The best thing to do in most cases of volatility is nothing.

Volatility should not affect a great long-term plan!

We get it. When markets are in a volatile state, it’s easy to panic. It’s tempting to want to do something when the market starts to drop, even if it isn’t in your best interest. When things are scary and emotional, that is not the time to making adjustments.

A great financial plan should be prepared for any kind of market condition, so market volatility shouldn’t change your long-term plan. The best thing to do in most cases of volatility is nothing.

Volatile markets are a great time to take advantage of planning opportunities!

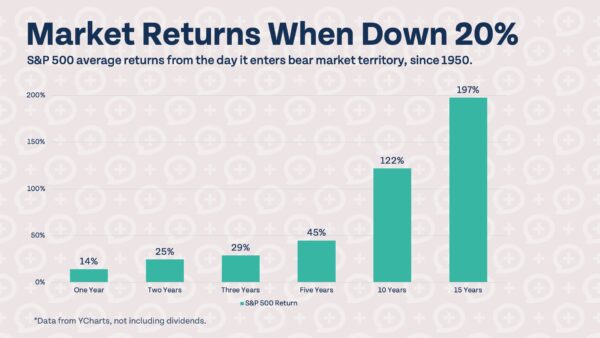

- A great buying opportunity. Stocks are on sale!! Remember you don’t have to get it exactly right, but if you get close, in the long term you will still be successful. If you have at least 5 years from retirement, you should still continue to move forward in the market, and keep investing as you planned.

- Dollar Cost Averaging. Especially powerful in a crisis driven market. By continuing a regular and systematic investing strategy, you can take the emotion out of volatile market behavior.

- Turbocharge paying yourself first. If you have extra savings capacity, downturns can be a great time to get those dollars in the market working for you. Be opportunistic, but don’t put your financial life at risk!

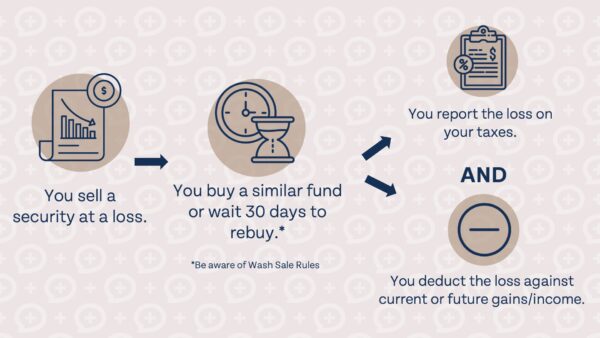

- Tax Loss Harvesting. This is the practice of selling a security that has a loss, and by realizing losses, investors may offset taxes on capital gains and/or income. Learn more from the video below!

Video: How to Harvest Losses to Lower Future Taxes!

- Great time to rethink legacy positions. Positions you received through gifts or inheritance that you have been stuck with. If these positions no longer fit into your model, volatility can be a great time to tax-efficiently get out of them.

- Rebalance portfolio. In volatility, your asset allocation may have gotten a bit out of whack. You may be able to use this time to tweak your allocation and get it back to where it should be. However, keep in mind, this is NOT the time to completely change your allocation and investment strategy.

- Roth conversions. If there is a safe level of Roth conversions you can do to not trigger any adverse tax implications, downturns are a great time to go ahead and convert. By converting when markets are suppressed, when the markets turn back around, you will have more growth in your Roth bucket.

Remember to learn from the experience of navigating historic market events!

Wisdom comes from experience! Recognize how you reacted to the raw emotions from this situation and noise from the press and peers. Learning from past experiences will only make you a better investor in the future and prepare you for the next downturn!

Learn more about our experiences and response to downturns in the following videos.

Video: The BEST Financial Strategy During the COVID-19 Pandemic