The Nasdaq stock market index is in correction territory, down over 10% from recent highs. The other major US indexes, the S&P 500 and Dow, are down 8% and 7% over the last month, respectively. The recent stock market selloff has prompted fears of a bear market and recession in 2025. The CNN Fear and Greed Index, designed to show what emotions are currently driving the stock market, is currently in “extreme fear” territory.

It’s an uncertain time to be an investor. The S&P 500 Volatility Index, another measure of uncertainty in the market, has reached highs last seen amidst high inflation and concern about rising interest rates in 2022. Before that, the last time the volatility index was this high was during the pandemic and uncertainty around Covid outbreaks. I mention these events because they all have something in common, as with every market dip: this time feels different.

Is this time different?

I remember when the stock market was crashing during the pandemic. I don’t normally like to use the word “crash,” as it often feels like hyperbole, but the spring of 2020 absolutely was a crash. The stock market dropped so quickly that trading had to be halted multiple times. One of the lengthiest Wikipedia articles I’ve read, at nearly 10,000 words and over 500 sources, is simply titled “2020 stock market crash.” I remember feeling extreme uncertainty about the future of the stock market, and even though I knew the market had experienced similar declines before, some much worse, there’s always a nagging question in the back of your mind: is this time different?

It’s yet to be seen whether the bull market will change to bear market or whether we will experience a recession in 2025 – both of those could very well be avoided. This could be a small blip on the radar that we won’t even remember a year from now. Or it could be the beginning of a larger selloff; there’s simply no way to tell for certain. If history can predict one thing about the future, though, it’s that this time will not be different. It may feel and look different, like all corrections do, but the stock market always recovers, and usually very quickly.

How to prepare for a bear market

I don’t want to say that you should never make changes to your investment portfolio in reaction to market declines because that simply isn’t true. The recent market selloff might help you realize that you are further out on the risk spectrum than you should be, and you need to dial it back a bit. However, any changes to your portfolio should be made based on numbers and evidence rather than emotion. Sure the stock market might feel scary now, but will a bear market in 2025 significantly impact your retirement plan? If you are retired and invested 100% in the S&P 500, the answer to that question would be yes and you likely would need to make changes to your investments. But if you have a risk-appropriate mixture of stocks and bonds in your portfolio, the answer to that question is likely no.

Personally, I have never met anyone that wishes they would have sold all of their investments and gone to cash right before a steep market decline. “We wish we would’ve sold everything in 2008” or “I can’t believe we didn’t sell everything right before the pandemic” just aren’t sentiments you often hear. What I do hear are regrets about making portfolio changes. The fear and emotion of a market decline can cause a strong reaction, and sometimes that reaction is to make a large change to your portfolio that you will regret later down the road.

I don’t want you to take my word for it. Here’s what the data says about what happens after a bear market.

The evidence and numbers

When it feels like the worst time ever to be invested in the stock market, chances are it could be the best possible time to be an investor. I know that sounds like an oxymoron, but it’s true: the stock market often experiences some of its best returns when things feel hopeless. Is there anything more hopeless than hitting the absolute bottom of a bear market? To jog your memory, this feels like March of 2020 in the middle of the pandemic, or like March of 2009 in the middle of the housing crisis.

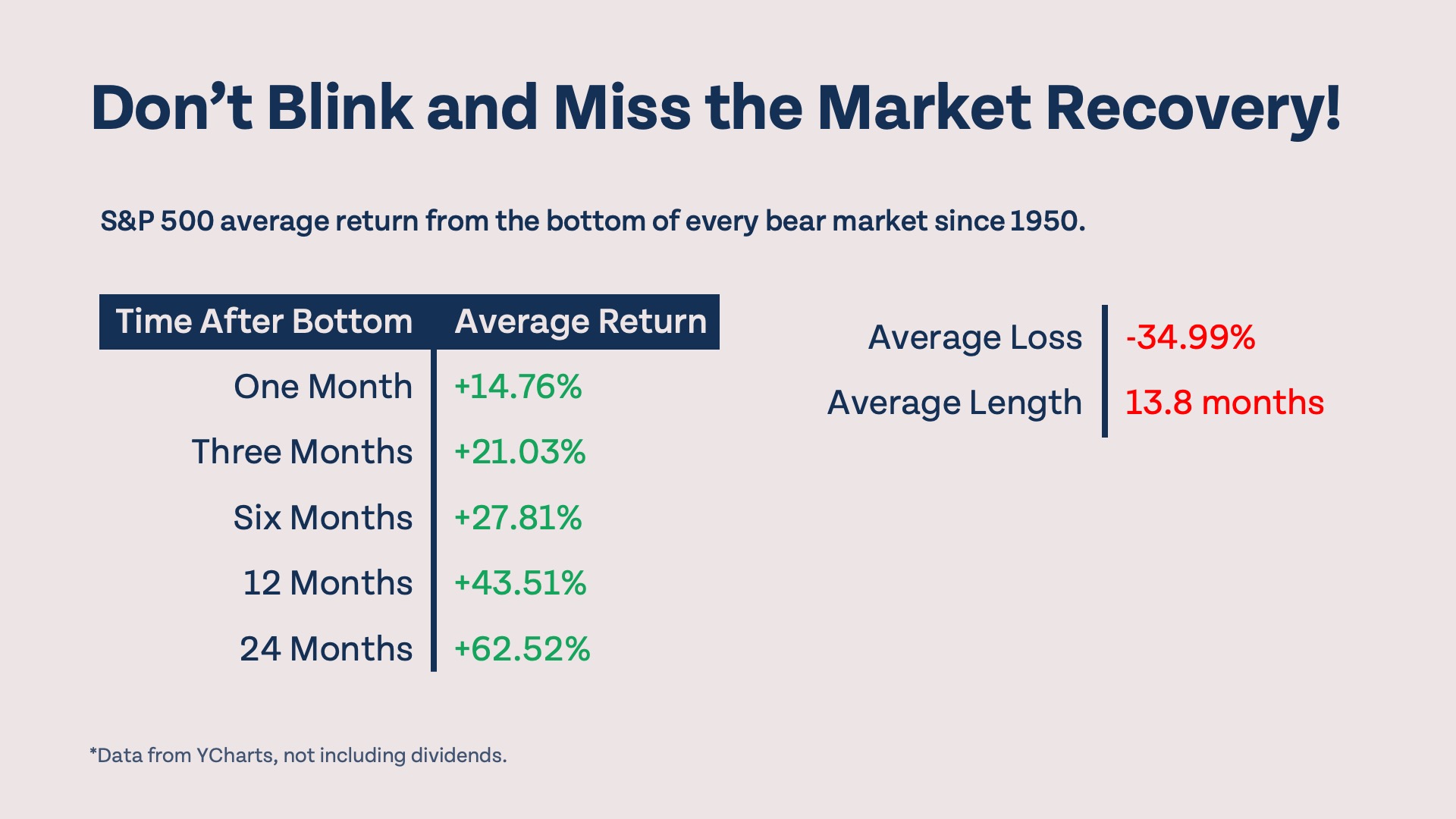

Here’s how the stock market performs once it hits that bottom. The average return in just one month is nearly 15%! One year after hitting the bottom of a bear market, the S&P 500 is up, on average, 43.51%. Stock market recoveries tend to happen very quickly once the market bottoms out, which is why any changes made to your investment strategy can potentially be harmful.

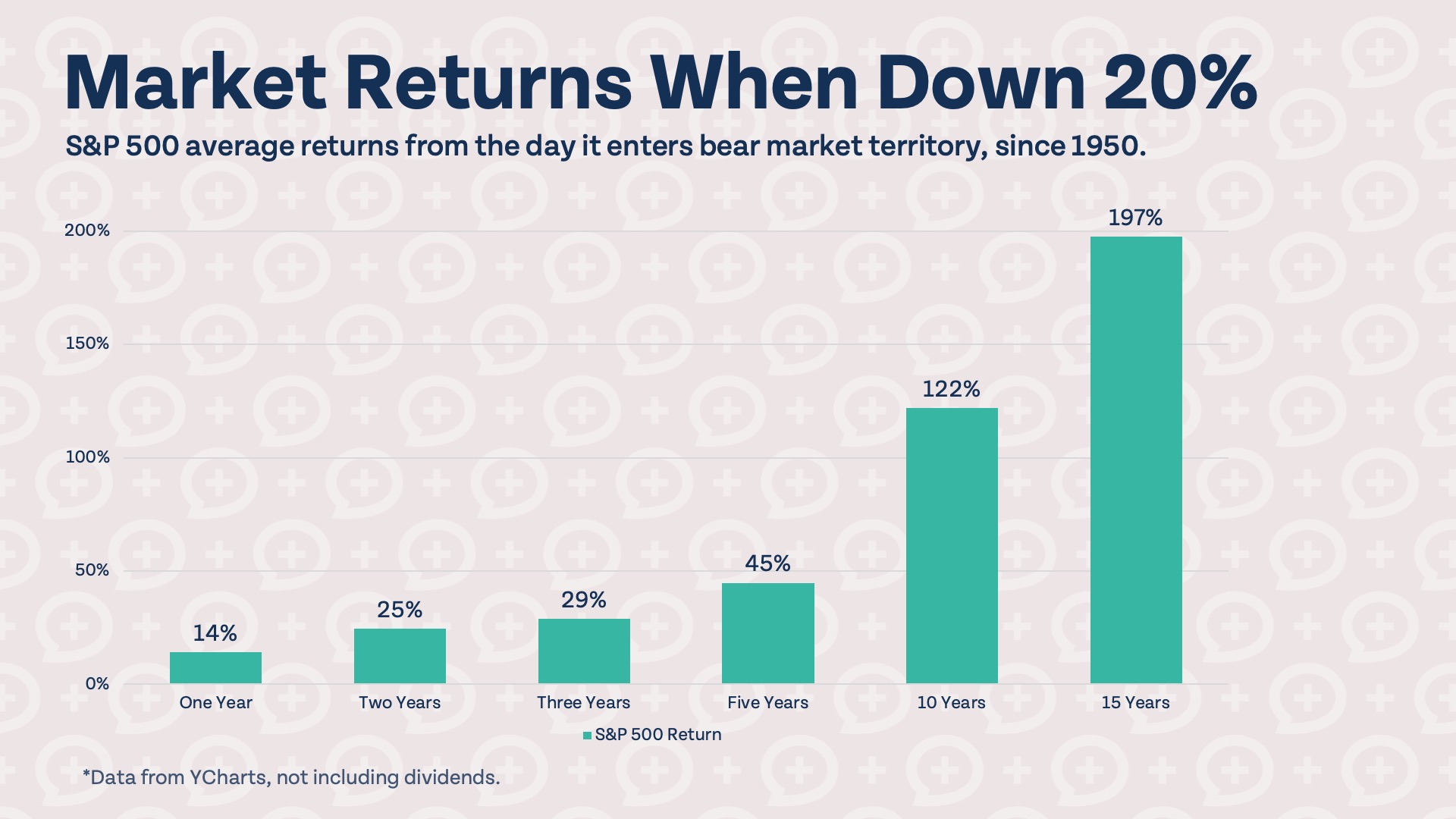

The S&P 500 experiences strong returns once hitting the bottom of a bear market, but the same is true of entering a bear market. The chart below shows S&P 500 average returns from the day it enters bear market territory. In many cases, the S&P 500 still has quite a ways to fall before rebounding. However, the average returns are still very strong. Whenever we enter a bear market, you can expect, on average, the S&P 500 to gain 14% over the next year. If you like to think longer-term, you can expect the S&P 500 to gain 122%, on average, over the next 10 years.

Experiencing stock market volatility isn’t fun. Usually your retirement depends on the performance of the stock market, to a certain degree, and the thought of your retirement being in jeopardy is very scary. While every event that causes a bear market looks really different, recoveries often look similar. They tend to happen quickly and stock market performance after hitting the bottom, and after entering bear market territory, is exceptional. It might not be wise to make big changes to your investment portfolio driven purely by emotion and fear, but it is always worth evaluating whether the level of risk in your portfolio accurately reflects your risk capacity and retirement goals. If you think it’s time to take the relationship to the next level and meet with a professional, visit our Work With Us page.