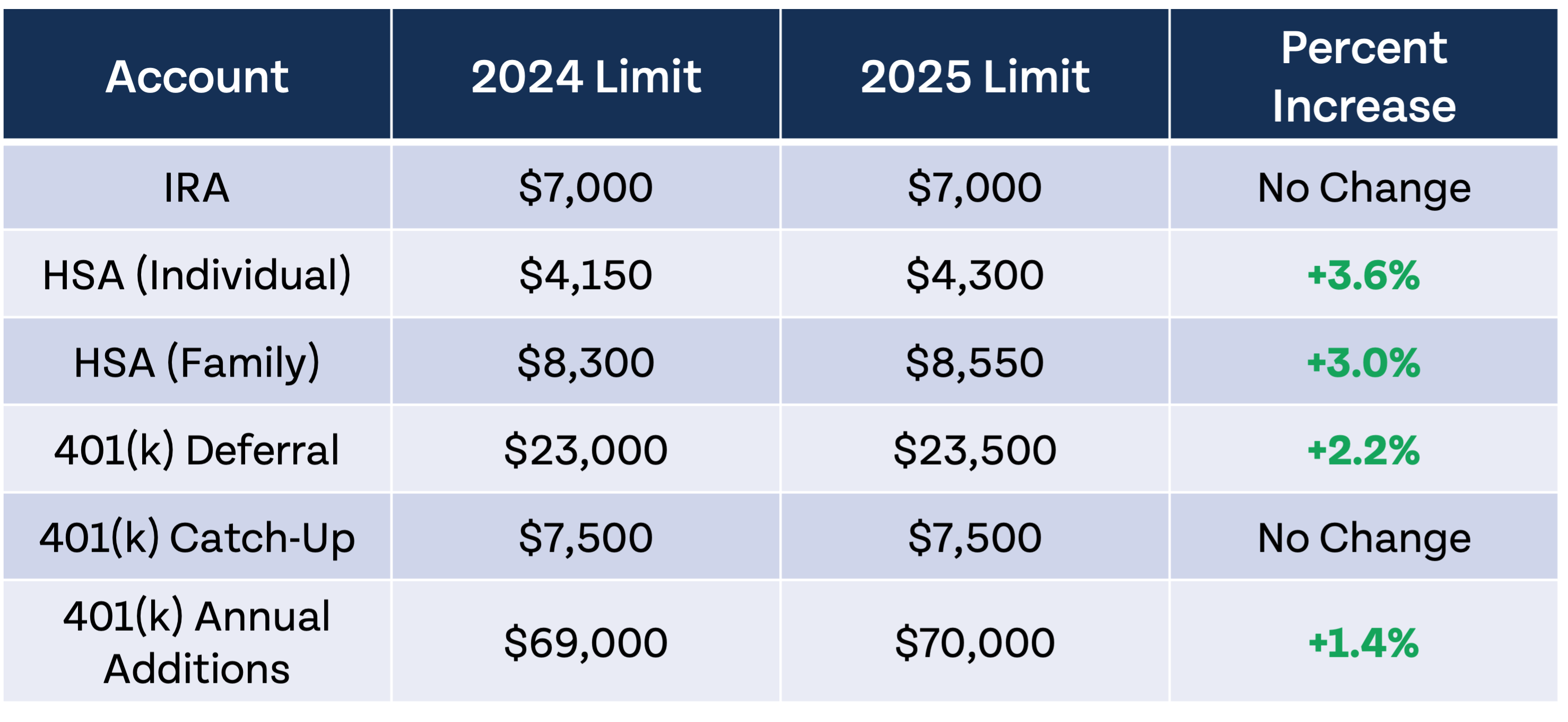

It’s my favorite time of year: the weather is getting cooler, the leaves are changing, football is in full swing, and most importantly, the IRS just announced 2025 tax changes! Every year around this time, the IRS announces inflation-adjusted numbers for the next calendar year, including retirement account contribution limits, standard deductions, tax brackets, and more. Here are the most notable changes for 2025.

Changes to retirement accounts

The Consumer Price Index (CPI) has risen 2.4% over the past 12 months, so inflation adjustments this year aren’t as notable as they have been in recent years when inflation was higher.

Most limits are going up a little bit next year, but there’s nothing to write home about. The IRS was especially stingy with the 401(k) annual additions limits, raising it just $1,000. If you do have automatic contributions set up for your 401(k) to max out your account, make sure you adjust them ever so slightly next year.

One Money Guy metric I like to keep an eye on is the gross income someone needs in order to complete Step 6 of the FOO without contributing more than 25% of their income. Assuming you can’t make catch-up contributions and have a Roth IRA, individual HSA, and a 401(k), in 2025 you would need an income of $139,200 to complete Step 6 of the Financial Order of Operations. This essentially means if you make under that amount, contributing to a 401(k), Roth IRA, and HSA will meet the 25% investing goal. If you make over that amount, you may need to utilize a mega backdoor Roth strategy and/or contribute to a taxable brokerage account.

The income phaseouts for retirement plans are also changing again next year. If you are following the FOO, the traditional IRA phaseout isn’t as important since you would prioritize a Roth IRA, but the Roth IRA income phaseout does matter. If you are single and will make under $150,000 in 2025, you can make regular Roth IRA contributions. The same goes for couples filing jointly that will make less than $236,000 next year. If you will or may make over those amounts, you may need to consider utilizing the backdoor Roth strategy.

Standard deductions and marginal tax rates

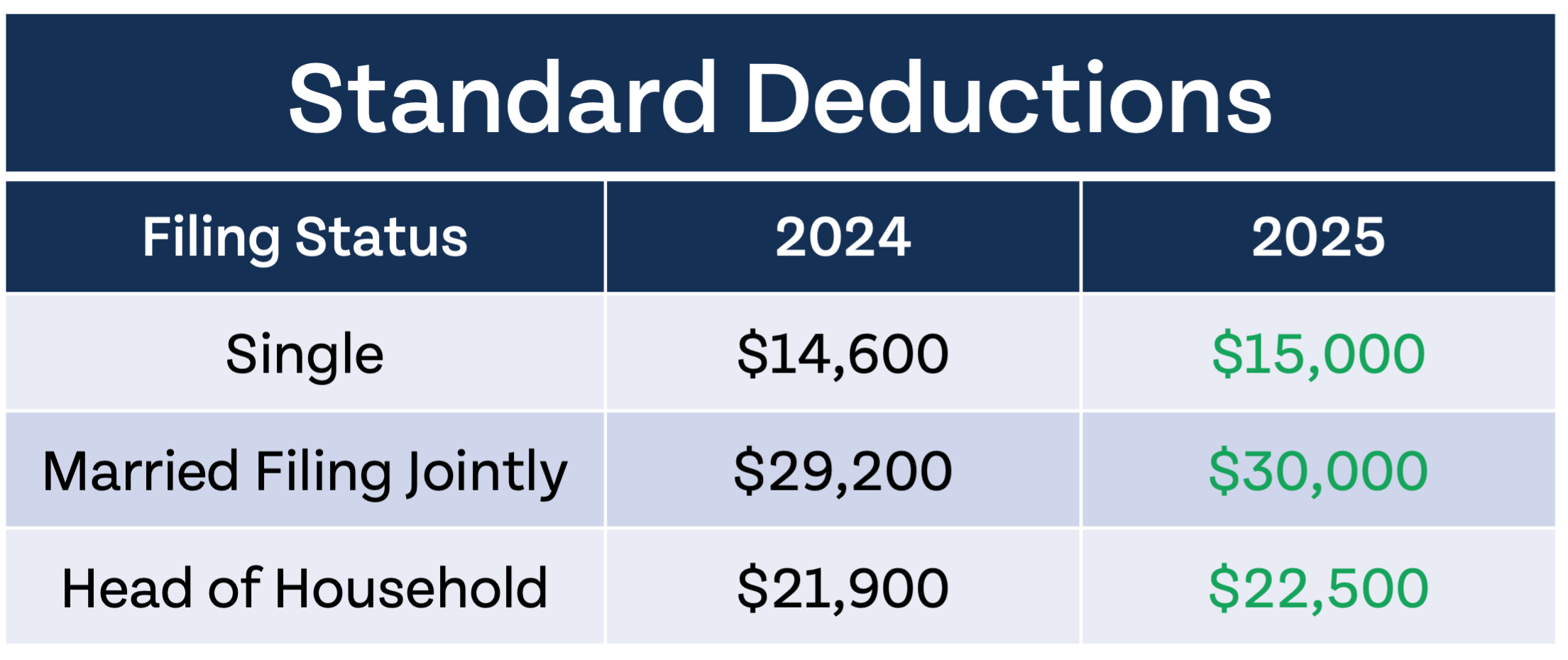

The standard deduction, which 87% of Americans take, is increasing modestly in 2025. While the increase may not be that exciting, I would argue it is a very exciting year for those of us that love round numbers. A standard deduction of $15,000 for single filers and $30,000 for married filing jointly is just about perfect. We’ll have to enjoy it while it lasts, as it will almost certainly change to another imperfect number in 2026.

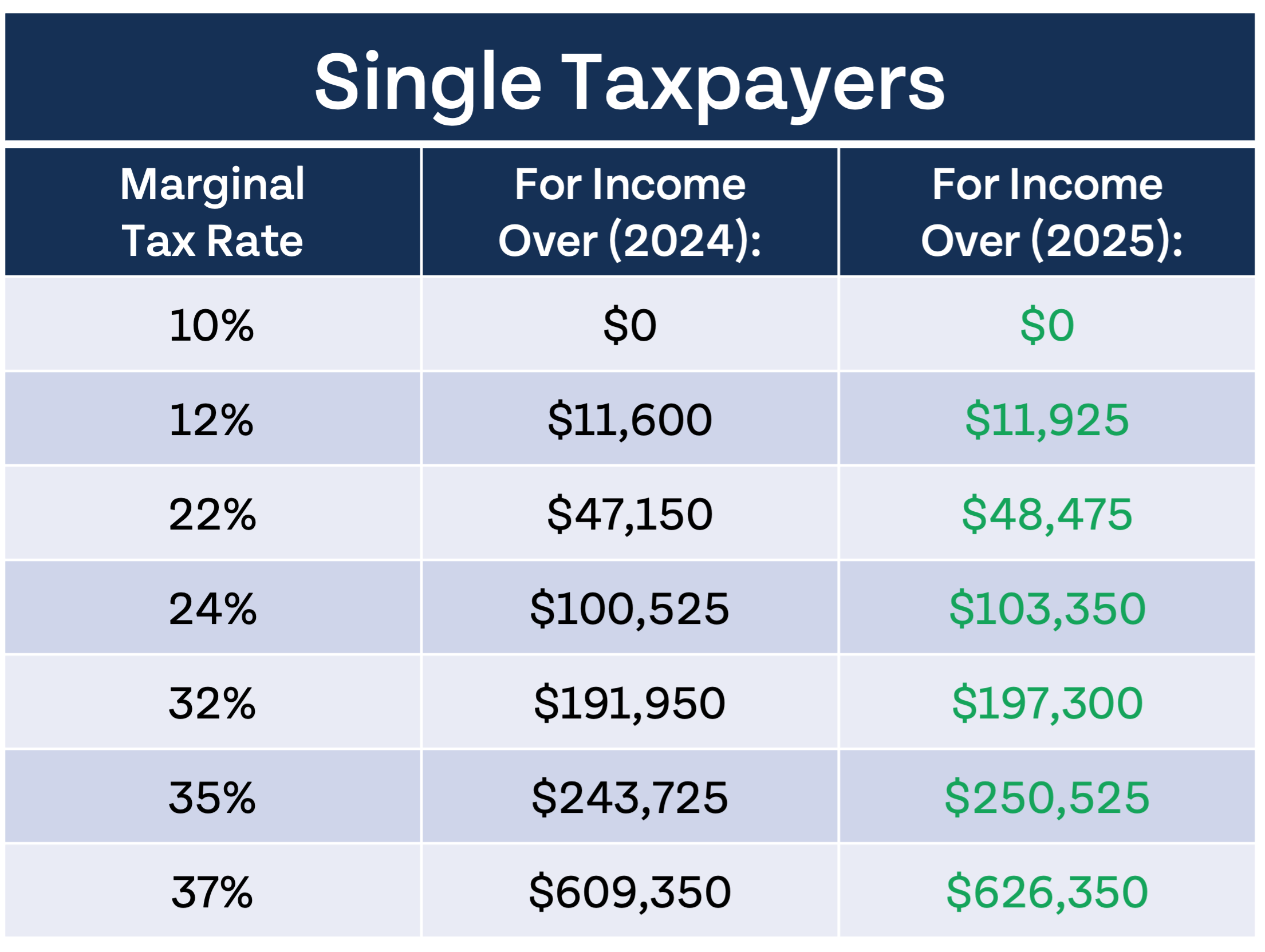

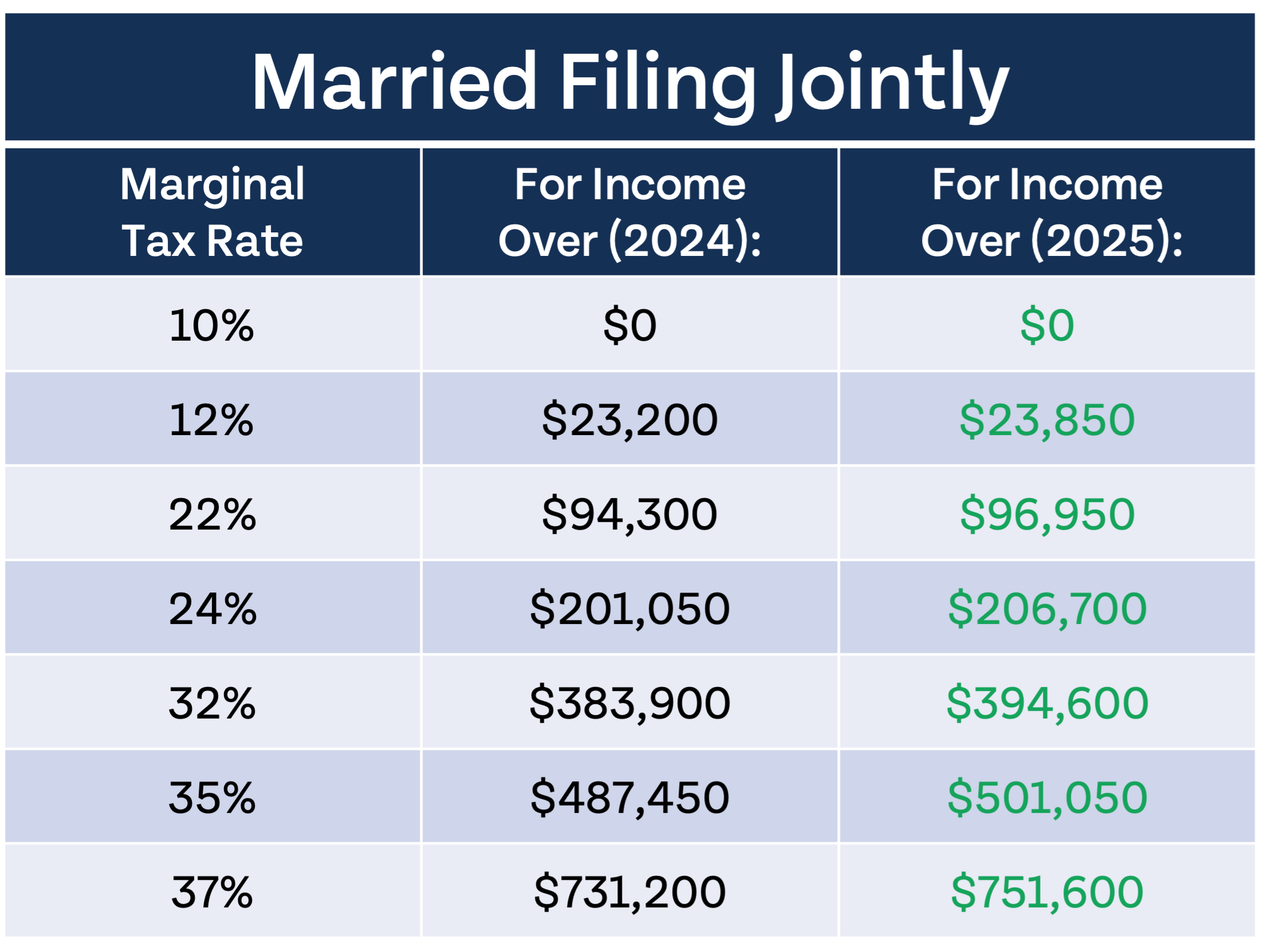

Marginal tax rates remain the same next year, but income thresholds subject to those rates increase annually for inflation. This could be good news if you are making the same amount in 2025 as you did in 2024: the amount of taxes you owe will decrease, all else being equal, even if your taxable income stays the same.

If you are thirsty for even more IRS tax changes heading into 2025, check out the IRS rundown of notable changes for tax year 2025. It is worth pointing out that we are getting ahead of ourselves – it is fun, at least for tax nerds, to look ahead at future changes, but when you file taxes next year you are going to be using tax year 2024 numbers. Fortunately for you, we have a handy Tax Guide PDF that we update annually to reference as you prepare your taxes next spring (or winter).