The news of today is designed to generate as many views and clicks as possible by exploiting our fears and biases. One famous example is the teaser, “What’s in your tap water that you need to know about?” Almost everyone uses tap water in some capacity, and would definitely want to know if anything is in their tap water that shouldn’t be. More often than not, though, there’s not actually anything to worry about; legitimate information is presented in a misleading way to hook viewers and create fear and anxiety.

The financial media is no exception. Money worries aren’t uncommon at all, whether you are worried about the stock market and your retirement account or making ends meet this month. The financial media preys on existing fears and creates a sense of urgency. There are a few financial topics that seem to come up in the news over and over again, and it’s important to be aware of them.

Alternative investments

Alternative investments, such as gold, can sometimes have a small place in your portfolio, but many times they are pitched as primary investments. These are often seen as “the world is ending” or “the country is collapsing” type of investments; historically, gold has underperformed stock market indices, but in times of fear, investors flock to “safe” investments. Many use gold as a long-term investment despite its lack of attractive qualities. Gold does not pay dividends, drive innovation, or create jobs. When considering alternative investments, make sure your decision is based on the investment quality, your risk tolerance and capacity, and personal goals, not fear.

Recessions

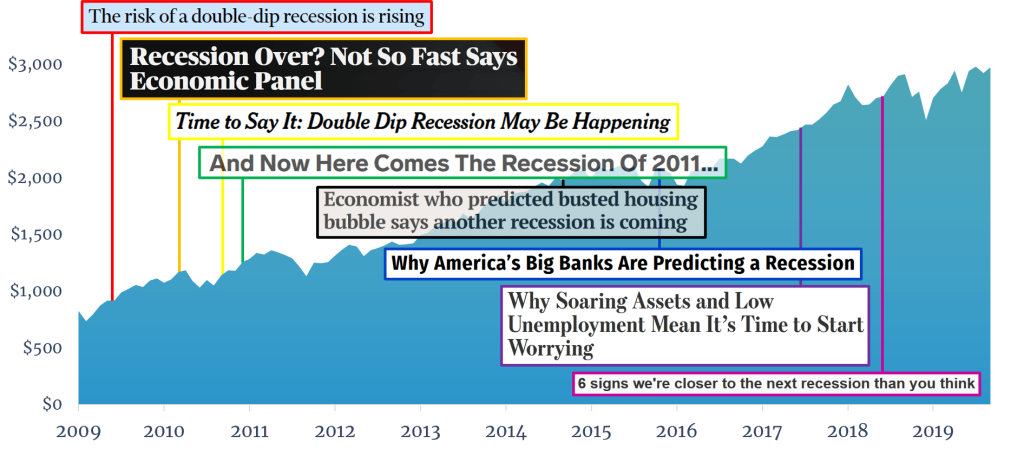

The media loves predicting when the next recession will hit, although they are right about as often as a broken clock. Recessions create an enormous amount of fear in the majority of the population. Not only could the stock market decline, which means millions of retirement accounts decline with it, but millions of Americans could lose their jobs or suffer from reduced pay and benefits. It’s easy to see how the idea of an imminent recession would generate a great amount of clicks and views, and the media does not usually miss an opportunity to create a sense of fear and panic. Below we’ve compiled some of the headlines we’ve seen over the last 10 years and how they’ve tracked with the S&P 500.

As you can see, it doesn’t seem to matter which direction the market is headed; if you pay attention to the media, you’ll always think we’re on the verge of another recession.

Fear of missing out (FOMO)

In addition to fear mongering about potential recessions, good times can create fear, too. The fear of missing out on gains in the stock market is a great generator of internet traffic and television views. In exchange for your attention, you may be offered secrets beyond your wildest imagination, like which stocks are about to skyrocket or when to put your money into the market. As you might imagine, predicting the direction of individual stocks or the market is a difficult (if not impossible) task for even seasoned money managers. Those promising to give away this information for free should be looked upon with extreme skepticism.

The danger of media consumption

Consuming the right kind of media is a good thing; it’s important to stay up-to-date about world events and news, but certainly not all media consumption is positive. Overconsumption of financial media in particular can cause what’s known as analysis paralysis. When you hear in the media that the next recession is right around the corner and stocks are about to crash, and also how now is the best time to invest and stocks look like they’ll only go up, what do you do? The answer may be nothing. Information overload, combined with conflicting views, means you won’t have any idea what to do and may be unable to make a decision. It’s important to limit your consumption of harmful and fear mongering sources of information because your decision-making skills (and even your happiness) could be negatively impacted.

On our latest show, we discuss the financial media and give examples of influencers who may not have your best interests at heart. In addition, we’ll let you know personalities out there who are forces of good and can help improve your financial life. Watch our latest show, “4 Ways the Financial World is Lying to You (Who CAN You Trust?),” on YouTube below.