The S&P 500 is down nearly 15% year-to-date, the economy unexpectedly shrank last quarter, and financial experts say there is a 70% chance of a “near-term recession.” Investor sentiment has rarely been more negative than it is now; the Fear & Greed Index is currently at an 8 out of 100, at the time of writing, indicating extreme fear in financial markets. All indicators appear to be pointing towards an economic downturn, but is it a certainty or a possibility? No matter what happens in the economy, what can you do to make sure you are prepared?

Recession vs. bear market

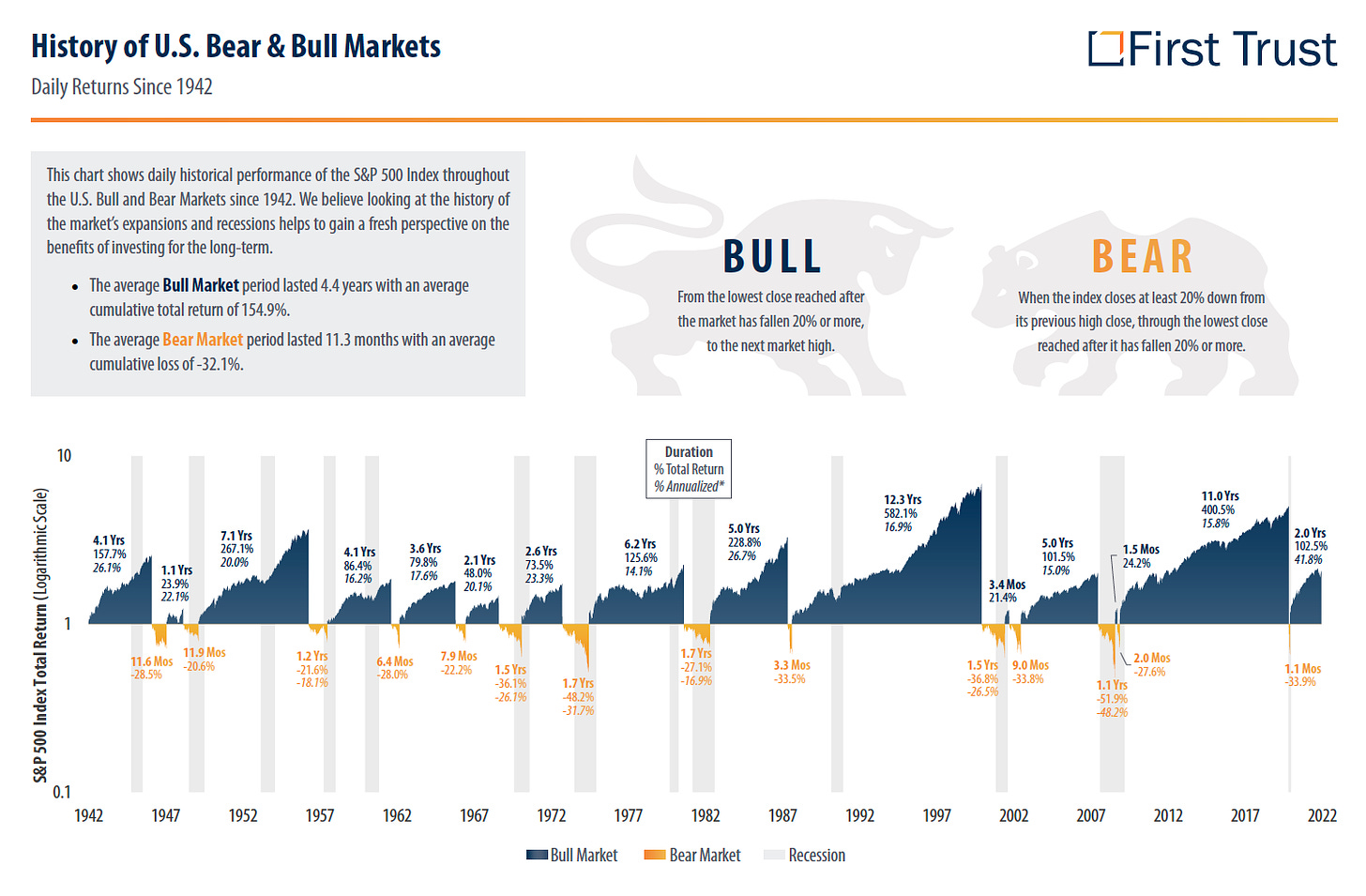

The terms “recession” and “bear market” refer to different things, but they often occur in tandem. A recession occurs when we experience two or more consecutive quarters of a decline in GDP. Last quarter we experienced negative GDP, so if this quarter is also negative, we will be in a recession. Bear markets occur when stocks decline 20% or more from highs, and typically accompany recessions. Excluding the short-lived bear markets of 2018 and 2020, every bear market since 1953 has been accompanied by a recession.

Are we going to experience a recession and/or a bear market?

We are not yet in a bear market, and won’t know until this quarter’s GDP numbers are released if we are in a recession or not. We do know bear markets are typically short-lived. The chart below from First Trust shows bull and bear markets in the S&P 500 since 1942. As you can see, bull markets last longer with substantial cumulative returns. Bear markets are normally shorter, and, in many cases, shallower.

Regardless of what the market and economy do from here, there are some steps you can take to prepare your money and portfolio for whatever comes your way.

How to prepare for a recession

If you are a newer investor, you may never have experienced a downturn like we’re currently experiencing. The bear markets of 2018 and 2020 were very brief; the current market downturn has already outlasted them both. It might feel like this time is different, and it is. Every time is different. Black Monday in 1987, the dot com bubble of the early 2000s, the housing crisis of 2008, and more recently, the Covid crash in 2020. All of these events felt seismic and like they would change financial markets forever, and this time is no different. How can you prepare for something like that?

Assess your plan

A great first step when the market is down is to assess your current plan. You should be assessing your plan in all types of market conditions, but especially when the market is down. Do you have a plan that was designed to be good before, during, and after a bear market? If you are overallocated to risk-on assets, you may now be realizing for the first time that your risk tolerance isn’t as high as you thought it was. Take a closer look at your investment allocation and ensure it is aligned with your financial goals. If there are things that have materially changed since you last updated your plan, you may be due for some adjustments.

Your investment allocation is just one piece of the puzzle. In downturns and recessions, you may also need to reassess your emergency reserves. It is easy to run too lean when the economy is doing well and job loss doesn’t seem like a possibility, but you may need to tighten the belt if the economy contracts. If you are near or in retirement, consider carrying 18 to 36 months of expenses in cash-equivalent investments. This helps ensure you aren’t selling investments every month to live on as the market keeps going down. If you are in the workforce, a 3 to 6 month emergency fund is the general rule of thumb, but may be higher in some cases. If you are the sole provider for your family, work in a seasonal industry, or think it may be difficult to replace your current job, you may want to be more conservative and build a larger emergency fund.

Be wary of doomsday predictions

The media knows that fear sells. The more worried investors are, the more likely they are to watch the news or click on fear-mongering headlines. The economy and the stock market can be very scary and volatile in the short-term, and it is easy to be pessimistic about the future when you are only consuming negative headlines. If you believe all the stock market predictions you see, you’ll always think the next recession is right around the corner. In one of our recent shows, which you can watch below, we looked at some market headlines we’ve seen over the past few decades and the performance of the stock market immediately after those headlines were published. Spoiler alert: negative headlines can’t predict the direction of the stock market or the economy.

Take advantage of unique opportunities

I won’t roll the old Warren Buffett quote out again, but extreme fear in financial markets can be a great contrarian indicator. Market downturns can be an opportunity to not only invest, but also rebalance your portfolio or harvest losses in taxable accounts. If you now have losses in a taxable account, you may have an opportunity to rebalance without incurring a tax liability or harvest losses to offset capital gains.

If you are younger with decades until retirement, the opportunity of investing in a down market may even excite you. You may want to consider accelerating contributions to retirement accounts or putting cash on the sidelines to work. If you are closer to or in retirement, keeping an adequate allocation to cash can help you weather downturns and ensure you aren’t selling investments at the bottom of a market.

Don’t solve a temporary problem with a permanent solution

Market declines are temporary. Declines of 10% to 20%, which we’re currently experiencing now, last an average of 4 months, and the average time to recover is another 4 months. Bear markets that go down no more than 40% last 11 months on average and take 14 months to recover. Market downturns typically last less than a year, and full recovery may take a few months to a little longer than a year.

Losses in your portfolio are likely temporary, but implementing a “solution” when the market is down – like selling everything and investing in cash – could have a permanent and detrimental impact on your portfolio. Be wary of implementing changes to your portfolio that could have impacts that last much longer than the current downturn. Make sure decisions are being driven by goal-based planning and not an emotional reaction.

Nobody knows what is going to happen next in the economy or in financial markets. It’s important to stay up-to-date with the latest news, but having too much information, especially inactionable information, can be a bad thing. Focus on what matters and what you control: your financial plan, unique opportunities, and your future financial goals. Don’t let negative sentiment derail your finances.