After a brief reprieve from 7% mortgage rates in August and September, 30-year fixed rates have surged back above 7%. We first hit 7% rates over two years ago, in the fall of 2022, and rates have bounced between 6% and 8% since.

Average 30-Year Fixed Mortgage Rates

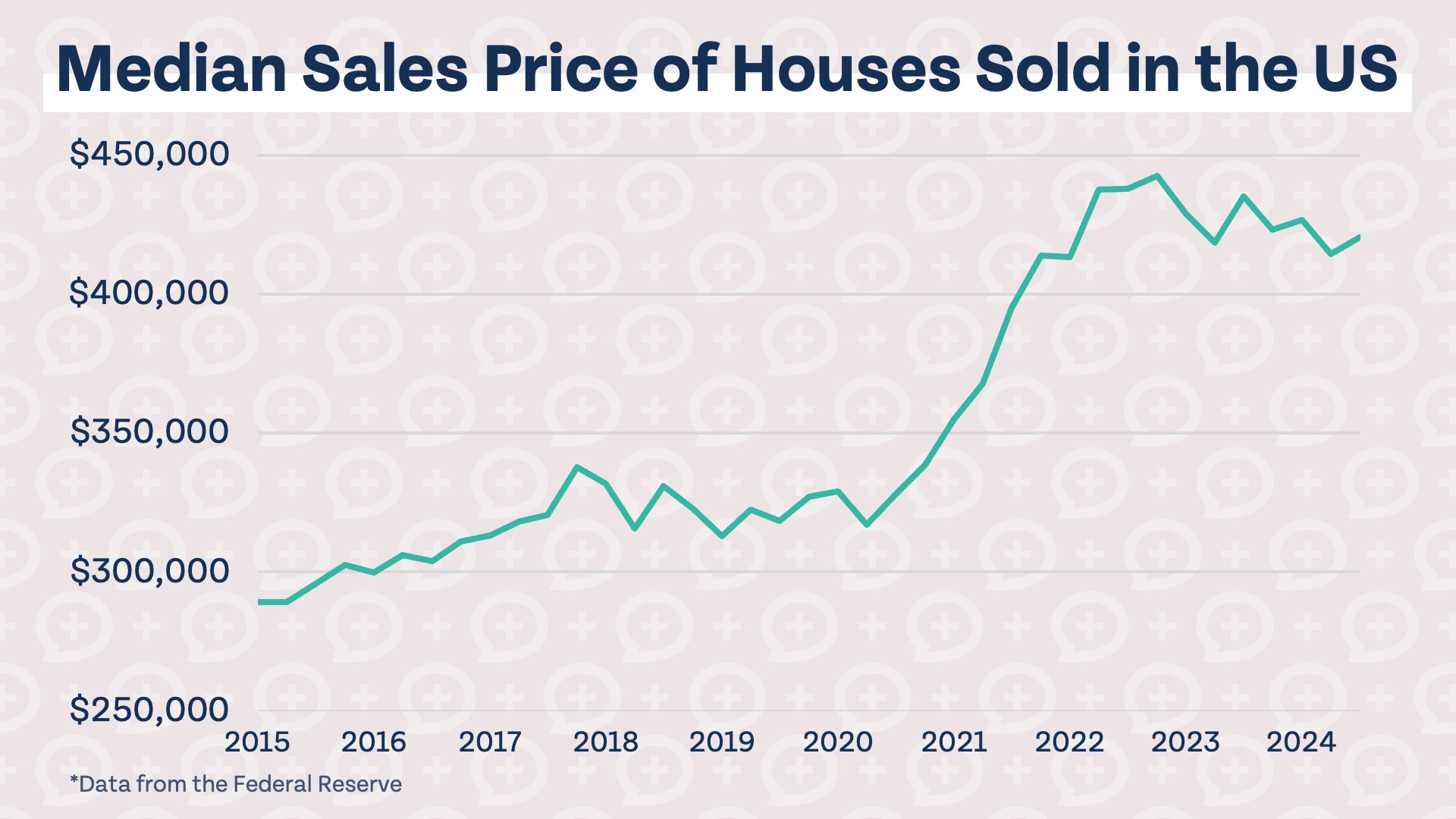

These higher interest rates were, as Brian would say, a bucket of cold water for the housing market. Residential real estate caught fire in 2020, as you can see from the chart below, and home prices didn’t really start coming down until interest rates started rising (which began in early 2022).

Home prices haven’t crashed, as some were predicting, but prices have remained stagnant and dropped slightly over the last 2+ years. Higher interest rates have kept many buyers on the sideline, and those who have bought are anxiously waiting for rates to drop so they can refinance their home at a more affordable rate. Potential homeowners want to know if now is the right time, or a good time, to buy, and those that bought homes since rates have increased want to know when they can refinance and get a break on their monthly mortgage payment.

Is it a good time to buy a home?

It is difficult to answer a question that is so personal. If you are someone that doesn’t have anything saved for a down payment and can’t afford a reasonable mortgage payment, it is probably a really bad time for you to buy. If you are on the opposite end of the spectrum and have a large down payment saved and can comfortably afford a mortgage payment at today’s interest rates, it might be a great time to buy. Instead of trying to time the market and buy at the “right time,” buy a home when it makes sense for you. Check out our ultimate guide to buying a home if you are thinking about buying a home or may be purchasing a home in the near future.

To ensure you can comfortably afford a home, ask yourself what would happen if everything went wrong for you. If you can feel good about your answers to the questions below, there’s a good chance you can successfully buy a home.

- Will I be okay if my home is worth less in 5 years?

Home prices don’t drop often, but they typically take longer to recover than the stock market. If you are purchasing a home, you need to be prepared for the worst case scenario of your home dropping in value. This usually means planning to stay in the home at least 5-7 years, or longer if you put down less than 20%, to ensure you are never in a situation where you are forced to sell when you are “underwater” on your home (owing more than the home is worth).

- What if mortgage rates don’t drop anytime soon?

It is very difficult to predict the future of mortgage rates, and if you are purchasing a home, it should be a financially smart decision regardless of whether interest rates drop, go up, or stay steady. Would it be great if rates dropped significantly over the next few years and you could suddenly cut your mortgage payment by 50%? Absolutely. While that is a possibility, you should not count on being able to refinance anytime soon when buying a home. You should be able to afford your monthly mortgage payment on the day you buy (which means it should be no more than 25% of your gross income).

- What if the home requires more repairs than I thought?

Certain major home expenses can be planned for, but many are unexpected and can be devastating if you aren’t prepared. What happens if you need to replace your HVAC unit in the first few months of buying a home? That happened to me. How soon will you need to replace your roof? What is your plan if major appliances fail? Make sure you are financially prepared for the unexpected before buying a home.

- How stable is your household income?

Preparing for the unexpected means thinking about the possibility of uncomfortable events; what would happen if you or your spouse lost your job after buying a home? Do you have multiple sources of income in your household? How easy would it be for you or your spouse to find a new job with a comparable income?

Thinking about how everything could go wrong when you buy a home isn’t fun, but it is a necessary evil to make sure you can truly afford your home and avoid potential financial disaster. It may be unlikely that home prices drop, it may be unlikely that mortgage rates stay high for a long period of time, you may not experience major issues with your home after purchasing it, and you might not experience a negative change in income. However, all of these events are very possible and should be seriously prepared for before purchasing a home.

When can I refinance my mortgage?

I can’t wait until the day I get a call from our mortgage broker, telling me how much he can save us if we refinance our home. Considering we have almost 30 years left on our mortgage, this call will probably come before we pay off our home – but when will it? In 2022 when mortgage rates first hit 7%, I did not think rates would still be around 7% over two years later. Rates could very well be lower in two years, they could very well be higher, and they could very well be about the same.

I made peace with the fact that we locked in a good rate for the time we bought and we will refinance our mortgage when it makes financial sense to do so. It would be incredible to suddenly save a pretty significant amount of money every month on our mortgage, but we made sure we bought a home we could afford at current interest rates. When you are evaluating the affordability of different homes, it is best to assume you won’t have the ability to refinance your home anytime soon.

Mortgage rates could be higher for longer than most people thought. That might affect your ability to buy a home or make your current home more affordable. It would be great if we had a crystal ball and could tell you, “Yes, buy a home that’s a bit out of your budget because you can refinance in May of 2026 at 2.75%. Also my crystal ball tells me you will never lose your job, your home won’t need any major repairs, and housing prices will keep going up.” It would be such an easy decision if that was the case! Until we are able to predict the future with 100% certainty, it is best to err on the side of caution and anticipate what could go wrong when buying a home. It is much better to be wrong about everything going wrong than to be wrong about everything going right.