Inflation has been on everyone’s mind recently, whether you’re in the financial world or not. The consumer price index (CPI) is up 7.9% over the last year, the highest annual rate since July 1981. All major components of CPI have increased year-over-year; food at home (meaning groceries, not eating out) is up 8.6%, electricity is up 9.0%, gasoline is up 38.0% (as of February, even more recently), used vehicles are up 41.2%, and shelter is up 4.7%.

CPI data may even understate true inflation, as the index has been changed several times for political and economic gain (you can read more about those changes here: “Why CPI Is Not an Accurate Measure of Inflation.” One economist has gone to the trouble of reverse engineering the changes the government made to the way CPI is calculated – and determining what the “true” rate of inflation would be now if those changes had never been made. If CPI was calculated today how it was in 1980, it would be around 16%; if it was calculated how it was in 1990, it would be around 11%.

Widespread price increases are scary for everyone. Businesses are paying more for raw materials to make products, and must pass those costs along to the consumer or pay for it out of their own pocket. Consumers are worried about wage growth keeping up with inflation and the erosion of purchasing power. Is inflation going to become a problem over the coming months and years or is the increase we’re experiencing only temporary?

What’s causing inflation?

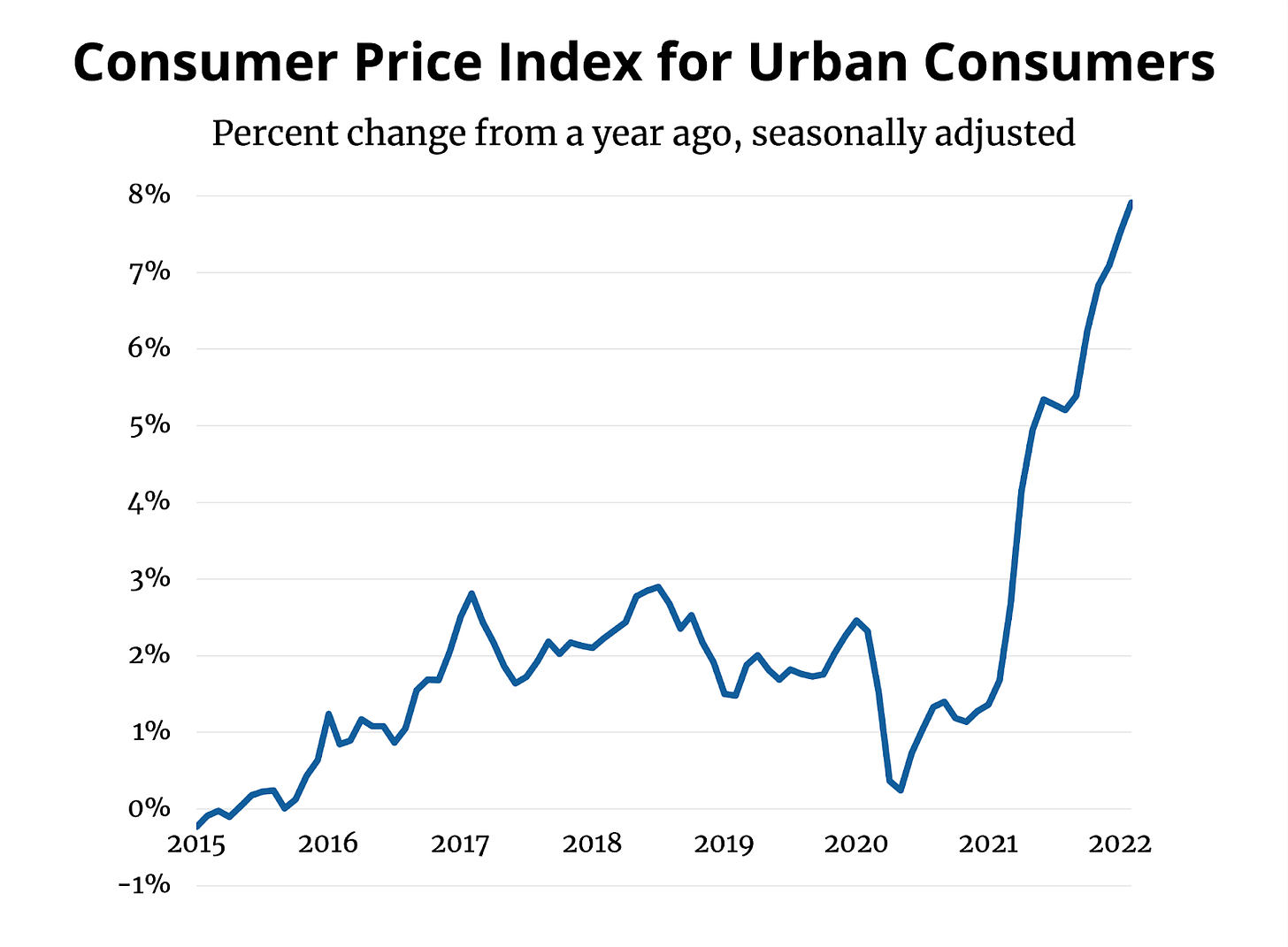

The decrease in activity we saw in the spring of 2020 was logically accompanied by a drop in demand for many goods and a sharp drop in inflation. The chart below shows the percent change in the consumer price index from one year ago, seasonally adjusted. Note the decrease in April and May of 2020, and the sharp increase that started at the beginning of 2021.

Some increase in inflation from 2020, when almost everyone was staying at home and not spending money, was inevitable. The increase we’ve seen over the last year, though, is above and beyond what many expected. Consumer spending is very strong, and many manufacturers of goods like cars, homes, electronics, furniture, and more, are still unable to obtain the materials and labor required to meet demand. The recent Russian invasion of Ukraine and lockdown of Shenzhen, a major tech hub in China, may only exacerbate inflation that has proven very sticky.

Is inflation here to stay?

The big question, and really the only question that matters right now when it comes to inflation, is how long inflation will hang around. After nearly two years of companies struggling to keep up with demand for almost every type of good out there, it’s difficult to imagine supply catching up with demand and inflation worries subsiding overnight.

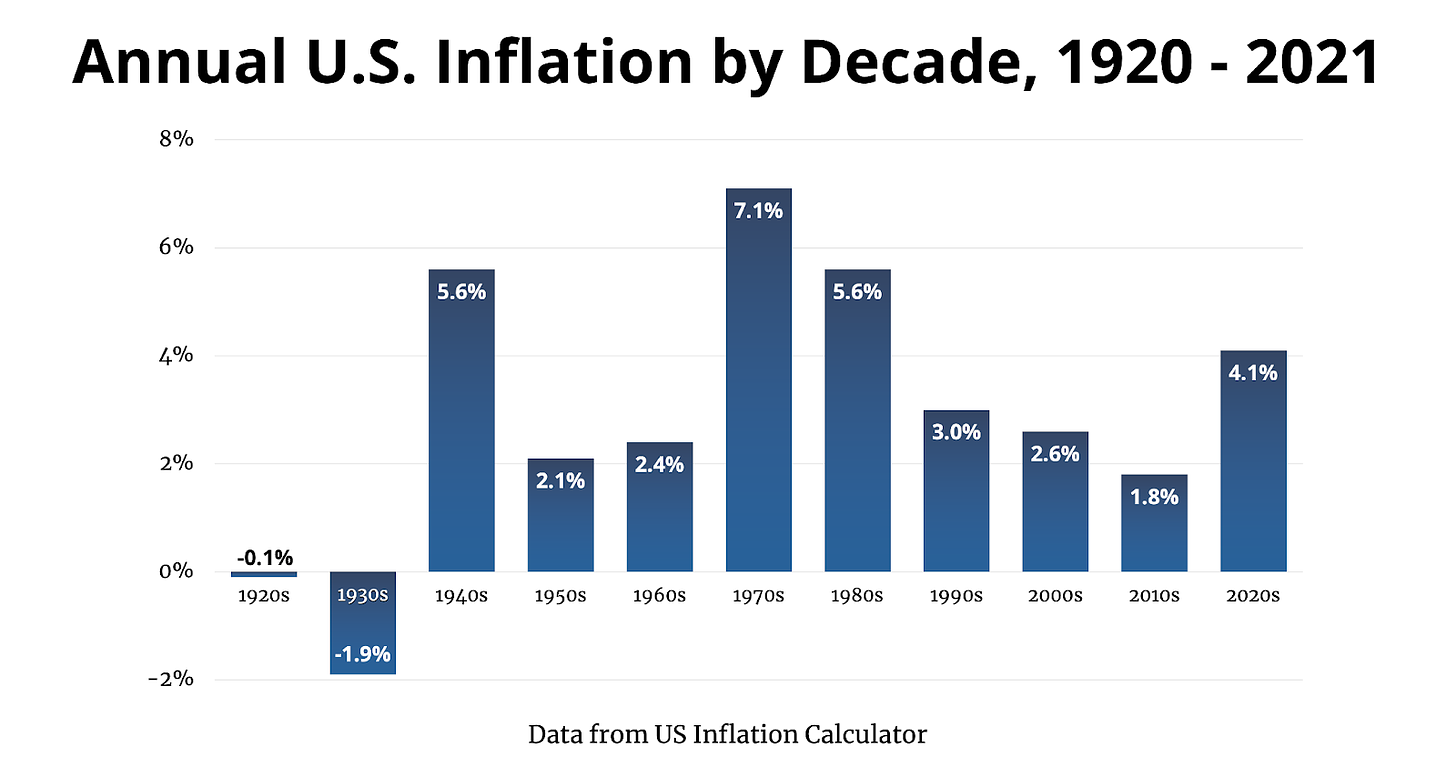

Inflation has been at historically low levels for the last several decades, as you can see below. Since 1914 inflation has averaged 3.2% per year, and before last year, we hadn’t had a single year over 3.2% since 2008 (and only three years since 1991 have been above 3.2%). Younger generations, like mine, have never experienced higher inflation (until now), and may have a difficult time imagining an extended period of elevated inflation. Older generations that lived through the 1970s and 1980s probably think we’ve been overdue for higher inflation.

You may have noticed in the chart above a spike in inflation during the 1940s. During and after World War II, when the government spent twice as much as it had ever spent throughout the entire history of the U.S. up until that point, inflation was unsurprisingly elevated. Coincidentally, the two stimulus packages passed in 2020 are roughly equal to the amount spent during World War II (and that doesn’t even include the $1.9 trillion package passed last spring).

One of the biggest dangers now is that the Federal Reserve doesn’t act quickly or strongly enough to rein in inflation. They raised interest rates by 0.25% last week, which is technically something, but is certainly not aggressive action against inflation. The Federal Reserve is expected to raise interest rates six more times this year. It remains to be seen if they will be more aggressive and if their actions will help rein in inflation. If we do experience higher inflation for several more years, how can you protect your money?

How to protect yourself from inflation

Owning things is one of the best ways to protect yourself from the impacts of inflation, and in many cases actually benefit. Traditionally gold is seen as a hedge against inflation, fear, and uncertainty, and now cryptocurrency is becoming like a digital gold in the sense that some are turning to it as an alternative store of value and to protect from inflation and uncertainty. Gold has historically performed much worse than the stock market; cryptocurrencies have fared better, but extreme volatility and a brief history has kept the asset class out of many portfolios. If you had invested in bitcoin one year ago in an attempt to beat inflation, you would be very disappointed today. Bitcoin is down 31% over the last year. There are other asset classes worth considering that have a long history of beating inflation.

1. Real estate

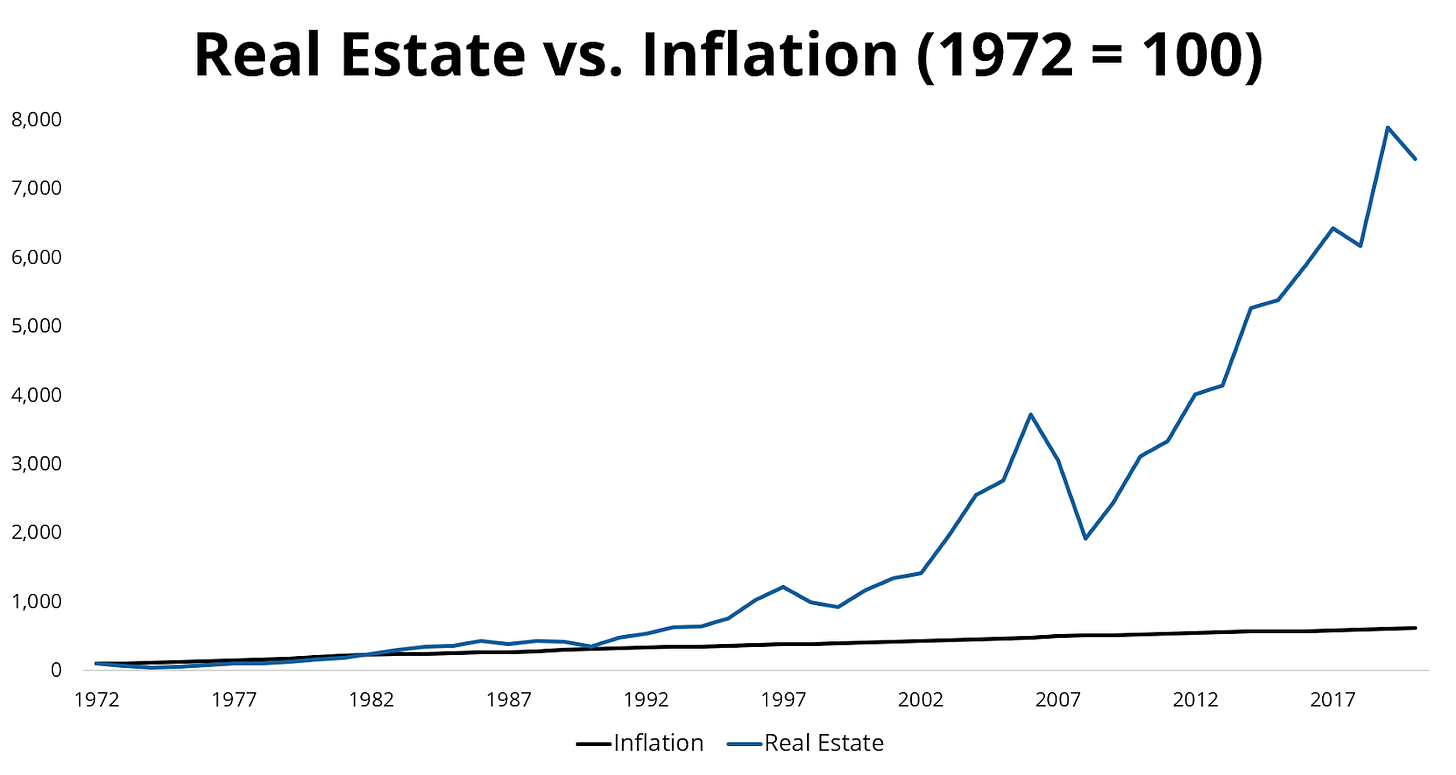

Owning property has historically been a great way to protect against inflation. Home values and rents typically increase during times of inflation, but you can own real estate even if you don’t own your primary residence; one way to do so is by investing in a REIT (real estate investment trust). The chart below shows how the all REITs index has performed against inflation since 1972 (the earliest data was available).

Since 1972, inflation has averaged 3.9% per year and real estate has returned 9.2% annually.

2. TIPS

Treasury inflation-protected securities were created to, well, protect against inflation. The principal value of the bonds increase when interest rates go up. This chart from Morningstar shows the performance of TIPS since their creation in 1997 against inflation, and they certainly have protected against inflation. However, TIPS have performed similarly to other fixed-income assets over this timeframe. TIPS have shown they can beat inflation and be part of a well-diversified portfolio.

3. Stocks

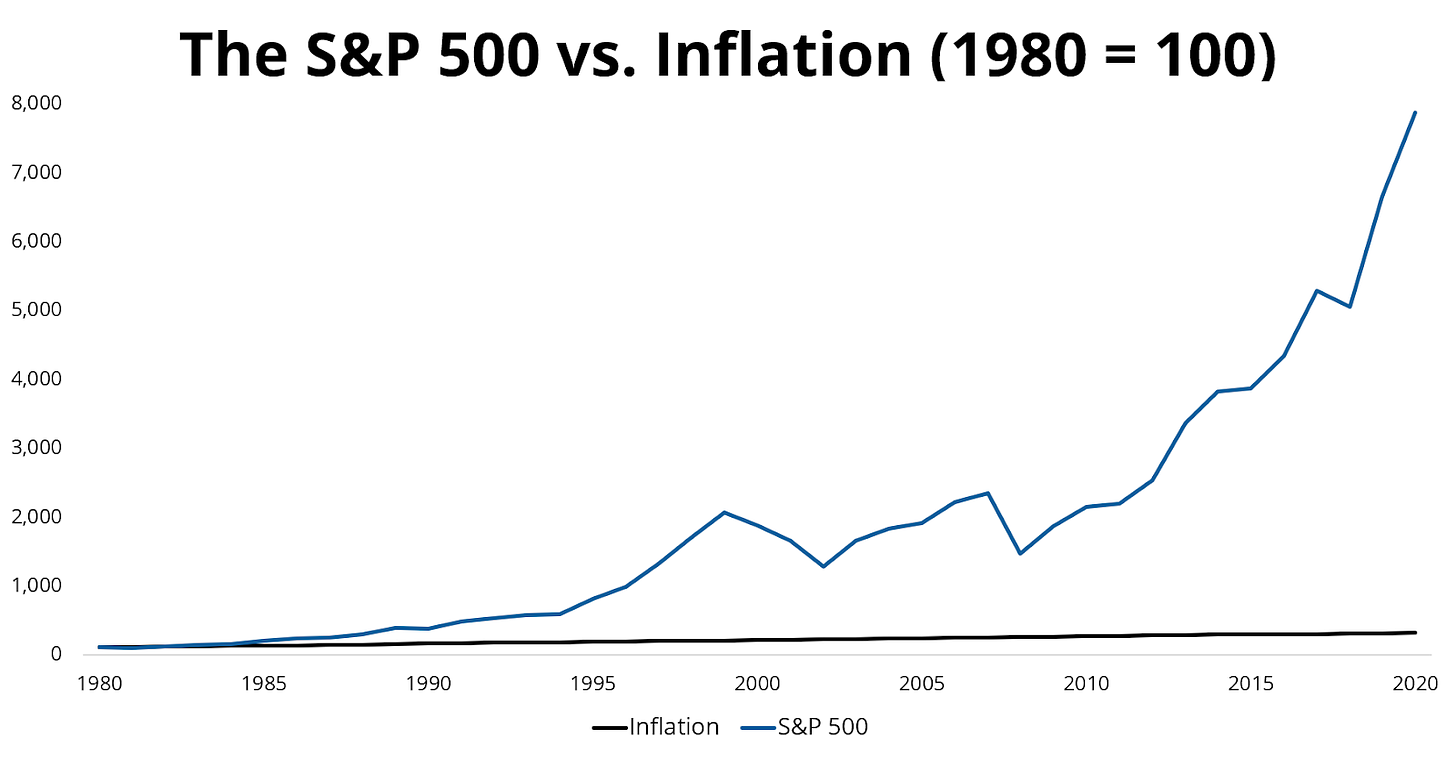

Investing in the stock market is one of the best ways to protect your assets from inflation. The growth rate of stocks has exceeded inflation, even during some periods of very high inflation. From 1979 to 1982, the most recent period of double digit inflation in the U.S., annualized inflation was 9.93%. During the same period the S&P 500 annualized nearly 16%, though, for a real rate of return of nearly 6%. Earning a 6% real rate of return when inflation is 10% isn’t bad at all. Since 1980, the S&P 500 has handily beaten inflation and then some.

The annualized return of the S&P 500 is 12.0% since 1980, and inflation over the same period is 3.2%.

Unfortunately nobody has a crystal ball to look into to see the future of inflation, and even the experts have a history of getting it wrong. Whether or not the increase in inflation over the last several months proves temporary, until supply catches up with demand, or more persistent and lasting, owning property and a well-diversified portfolio of stocks and bonds has historically been a great way to protect your assets from inflation.