The S&P 500 is down nearly 15% from its highs earlier this year, inching closer to bear market territory. While it may not be wise to make major changes to your portfolio in anticipation of a bear market, there are opportunities that present themselves when the market is down. Here’s how to take advantage of those opportunities and what not to do when the stock market is down.

1. Don’t try to time the market

Timing an investment into a declining market is like trying to catch a falling knife. Instead of attempting to time the market bottom, invest regularly and consistently while the stock market is declining. If the market is extremely volatile, it may make sense to invest more frequently in the market; if you normally make contributions once per month, for example, you could consider making weekly contributions in periods of extreme volatility.

Historically, the more money you can invest in the stock market while it is down, the better. If you are able to accelerate contributions, it may be worth considering; nobody knows exactly how far the market will fall or when it will turn around, so it’s important to make regular contributions instead of contributing everything into the market at once. Trying to time the bottom could work out well, but what if the market drops another 30% after you make a lump sum investment? Spreading your investments over a period of time, known as dollar cost averaging, can reduce the impact of stock market volatility on your portfolio.

Stock market declines (and bear markets) often coincide with other negative economic events, like increased unemployment. If you don’t currently have a full emergency fund, now is a great time to start building one.

2. Harvest losses in taxable accounts

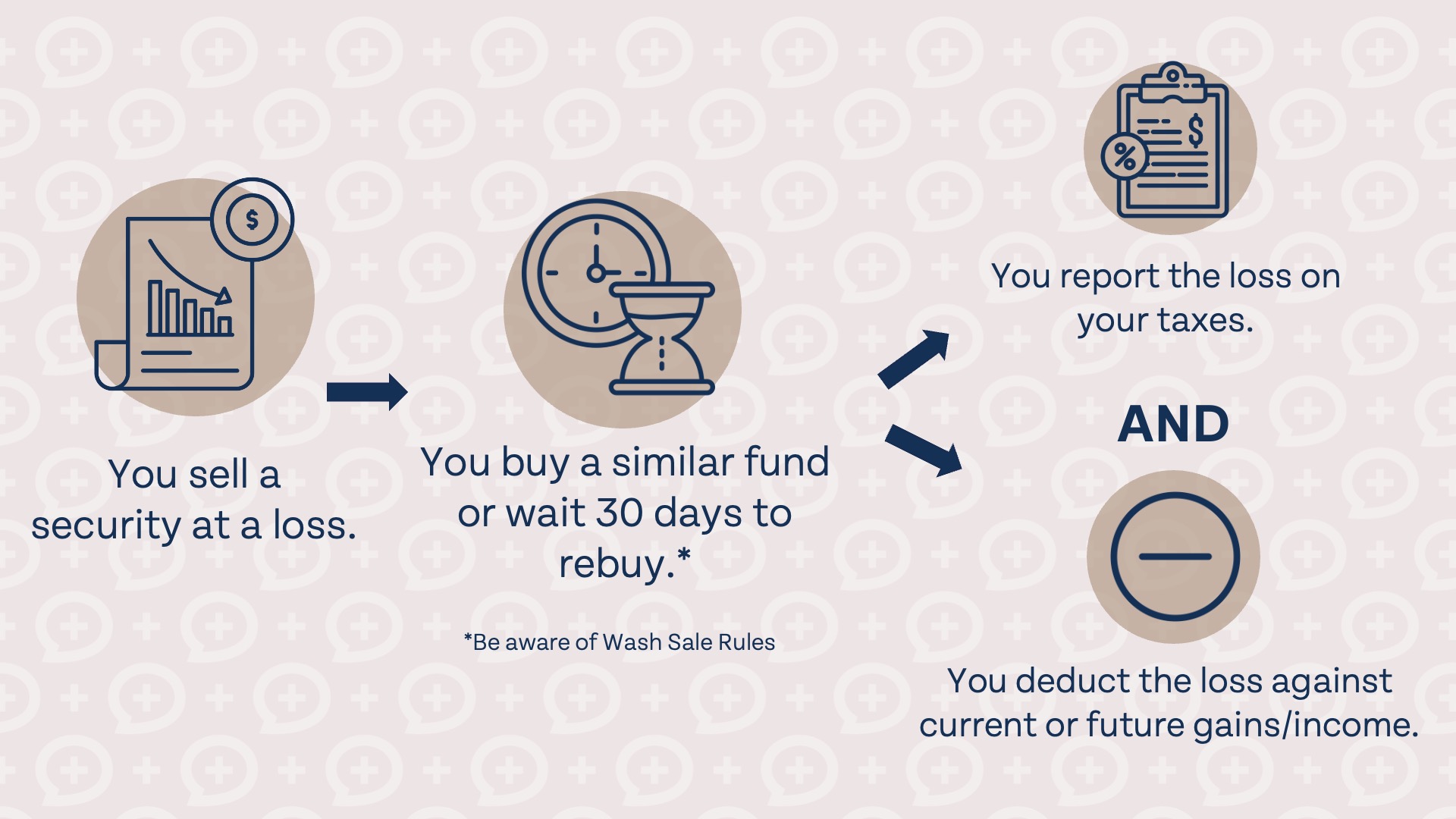

A positive to stock markets being down is the opportunity to harvest losses where appropriate. Harvesting losses is only beneficial in taxable accounts; investments in tax-advantaged accounts like Roth IRAs and 401(k)s are not subject to capital gains tax, so there is no benefit to harvesting losses. In taxable investment accounts, though, harvesting losses can save you money on taxes.

Here’s how it works: by selling a security at a loss, you “lock-in” that loss and can report the loss on your taxes and deduct the loss against future gains/income. It is very important to be aware of wash sale rules. If you reinvest in the same or a substantially similar security within 30 calendar days before or after the sale, you won’t be able to use the loss against gains or income.

3. Reevaluate your investing strategy

It may not be wise to make major changes to your investment strategy solely because of a market downturn, but it’s as good of a time as any to reevaluate your investing strategy. If it feels like your portfolio shouldn’t be down as much as it is down, compare it to a target date index fund close to the year you’d like to retire. If the target date index fund is down, say, 10%, but your portfolio is down 50%, you may need to reevaluate how much risk you are taking in your portfolio.

Diversification doesn’t feel important until it is. When certain sectors of the market are outperforming, it can feel like diversification is holding you back. When certain sectors of the market are dropping much more than others, though, diversification helps ensure your portfolio doesn’t take the brunt of the losses by being invested in a wide array of assets.

4. Focus on how much you are investing rather than your investment returns

It’s really fun to check your investments when the market is going up, but not so fun when the market is declining. If you are contributing to your portfolio every month and it is still dropping in value overall, it probably doesn’t feel like your contributions are making any difference. When the market is dropping, try focusing on how much you have invested into the market and how much you own instead of the value of your investments. You don’t control the direction of the stock market, but you do control how much you contribute and how many shares you own.

A little over a week ago, the CNN Fear and Greed index was at 3 – that’s 3 out of 100, not 3 out of 10, which is about as far into “extreme fear” territory that we can get. Stock market declines are scary and fear-inducing, even for seasoned investors. Instead of focusing on what you can’t control during a market decline, do your best to stay focused on actions you can take. Don’t try to time the market bottom, use the decline as an opportunity to harvest losses in taxable accounts, reevaluate your investment strategy (but don’t make major changes unless they are warranted), and instead of checking how much your accounts are up or down, look at how many shares you own and how much money you have contributed to your accounts.