Last Updated

June 2, 2025

Read Time

Share

Now Is The Time To Plan Your Estate

Estate planning is, at a basic level, planning for what happens to you, your money, and your possessions after you die or become incapacitated.

Not many of us enjoy thinking about this, which is a large reason why Americans are so behind when it comes to estate planning.

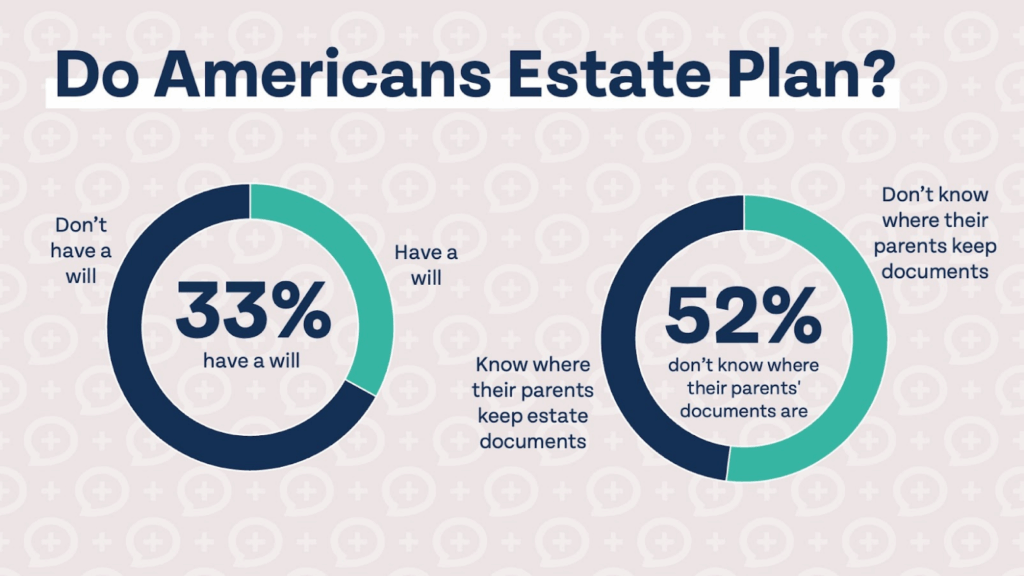

Only 33% of Americans have estate planning documents, such as a will, and 52% of people don’t know where their parents store estate planning documents. Unfortunately it often takes a wake-up call to get serious about estate planning: Americans who dealt with a serious case of COVID-19 are 66% more likely to have a will.

In this Money Guy Ultimate Guide, we take you through estate planning fundamentals, critical mistakes to avoid, planning for different life stages, and what to do if you inherit money or are the beneficiary of someone’s estate.

The consequences of not having any estate plans in place can be severe. If you become unable to make your own medical decisions, those put in charge may not know what decisions you would like them to make.

After your death, your assets may not be distributed according to your wishes if you don’t have a will. In this guide, we cover everything from basic wills to larger complex estates, and we break it down by your current life stage, so you know what you need to do right now.

Don’t put it off!

What Is Estate Planning?

Copy link to this section: What Is Estate Planning?

Copied the URL to your clipboard!

Estate planning is much more than just writing a will. It encompasses planning for all of the decisions that will need to be made when you no longer have the ability. Estate planning can include establishing wills, trusts, power of attorneys, healthcare directives, and more.

Nobody really enjoys thinking about planning what happens after they’re gone, but even if you don’t care about what happens to your assets (which you probably do), your family will benefit tremendously from a sound estate plan. Many families are left to put the pieces together after a death or incapacitation, which adds more stress to an already stressful season of life.

Contrary to popular belief, estate planning isn’t just for rich people and it isn’t just for old people. Even if you don’t have any assets when you die, you still need to plan for medical decisions and post-death decisions (such as burial vs. cremation or what happens to your kids).

Estate planning becomes more imperative the older you get, but it is not just for old people. Life is unpredictable, and while odds are you will live a long and happy life, it is always best to prepare for the unexpected.

The Essential Estate Planning Documents Everyone Needs

Copy link to this section: The Essential Estate Planning Documents Everyone Needs

Copied the URL to your clipboard!

Last Will and Testament

- A will expresses what you would like to happen to your assets after your death.

- You can also use a will to appoint guardians for dependents and/or pets.

- Earlier in life, an informal will or a will prepared online may be adequate. As your estate becomes more complex, you should consider paying for an estate attorney to prepare your will.

- It is very important to remember that certain assets, like retirement plans and life insurance policies, pass directly to named beneficiaries instead of through your will. Wills also do not cover medical decisions.

- Some states have different property laws than other states, so it’s always important to update your will if you move to another state and to use the services of an estate planning attorney that is licensed in your state.

Financial Power of Attorney

- A financial power of attorney appoints someone to manage your finances for you.

- An immediate financial power of attorney is effective immediately, as you might have guessed, while a springing financial power of attorney takes effect when certain conditions are met.

- It is very common for older Americans to put their adult children in charge of their finances through a financial power of attorney.

- Who you choose to handle your financial affairs, called your agent, should be someone you trust completely to make decisions in your best interest. Unfortunately, not even family can always be trusted, so don’t take this decision lightly.

Healthcare Directives

- A living will, medical power of attorney, or advance healthcare directive outlines what medical treatments you would like to be used to keep you alive in the event of a medical emergency. Specific treatments include dialysis, breathing tubes, feeding tubes, and CPR.

Trust Documents (When Applicable)

- Revocable trusts allow the grantor, or creator of the trust, to manage and make changes to the trust after its creation. Irrevocable trusts, on the other hand, cannot be modified by the grantor alone after its creation. So why would anyone ever create an irrevocable trust? Well, irrevocable trusts often offer estate tax benefits that revocable trusts do not. This benefit is useful if your total estate is expected to exceed the estate tax exemption (currently $13.99 million in 2025).

- A special needs trust is a tool used to provide for someone’s care while maintaining their eligibility for government benefits such as Medicaid and SSI.

Life Insurance as an Estate Planning Tool

Copy link to this section: Life Insurance as an Estate Planning Tool

Copied the URL to your clipboard!

How Life Insurance Bypasses Probate

As mentioned above, life insurance, as an asset with a named beneficiary, is typically not subject to the probate process and instead passes directly to the named beneficiary/beneficiaries.

The death benefit from a life insurance policy is typically not subject to income taxes or estate taxes, which can make it a valuable estate planning tool. The estate tax exemption is currently so large, at $13.99 million, that it is often more financially beneficial to consider other assets before life insurance (like 401(k)s, Roth IRAs, HSAs, and taxable brokerage accounts).

Whole Life vs. Term Life for Estate Planning

Life insurance is a great tool for protecting your family in case something were to happen to you, but we believe for most situations, term life insurance offers the same protection as permanent life insurance at a much cheaper price. The drawback, of course, is that term life insurance is only for a set term and most policies expire without ever paying out a benefit.

If a term life insurance policy expires and you don’t receive any financial benefit, that does not mean you “threw your money away.” Life is unpredictable, and if everyone knew exactly when or if they would need insurance, there would be no need to purchase health insurance, car insurance, homeowners insurance, or life insurance unless you knew you would experience a need.

Permanent life insurance coverage may be a strategy worth considering for those who will exceed the estate tax exemption ($13.99 million in 2025) due to the general tax-free nature of life insurance benefits.

Estate Planning by Life Stage

Copy link to this section: Estate Planning by Life Stage

Copied the URL to your clipboard!

Young Professionals (20s)

As a young adult, you likely don’t need an elaborate estate plan. Chances are you haven’t yet had the chance to accumulate a large number of assets, and if you are unmarried without children you likely don’t have anyone financially dependent on you.

It is still a good idea to create a basic will, either written yourself (“back of the napkin,” as Brian likes to say) or prepared by a budget online service. If you have retirement accounts or other accounts with beneficiaries, check those regularly to make sure they are up-to-date. If you do have dependents, even just pets, make sure you include your guardianship wishes in estate documents.

Growing Families (30s)

Estate planning becomes much more real once you get married and have children. Now you have people that you love and care about that could be significantly impacted by your death financially.

Term life insurance will become a consideration at this stage of life, and estate planning documents should be in place and updated regularly. If you have children, make sure you have a plan in place if something were to happen to you. The chances of an early death are thankfully very slim, but the risk of leaving your family without a plan is too great to ignore.

Peak Earners (40s-50s)

Peak earning years are typically between 45 and 54, and as your assets grow so does the importance of having a sound estate plan in place. It may be time to visit a professional estate attorney to have documents prepared, and they should be updated regularly.

Beneficiaries on retirement accounts and life insurance policies should also be checked and updated regularly. If you don’t yet have documents in place that outline your wishes for medical treatment if you are incapacitated, there is no better time than the present.

It is possible that you may be able to self-insure at this stage of life, which means the assets you’ve accumulated are enough to pay off your debts and provide for your family if something were to happen to you. Life insurance may no longer be necessary if you are able to self-insure. As the complexity of your financial life grows, it may be a good time to reach out to a fee-only financial advisor.

Pre-Retirees and Retirees (60+)

As you get older and enter the later stages of life, estate planning becomes vital. You should already have a will in place that you review and update as needed.

Consider drafting medical power of attorney and financial power of attorney documents to appoint someone to handle your affairs and make decisions for you if you are no longer able. If you have adult children, involve them in your estate plan. It’s great to have estate documents in place, but if none of your children know how to access your documents or who your estate planning attorney is, it could be very difficult for them after you die.

What to Do When You Inherit Money

Copy link to this section: What to Do When You Inherit Money

Copied the URL to your clipboard!

First Steps After Inheriting $100k or More

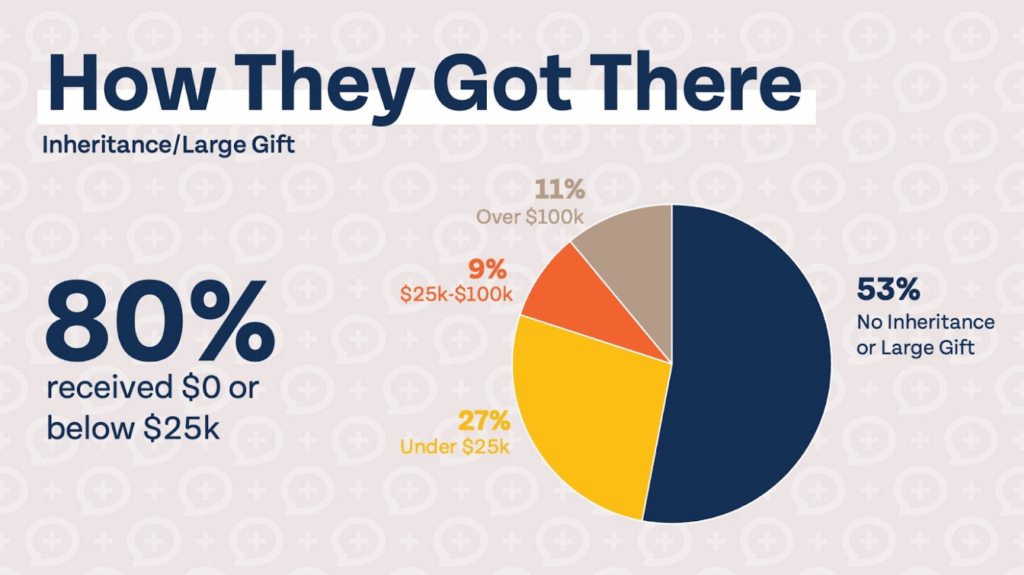

Receiving a large inheritance can be life-changing, but it is often accompanied by the loss of someone you love and can make an already hectic time of life even more stressful. About 26% of Americans expect to leave behind an inheritance, and an even smaller percentage will leave their children over $100,000 when they die. Data from the latest Money Guy Wealth Survey shows that just 11% of millionaires received an inheritance of over $100,000.

If you are in the small percentage of Americans that has received or expects to receive a large inheritance, what should you do with it?

The Financial Order of Operations is a great resource for deciding what to do with your next dollar, or if you receive a large inheritance, maybe your next $100,000.

Following the FOO can help you decide when to pay off high-interest debt, when to build an emergency fund, and when to contribute to your retirement accounts. If you’ve already got those covered, the FOO covers more advanced things like maximizing retirement accounts and saving for future goals such as big vacations or your child’s college education.

If you are interested in learning more about how to handle a sudden financial windfall, check out the video below.

Common Estate Planning Mistakes (And How to Avoid Them)

Copy link to this section: Common Estate Planning Mistakes (And How to Avoid Them)

Copied the URL to your clipboard!

There are some potentially catastrophic estate planning mistakes you will want to avoid to make things much easier for your family in what will already be a stressful and emotional time.

1. Wrong beneficiary on accounts

Did you intend to leave the entirety of your 401(k) to your ex-husband? Didn’t think so! But that’s what can happen if you don’t regularly check and update beneficiaries on bank accounts, retirement accounts, life insurance policies, trusts, and other assets.

Assets with beneficiary designations typically pass outside of the probate process, which means even if you update your will and other estate planning documents, assets with beneficiaries may not reflect your current wishes. It’s a good idea to regularly log in to your accounts and check who the beneficiaries are and update as necessary. You may never need to change beneficiaries, which is great, but it’s always better to be safe than sorry.

2. Giving assets away before you die

There is absolutely nothing wrong with being generous while living and giving assets to your heirs, but in some cases giving assets away before you die can be a huge mistake. Investments, real estate, and other property can receive what is called a step-up in basis at death.

Let’s say a nice couple, Bobby and Bobbina, want to give their favorite son Bobbo their treasured family vacation home. Bobby and Bobbina bought the home for $10,000 and a silver dollar in 1958, but now the home is worth almost $3 million. If they gave Bobbo the home while they are living, their basis of $10,001 carries over to Bobbo. That means if or when Bobbo sells the home, he will owe taxes on the entire sale price over $10,001 (minus any exemptions if the home becomes his primary residence).

If Bobby and Bobbina instead will the vacation home to Bobbo, he will receive a step-up in basis when he inherits the home. That means if or when Bobbo sells the home, he would only owe taxes on the amount the home has appreciated in value since he inherited it. The difference between giving assets away before you die or after you die may seem small, but it can have huge tax consequences for your heirs.

3. Not having any or enough life insurance

A large number of Americans don’t even have health insurance, much less life insurance. Not everyone needs life insurance, but if others are financially dependent on you to live, chances are you should consider your need for life insurance.

A need for life insurance often exists when your assets aren’t large enough to cover your debts (like a mortgage). Life insurance can also be used to replace your income if you are worried about taking care of your family financially if something were to happen to you.

If you are older and have done a great job investing for retirement, you may be able to self-insure. This means you have enough assets to pay off your debts if you were to die and your family would be taken care of. There are many different types of life insurance available, but we believe term life insurance is the best and most cost-effective solution in most situations.

4. Not having estate planning documents

Wills typically don’t cost a lot of money, and if you don’t have children or many assets, a simple will may do the job. If your estate is more complex, it would be smart to use an estate attorney to prepare your will.

Dying intestate, or without a will, means the laws of your state will decide how your property is distributed upon your death. This might not be a huge deal if you don’t leave behind anything worth fighting over, but the more assets and potential heirs you have, the greater the need for a will.

Wills aren’t the only way to express your wishes when you are no longer able to do so. An advance healthcare directive gives instructions for your medical care if you are no longer able to make your own decisions.

There are several different types of power of attorney that can be used to allow a person or organization to manage certain affairs on your behalf. There is medical power of attorney, financial power of attorney, and durable, limited, or springing power of attorney. Like the names suggest, a power of attorney can handle your estate, financial, and even medical decisions.

5. Worrying (or not worrying) about estate taxes

Not worrying about estate taxes can be a catastrophic mistake, but for most people, at least with the current federal estate tax exemption, worrying about federal estate taxes is a much more common mistake.

The current federal estate tax exemption is $13.99 million, or $27.98 million for married couples, which means you must have a very substantial amount in assets to be impacted by federal estate taxes. If you think you will or could be impacted by federal estate taxes, consider reaching out to a fee-only financial advisor to develop a plan for minimizing or eliminating the impact of estate tax.

Working with Estate Planning Professionals

Copy link to this section: Working with Estate Planning Professionals

Copied the URL to your clipboard!

Early in your life, when you don’t have a significant amount of assets, you can get away with a “back of the napkin” estate plan and prepare documents using online services. As your situation becomes more complex, it may be a good idea to work with a fee-only financial advisor and an estate attorney to prepare your documents.

There aren’t any hard and fast rules of when it makes sense to work with professionals, but answering the questions on the checklist below can give you an idea of where you are at in your financial life.

- Do you have enough time in the day to manage your own finances?

- Have you found it beneficial to work with other financial professionals, like a CPA to file your taxes?

- Would you describe your finances as optimized or do you believe there is room for improvement?

- Has your financial life become more complex? In practice, this often means your assets and number of accounts have grown significantly, your taxes must be prepared with the help of a professional, and you utilize more advanced retirement investing strategies like the backdoor Roth and mega backdoor Roth.

- Is your situation unique in a way that may necessitate the help of a professional? Examples of unique situations include owning your own business or having a special needs child that you need to plan for.

Common Questions about Trusts, Estate Planning, and Inheritances

Copy link to this section: Common Questions about Trusts, Estate Planning, and Inheritances

Copied the URL to your clipboard!

Do I need a trust?

- Trusts can be great tools for individuals with large or complex estates, but not everyone needs a trust. If you are concerned that your current estate plan doesn’t adequately meet your needs, it is worth speaking with a fee-only financial advisor or estate planning attorney to see if a trust may be right for you.

How much does estate planning cost?

- There are many factors that determine how much estate planning will cost you, including the experience and rates of the attorney you plan to use, the number and complexity of documents being prepared, and how much time it will take the attorney to prepare your documents.A very simple will couldcost as little as a few hundred dollars, while more complex plans with more documents may cost in the thousands.

When should I update my estate plan?

- You should review your estate plan documents at regular intervals to ensure everything is still up-to-date and nothing needs to be changed. How often you choose to review your documents is up to you, but it would be wise to review them at least once every couple years.If you work with a financial advisor, they may assist you in reviewing documents and making sure everything is up-to-date.

Can I do estate planning myself?

- Many aspects of estate planning can be done yourself, but that doesn’t mean it’s always a good idea. Online websites can help you create wills and other documents like power of attorneys, but may not provide the same level of guidance as an experienced estate attorney. If your estate is simple you may be able to use DIY services, but consider seeking the help of a professional if your estate is more complex.

How do I talk to my parents about their estate planning?

- Approaching loved ones about their estate plan can be a difficult conversation to have. If you are in a position where you may be responsible for someone’s estate after they die, it’s very important that you know exactly how to access their documents and to assist them in creating documents if they haven’t already. You can’t force someone to have a good estate plan, but having a conversation about it will at least give you an idea of what to expect after they die.