What if I get an inheritance, sell a business, receive a big bonus, win the lottery, etc.?

Investing at least a portion of this money for the future is a great idea. You have two options when it comes to how you will invest. Let’s unpack them both.

Lump-Sum:

Don’t sweat the small stuff! When the cash to invest is just a small percentage of your investable net worth, you may consider getting that money to work as quickly as possible and investing it all at once.

Dollar Cost Average:

When the cash to invest gets to a larger percentage of your investable net worth, then it makes more sense to be more methodical about working it into the market by creating an investment schedule. A common way to put this into practice is choosing a certain amount of the money to invest monthly or quarterly. Remember: “measure twice, cut once.”

The Dollar Cost Averaging (DCA) strategy can also serve as a sort of “insurance.” If the markets increase during the DCA period, at least your money is working for you rather than sitting on the sidelines.

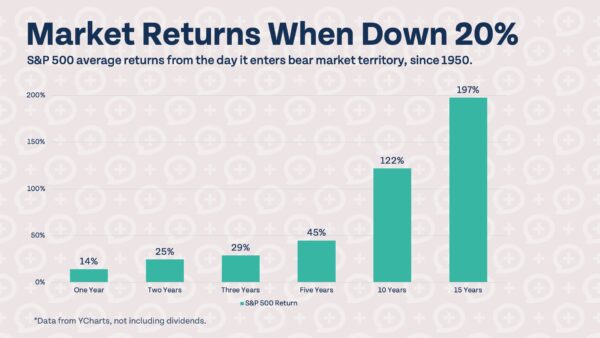

However, if the markets decline during the DCA period, that’s ok, because you will be buying while the markets are low. You’ve probably heard the popular saying, “buy low, sell high!”

How long should your Dollar Cost Average period be?

Our typical rule of thumb is to systematically work the cash into the market over an 8-12 month period. Studies show that longer periods could actually diminish returns.

Want to learn more? Check out these videos weighing the pros and cons of Lump Sum investing and Dollar Cost Averaging.

Video: Best Way to Invest $100,000? (Lump Sum or Dollar Cost Average?)

Video: Don’t Blow it! What NOT to Do After a Financial Windfall!

What about a rollover check from a previously invested account (i.e. IRA, 401k, etc.)?

Typically, when you roll over IRAs or 401(k)s, the sending custodian liquidates the original account and mails a check to the receiving custodian. When that check is deposited, it may be deposited in cash.

Because that money was just fully invested in the previous account (and not a life changing circumstance listed above), then you may want to consider getting that money invested and back to work quickly as a lump sum.