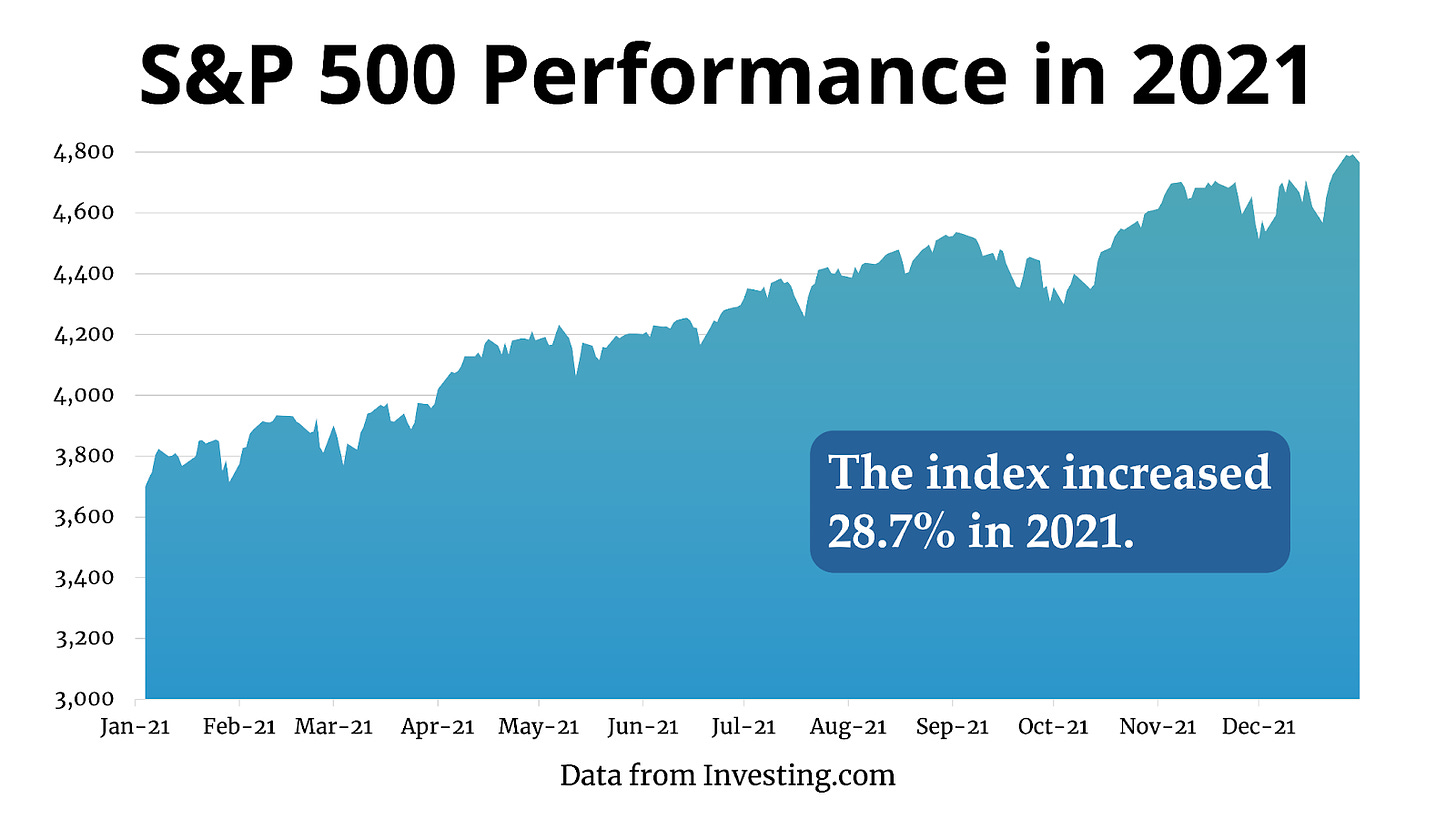

The S&P 500 had a very good year last year, and not just for returns, but for volatility. The total return of the index last year was 28.83%, and the largest decline from peak to bottom was just 5.2%. That is exceptionally good – the average intra-year drawdown since 1980 is 12.88%, and the majority of years have experienced an intra-year double digit decline. Below is a chart showing just how steadily the S&P 500 grew last year.

In one month this year, we’ve already experienced a nearly 10% decline (and have already made about half of that decline back up). The volatility experienced so far this year has renewed ever-present fears about a market crash.

One industry in particular capitalizes on any fear and uncertainty. Over the past few weeks we’ve seen headlines like, “‘Catastrophic’ Stock Market Crash Isn’t Over – Here’s How Much Worse It Could Get,” and “Stock Market Crash: Expert Warns of 41% Drop in S&P 500.” As we’ve shown before on the show, the financial media has great difficulty predicting the direction the market is headed.

Headlines are speculation at best, and can cause great harm to your financial life at worst. Notice how you never see headlines such as, “S&P 500 Headed Up Over the Long-Term, No Cause for Concern” or “Another Boring Day in the Stock Market.” Headlines are designed to instill fear and create a sense of urgency, and in the financial world, market predictions can be safely ignored.

Market “crashes,” or declines, are uncommon but regular occurrences. They shouldn’t cause you to panic and make irrational decisions about your portfolio. In fact, if you are young, you might even get excited when you see the market going down. How can you prepare for the next market crash, whether it is this year, next year, or many years from now?

Understand the importance of risk and diversification.

The best time to prepare for the next market crash is before it happens. Before you consider how to ensure your portfolio is prepared for the next market crash, you need to examine your entire financial life and make sure all of your eggs aren’t in one basket. If all of your assets are invested in the stock market, you are more likely to panic when the market starts to decline.

Not having all of your eggs in one basket means, to start, covering your insurance deductibles and maintaining a liquid and accessible emergency fund. High-yield savings accounts aren’t paying attractive rates right now, but they provide the safety and liquidity that is most important with an emergency fund. The yield of this pot of money shouldn’t override the purpose of having cash when facing uncertainty.

Insurance is also an important tool for reducing the amount of risk in your financial life. Consider your need for not just term life insurance, but disability insurance, umbrella coverage, and more. The general rule for life insurance coverage is 10x your annual income, but you may need more or less depending on how much debt you have and the amount of people depending on your income.

Disability coverage is often overlooked. One in four 20-year-olds can expect to be out of work for at least one year due to a disability before they reach retirement age. A fully-funded emergency reserve can help cover a short-term disability, and for long-term coverage, consider your need for disability insurance. You may be able to purchase disability insurance through your job, or you may have to purchase additional coverage. Generally with disability coverage you want to replace around 60% to 70% of your pre-disability income (Why not 100%? Benefits are tax-free if premiums are paid with after-tax dollars).

Once you cover financial risks outside of your portfolio, it’s time to examine the risk inside of your portfolio. Diversification becomes more important the closer you get to retirement. If you have decades until retirement, you have decades to recover from a market crash. If you are nearing or in retirement, you don’t have that luxury.

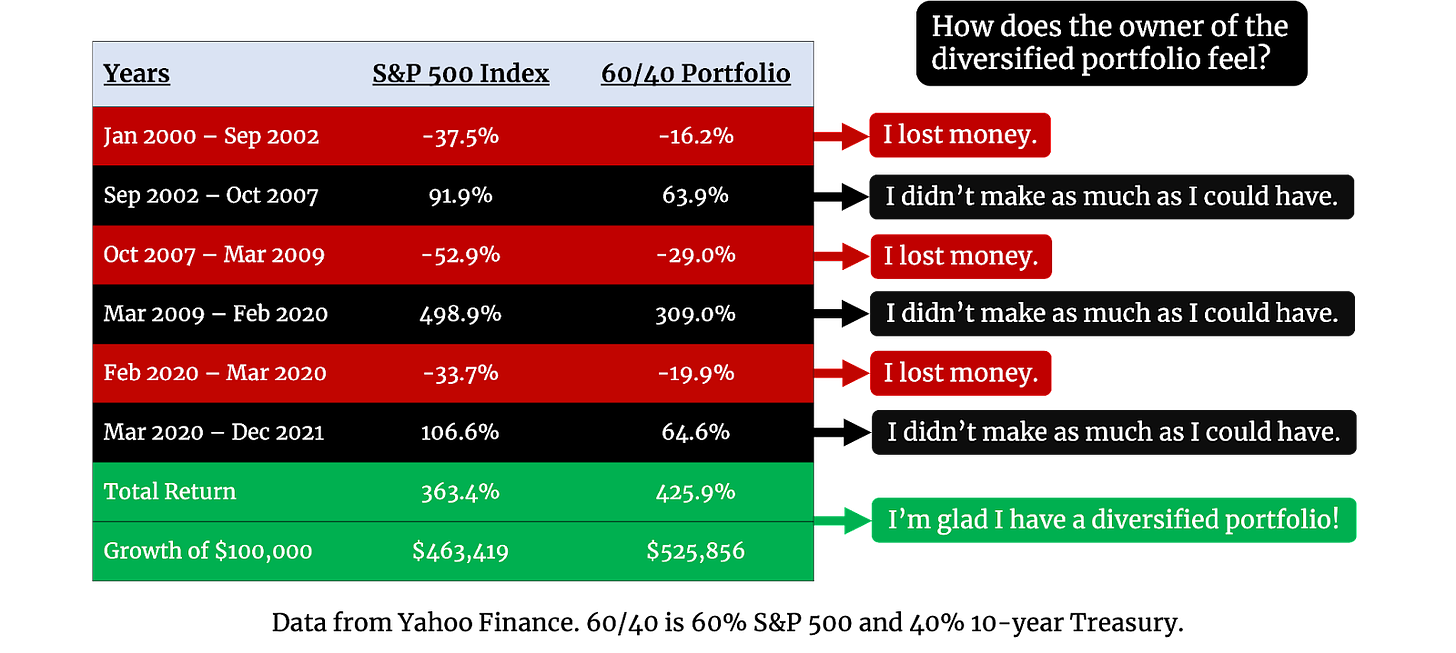

The following illustration shows the importance of a diversified portfolio, and how it often doesn’t feel great having a diversified portfolio.

It is important to note that the above example is more applicable to those approaching or in retirement, as they start with a lump sum of $100,000 and are no longer actively investing in the market. The illustration also starts at a bad time for the market; if it began in 2003 or 2009, it would look completely different.

Younger investors are actively investing in the market, and don’t have the sequence of return risk someone entering retirement would face. But the risks of owning an undiversified portfolio are very real for those with a nest egg entering retirement. If you retired in January of 2000 and were invested 100% in stocks, your retirement wouldn’t have been as great as your retirement friend invested in a diversified portfolio.

Know your financial personality.

How did you feel in March of 2020 when the S&P 500 dropped nearly 35%? If you have been investing for a little longer, how did you feel during the housing crisis, or the dot com bubble? Are you glad that you stayed disciplined or did you make some investing mistakes? Setting rules for future market downturns can help remove some of the emotional aspects from your decision-making. If you know your plan is solid long-term, you shouldn’t feel the need to make changes in the short-term. If you do plan to invest more when the market is declining, set rules for yourself before the market drops, such as contributing more when the market is down 20% or accelerating dollar cost averaging strategies.

A crash is coming, but no one knows when.

The S&P 500 experiences a 10% decline, often called a market correction, normally once every year or two. 20% market declines, which signify the start of a bear market, occur about once every four years. 30% drops, which we experienced in 2020, happen about once every decade.

Stock market crashes are uncommon, but happen with some regularity. A well-designed plan can help fix your fear of volatility. If you know you have your financial risks covered, inside and outside of your portfolio, you may not live in fear of the next market decline. If your investable portfolio has reached a critical mass, where one bad mistake could be devastating to your finances, it may be time to find a co-pilot.