Each year we conduct an annual survey of our millionaire clients. Some of the data is not too surprising. Yes, they have much higher than average household incomes ($330,132 this year). Their average home value is just over a million dollars. But other habits of millionaires are surprising and aren’t usually thought of as millionaire habits. In this article, I want to cover some millionaire habits and traits that you can implement in your own life without an extremely high income or net worth.

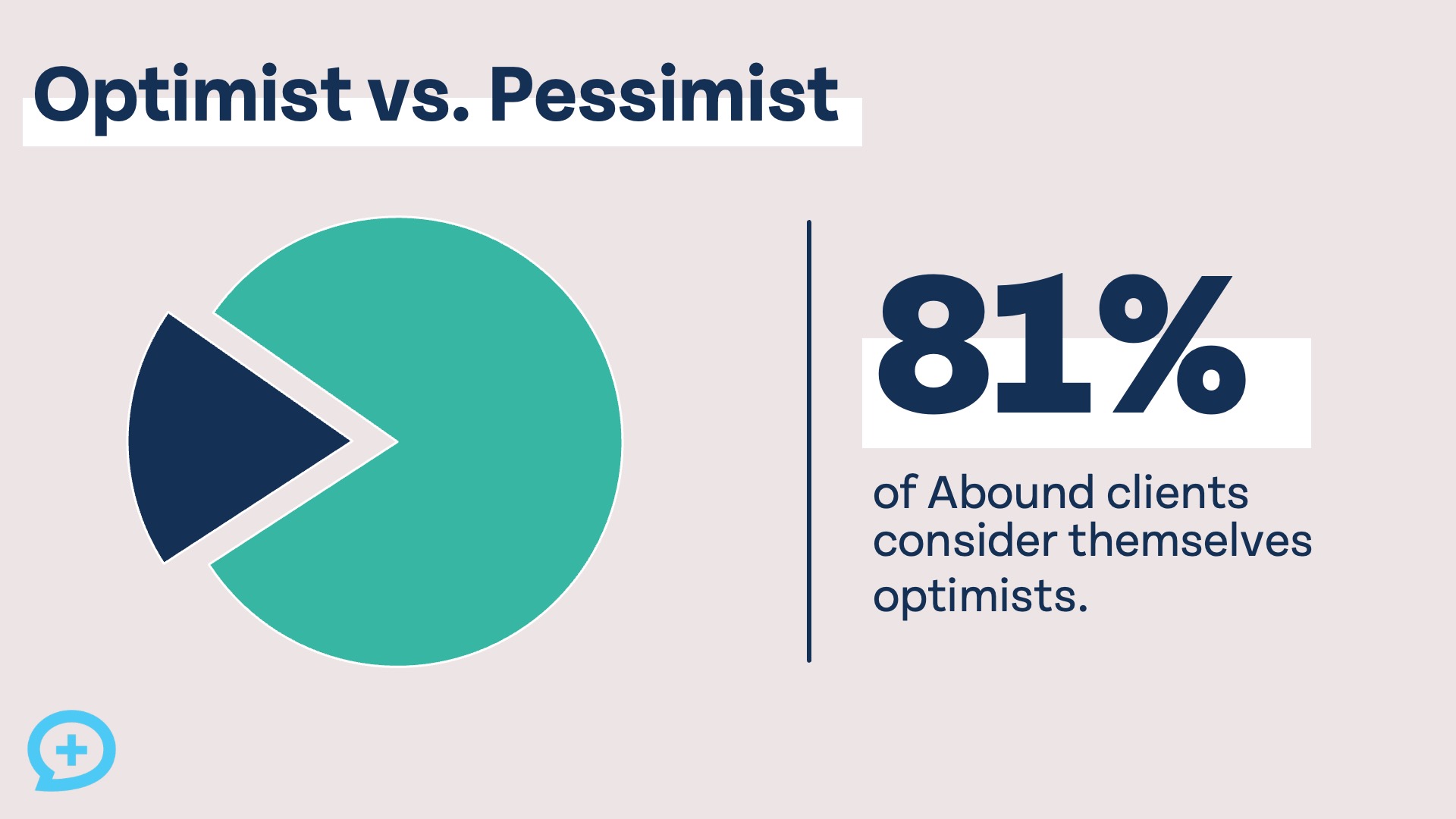

Millionaires are optimists

Year after year, we’ve found that our clients overwhelmingly consider themselves to be optimists. That shouldn’t come as a huge surprise since studies have found that optimists tend to experience more financial success. So what should you do if you are more of a pessimist? You can’t change your personality overnight to become an optimist, but you can become more optimistic over time through habits like practicing gratitude.

Being an optimist doesn’t mean seeing everything with rose-tinted glasses, either. You can recognize problems in your life (or the world) while working towards change. An optimistic outlook means believing you can change your life (and finances) for the better. The biggest problem with pessimists isn’t that they see themselves and the world for how it truly is, but that they often have a fatalistic outlook and don’t believe their actions matter.

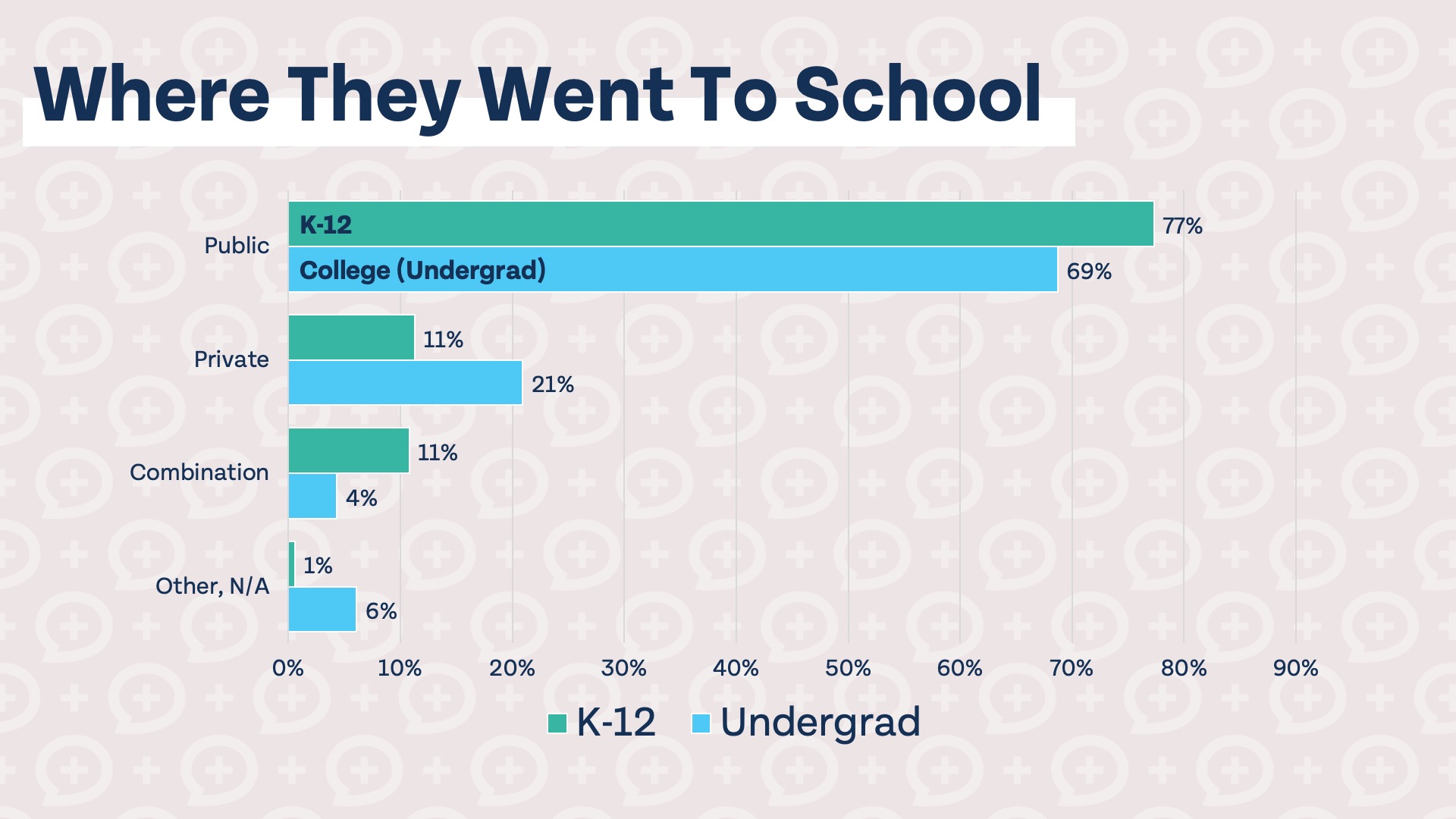

Private schools are optional

Only 9% of children in the US attend a private school, but Americans largely agree that private schools do a better job educating children than public schools. In fact, studies have found that private school students score higher on the SAT than public school students. Another study compared academic performance for private school and public school students and actually found no statistically significant correlation after adjusting for one key variable: family income.

Private school students tend to perform better than public school students, but there is a glaring selection bias. Private school is generally very expensive, so if you can afford to send your children to private school, chances are they are already ahead of the curve. Indeed, the study referenced earlier found that once you adjust for income, there is no statistically significant difference in academic performance.

Our millionaire survey further reinforces the idea that private school is not a prerequisite for success. 77% of clients surveyed attended public school from K-12 and 69% attended public universities.

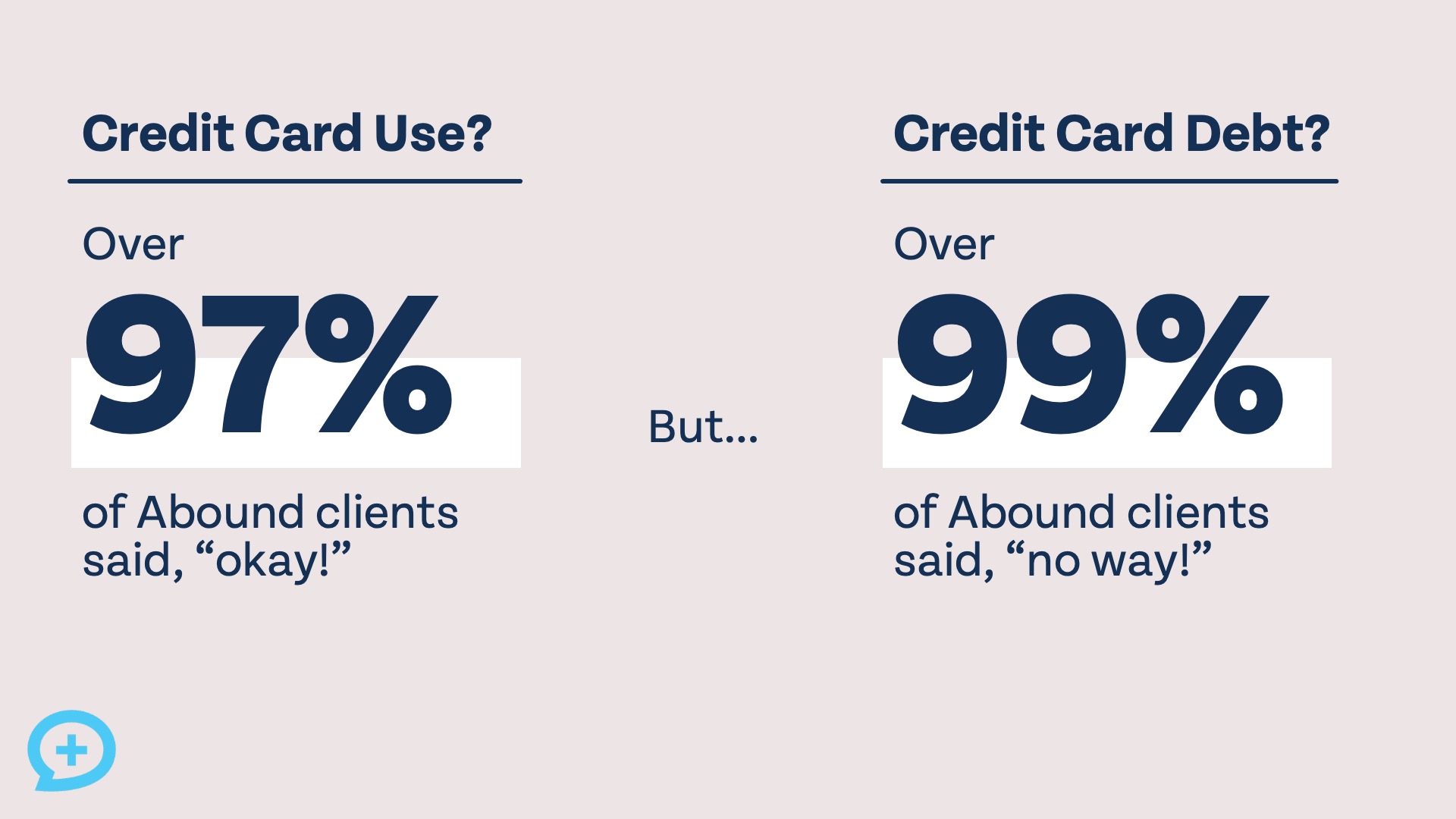

Credit card use okay, credit card debt no way

Why do millionaires use credit cards? Credit cards can be a powerful tool, as I wrote recently, and millionaires know how to use them effectively. It’s really simple, actually – just don’t use them to live above your means! Credit cards are superior to cash or debit cards in almost every way. They often offer enhanced fraud protection, points or rewards, and some offer extended warranties, price matching, and insurance. But all of these benefits are only worth it if you have the discipline to use it like cash or a debit card and not go into credit card debt.

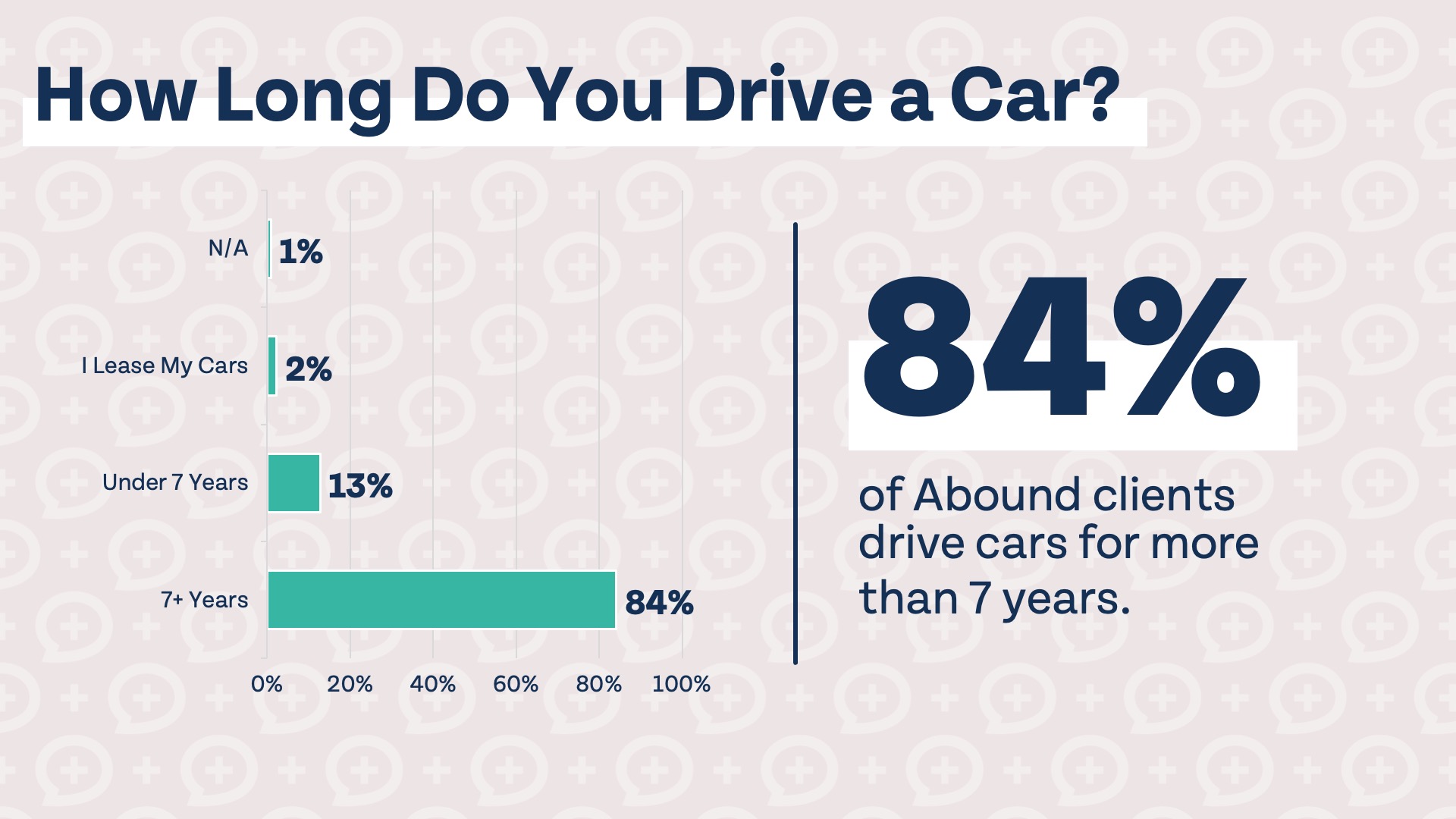

Drive it until the wheels fall off

When you think “millionaire,” you probably don’t imagine someone driving an older, high-mileage car. But our millionaire survey found that most clients tend to drive cars for over seven years! Driving vehicles for as long as reasonably possible makes a great deal of sense. Cars are depreciating assets, but depreciate the most in the first 3-5 years. The longer you keep a car, the greater the “value” you are getting out of driving it.

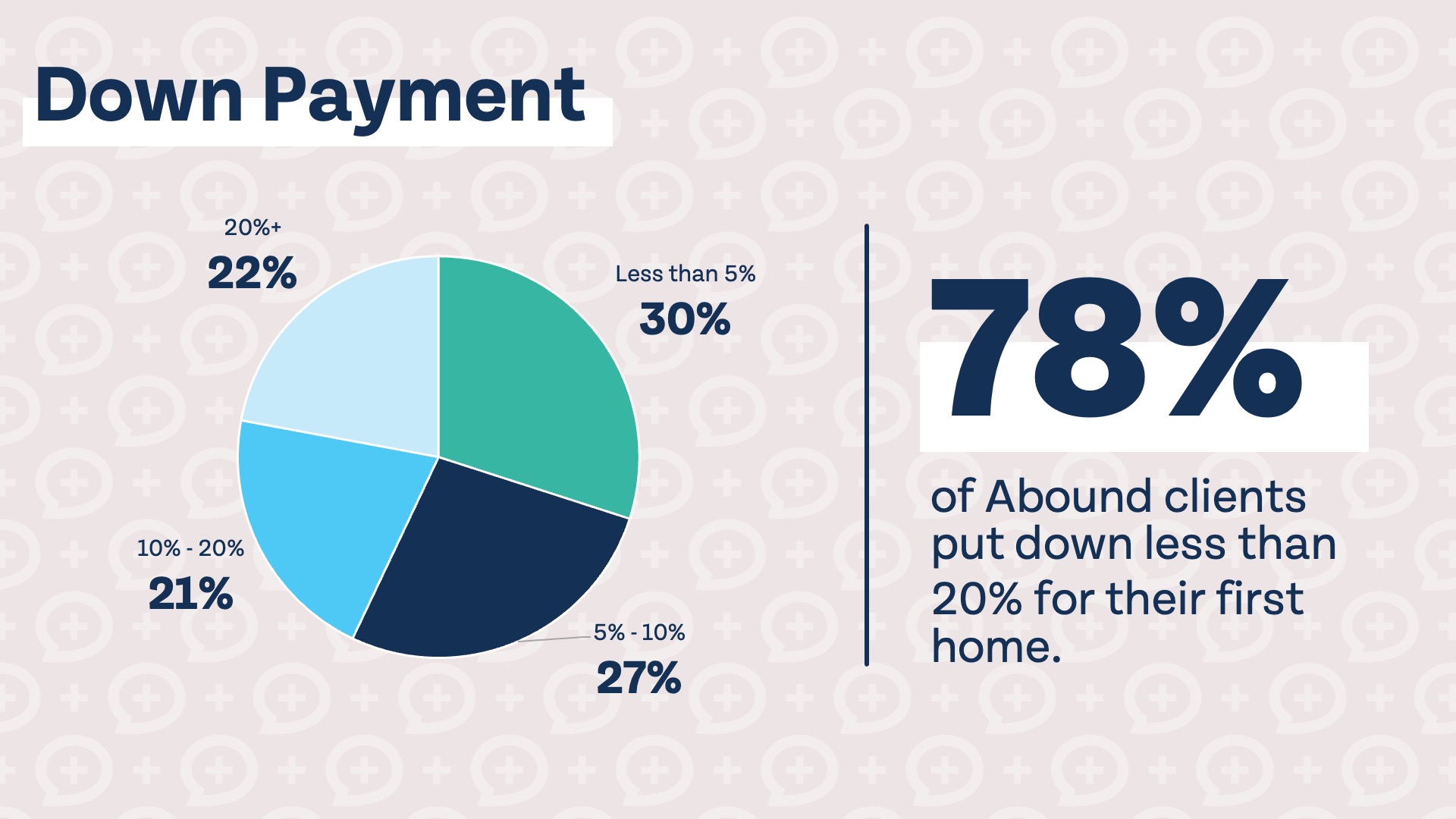

20% down isn’t a must on your first home

Putting 20% down on your first home is a good idea. It gives you a buffer against price depreciation and will make your monthly mortgage payment a bit lower than putting down less. With median home prices over $400,000, though, putting 20% down on a first home can be really difficult. Our millionaire survey found that 78% of our clients did not put down 20% on their first home, and you don’t need to either, but you still need to follow some ground rules to make sure you aren’t buying more home than you can afford.

Follow our 3/5/25 rule (aim to put down at least 3% to 5% on your first home, and make sure your monthly mortgage payment does not exceed 25% of your gross income). You need to plan to live in the home for at least 5 to 7 years, especially if you are putting down less than 20%. And on subsequent houses, you should aim to put down at least 20%.

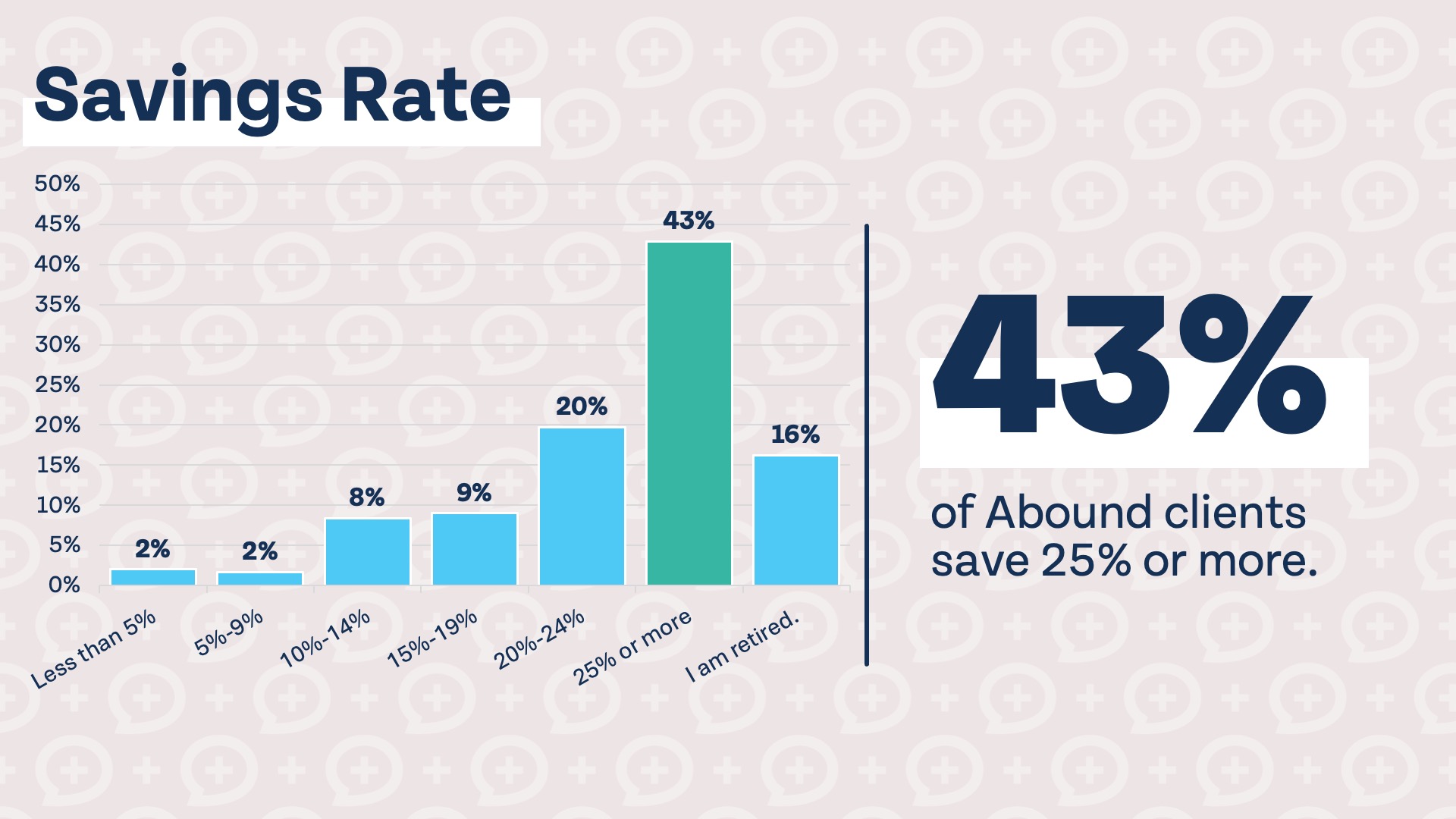

Invest 25% or more for retirement

It should come as no surprise that our millionaire clients are good at saving money. The majority of Abound Wealth clients either invest 25% or more for retirement or are already retired.

Investing a healthy amount for retirement is a no-brainer if you want to achieve financial success. It’s like brushing your teeth to avoid cavities or eating healthy and exercising to keep in good shape. We recently launched a compound interest calculator if you are curious to see how much your savings can grow.

We’ve found that the public perception of millionaires is often quite different from the reality. Millionaires are optimists, usually go to public schools, use credit cards (responsibly), drive cars for a long time, don’t put 20% down on their first home, and most importantly, invest a large percentage of their income for retirement. None of these habits and traits require an extremely high income to achieve. No matter whether you are already a millionaire or currently have a negative net worth, implementing these habits and traits in your own life can help jumpstart your financial success.