Last Updated

May 19, 2025

Read Time

Share

Who Needs to Read This?

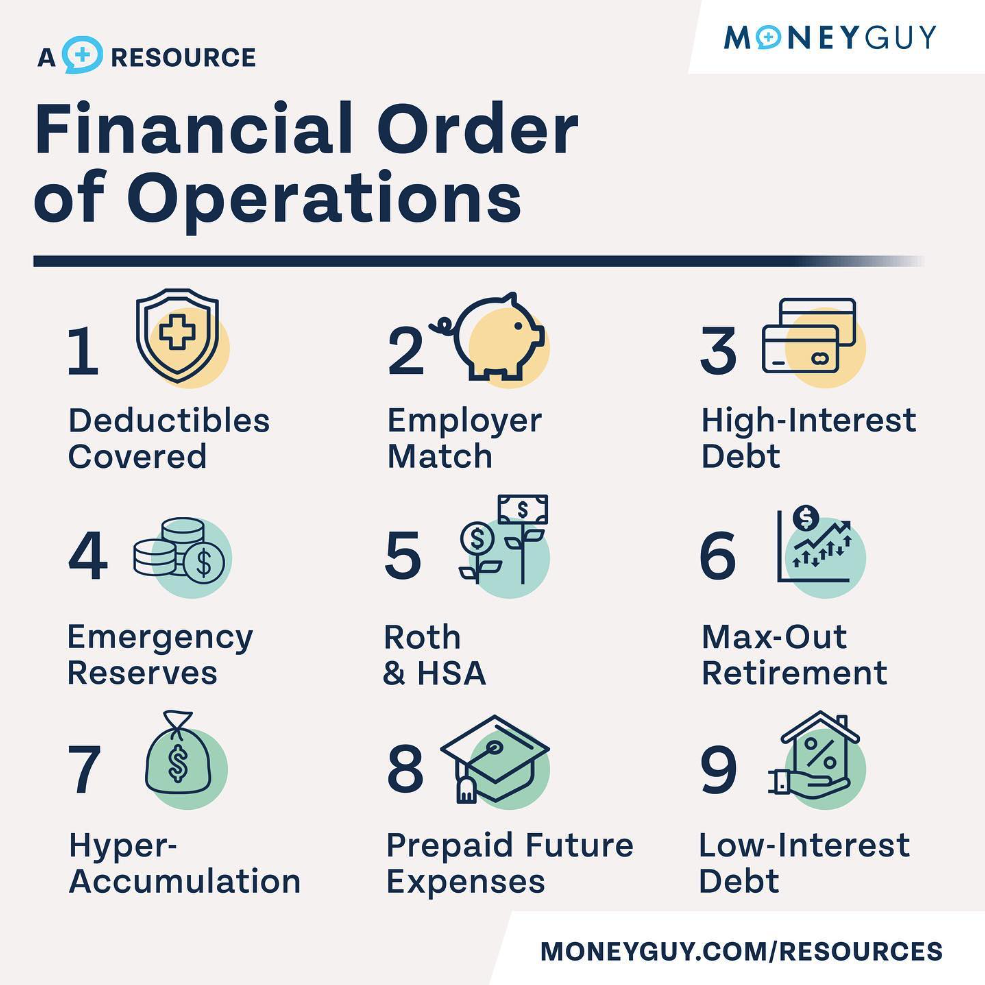

How do you know what to do with your next dollar? Should you invest it, pay off debt, pay for your kids’ college, or something else? The Financial Order of Operations is a nine-step system designed to help you discover the answer to just that: what to do with every dollar. From insurance, maxing your employer match, paying off credit card debt, building an emergency fund, investing in a Roth IRA and more, the nine steps will help you prioritize your financial goals and build your more beautiful tomorrow.

Brian Preston’s book Millionaire Mission, a guide to the nine steps of the Financial Order of Operations, is available now.

Key Takeaways

- Important ground rules for making the most of FOO

- We explain our 9 Steps in detail

- Does FOO make sense for you?

- Compare and contrast alternative models for building wealth

What is the Financial Order of Operations (FOO)?

Copy link to this section: What is the Financial Order of Operations (FOO)?

Copied the URL to your clipboard!

Have you ever thought that there should be an instruction manual for managing money?

If you remember anything from your days in grade school math, it’s probably the acronym PEMDAS, or Please Excuse My Dear Aunt Sally, designed to help you remember the correct order for solving math equations (Parentheses, Exponents, Multiplication, Division, Addition, Subtraction). We believe that money problems have a similar order of operations, which we like to call the Financial Order of Operations.

No matter where you find yourself in your financial life, the Financial Order of Operations will work for you. Did you just start your first job and aren’t sure how to start investing? Do you have high-interest debt that you aren’t sure how to balance with other financial needs? Or maybe you are maximizing all of your retirement accounts and don’t know where to invest next.

Nearly 60% of Americans are unable to pay for an unexpected $1,000 expense with savings. We struggle with the basics, like budgeting, credit card debt, and saving for retirement. That’s why the Financial Order of Operations is so powerful – it grants clarity to those seeking order amidst financial chaos.

Paying for a car in cash is ideal. Unlike homes, cars are quickly depreciating assets, which means if you take out an auto loan you could become underwater on your purchase if you aren’t careful.

However, not everyone has the ability to pay for a car in cash. Rather than driving a clunker off the lot and spending more in maintenance and repairs than a dependable car would cost, we believe it is often more cost-effective to take out an auto loan and drive a safer, more reliable vehicle.

Check out our Financial Order of Operations mini-show below for a quick 8 minute introduction to the FOO.

Where did the FOO come from?

Copy link to this section: Where did the FOO come from?

Copied the URL to your clipboard!

Our FIRST EVER YouTube video all the way back in 2017 lays the groundwork for what is today known affectionately as the FOO. The 9-step Financial Order of Operations has not had to change much over the years; it is an all-weather plan for your finances that works no matter what stage of life you are at, how much money is in your bank account, or how much you have invested for retirement.

First, What Are the Ground Rules for FOO?

Copy link to this section: First, What Are the Ground Rules for FOO?

Copied the URL to your clipboard!

Before we dive into all nine steps of the Financial Order of Operations, there are a few ground rules to the Money Guy philosophy about building wealth. These ground rules are foundational to being successful with the Financial Order of Operations, and will make the steps much easier!

Ground Rule #1: Generosity is rewarding.

Generosity and charitable giving is an important part of any financial plan, no matter where you are in your journey. If time is a scarce resource, generosity might mean donating money to causes you support. If you are earlier in your journey and have an abundance of time, volunteering may be a better option than giving money.

Ground Rule #2: Bedazzle your basic life.

Saving for the future requires sacrificing a little bit of today for a more beautiful tomorrow. Sacrificing today doesn’t mean living like a miser and foregoing any “unnecessary” expenses, but it may mean planning those expenses carefully and making sure they aren’t harmful to your finances. There will be a time and place in your financial journey for more extravagant splurges, but until then focus on bedazzling your basic life.

Ground Rule #3: The FOO is not a straight line.

The FOO is a step-by-step guide to tackling your finances, but not everyone follows a linear path. There will be bumps in the road, you may move backwards in the steps, you may jump forward several steps very quickly. Your financial path won’t always perfectly progress from one step to the next.

Our Favorite FOO Resources

Copy link to this section: Our Favorite FOO Resources

Copied the URL to your clipboard!

Know somebody getting started on their path to prosperity? Point them to these popular Financial Order of Operations Tools & Products:

- Free One-Sheet Guide

For a handy one-sheet guide to the FOO, download our free Financial Order of Operations PDF. - Millionaire Mission

New York Times bestseller Millionaire Mission is not only an in-depth guide to the nine steps of the Financial Order of Operations, it is backed up by Brian’s own journey through the FOO and generously sprinkled with research and data, tables and charts, and of course Brian’s signature anecdotes and personal stories. - Our Instructional FOO Course

Are you looking to take it to the next level with 2+ hours of video content, a workbook guiding you through each step, and access to our private Facebook group? Check out our Financial Order of Operations online course at a new, low price of $49!

Deep Dive Into Money Guy’s 9 Step Financial Order of Operations (FOO)

Copy link to this section: Deep Dive Into Money Guy’s 9 Step Financial Order of Operations (FOO)

Copied the URL to your clipboard!

The Financial Order of Operations is so foundational to Money Guy that we created our first course based on it. The FOO course includes video lessons from Brian and Bo, homework for each step in the FOO, private YouTube live streams, and access to an exclusive Facebook group.

What Are The 9 Steps?

- Deductibles Covered

- Employer Match

- High-Interest Debt

- Emergency Fund

- Roth IRA/HSA

- Max-Out Employer Plans

- Hyperaccumulation

- Prepay Future Expenses

- Prepay Low-Interest Debt

Let’s dive in deep!

FOO Step 1 – Deductibles Covered

Copy link to this section: FOO Step 1 – Deductibles Covered

Copied the URL to your clipboard!

The first step of the Financial Order of Operations is to cover your insurance deductibles. When something goes wrong in life, having your deductible covered is essential to keeping your financial life out of the ditch. You likely have deductibles for your health insurance, car insurance, homeowner’s insurance (if you own a home), and more.

Do I need to save all my deductibles? Or just one?

To complete step one, you only need to save enough to cover your highest insurance deductible. The biggest risk is of a single emergency to happen, and while it is possible for multiple financial emergencies to happen at once, you’ll build savings for that later in step four, emergency fund.

What is an insurance deductible?

Insurance can protect you from financial disaster, but it doesn’t cover 100% of everything. A deductible is the amount that you pay before insurance foots the bill, whether it’s for a car accident, home disaster, or medical emergency.

Why would I not want the lowest deductible possible?

A lower deductible means insurance will start paying out sooner. However, a lower deductible typically comes with a higher premium cost. And if you love HSAs like we do, you need a high-deductible health insurance plan in order to contribute.

How do I know I’ve completed Step 1, Deductibles Covered?

If you have enough in a liquid savings account to cover your highest insurance deductible, you can check the box on the first step of the Financial Order of Operations. If you aren’t sure what your deductibles are, check your policy documents for all insurance policies you have.

See Also: Money Guy Covers 16 Types of Insurance and Which Ones You Need

FOO Step 2 – Employer Match

Copy link to this section: FOO Step 2 – Employer Match

Copied the URL to your clipboard!

Getting your employer match is important – so important, in fact, that we prioritize it in the Financial Order of Operations before high-interest debt. High-interest credit card debt may have interest rates of 20% or a little more, but an employer match can have a rate of return of 50% or 100%.

What if I don’t have an employer match?

If you are self-employed or work for an employer without a retirement plan, you won’t have an employer match. No, completing step two does not mean finding a new job: if you don’t have a match, simply move on to step three.

What could I be missing out on if I don’t get the match?

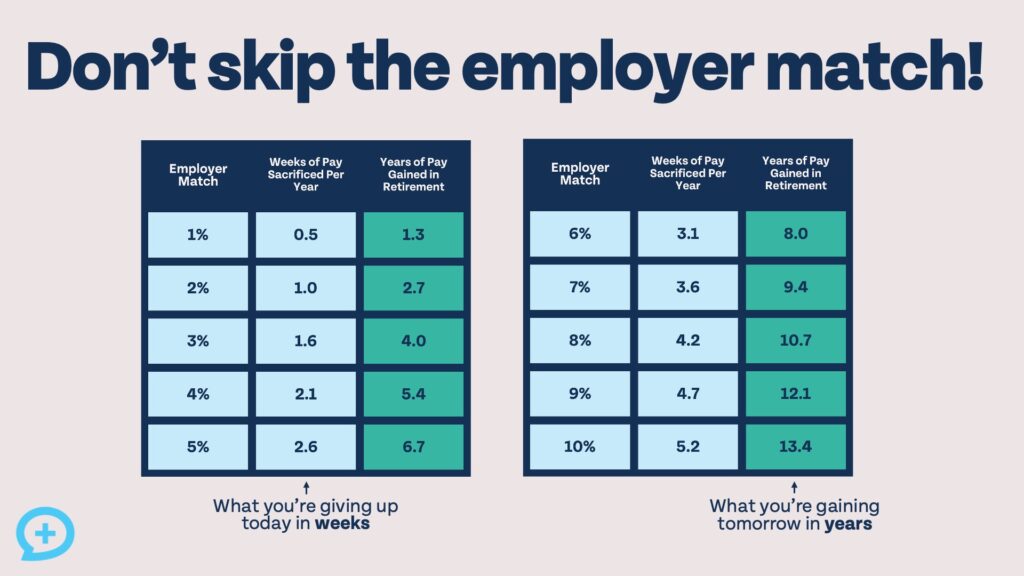

Getting your employer match is a case of sacrificing a little for a lot. Check out this chart that shows the weeks of pay you need to sacrifice per year and the years of income you will gain in retirement.

Are employee stock purchase plans (ESPPs) part of getting my employer match?

If your employer offers a discount on their stock, taking advantage of it counts as part of getting your match. However, if you have high-interest debt, make sure the discount on employer stock trumps the rate on your high-interest debt.

Is my employer match guaranteed?

When you contribute to receive your employer match, those matching funds aren’t always guaranteed to stay if you leave your job. Your contributions are always there, but matching funds may have what is called a vesting period. If you leave your job early, you may lose some funds. Make sure you know the details of your plan so you don’t leave money on the table.

How do I know I’ve completed Step 2, Employer Match?

To complete step two, you need to be investing enough to your employer-sponsored account, such as a 401(k), to get your full employer match. Some may not need to contribute anything to get their match, while others may need to contribute 5% of their income, 10%, or even more.

FOO Step 3 – High Interest Debt

Copy link to this section: FOO Step 3 – High Interest Debt

Copied the URL to your clipboard!

High-interest debt can be extremely harmful to your finances, which is why it is prioritized highly in the Financial Order of Operations. Paying off all of your high-interest debt will allow you to invest more for the future.

Does my mortgage count as high-interest debt?

In 2024, it is not uncommon for homeowners to have mortgage rates over 6% or even 7%. Does this count as high-interest debt? While the interest rate is bordering on what would be considered a high rate, there are a few reasons it may still count as low-interest debt. Mortgages are on homes, which are typically appreciating assets, a distinct difference from car loans, student loans, and consumer debt. Mortgage interest may be deductible if you itemize your tax deductions, which effectively lowers your interest rate.

Does a 0% interest rate credit card count as high-interest debt?

While a 0% APR credit card is technically low-interest debt, we still count it as high-interest debt. The 0% rate is always a teaser rate, available only for a limited time. After that introductory period, the APR may skyrocket to 20% or higher. Carrying any debt on a credit card, even if it is temporarily at 0%, is a dangerous game to play. Any consumer debt, no matter the interest rate, should be prioritized at step three of the Financial Order of Operations.

Which high-interest debt do I pay off first?

If you have more than one high-interest debt, you may be asking which debt to pay off first. Mathematically, it makes the most sense to pay off your debt with the highest interest rate first, then prioritizing debts with lower and lower interest rates until they are all paid off. However, if getting rid of debts completely is a big motivating factor for you, paying off your smallest debt first may help keep you going and pay off your debt sooner.

How do I know I’ve completed Step 3, High-Interest Debt?

You can move on to the next step in the Financial Order of Operations if you have no high-interest debt. High-interest debt includes consumer debt such as credit cards, car loans outside of our 20/3/8 rule, and student loans depending on your age and the interest rate.

FOO Step 4 – Emergency Fund

Copy link to this section: FOO Step 4 – Emergency Fund

Copied the URL to your clipboard!

Building a full 3-6 month (or greater) emergency fund is step four of the Financial Order of Operations. An emergency fund is vital to staying on-track financial and paying for unexpected emergency expenses.

Is my deductibles covered fund included in my emergency fund?

Yes, your deductible covered fund becomes part of your emergency fund. They are not separate funds, so it should give you a head-start on your emergency fund!

How do I determine what to save in my emergency fund?

The amount you need to save in your emergency fund should be calculated based on your expenses, not income. Determine what amount you spend each month and multiply that by the number of months you need your emergency fund to be.

What account should my emergency fund be in?

We love using high-yield savings accounts for emergency funds. Online banks offer better rates, on average, than brick and mortar banks. Bankrate lists the top savings accounts available and how much you could expect to earn annually by banking with them.

How do I know I’ve completed Step 4, Emergency Fund?

The typical rule of thumb is to save three to six months’ worth of expenses for an emergency fund, but depending on your situation, you may need more. If you only have one income in your household or are in a very specialized field where it may take you longer to find a new job, you should consider having a larger emergency fund.

FOO Step 5 – Roth IRA / HSA

Copy link to this section: FOO Step 5 – Roth IRA / HSA

Copied the URL to your clipboard!

Maximizing your Roth IRA and HSA, if you are able to contribute to both, is step five of the Financial Order of Operations. These powerful tax-free accounts can supercharge your retirement which is why they are prioritized before maximizing your employer-sponsored account or contributing to a taxable brokerage account.

What if my income is too high to contribute to a Roth IRA?

If your income exceeds the Roth IRA contribution limit, you may still be able to contribute using the backdoor Roth strategy. This is a strategy that can have unintended tax consequences, so you’ll want to measure twice and cut once and consult a professional if you have any questions or doubts.

How do I use an HSA?

HSAs are very versatile and can be used in many different ways. Most use them as a slush fund to pay for current-year medical expenses, however the best way to use an HSA is to keep your dollars invested and save your receipts for the future. There is no time limit on reimbursing yourself for eligible expenses, so you can let your dollars grow as long as you can.

What if my HSA is too big by retirement?

Some with a large HSA may be worried about having more in their HSA than they have in eligible medical expenses. If this happens, you can still take money out of your HSA and use it like a traditional retirement account (which will be taxed).

How do I know I’ve completed Step 5, Max Roth IRA/HSA?

If you are maximizing your Roth IRA and HSA, you can check the box on step five and move on to the next step in the Financial Order of Operations. If you don’t have a high-deductible health plan and can’t contribute to an HSA, or are unable to contribute to a Roth IRA, you can skip step five of the FOO.

FOO Step 6 – Max-Out Employer Plans

Copy link to this section: FOO Step 6 – Max-Out Employer Plans

Copied the URL to your clipboard!

Maximizing all of your employer-sponsored retirement accounts is step 6 of the Financial Order of Operations. This includes 401(k)s, 403(b)s, 457 plans, and more. This is a very difficult step of the FOO to accomplish because of how much money it takes to maximize your accounts.

Can I have too much saved in employer accounts?

If you are maxing out your employer accounts, you may accumulate a significant amount of money in them by retirement. If you are planning to retire early, before you can access your employer accounts, this could create an issue. A taxable brokerage account, which enters the picture at step 7, may be a useful tool for those that require early access to their retirement savings.

Can I contribute more than the max?

The annual 401(k) employee contribution limit is currently $23,000 for those under 50. This does not include employer contributions, and if your employer offers after-tax contributions and in-service distributions or conversions, you may be able to build even more tax-free retirement dollars with the mega backdoor Roth strategy.

What if my employer plan has bad investment options?

Due to the tax-advantaged nature of employer accounts, we think it’s still a good idea to contribute even if you don’t have the best investment options. Keep in mind that your money is not locked in the plan forever – if you leave your employer you may have the opportunity to roll funds into an IRA or Roth IRA or your new employer’s plan.

How do I know I’ve completed Step 6, Max Employer Accounts?

Obviously if you’ve maximized your employer accounts you can move on to the next step in the Financial Order of Operations, but you may be able to complete step 6 without maxing out your accounts. If you don’t have a high-income and can hit an investing rate of 25% before maxing out your employer accounts, move on to the next step of the FOO.

FOO Step 7 – Hyperaccumulation (Invest 25%+)

Copy link to this section: FOO Step 7 – Hyperaccumulation (Invest 25%+)

Copied the URL to your clipboard!

Hyperaccumulation occurs when you are investing 25% or more of your income for retirement. Depending on your income, hyperaccumulation may happen inside of your employer-sponsored accounts, using the mega backdoor Roth strategy, or in a taxable brokerage account.

Why should I invest so much for retirement before paying for my kids’ college education?

We love the analogy of putting your own oxygen mask on before helping your kids if there’s an emergency on an airplane. Saving is no different; you need to ensure your financial future is on solid ground before worrying about your children. Ultimately if you save too little for retirement, your children may bear the responsibility of caring for you. There are no retirement loans or scholarships, but there are many different ways to pay for college.

How much should I contribute to a taxable brokerage account?

Depending on when you plan to retire, it may be a good idea to have a significant amount saved in a taxable account, or nothing at all. Since there are no restrictions on withdrawing assets and no tax penalties for taking money out early, they make ideal vehicles for investing for an early retirement. If you plan for a more traditional retirement, you may not need much, if anything, in a taxable account.

How do I know I’ve completed Step 7, Hyperaccumulation?

Completing step seven means you are investing 25% or more of your income and you know you’re investing what you need to be for retirement. Why the caveat? If you started investing later or want to retire early, hyperaccumulation for you could mean investing more than 25% of your income for retirement.

Can I complete step 7 if I am still on step 6?

You can actually complete steps 6 and 7 of the Financial Order of Operations without maximizing your employer-sponsored accounts. It takes a high income to be able to max out your account and invest even more. As long as you are investing 25% or more and know you are saving what you should be saving, you can check the boxes on steps 6 and 7.

FOO Step 8 – Prepay Future Expenses

Copy link to this section: FOO Step 8 – Prepay Future Expenses

Copied the URL to your clipboard!

It’s finally time to save for your kids’ college education! Step 8 of the Financial Order of Operations is, among other things, where you start investing for your children. This could mean saving in a 529 plan, UGMA/UTMA, custodial account, or if they have earned income, custodial Roth IRA. Step 8 is also for any other long-term financial goal you have. Maybe you want a vacation home in Florida. Maybe you want to take a month-long trip of your dreams to Europe. Or maybe you want to start investing in real estate.

How should I save for my kids’ college?

We still think 529 plans are one of the best ways to save for your children’s college education. Many states offer tax deductions, and contributions grow tax-deferred, and are not taxed when used for qualified higher education expenses.

How do I know I’ve completed Step 8, Prepay Future Expenses?

Unlike other steps of the Financial Order of Operations, where your goals are clearly defined, completing step 8 will be different for everyone. You may not need to save anything on step 8, or you may need to save a lot, depending on your financial goals.

FOO Step 9 – Prepay Low-Interest Debt

Copy link to this section: FOO Step 9 – Prepay Low-Interest Debt

Copied the URL to your clipboard!

It’s difficult to say you are truly financially independent as long as you have debt, and step 9 of the Financial Order of Operations is where you finally get rid of those pesky low-interest debts. This typically includes mortgage debt, but may include student loan debt depending on your age (as it may be a priority at earlier steps if you are older).

How do I know I’ve completed Step 9, Prepay Low-Interest Debt?

It’s easy to know when you’ve completed step 9 of the FOO – you no longer have any debt! We want everyone to be debt-free by retirement, so aim to have all of your debts paid off, and step 9 completed, by the time you retire.

Frequently Asked Questions

Copy link to this section: Frequently Asked Questions

Copied the URL to your clipboard!

Does Money Guy’s Financial Order of Operations Work for Everybody?

The Financial Order of Operations is designed to work no matter what stage of life you are at or how much money you have in your bank account. It’s for those who are in debt and have a negative net worth, for those looking to optimize their retirement savings, and for millionaires who want to ensure they are checking all of the boxes on their financial journey.

Is FOO for students or those in their early career?

The Financial Order of Operations is perfect for those just starting out on their financial journey. It starts with the very basics, covering financial emergencies and paying off high-interest debt, and gradually moves to investing for retirement and bigger financial goals.

Is FOO good for families?

We get it: when you are a family with young children, prioritizing your finances and investing for retirement can be difficult. The Financial Order of Operations helps you prioritize everything pulling at your purse strings, including saving for the kids’ college, investing for retirement, and buying that new home.

Does FOO work for those in the middle of their career?

No matter how far along you are with your finances, the Financial Order of Operations works for everyone. Are you behind on saving for retirement and need to catch-up? The FOO is for you! Have you been investing for years and want to know what else you should prioritize? The FOO can help with that, too.

Will FOO work for me if I’m retired?

The Financial Order of Operations is designed to work no matter where you are on your financial journey. If you enter retirement with work to still do, such as debt or other financial goals, the FOO can help you prioritize. If you enter retirement debt-free and all of your financial goals met, you’ve graduated from the FOO!

Is FOO for kids or young savers?

Most of the steps in the Financial Order of Operations will not apply to kids until they are adults with their own financial obligations and responsibilities. One big step of the FOO can apply, though: investing for retirement in a Roth IRA, if they have earned income.

Does the FOO work for businesses and entrepreneurs?

The Financial Order of Operations will look a little different if you are an entrepreneur. You won’t have an employer match or traditional 401(k), but can still contribute to accounts like Roth IRAs, HSAs, and solo 401(k)s. If you are self-employed, covering your risks becomes even more important. Maintaining a large emergency fund and covering insurance deductibles is a very important step of the FOO.

Criticisms of Our 9 Steps of FOO – Our Response

Copy link to this section: Criticisms of Our 9 Steps of FOO – Our Response

Copied the URL to your clipboard!

A financial system as popular as our Financial Order of Operations doesn’t come without detractors. Here’s what we have to say about criticism of the FOO and why we still believe it can work for everyone.

The FOO is too complicated. Why are there so many steps?

We distilled our decades of experience helping people make smart financial decisions into nine simple and easy to understand steps. While we wish it were even simpler, all of the steps are necessary and apply to a wide portion of the population. You don’t need to worry about doing everything at once, either: focus on one step at a time.

Half of the steps don’t apply to me. Why all the unnecessary fluff?

While the steps in the Financial Order of Operations apply to a wide portion of the population, not everyone can do every step. If your employer does not offer a retirement account, for example, you will be unable to complete steps 2 or 6.

Interested in learning more about the Financial Order of Operations? Check out Brian’s recent book Millionaire Mission for an in-depth guide through the nine steps of the Financial Order of Operations.

Alternatives to FOO for Building Wealth and Personal Finance Planning

Copy link to this section: Alternatives to FOO for Building Wealth and Personal Finance Planning

Copied the URL to your clipboard!

If you feel like fighting the FOO, you may be considering alternatives to the Financial Order of Operations. Here’s how the most popular alternatives to the FOO stack up.

Financial Order of Operation vs. Dave Ramsey’s Baby Steps

Dave Ramsey’s 7 Baby Steps is an alternative plan for your personal finances, but has some major differences when compared to the Financial Order of Operations. One major difference is debt prioritization, which Dave Ramsey places after saving $1,000.

Paying off all debt except your house comes before saving anything for retirement, including getting your employer match. Dave Ramsey also suggests investing 15%, while the Financial Order of Operations investing rate is 25% or more.

We believe low-interest debt such as student loans shouldn’t be prioritized so early for younger investors. The amount you can earn investing in low-cost index funds and by getting your employer match can typically beat the interest rate on low-interest debt.

The retirement investing rate of 25% or greater in the Financial Order of Operations is designed to provide flexibility and make up for the decline of pensions and uncertainty of Social Security.

Check out our popular Dave Ramsey vs Money Guy Strategy Comparison episode.

Financial Order of Operations vs. Reddit’s Prime Directive

The Personal Finance Subreddit has its own 7-step plan for getting your finances in order known as the Prime Directive. This plan is more similar to the Financial Order of Operations than Dave Ramsey’s Baby Steps, however there are a few key differences.

The Prime Directive prioritizes building a full emergency fund before getting employer matching funds or paying off high-interest debt. The total savings rate suggested is also slightly lower at 15% to 20%, compared to 25% under the Financial Order of Operations.

Conclusion

Copy link to this section: Conclusion

Copied the URL to your clipboard!

The Financial Order of Operations is a simple system designed to help you make the most out of every single dollar. It works no matter what stage of life you are at or how much money is in your bank account. Following these nine simple steps can help you get back on-track financially and keep you from making costly financial mistakes.