This article was originally published in November of 2022.

Not everyone gets excited about annual IRS inflation adjustments, but there are some reasons to be excited for next year’s adjustments especially, as they are the largest in years. While everyone would probably rather both inflation and inflation-adjustments to be much lower, having the opportunity to invest more in your 401(k) or IRA is at least a little bit of a silver lining.

Changes to retirement accounts

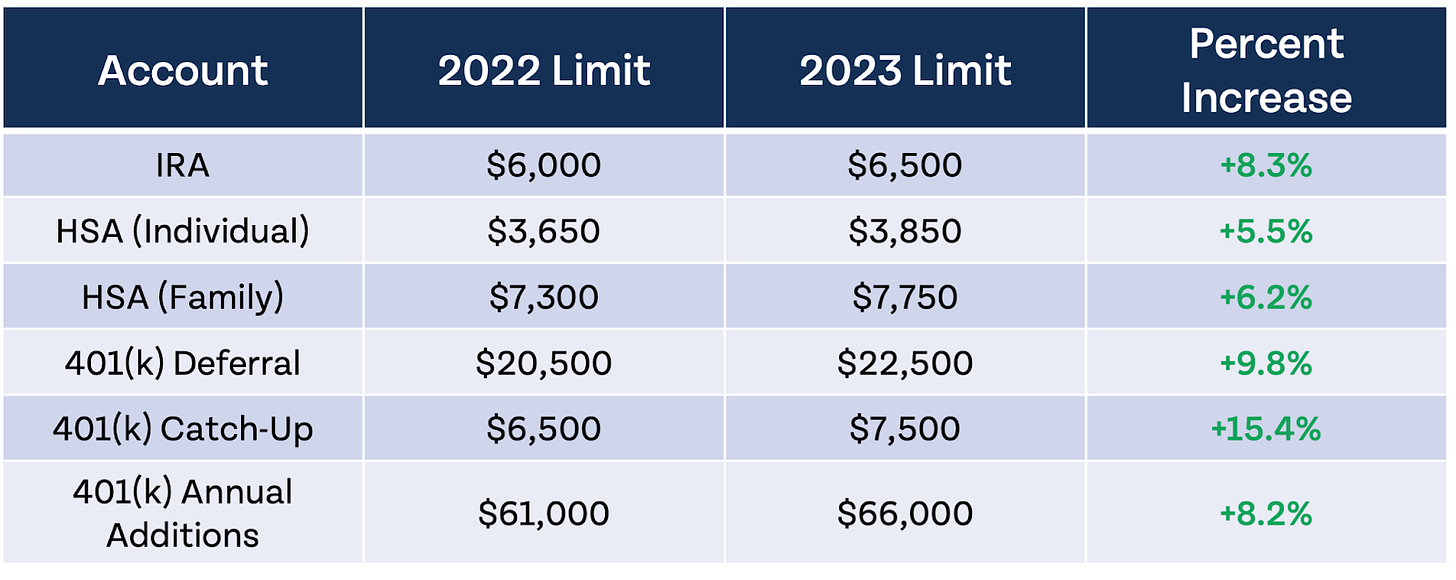

The table below shows how retirement account contribution limits will change in 2023; note that 401(k) limits also apply to 403(b) plans, most 457 plans, and TSPs.

Employer-sponsored retirement plans are getting a pretty substantial boost next year, which is great news for anyone who is maximizing their 401(k) or using the mega backdoor Roth conversion strategy. 401(k) catch-up contributions went up, for those 50 or over, and IRA catch-up limits stayed the same at $1,000. IRA limits increased for the first time since 2019, although it is hard not to wish these accounts had higher limits, especially for those without retirement plans through work.

When IRAs were created in 1974, the contribution limit was just $1,500, and it was not indexed to inflation until 2001. If they had been indexed to inflation from the start, the contribution limit today would be just over $9,000. Would it be too much to ask for a one-time inflation adjustment to make up for the lost time between 1974 and 2001?

Income phaseout ranges will increase next year as well, so if you are on the brink of not being able to contribute to a Roth IRA (or needing to use the backdoor Roth strategy), you may have a little extra time. The table below shows how income phaseouts will increase next year for IRAs. (“401(k)” in the table below is used as a proxy for all workplace retirement plans.)

Standard deductions and marginal tax rates

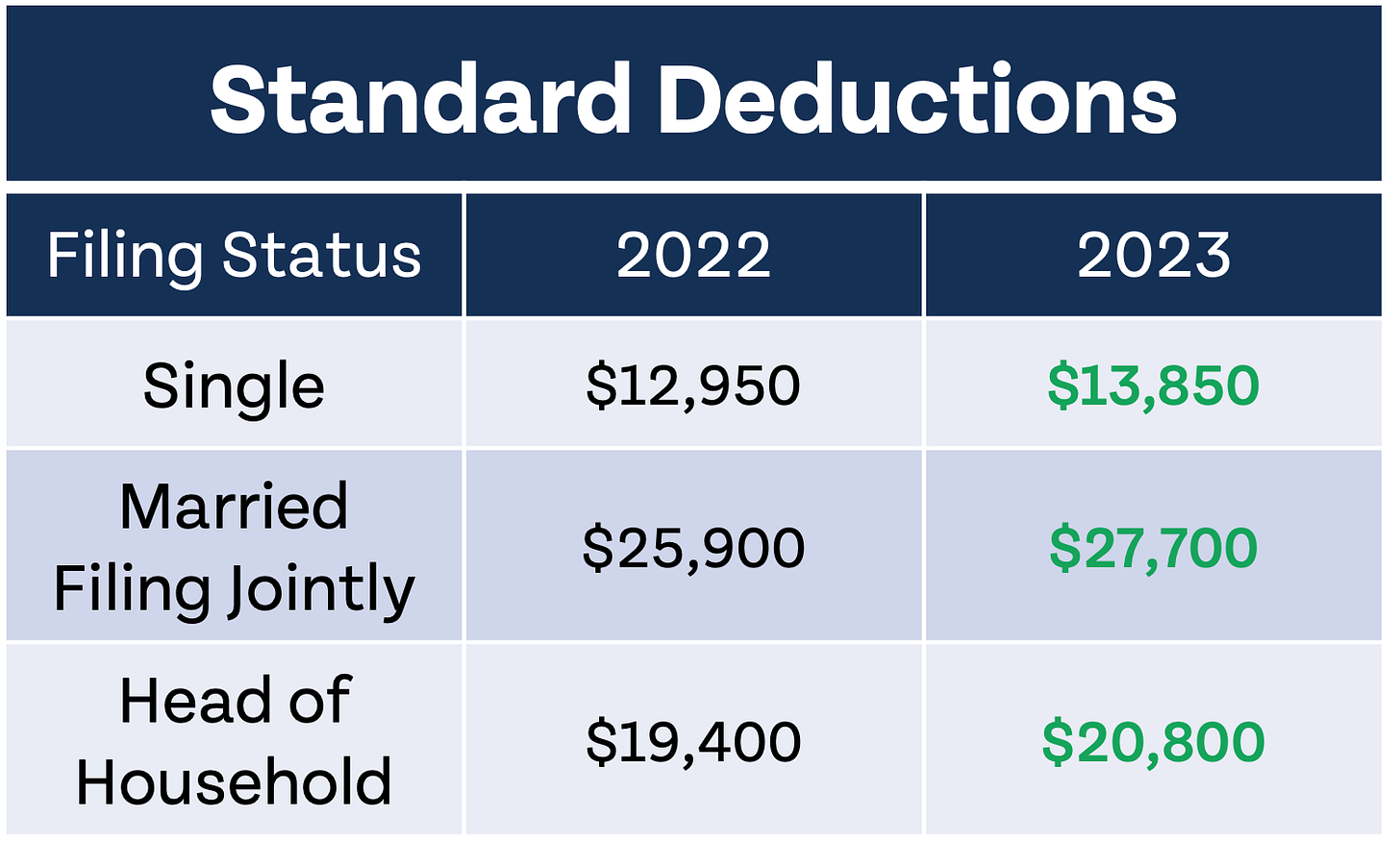

Most Americans don’t really understand the standard deduction or what itemizing means. A recent survey found that just 17% of Americans plan to take the standard deduction as opposed to itemizing, but in reality 90% of the country ends up taking the standard deduction. The standard deduction nearly doubled with the Tax Cuts and Jobs Act of 2017, so for the majority of the country, the standard deduction is the best option. Here’s what the standard deduction looks like in 2022 and 2023.

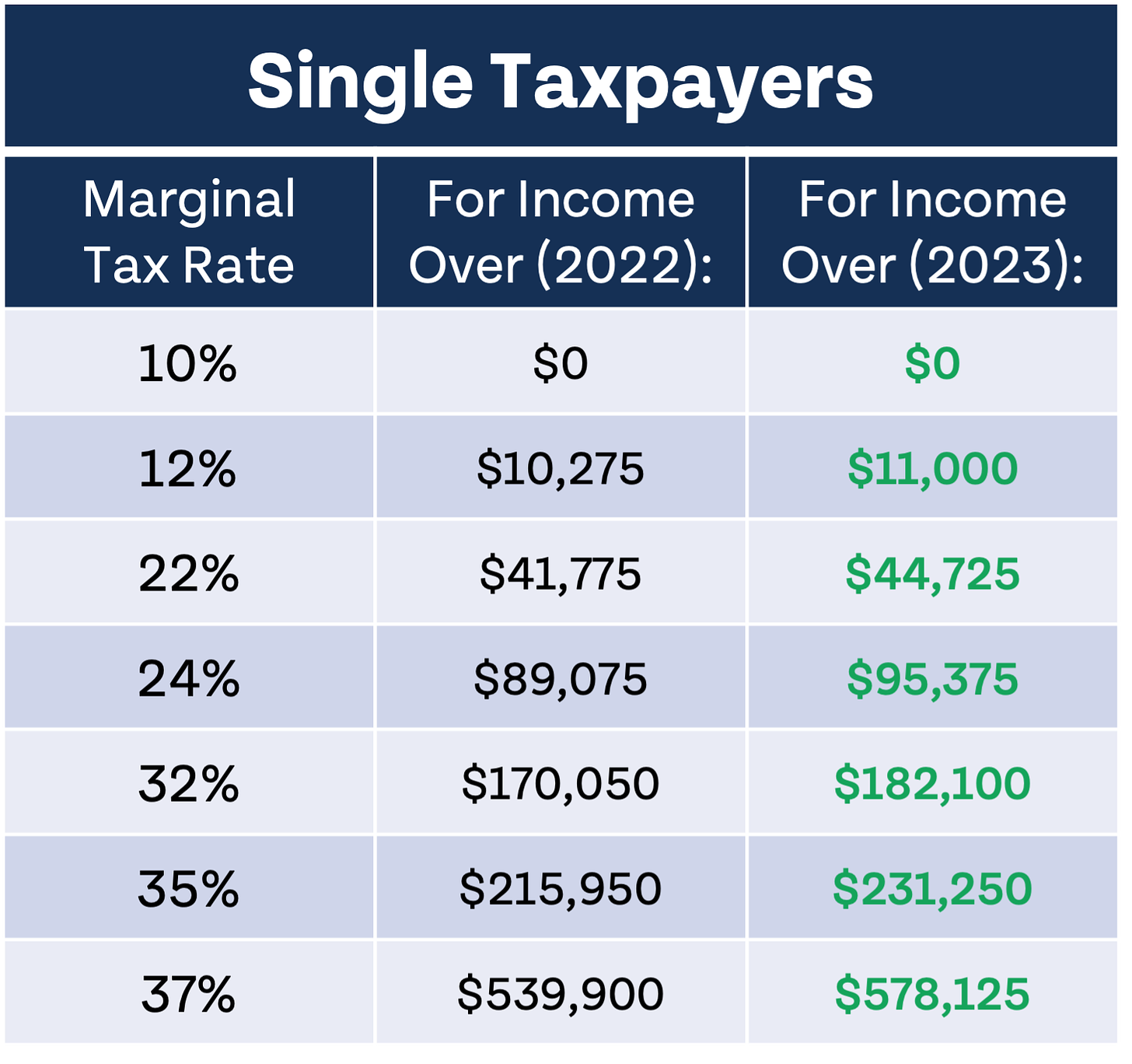

Marginal tax rates will remain the same in 2023, but income thresholds will increase for inflation. The table below shows single tax rates in 2022 and 2023.

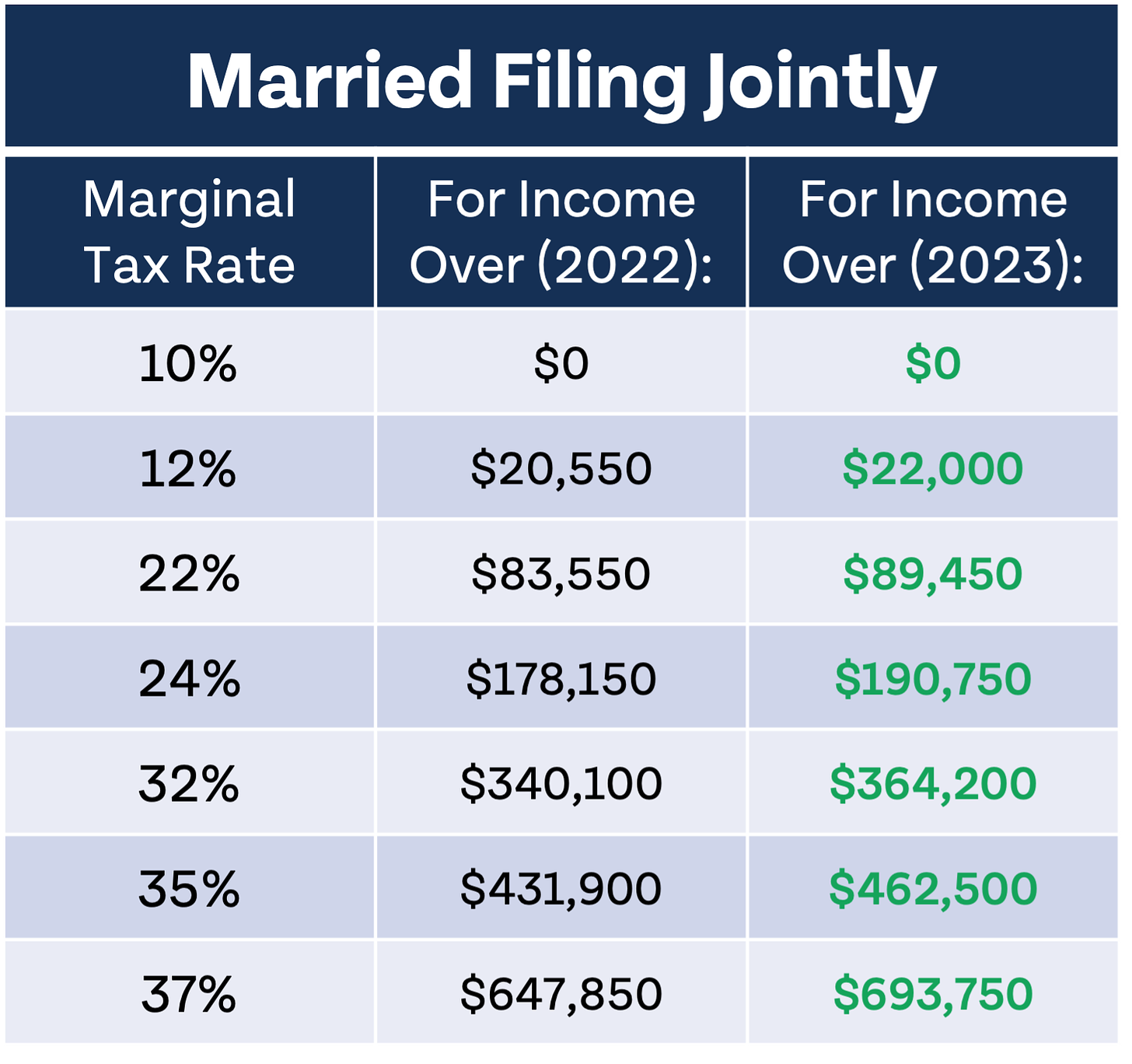

The next table shows marginal tax rate thresholds for married couples (note the so-called “marriage penalty” on the highest marginal tax rate of 37%).

Other changes in 2023

Retirement accounts, standard deductions, and marginal tax rates are the most exciting and notable IRS inflation adjustments, but most other tax credits and phaseouts that are indexed to inflation will also be going up in 2023. This includes the largest Social Security COLA in more than four decades, Earned Income Tax Credit, FSA limit, amount of income subject to payroll taxes, gift tax, capital gains tax phaseouts, and more.

You don’t have to worry about 2023 changes just yet, but we think it’s exciting to get a sneak peek of changes headed our way. When you file taxes next year, for tax year 2022, you’ll still be using the “old” numbers. If you haven’t already, download the 2022 Money Guy Tax Guide to reference as you begin planning for next year’s tax season. We update this resource annually, so make sure you check back after tax filing season for our complete guide to all of the 2023 tax year changes.