We are not in the business of making predictions at The Money Guy Show. In fact, if you’ve watched or listened to the show for any amount of time, you know we stay far away from predicting the direction of the stock market, economy, and other leading financial metrics. The last several years, inflation has been about the only financial metric on everyone’s minds. If inflation continues to drop, interest rate cuts by the Federal Reserve seem more likely. Interest rate cuts are stimulative to businesses, households, and the overall economy since they make borrowing money cheaper and encourage people to buy houses, businesses to hire employees and take risks, and more.

Have questions about how to buy a home in this crazy market, ways to beat the system, and common mistakes home buyers make? Check out our Money Guy Guide to Buying a House!

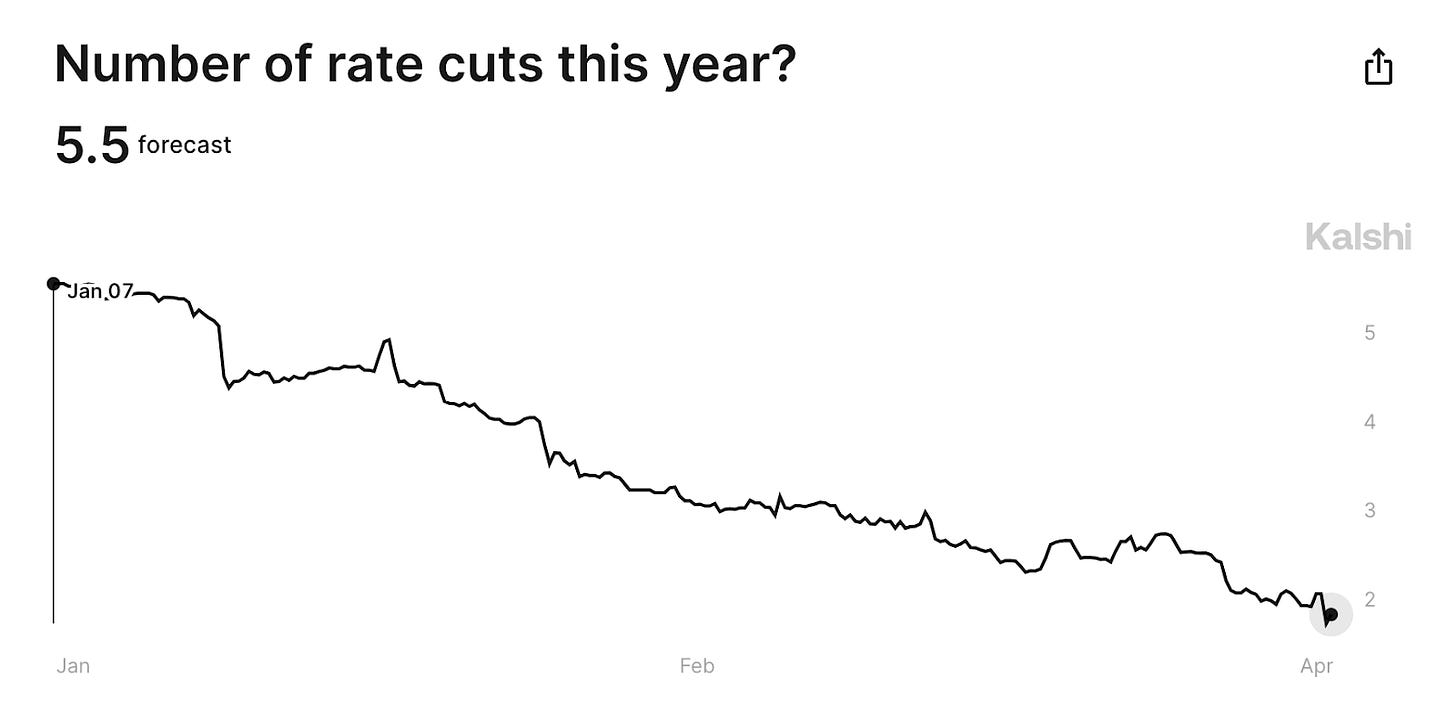

How the expectation for rate cuts have changed this year

In January, prediction markets expected 5 or 6 interest rate cuts this year, which would significantly reduce the Federal Reserve target interest rate. Now, the consensus has dropped to between 1 or 2 interest rate cuts this year.

It is still very possible the Federal Reserve does not cut interest rates at all this year. Chair Jerome Powell has long said the central bank needs to see more evidence that inflation is on its way down to the long-term target of 2%, and in recent months inflation has been moving in the wrong direction. Data for March shows the overall Consumer Price Index (CPI) coming in at 3.5% year-over-year, hotter than expected and well above the 2% target.

This change in expectations may be very frustrating to consumers and businesses looking for interest rates to drop so they can make large purchases, like a home, or expand their business. For anyone that understands how inflation works, the dramatic change in expectations shouldn’t be surprising at all. Here’s why forecasting inflation, and interest rates, is so difficult.

Why forecasting inflation is so difficult

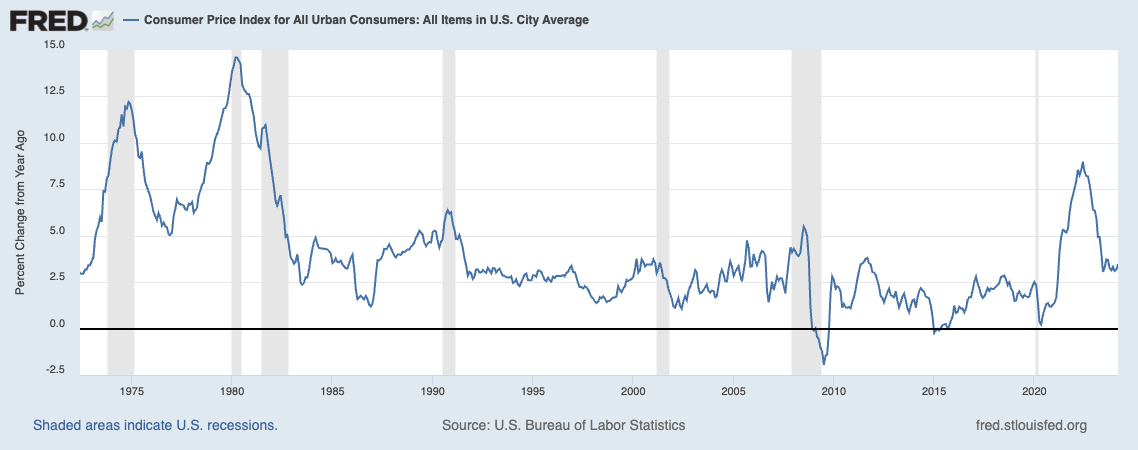

The last period of high inflation our country experienced, before 2020, began in about 1972 and lasted until 1983. As you can see from the chart below, inflation did not rise and then subside. Inflation seemingly peaked in late 1974, then came back and actually peaked in 1980.

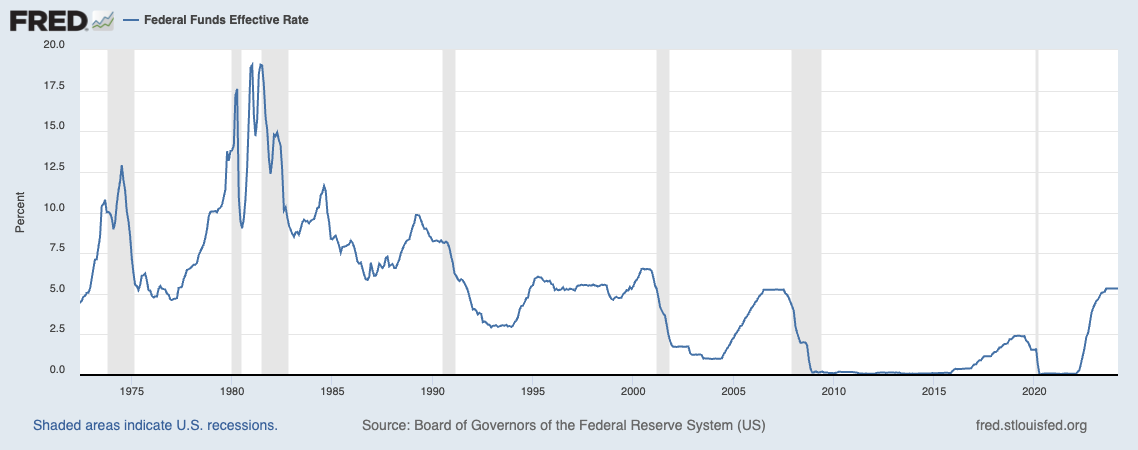

The federal funds rate also had several peaks, and topped 19% before declining (if you think mortgage rates in the 6% or 7% range are bad, try 19% or 20%).

I am not predicting we will see a resurgence in inflation like we did in the 1970s and 1980s. I am saying that the future of inflation is very difficult to predict, and it may have a lot to do with consumer expectations.

Inflation expectations can influence reality

Consumer expectations for inflation remain elevated. Consumers aren’t expecting high inflation, but they expect inflation to remain higher than the Federal Reserve target of 2% in the short-term (one year) and medium-term (five years). Just like actual inflation, expected inflation has stalled out around 3% and doesn’t appear to be budging. It should be no surprise that actual inflation and consumer expectations seem to mirror one another. If you expect prices to keep increasing, you may spend more now while prices are lower.

Consumer spending is still increasing very sharply month over month, which creates sort of an inflation loop. Consumers expect inflation to remain elevated, although not as high as several years ago, and keep spending money like there’s no tomorrow. Consumer spending fuels inflation, which in turn fuels the belief that inflation will remain elevated. See now why it isn’t so easy to predict the future of inflation?

How you can win financially regardless of inflation

Persistently high inflation and interest rates can be very frustrating for those trying to borrow money, but it is still very possible to build wealth and make smart financial decisions no matter what inflation or interest rates do. If you want to help protect your wealth from inflation, owning assets like stocks and real estate are some of the best ways to hedge against inflation. If you are looking to borrow a large amount of money and want interest rates to drop, consider only borrowing what you can afford now or waiting for rates to drop. Do not borrow money at a rate you can’t afford in the hopes that interest rates will drop in the near future and allow you to refinance.

We created several awesome tools on our website to help you think through some of these big life decisions. Check out our home-buying calculator to determine how much house you can afford based on your income and current interest rates. If you are looking to buy a car, give our car-buying calculator a go.

Nobody likes high inflation, and anyone taking out a mortgage now probably feels sick to their stomach that they are getting a rate in the 6s or 7s instead of the 2s or 3s of a few years ago. At The Money Guy Show, we strongly believe that you can build wealth and make smart financial decisions even in less than ideal periods of high inflation, and we are committed to giving you the tools to help you along the way.