Looking for our latest Net Worth By Age episode? Check it out here. For everything else net worth-related, visit our ultimate guide to net worth.

Keeping track of your annual net worth is an extremely important tool in tracking where you’ve been, where you’re at, and where you’re going. It’s the one metric that tells you, at a single point in time, if you are closer to accomplishing your financial goals or further away. We have a free net worth template available on our website for anyone who isn’t tracking their net worth yet, and a more advanced Net Worth Tool available with a home dashboard tracking your progress over time and the most important metrics to keep an eye on.

2022 wasn’t an exciting year to do net worth statements for many of us, since the market was down nearly 20%, but 2023 is so far shaping up to be a better year. We love diving into the data, so I’m going to show you what it takes to be better than the median, in the top 25%, and in the top 10% by age.

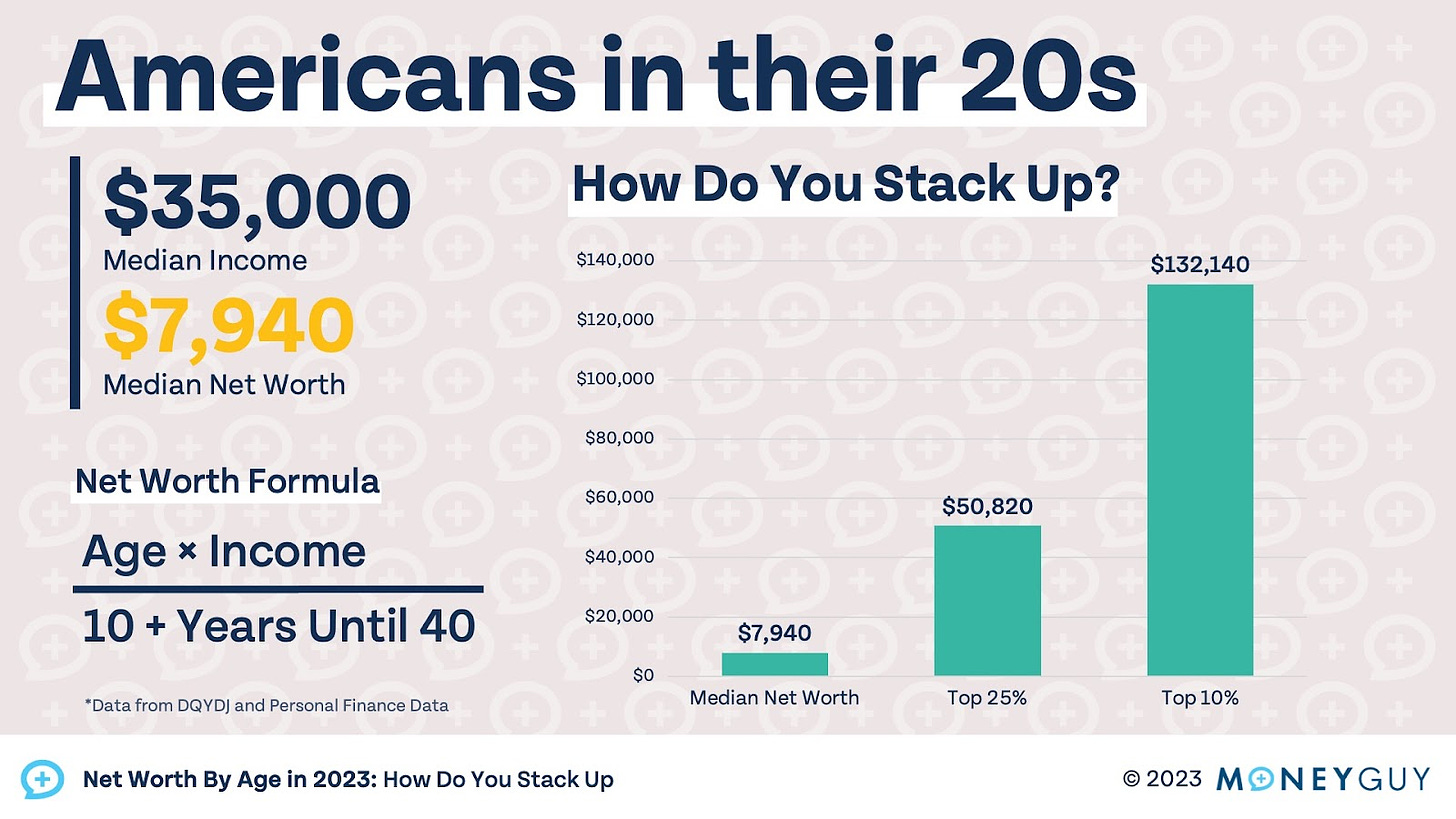

Net Worth By Age in Your 20s

No matter how you stack up to your peers in your 20s, you have plenty of time to catch up (or widen the gap). Getting your behavior right in your 20s will set you up for success and allow your net worth to blossom. What does “getting your behavior right” mean? Don’t fall into debt traps and start investing now. Follow our 20/3/8 car-buying rule, download our home-buying checklist if you are considering purchasing a house, and avoid credit card debt entirely. Start investing a little now, even if it’s only $20 per month. If you are able to build the habit of investing now when you don’t have a lot of extra margin in your budget, it will become even easier as you progress in your career.

The median American in their 20s has a net worth of just $7,940. To be in the top 25% you would need $50,820, and $132,140 to be in the top 10%. Many Americans in their 20s have a negative net worth, so don’t feel discouraged if you are behind the curve in your 20s. You have plenty of time and opportunities to build wealth ahead of you.

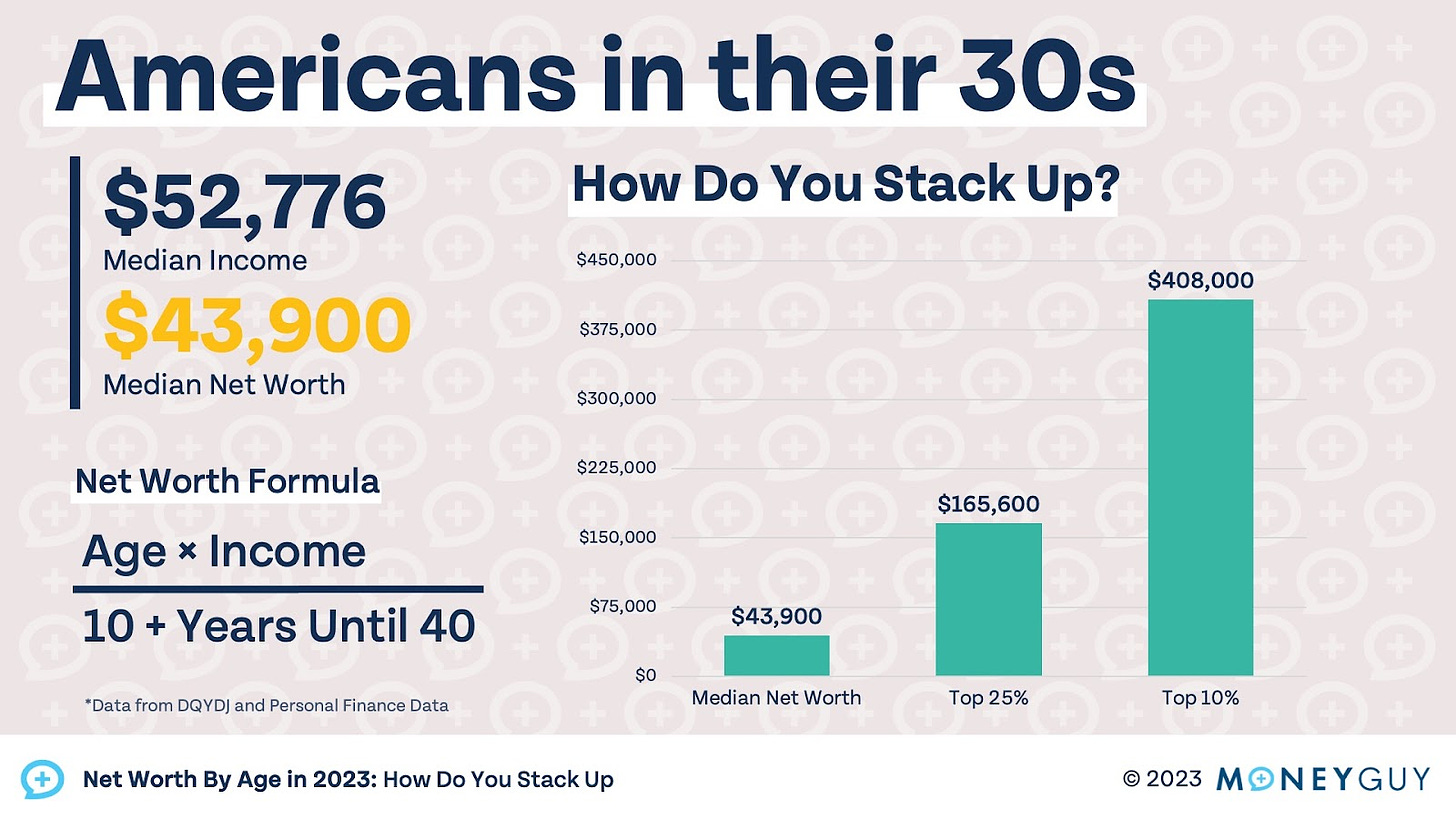

Net Worth By Age in Your 30s

By the time you reach your 30s, you should be making solid progress towards your financial goals. If you aren’t already, aim to be investing 25% of your gross income for retirement. If you make under $100,000/single or $200,000/married, you can include any employer retirement contributions in your own savings rate. There are plenty of excuses: you may start having children, buy your first home, and see expenses increase more than in your 20s. If you can tune out the noise of what many of your friends and neighbors are doing with money in their 30s, you will make the next few decades much easier.

The median American in their 30s has a net worth of $43,900. To be in the top 25%, you need to have a net worth over $165,600, and over $408,000 to be in the top 10%. If those top-end numbers sound high to you, remember that the average American has over 70% of their net worth in their primary residence. If you are worried that your net worth is being inflated by the value of your primary residence to the point that it is impacting your ability to see the changes in your liquid investment and retirement capital, there is a more conservative way to value your house on your net worth statement. You can borrow the accounting concept of lower of cost or market, meaning you would value at the more conservative purchase price versus the market value that has potentially increased by a ton over the last three years.

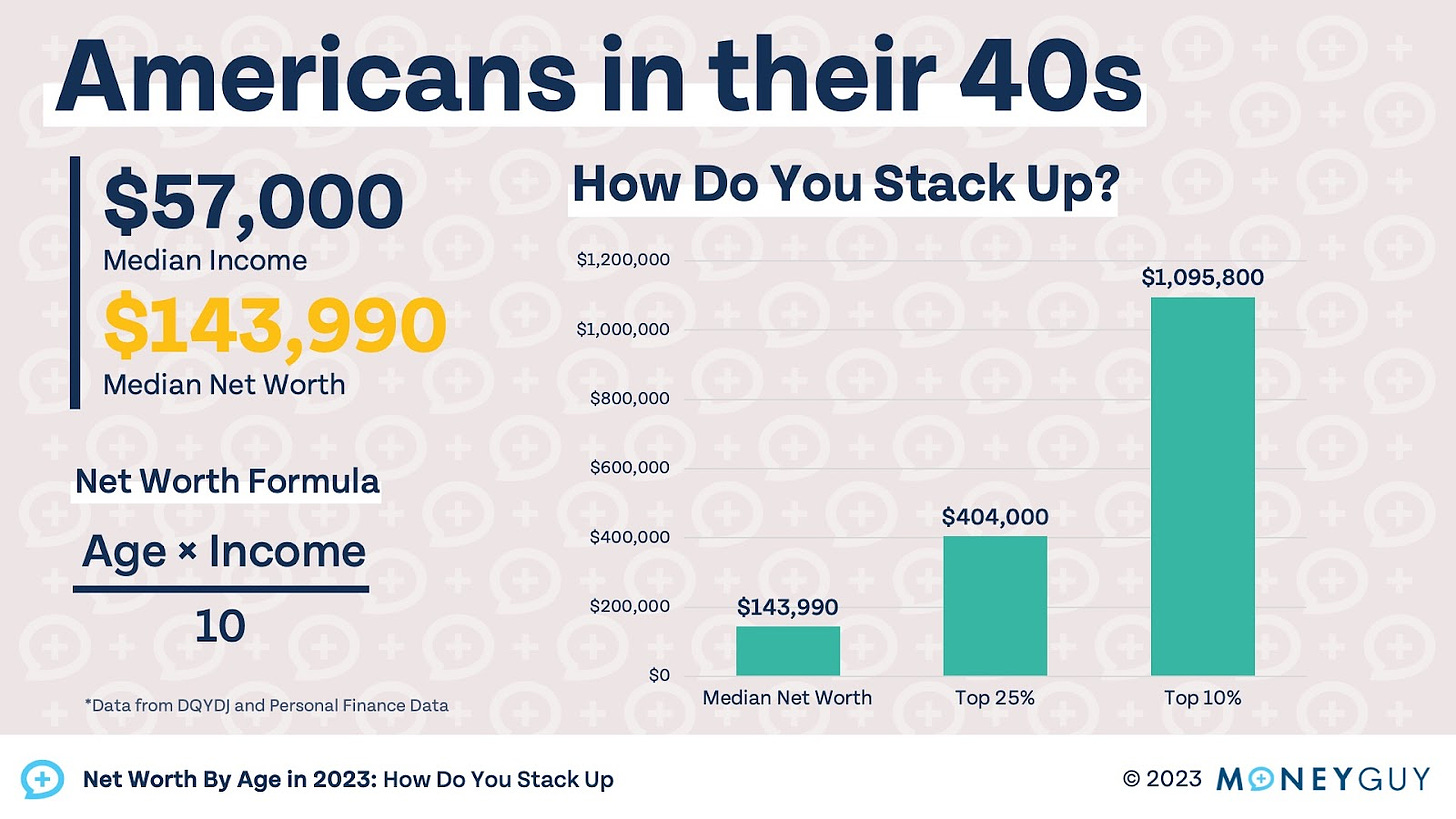

Net Worth By Age in Your 40s

Brian likes to refer to your 40s as a “fork in the road” period, for a few reasons. Your 40s might be the time when you can finally loosen the belt and ease your foot off the accelerator. Or it might be the time to tighten the belt and save like crazy before retirement. You should aim to be investing 25% of your gross income, but may need to invest more if you got a late start or want to retire early. As you get closer to retirement, asset location becomes a concern to ensure you not only have the liquidity to retire, but that you have a tax-efficient retirement plan. After age 45, it may be time to start accelerating paying off your house if you are in the last step of the Financial Order of Operations.

The median net worth of Americans in their 40s is $143,990, but to be in the top 25% you need a net worth of $404,000 and a net worth of $1,095,800 to be in the top 10%. If you are a Financial Mutant, we like the idea of aiming to be in the top 25% or even top 10%.

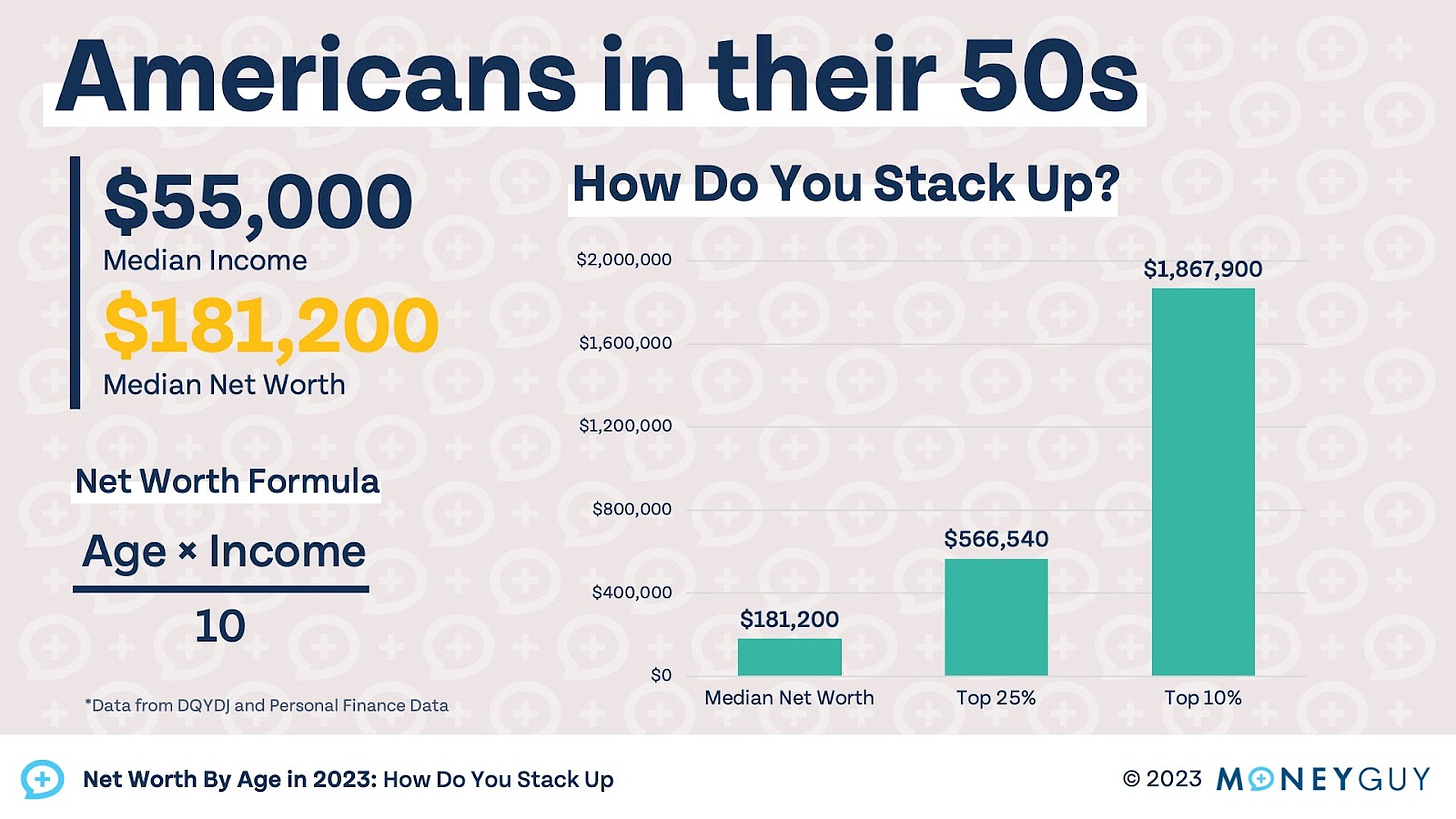

Net Worth By Age in Your 50s

As you near retirement, or enter retirement early, it’s time to make sure your financial plan is solid and your net worth is where it should be. It is so much easier to plan for retirement when you are closer to retirement: not only do you have a better idea of how much you will have in your portfolio, you have a better idea of what things will cost, what your living expenses will be, and any other income sources you may have (such as pensions and Social Security). We created our Know Your Number course to, in part, reconcile your projected retirement need with how much you actually have saved.

In their 50s, the median American has a net worth of $181,200. We know that over 70% of that is usually home equity, which leaves a paltry $54,360 in other assets to retire on. At a withdrawal rate of 4%, that would provide just over $2,000 per year in retirement. It’s safe to say the median American in their 50s hasn’t done a great job saving for retirement. We prefer for you to shoot for the top 25% or higher.

How do you know how you are doing financially if you aren’t keeping track? Completing an annual net worth statement gives you an idea of where you are and how you are progressing in your financial life and awakens the invisible hand. Just like the act of starting a budget and tracking where your money is going can help you save money, tracking your net worth can help you identify areas you can improve and raise your net worth.