Equity-indexed life insurance products promise stock market-like returns with no risk of losing money (if market returns are negative, the return of the life insurance product will be 0%). These products can be very attractive to investors that have a lower risk tolerance, but still want to capture the upside of the stock market. As the market rises, the cash value of an equity-indexed policy rises with it; when the market falls, the cash value of the policy does not rise or fall.

Is it possible to capture most of the upside of the stock market without any risk of losing money? How do equity-indexed life insurance products work, and are they a worthy investment?

How equity-indexed policies work

Indexed universal life insurance, or IUL, provides permanent life insurance coverage with a cash value component that earns interest based on the performance of a stock market index. Policies typically have a rate cap and floor. The cap is normally in the high single digits, and the floor usually is set at 0%. So a policy may allow you to earn as much as 9%, based on returns of a stock market index, or as little as 0%.

In addition to a rate cap, policies may also limit potential returns with a participation rate. The participation rate means you only capture a percentage of the upside of the market. If your policy tracks the S&P 500 and the index goes up by 12% one year, but the participation rate of your policy is 50%, you will earn 6%. Most policies feature a participation rate around 80%, although it can be higher or lower.

Like other forms of permanent life insurance, indexed universal life can be prohibitively expensive. Policies can include premium expense charges, administrative expenses, fees, commissions, and surrender charges.

Could indexed universal life beat the S&P 500?

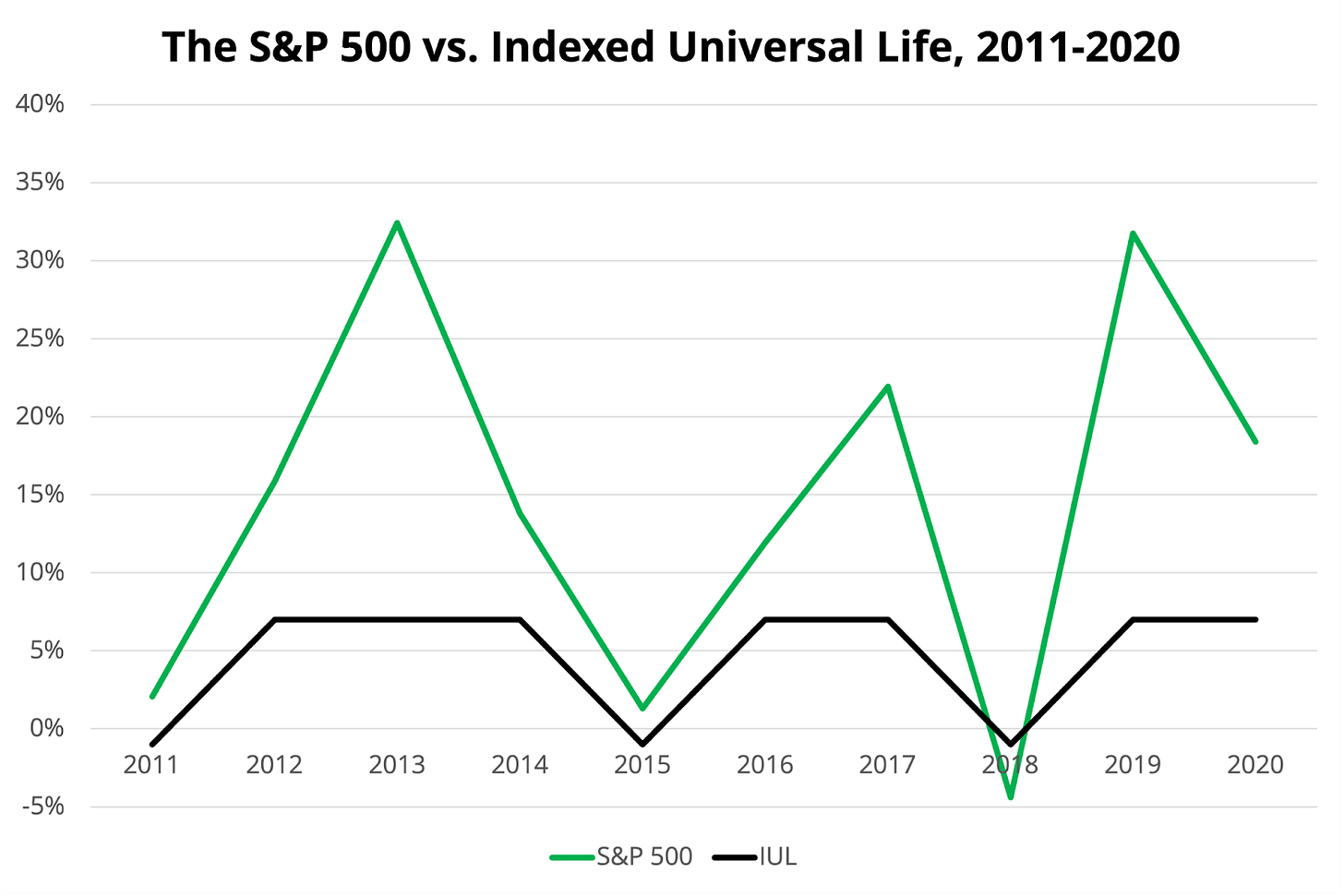

Equity-indexed insurance products are, unsurprisingly, often pitched as investments. Many policies track the S&P 500, the index containing the 500 or so largest companies in the United States. To ensure we’re being fair to indexed universal life policies, let’s assume you are able to find a policy with an 8% rate cap, 0% floor, 80% participation rate, and total expenses and fees of 1% annually. Could your indexed universal life policy beat the S&P 500?

Below are returns of the S&P 500 and this hypothetical indexed universal life policy over the last 10 years.

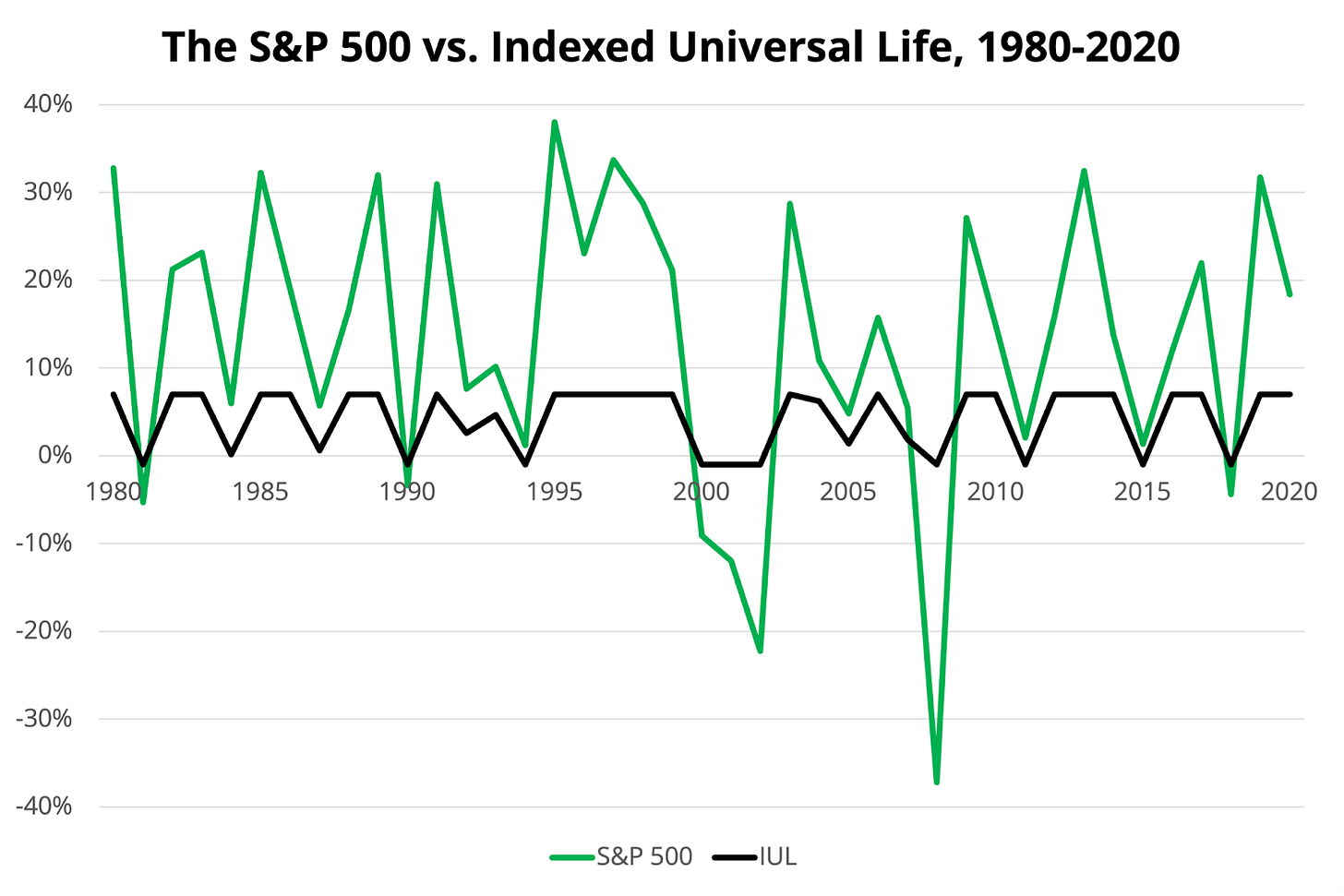

You may notice that in really good years, the life insurance policy earns 7% interest (the cap of 8% minus 1% in fees and expenses). However, in years when the S&P 500 earns 10% or less, the IUL policy does not return 80% of the S&P 500 return. This is because the S&P 500 price index used for IUL policies does not include dividends. Over the past 10 years, from 2011 through the end of 2020, the S&P 500 annualized 13.90%. Our hypothetical IUL policy annualized just 4.53%, less than one-third of the return of the S&P 500 over the same period. Here’s how the S&P 500 and our hypothetical IUL policy performed going back to 1980.

Over the last 40 years, the S&P 500 has annualized 12.01% while our hypothetical IUL policy annualized 4.22%.

Cons of equity-indexed life insurance

Even with fair assumptions, equity-indexed life insurance didn’t come close to beating the S&P 500. There are some major drawbacks to how equity-indexed life insurance products work that insurance salespeople often don’t openly discuss.

1. The index does not include dividends.

This is a significant hindrance to the growth of an IUL policy. Since 1960, the S&P 500 has annualized 10.27% when including dividends. Without dividends, the index has returned just 7.02% since 1960. If someone owns a policy that is supposed to track the S&P 500, they are going to assume, naturally, that it tracks the growth of the index instead of the price change of the S&P 500. Leaving dividends out of the equation is a sneaky way to lower the expected return of the policy that many customers might not even notice.

2. Expenses, fees, and commissions are often prohibitive.

Term life insurance is very affordable, often only a few hundred dollars per year, and index funds that track the largest companies in the U.S. have expense ratios as low as 0.00% (or in other words, free). The average cost of an IUL policy is around 1.5% if held for 50 years (in our example we assumed total fees and expenses of just 1%, no matter how long the policy was held). The front-loaded sales charges and smaller initial cash values make IUL more expensive in the first few years, with the average cost in the first year over 20%, and over 5% until you’ve held the policy for five years. This is not to mention the surrender charges you’ll pay if you want to get rid of the policy early.

3. The policy can lose value.

One of the major “pros” of indexed universal life is that it supposedly cannot go down in value; if the S&P 500 goes down 30% one year, the cash value of the policy will not go down. However, this does not include the fees and commissions of the policy. In the first year, these can be over 20%. Many of those “investing” in an IUL policy often do not consider that their policy could essentially go down by over 20% in one year when accounting for sales charges, fees, and expenses (and more if you consider inflation). If you surrender your policy, your return could be even lower when accounting for surrender charges. Even if you’ve held your policy for decades, it can still lose value if the index it is tracking has an off year.

4. The cap rate can be changed annually.

It’s not uncommon for IUL policies to have a cap rate in the high single digits when purchased, but the cap rate can be adjusted annually at the company’s discretion. All of our calculations assumed the cap rate stayed at a consistent 8% over the life of the policy, which may not be realistic. If long-term interest rates are low, like they are now, the cap will be lower, and volatility in the market also lowers the cap rate.

5. The participation rate can be changed annually.

In the examples above, we assumed the IUL policy had an 80% participation rate for the life of the policy. Lower long-term interest rates and higher market volatility can negatively affect the participation rate of the policy, which can be as low as 25% in some cases. A participation rate of 25% would mean if the index your policy is tracking goes up 8% one year, the cash value of your policy will only be credited 2%. After fees, expenses, and commissions, the real return of your policy may be less than 0%.

When to consider permanent life insurance

Permanent life insurance as an investment may not make sense for many retirement savers when compared to investing in the market, but it can be used in certain situations as an estate planning tool for those with estates larger than $11.7 million. We covered equity-indexed annuities, which work similarly to IUL policies, in this episode of The Money Guy Show: “The Harsh Truth About Annuities!” I wrote about factors to consider when purchasing life insurance in this FYI by FTE article: “When and How To Buy Life Insurance.”

The decision to buy life insurance to protect your family should not be taken lightly. Avoiding or delaying the purchase of life insurance can have an enormous cost, and purchasing an unnecessary life insurance product can be just as costly. If you are being sold a policy from someone who stands to financially benefit from your decision with commissions and fees, you may want to consider working with a fee-only fiduciary advisor, like Abound Wealth Management, that does not sell products or collect commissions.