Change your life by

managing your money better.

Subscribe to our free weekly newsletter by entering your email address below.

Subscribe to our free weekly newsletter by entering your email address below.

Think all FIRE is created equal? Think again. The Financial Independence, Retire Early (FIRE) movement has evolved into many distinct strategies, from Lean FIRE to Fat FIRE. We break down the math, mindset, and general lifestyle of each FIRE strategy, then share our preferred approach: building your army of dollar bills not just to stop working, but to work on your own terms with purpose.

Whether you’re drawn to the simplicity of following the Financial Order of Operations while pursuing early retirement or you’re trying to figure out if sleeping on hotel room floors forever sounds appealing, find out which path aligns with your great big beautiful tomorrow and what blind spots you should measure twice before cutting once.

Subscribe on these platforms or wherever you listen to podcasts! Turn on notifications to keep up with our new content, including:

Brian: Help, somebody grab a bucket of water because this show is on fire!

Bo: I am so excited because today we are going to explore the financial independence retire early movement. We’re going to break down five different types of FIRE as well as the math behind them and try to help you better understand if these early retirement strategies are right for you.

Brian: In all seriousness, you might be dead set on retiring early, but you need to figure out, are you leaning on lean FIRE, fat FIRE, or coast FIRE? With that, let’s dive right in.

Bo: Yeah, Brian, the idea or the concept of financial independence is not a new one. We’ve seen people that are seeking financial freedom via a specific dollar amount for a long time, but there has been in the past couple of decades this movement, the financial independence, retire early movement that I think has caught a lot of, no pun intended, fire.

Brian: Yeah. I mean, this has been fun. And look, I think we have a great relationship with FIRE, but sometimes we’re called the fire extinguishers. And I think all that we and that’s what we want to do on this show is just highlight to make sure you get a full 360 approach of all the things you need to be thinking about. That’s what our goal is. But we ought to at least understand that this is and I’m glad to see FIRE has kind of caught on is that one size definitely does not fit all. So there’s some key changes that have happened over the last decade that we want to cover today. But first, we kind of need to understand what are the key tenets to what the FIRE movement in general believes in, Bo.

Bo: Yeah. When you think about FIRE, people that are proposing that they want to have financial independence at an earlier age, there are some general tenets that they like to hold on to. The first is FIRE proponents understand the idea of living below your means. They understand deferred gratification. And oftentimes someone who wants to participate in the FIRE movement has to have a much higher, much more significant savings rate than their traditional retirement counterparts.

Brian: And another tenet is that they’re investing in diverse long-term and let’s focus on tax advantage investments. I love it because that sounds very similar to a financial order of operations type focus with the investments.

Bo: And maybe the most important tenet or the most well-recognized tenet of folks that are in the FIRE movement is they have this idea behind living an intentional life. I know that there’s some future I want to work towards and I want it so bad. I want it so tangibly. I’m going to be willing to make very intentional, very strategic decisions today so that I can move towards those future goals.

Brian: Now, there’s something I do like that this is very math focused, Bo. In a lot of ways, I think a lot of people who get excited about the FIRE movement in addition to just they want to be done with working as soon as possible, they’ve created some formulas and this is tied into some good things like you hear the 4% withdrawal rule. I like math focus, but I have found in my own experience is that there’s actually a better way to do money is to combine both the math and the mindset. But we can at least walk through when they talk about the FIRE movement, how they use math, how are they using the 4% and can we put some layers on this?

Bo: Yeah, the traditional FIRE rule is that they want you to accumulate 25 times your annual expenses in investments. So if you think about okay well how much can I live off of? How to calculate what I can take out of my portfolio? I would just take the amount of money that I’ve amassed at financial independence and I’d multiply it times 4% or times 0.04. That would tell me what my annual spend could be. Or if I want to reverse engineer this and I know what my annual expenses are, I can take my annual expenses that I need in retirement and I could just divide by 0.04. I could divide by that withdrawal rate and that would tell me how big the pot of money needs to be. But when we think about the 4% withdrawal rate or even now it’s been sort of adjusted to maybe 4.7%, all of this study and all this research was based on a traditional retirement timeline. Someone who’s going to retire at age 65 and live out to their mid-80s early 90s. When it comes to financial independence retire early they’re operating on a slightly different timeline.

Brian: Yeah. This is where we get to be the fire extinguishers, the cold water of the situation is because we often say exactly what you said, the Trinity study was a 30-year traditional retirement. So, if you start expanding how long your retirement is going to be, because let’s face it, you’re leaving the workforce much earlier, you have many more decades to have life, and life has a funny sense of humor in that it throws all kind of crazy things at you. We need to change what the rules say. 4% probably is not going to be enough. And that’s why we have adjusted the 4% rule to take into account the fact that we’re prolonging how long you will be living off these assets. So if you’re retired at age 55, above 55, we think the 4% withdrawal is perfectly fine. But if you’re somebody who’s retiring between 45 to 55, because you have more life, we need to dial down the risk profile on this to 3.5% withdrawal rate. If you’re somebody who’s retiring before 45, you have so much life on your side that you probably don’t even know. I mean, you think about education of kids, medical of life and kids and everything else is coming your way. You need to be so conservative that you even dial down that safe withdrawal rate to 3%.

Bo: Another issue that we see when it comes to mathematics of the FIRE movement is a lot of people incorrectly underinflate what they need to do this. Okay, I think I’m going to need $50,000 of spending in retirement. So, I just take $50,000, divide by 0.04, and that’s my number. Well, if you are 35 years old today, $50,000 today will not be the same as $50,000 in the future. So, the pot of money that you would need to retire today will not be the same as the pot you need in the future. So, as we walk through these different kinds of FIRE, we’re actually going to walk you through the mentality, the mindset, but also the mathematics of how you should think about it.

Bo: And the math matters a ton in this very first type of FIRE that we’re going to talk about. And this one is called lean FIRE. This one is not for those folks who like the finer things in life. If we’re just going to think about sort of Webster dictionary definition, lean FIRE is retiring early with investments that just cover your basic living expenses, potentially even dropping your standard of living and foregoing any excess or any extra spending. Oftentimes, lean FIRE proponents are going to live on less than like $60,000 a year. Brian, what are your initial thoughts on lean?

Brian: Well, I’m going to bite my tongue a little bit because we’re going to talk about what my thoughts are in a few seconds. We ought to at least show them the math on this. But I will just give you the initial thought. Living on $60,000 for your entire life seems like, man, you’re locking in how things feel in your 20s to when you get to be an old man on the porch like me in my 50s. And I’ll just go ahead and break it to you. When you get to be in your 50s and beyond, you can’t handle the things that you could handle in your 20s. And I’ve made this joke before. I could go in my 20s and sleep in a hotel room with four or five of my best friends. And if you just gave me a corner of the carpet, I’d be perfectly fine. Now, at this age, I want my own bed. I want my own en suite bathroom. So, you just change. Trust me, you can put up with a lot in your 20s and 30s, but as you get older, you’re going to get bougier and your needs are going to change. So, why would you want to lock that in while you’re, you know, I went and said too much already. Keep going. Show them the math.

Bo: Let’s think about the mathematics here. Let’s assume that you’re a 30-year-old and your goal is to reach financial independence by 50 and you know that your spending at age 50 will be $45,000 per year in today’s dollars. Well, the formula, the way to calculate what you need would just be your cash flow need divided by the appropriate safe withdrawal rate at retirement times 1 plus whatever inflation rate you want to assume raised to the power of the number of years until your goal. I know that sounded super super heavy. So, I’m going to actually walk you through the numbers here. So, your cash flow need $45,000 divided by your safe withdrawal rate, which would be 3.5% because you’re retiring at age 50 multiplied times 1.03. That’s just the inflation rate we want to assume. And we’re going to assume that’s 20 years in the future. So, the exponent’s 20. If you track this math through, you would need in order to be lean FIRE at age 50, about $2.3 million saved up to have the equivalent lifestyle of $45,000 a year in today’s dollars.

Brian: So, now let’s talk about the mindset stuff. I’ve given way too much, but we’ll at least jump to this. This is popular because, let’s face it, it’s a quicker way to reach an exit from the workforce ASAP.

Bo: It also appeals to the growing intrigue of people living a minimalist lifestyle. We’ve seen all these people that want to cut and live at a minimum level.

Brian: Well, if you’re someone who’s lean FIRE and you have the propensity to do that, those two ideals naturally align well. And look, the big tenet with FIRE for a lot of these is you have to have mega savings rates. At least with lean FIRE, it’s because your needs are so small from the portfolio, it actually allows you to have a much lower savings rate than traditional FIRE people have when we get into the other types of FIRE.

Bo: So, those are the reasons it’s popular. But if you ask us our opinion, when it comes to lean FIRE, not only does it not sound like a lot of fun, it sounds like, man, you’ve calculated what your basis level living expenses are. If you’ve watched any of our Making a Millionaire episodes, we ask, “Hey, what are your living expenses?” And they’ll say, “Oh, well, I could cut down to $2,000 a month or $3,000 a month or so.” No, no, no. Not what can you cut down to. What do you want your standard of living to be? Well, if you’re someone who’s subscribing to the Lean FIRE movement, you don’t get to add those extras, add those pluses, add those luxuries. You literally are planning on living at the basis level of your living needs for the remainder of your life.

Brian: And I’ll just say life changes. I mean the big thing I see with Lean FIRE is do you know how many marriages I’ve had to consult and help them out with because you can convince you and your spouse y’all go live this way of life so we can build up this pot of money but at some point life just changes and there’s been marriages I’ve seen where one spouse is still requiring hey let’s be as tight as possible let’s keep all of our receipts and it starts creating these friction points. I can’t imagine because I was tight. I don’t want y’all to mishear me. Yes, I have changed and you will change too with life. And to set myself up as a 20-something who is tight and saving and now I’m going to live my life in my 50s, 60s and beyond this way. I think people don’t realize how much life will change on them, how much your relationships will change over time. And that’s why I try to give you the combination of let me tell you how a tight wad did things but then why I had to give up my tight wad card as I started realizing success is going to create change in your life and you need to plan accordingly.

Bo: All right. So if lean FIRE is on one end of the frugal spectrum there is another end of the spectrum that a lot of people fall into and this is known as fat FIRE. Again, Webster definition here. Fat FIRE is retiring early with more income than you need to support yourself and likely it increases your quality of life and often provides a mechanism where you get to add luxuriousness to your life. Typically, folks that are in the fat FIRE movement are counting on having living expenses or income in excess of $200,000 a year.

Brian: I’m catching on to what we’re doing here is we’re going to go some lean, you know, and now we’re going to go fatty fat with the lifestyle. At some point, we’re going to land on what is reasonable for people to consider because this is kind of wild if you think about these are people who are saying, “Hey, I have a good income. I’m going to make a sacrifice right now so that I can really live the life in the future.” That sounds great. But man, oh man, I can’t wait to see what the math is on this. But then also, I can’t wait to give kind of the mindset stuff we want people to focus on.

Bo: Yeah. So, let’s think about let’s assume that you’re a 25-year-old and your goal is that you want to retire at age 55 and you want your living expenses or the amount that you can spend to be $200,000 per year in today’s dollars. Well, following through the math, you would take your cash flow need, $200,000, divided by the appropriate safe withdrawal rate since you’re retiring at 55, it’d be 4%, multiplied by the inflation rate, so 1.03 raised to the 30th power because it’s 30 years from now that you need these dollars. If you track that math through, the total portfolio that this 25-year-old will need will be $12.1 million by the time they get to age 55 in order to live a life with the equivalent of $200,000 today in living expenses.

Brian: So, let’s talk about why this is popular. Now, look, kudos to them because I mean, this is one of those where you’re providing a luxury retirement, but I would ask at what cost?

Bo: Yeah. What it does is it requires more sacrifice now. But the idea is okay, if I can make it real real painful now, in the future, I don’t have to make it painful at all. I don’t have to have a lot of sacrifice in the future. I can take some short-term discomfort for a lot of long-term comfort.

Brian: I mean, and who doesn’t want to retire rich? That’s it. I mean, man, oh man, I’m trying to always balance. And that’s why I guess when we get to the think I want you to live your best life now, but I also want you to live your best life in the future. I worry too much that the fat FIRE might get that priority a little out of shape, too.

Bo: Yeah. Well, and one of the things that we recognize is that this is an admirable goal. Having $12 million is awesome, but likely it’s only going to be available to very high earners or very prodigious accumulators of wealth. I don’t know that I would say every single person has the ability to ascribe to fat FIRE because you have to have a shovel big enough that allows you to actually get there.

Brian: Well, you have to have a good income. And then let’s talk about savings rate because we actually did the math on this. We love doing a good math equation. We wanted to kind of compare a lean FIRE person to a fat FIRE. And this is amazing to me, Bo. We took two 25-year-olds, one with the lean FIRE. Now, we said, “Look, this is still a successful person, $100,000 a year income.” Fat FIRE, we said, “Well, because their goal is so big, this is somebody we already said they have to be a prodigious accumulator, but they also have to have a big shovel.” We just assumed a $200,000 income at age 25. Wow, that’s pretty big. Then here’s the withdrawal goals. The lean FIRE, we did $50,000 a year. For the fat FIRE, we did the $200,000 a year. Both of these people, and that’s a little different than our earlier example, so pay attention to that. We put it at a retirement age of 55 for these two individuals. Same withdrawal rate. So 55 years of age. The FIRE number, listen to this, for the lean FIRE, a little over $3 million. For the fat FIRE, there’s that $12.1 million. So what is the savings rate? The person making $100,000 and wants to do lean FIRE is 20%. That seems very reasonable. Now, look, I don’t know that they’re going to want to live off of $50,000 a year, even adjusted for inflation, when they’ve been making $100,000 their entire career. But that’s the decision they made. But the fat FIRE person, look at this. They would have to be saving 40.5% of their income. That’s a lot. And like I said, I think it’s great that you have this goal of having $200,000 and retiring that much sooner, living off of that luxurious income and being able to spend like you want in retirement, but at what sacrifice now is what I get concerned about.

Bo: Because you think about it, for the entire working career for this fat FIRE person, at $200,000 a year of income, you’re in a higher tax bracket. So more money is going to taxes and you have to have a 40% savings rate. You are living a very likely frugal lifestyle at that stage and then all of a sudden you get to 55 and your lifestyle is going to magically change and magically blow up. Was it worth it? Was the sacrifice that you put in worth having this fat FIRE goal? Or might there be another example? Might there be another scenario that might get you to where you want to be?

Bo: And I think a lot of people recognize that. I want some mixture of the attainability of lean FIRE but maybe some of the flexibility of fat FIRE. And so another type of FIRE burst onto the scene. And I think this is one that’s maybe one of the most popular. And this is known as coast FIRE. And the idea of coast FIRE is that your current investments, you’ve saved up enough to grow your current investments to 25X your annual expenses by your traditional retirement age without having to contribute any more money. So, I’m going to save early early, build up a pot of money, and then I don’t have to save anymore because I know that pot of money will do the heavy lifting for me.

Brian: Just as the name implies, you’re going to coast. We even have some experiences. So, we did a Making a Millionaire with Danielle and she was a great guest and she had this goal of doing Coast FIRE, but we had to modify her scenario. I’d encourage you go check out that episode so you can see the actual math where we kind of created an intersection of giving her her best life where she could do the coast FIRE but made sure she measured twice, cut once and didn’t sacrifice anything in her life.

Bo: Well, and I think she had some incorrect assumptions going into her planning, going into her equation because here’s the way the math works. Let’s think about we’ll sort of make up a case study here. Let’s assume that you have CoastFI Carly. And let’s say that Carly from age 25 to 35 was able to build up an investment portfolio of $500,000. And she says, “Okay, I’m going to stop there. I’m not going to save anymore, and I’m not going to actually fully retire until I get to traditional retirement age of 65.” So, what I’m going to do is I’m going to do something different at age 35, where I don’t have to save. Maybe I take a different job. Maybe I pursue a passion. But that $500,000 that I built up, I’m just going to let it grow at 8% compounded over the next 30 years. Well, because she did that hard work from age 25 to 35, that $500,000 that she saved has the ability to turn into $5.5 million without her saving anymore. So, I think a lot of coast FIRE folks love this idea. I can do hard work early, similar to the fat FIRE folks, but I don’t have to do it forever. I can do it for a season and then I can coast.

Brian: Well, I mean, it is an interesting thing though when you look at this. You say $5.5 million. That’s the equivalent when you take in the safe withdrawal rate of pulling out about $218,000 a year. That sounds like a lot. But if we bring this back inflation adjusted, that’s only $90,108 in today’s dollars. That’s great. It’s not fat FIRE. But this is why you have to pay attention to inflation. I do like what Coast FIRE does though. It’s just a matter of once again, we’ve got to make sure you get the right numbers because to pull your foot off the accelerator too early could jeopardize your army of dollar bills if you’re not careful.

Bo: So why is this popular? Well, I think the main reason Coast is popular is because people love the idea of taking their foot off the gas. The idea of saving for 40, 45 years at these aggressive levels, 20, 25% might sound daunting, but a lot of folks say, you know what, I can do it. I can go real hard till I get to 30, till I get to 35. I’m okay. Again, taking a little bit of discomfort for a small amount of time in order to have more comfort later on, and it gives them something to work towards.

Brian: Well, I mean, because you’ve got such a head start, there is comfort in knowing that you’re actually still going to increase your funding in retirement by just taking your foot off the accelerator. That’s a good thing. There’s a lot of comfort in knowing that number.

Bo: You’ve already checked the box. You’ve done the thing that you have to do. And I think people really like it because being able to increase your lifestyle by decreasing your savings sounds like a win-win. It’s an easy sale. Wait. Okay, so I can save really aggressively now, but at 35, I can start living the life that I actually want to live, and I’m not sacrificing my retirement to do that. I think a lot of people like the idea that it provides a way to live the life I want today and a way to live the life I want tomorrow.

Brian: So, here’s the areas of concern. Here’s what we think and these things are kind of interconnected is that I often worry just because you can does it mean you should take your foot off the accelerator? You don’t know what life is going to throw your way. So I just want to make sure people are measuring twice, cutting once, doing the homework to actually know what the numbers are saying because I find that too many people are probably cutting off the savings a little too early.

Bo: Yeah. And another thing is it’s a long time horizon. Cutting off that savings too early can have a huge impact because there are so many variables that can come into play that can affect if your number was right. You know, in Danielle’s scenario, she does such a great job of thinking through what the short-term strategy was, not recognizing that that traditional retirement number, that big number at age 65, needed to be enough to provide for the rest of her life. And I think far too often people underestimate that. They do great with the short-term goal, but not so great with a long-term goal. And if you’re going to really do coast FIRE and you’re going to stop saving and you’re going to miss out on those years of savings, you better make sure that you’ve done the math correctly.

Brian: Well, it’s also how many of your variables have kind of firmed up. I mean, for instance, if you’re a single person when you come up with this goal and you leave the workforce thinking that in your 40s you’re going to have this and then you get a spouse later, your variables are going to change just based upon that right there. What about the fact that maybe you have a spouse, but then y’all have children later? Variables are going to change. That’s the thing that gets me a little nervous. And that’s why once again, I’ll say it. You have to measure twice, cut once to make sure you’ve really accounted for all the different variables so you don’t get yourself in a pickle of a situation because time is that valuable with the compounding growth opportunity that you just don’t want to leave anything and have regrets later.

Bo: So I think a lot of people recognize that there’s some big implications with coast FIRE when you say, “All right, I’m going to take my foot off the gas. I’m going to back down. I’m going to leave the high-paying job. I’m going to fill in the blank.” And so another type of FIRE has become prevalent where I think it removes some of that nervousness. It removes some of the unknown and allows you to smooth those variables. And this is known as BaristaFI. And the idea behind BaristaFI is you want to be able to quit your day job similar to what someone who’s doing coast FIRE would do, and you partially want to live off of your investments, but you recognize that I’m still going to go out there and create some sort of income to offset my expenses in retirement. I’m not actually planning on a full retirement where I’m never working. I’m always planning on having some sort of job to cover the base level, to cover the difference, and likely that job’s going to provide much needed things like access to health care and those sorts of things.

Brian: Now, look, I do love these middle versions of FIRE that we’re doing. I love the fact because they require you to save a lot in the beginning and then but you’re still not committing to the extreme like Lean and Fat FIRE did, but this appeals to the Hallmark version of myself. I mean, I watch these things coming through the holidays and I’m like, “Yeah, it would be fun to work at a bakery or do something like that.” I feel like that’s what a lot of people, especially if you don’t like your current job, this probably appeals to a lot of people. Bo, how does the math with this situation work?

Bo: Yeah. So, the math is very similar to some of the other math that we’ve looked at, except for now, what you get to do is you get to take your cash flow need and you get to subtract out the supplemental income that you’re going to achieve. So, let’s assume that you’re a 25-year-old that wants to retire at 55 and you’re going to need $70,000 in today’s dollars to live the life that you want, but you recognize you can get a part-time job or a lower-paying job that’s going to pay you $30,000 a year in retirement. You would take your cash flow needs, $70,000, minus your supplemental income, $30,000. You would divide that by your appropriate withdrawal rate. In this case, for a 55-year-old, it would be 4%. Multiply it times the rate of inflation raised to the number of years until you need the money. And you can see that for BaristaFI, if your goal were to just fund that shortfall of $40,000 a year in today’s dollars, you would need a portfolio of about $2.4 million at the same time maintaining a job all through retirement producing $30,000.

Brian: Or it doesn’t have to necessarily be a job. Maybe social security bridges where you work until something else fills in what you were making down at the local coffee shop or in my situation being the bakery and making cookies and cakes all day. But it is something that at least allows you to have options because you did so much saving in the beginning. $2.5 million that doesn’t sound crazy and this is especially popular for people if you don’t like your current day job. I can imagine that this is one that just starts growing from a small idea to a bigger and bigger idea because every day you wake up and that alarm clock goes off like I got to do something to get out of here. This might be a way to make yourself feel better about it.

Bo: Another thing that it does, it provides greater flexibility while still needing to hit a lower number. You’re not trying to chase that huge fat FIRE number or some of the other difficult coast FIRE numbers to hit. You can still have a lower number to hit but have flexibility in how you’re going to get there and how you’re going to achieve that.

Brian: Well, and it also a lot of people we’ve been hoping the exchange was going to fix this but it hasn’t because the exchange in a lot of states is pretty slim is it covers health insurance. A lot of people you can go work I mean Starbucks has great health insurance. So, you know, a lot of people will go and that’s why it fills in the gaps nicely that you get to pull the income lever, still have some income coming in, but cover the big risk of health insurance. That’s a good thing. And that’s why even when we think about what we think about this, I do like that it covers that big gaping hole that a lot of FIRE people, yes, you’ve saved well, yes, you have assets, but how do you make sure you don’t have something like a medical emergency blow up your entire financial situation?

Bo: We see people all the time, clients of ours, who say that they want to retire. What happens is they get that volunteer job or that lower paying job or that low-benefit job, but it covers their baseline. And so then what the portfolio does is it’s able to supplement the extras, the travel, the bonuses, the car replacements, those sorts of things. So it is a really really flexible way to be retired. But the reality is you may not want to have to work that job even in a part-time capacity forever. So you are going to figure out, okay, if I’m going to step away from the workforce completely at some point, if I am going to lose those benefits, if I am going to lose that income, is there something else that’s going to take its place? Do I have Medicare coming up? Do I have social security? Do I have some other solution that’s going to make up for that gap when I actually do truly leave the workforce?

Brian: Well, this leads to and I feel like this brings the culmination of everything and this is probably going to give you a little context on why we feel the way we do is that look this FIRE movement has been branded this way for really the last 10 plus years. But it’s not a new concept. I mean if I think about my 22-year-old version I had already promised myself, hey, I want to save a ton of money so that I can leave the workforce when I’m 50 years of age. Well, here’s the thing. Fast forward. I’m beyond 50 now. And y’all probably notice I’m still working. And that’s why I like the next thing that we’re going to talk about is the FINE movement or financial independence next endeavors because I resemble this is because I do thank myself for all the sacrifice I made when I was in my 20s. But I’ve realized I don’t necessarily want to retire early. I like to do things on my terms. And that’s why I love this concept of financial independence next endeavor because it doesn’t necessarily make you have to tap out of the workforce necessarily.

Bo: Yeah. What’s great is when it comes to financial independence next endeavor, the math, the way you calculate your number is the same as traditional FIRE. How much do I need to be able to live the life that I want on my terms the way that I want to live it? So, the math is the same as regular FIRE. But what shifts is the mindset. There’s a different way that you think about why you’re moving towards that goal and why you’re saving up those dollars so aggressively.

Brian: Yeah, we’re definitely bringing in purpose and the why factor. What we like about the FINE movement, we’ve kind of covered this is that instead of you just saving up a pot of money without purpose, you kind of now get to control the terms of what does your next step look like? It shifts the focus from retirement to what’s next for what gives me purpose. When I wake up in the morning, this is why I wake up energized. Instead of chasing a dollar value, I’m chasing a greater purpose.

Bo: Yeah. It allows you to be in that place where you’re living a truly intentional life. A lot of people think about, oh, well, my job is just this thing I clock into and it’s a means to an end, means to an end, means to an end. Financial independence next endeavor says okay I have now solved the money problem. I want to do the things that I want to do on my own terms. That may be still doing the vocation that you do. It still may be being an accountant, being an architect, being a teacher, being a fill in the blank or it might be doing something else. But now the reason that you do it is because you want to do it, not because you have to do it. You had to do it to get to the financial number. And now that you’ve solved the math, now you get to focus on the purpose.

Brian: I mean, and it’s worth repeating is that I was saving like I was going to retire at 50 back in the 90s and FIRE didn’t even exist back then. So, this is not a brand new concept. It’s just very well fine-tuned. A lot of people have kind of created this movement where they’re really thinking a lot and I commend them. I know for all the people who think we’re fire extinguishers, we’re actually not. I just want to make sure that people live their best life. And what are the blind spots that you might not be thinking about? Because we all know money is nothing more than a tool. And I just want you to know, what do you value? What gives you purpose? What gets you out of bed? Because money as a tool can give you security. Money as a tool can also give you freedom. And then if you do this right, and this is one of the powerful things that FIRE gets right, is if you build up enough pot of money, there’s opportunities for you to have a choose your own adventure. For anybody who’s my age loves those books and loves the fact that you don’t have obligations. You don’t have commitments unless you want to do something. And if you can build up your resources in your army of dollar bills, it just opens up the world to you. I’m just trying to make sure that you don’t sleep on those blind spots or areas that a lot of people just think that it’s set in stone, that this is the FIRE movement. It’s going to do this for me. And I’m just telling you, life changes. Like I said, you can live in a hotel room with three other friends on vacation and be completely happy in your 20s and 30s. Your life will change. And I just want to make sure you plan accordingly.

Bo: Yeah, money can give you these things. It can provide the security and the freedom and the opportunity, but only if you steward it well. Only if you begin with the end in mind and you understand, okay, what’s the reason I’m making the decisions that I’m making? And you aren’t someone who just lets life happen. It’s why if you go out to moneyguy.com/resources, you go check out any of our tools, any of our calculators, any of the content we put out there, it’s there for you because we really do believe that there is a better way to do money. And the sooner you figure that out, the more useful of a tool money can be for you.

Brian: Well, and look, I don’t mind sharing. We give away tons of free information because we know no matter how good you are with money, even if you keep it as simple as possible, it’s going to get complicated because you’re successful. As we’ve covered, every one of these FIRE movement choices is going to be the intersection of both math as well as mindset. You’ve only got one retirement likely, maybe multiples if you’re doing different versions of the FIRE process, but you have blind spots. We’ve done this hundreds, thousands of times if you take the whole firm together. And I just want to help you be the best version of yourself. So that’s why consider if you reach that level of complication, go out to our website, moneyguy.com, become a client. We’ll leave the porch light on for you. That way you can continue to live your best life because you’ve been so purposeful. Let’s just make sure there’s not something with your measure twice, cut once that doesn’t derail all that preparation and success. I’m your host Brian joined by Bo. Money Guy team out.

Free Resources

Here are the 9 steps you’ve been waiting for Building wealth is simple when you know what to do and the order in which to...

Free Resources

If you want to set yourself up for future success, find out how much you need to save every month to become a millionaire.

Free Resources

Here’s how you can buy a dependable car that won’t break the bank. Our free checklist walks you through the 20/3/8 rule and strategies to...

Articles

Health insurance premiums may make up a significant portion of your budget. How can you find more affordable health insurance? Is it ever worth going...

Articles

Over longer periods of time, index funds tend to outperform actively managed funds in most categories. Recently, total assets in index funds have surpassed the...

Articles

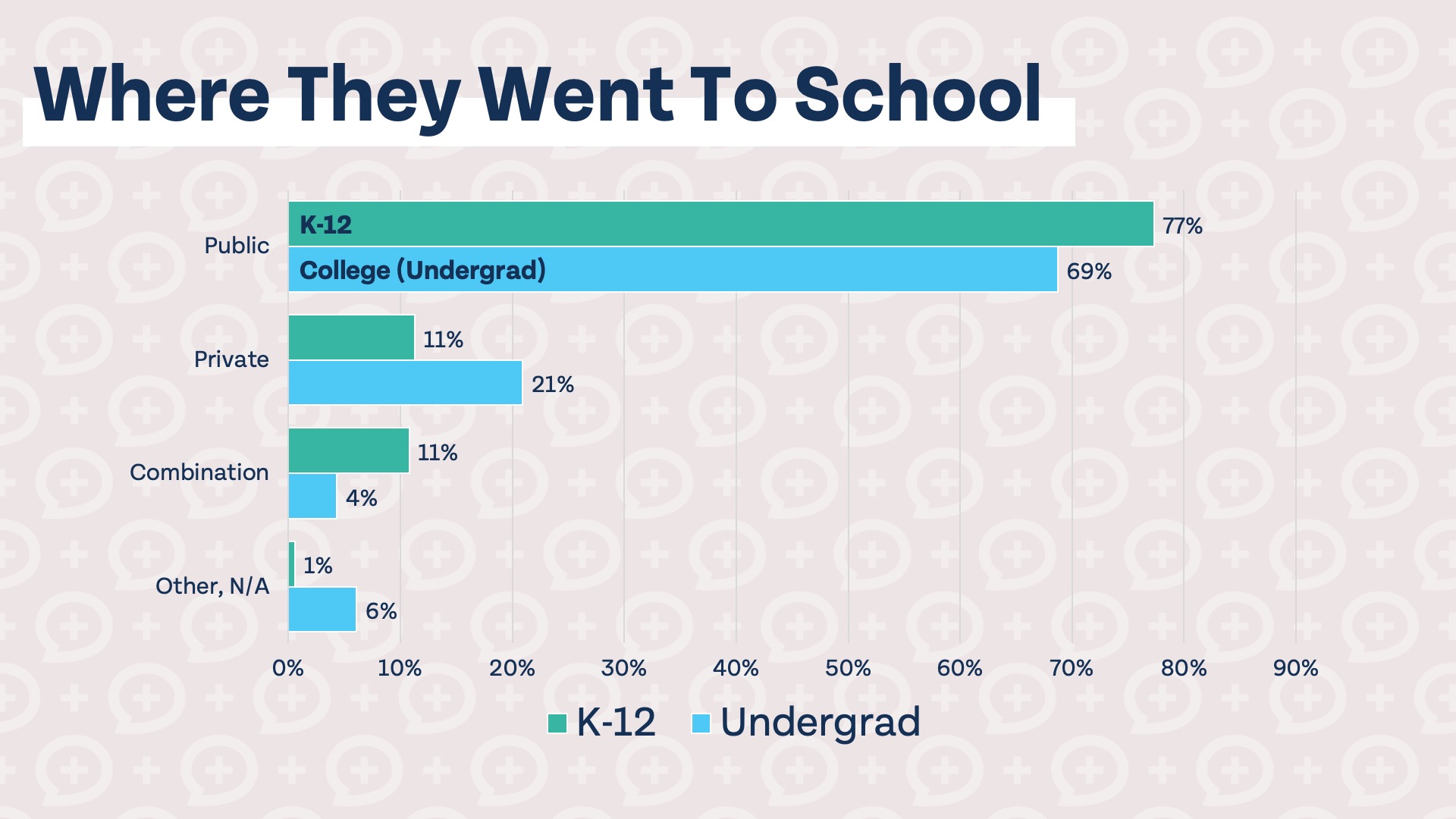

Each year we conduct an annual survey of our millionaire clients. Some of the data is not too surprising. Yes, they have much higher than...

How about more sense and more money?

Check for blindspots and shift into the financial fast-lane. Join a community of like minded Financial Mutants as we accelerate our wealth building process and have fun while doing it.

Free Resources

Here are the 9 steps you’ve been waiting for Building wealth is simple when you know what to do and the order in which to...

Free Resources

If you want to set yourself up for future success, find out how much you need to save every month to become a millionaire.

Free Resources

Here’s how you can buy a dependable car that won’t break the bank. Our free checklist walks you through the 20/3/8 rule and strategies to...

It's like finding some change in the couch cushions.

Watch or listen every week to learn and apply financial strategies to grow your wealth and live your best life.

Episodes

Is passive income really passive? We explain 3 common passive income myths and share our preferred strategy that helps you measure twice and cut once.

Episodes

Are you a Gen Z or Millennial discouraged about retirement? Discover how the vast majority of millionaires got there as regular savers, plus our new...

Episodes

Think your rental barely breaks even? We reveal the shocking math when this couple asks if they should sell their duplex to reclaim their time...

Subscribe to our free weekly newsletter by entering your email address below.