Last Updated

October 15, 2025

Read Time

Share

Retirement planning simply means developing a plan to pay for your expenses in retirement when you no longer have a job. Many Americans do very little retirement planning, as 40% of older Americans only receive income from Social Security in retirement. Those that do plan for retirement may not know if they are saving the right amount, and worry about saving too much or too little for retirement.

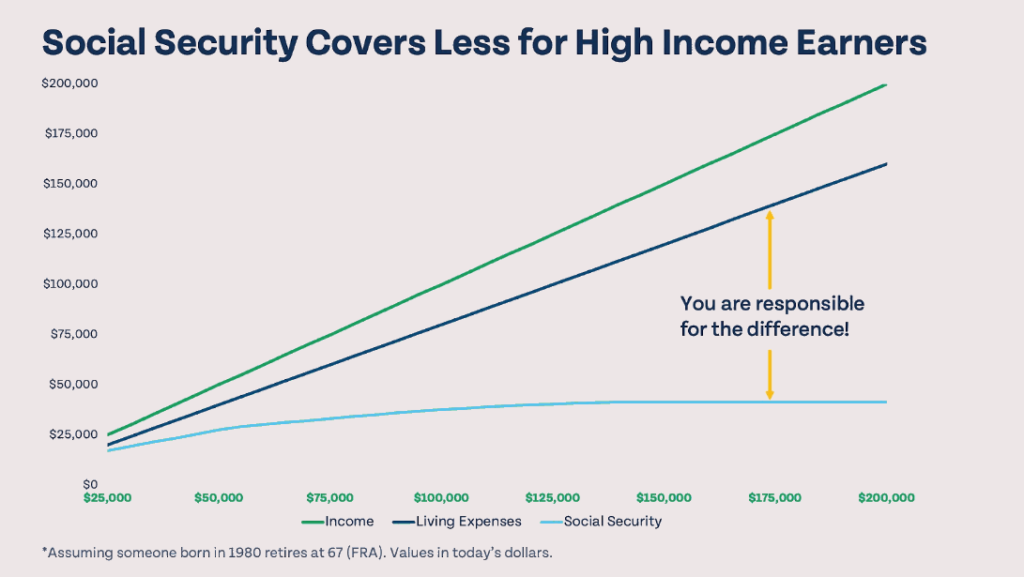

While Social Security may be enough to cover the retirement income needs of some Americans, you will likely need to save on your own to comfortably retire (unless you plan on working until you die, which not many people strive for). The higher your income, the more you need to invest outside of Social Security. Remember, Social Security was created as a safety net, not a primary source of income in retirement.

With proper planning and consistent saving, reaching millionaire status by retirement is an achievable goal for many Americans. Understanding how much you should be saving for retirement is a crucial first step in this journey.

There are so many questions that you probably have about your own retirement. Are you saving enough? Where should you save? What do I need to do to ensure a successful retirement? This article will aim to answer all of those questions and more, and provide you with the tools you need to successfully retire.

Money Guy’s Nine Insights for Retirement Planning

Copy link to this section: Money Guy’s Nine Insights for Retirement Planning

Copied the URL to your clipboard!

We created our Money Guy Guide to Retirement to give you a clear view of the most important factors and decisions leading up to retirement. If you aren’t sure exactly where to start when planning for your own retirement, download this free guide to see what you need to be thinking about and working towards for your retirement.

Many successful retirees use the 3 buckets strategy to manage their retirement investments and ensure their money lasts throughout retirement.

The insights include:

What’s Your Vision for Retirement?

So many Americans view retirement as an escape from their job and don’t stop to consider exactly what they’ll do in retirement. It is vital that you take time to plan through your retirement before retiring. Do you have any bucket list items you want to check off? Financial goals you’d like to achieve? What will your day-to-day life look like?

How Much will You Need? Doing the Math

In the next section, we will discuss “doing the math” more in-depth. For now, just know that running the numbers and calculating your retirement number and knowing how much money you need to retire is essential.

Your Golden Years Are Supposed to Be Fun!

They’re called the “golden years” for a reason. Retirement should be fun and shouldn’t feel like a full-time job. Plan activities that you (and your spouse, if you have one) will enjoy and have always wanted to do. This is your time to focus on doing what you want, when you want, where you want.

Download our Money Guy Guide to Retirement to check out all nine retirement insights.

How Much Do You Need To Retire?

Copy link to this section: How Much Do You Need To Retire?

Copied the URL to your clipboard!

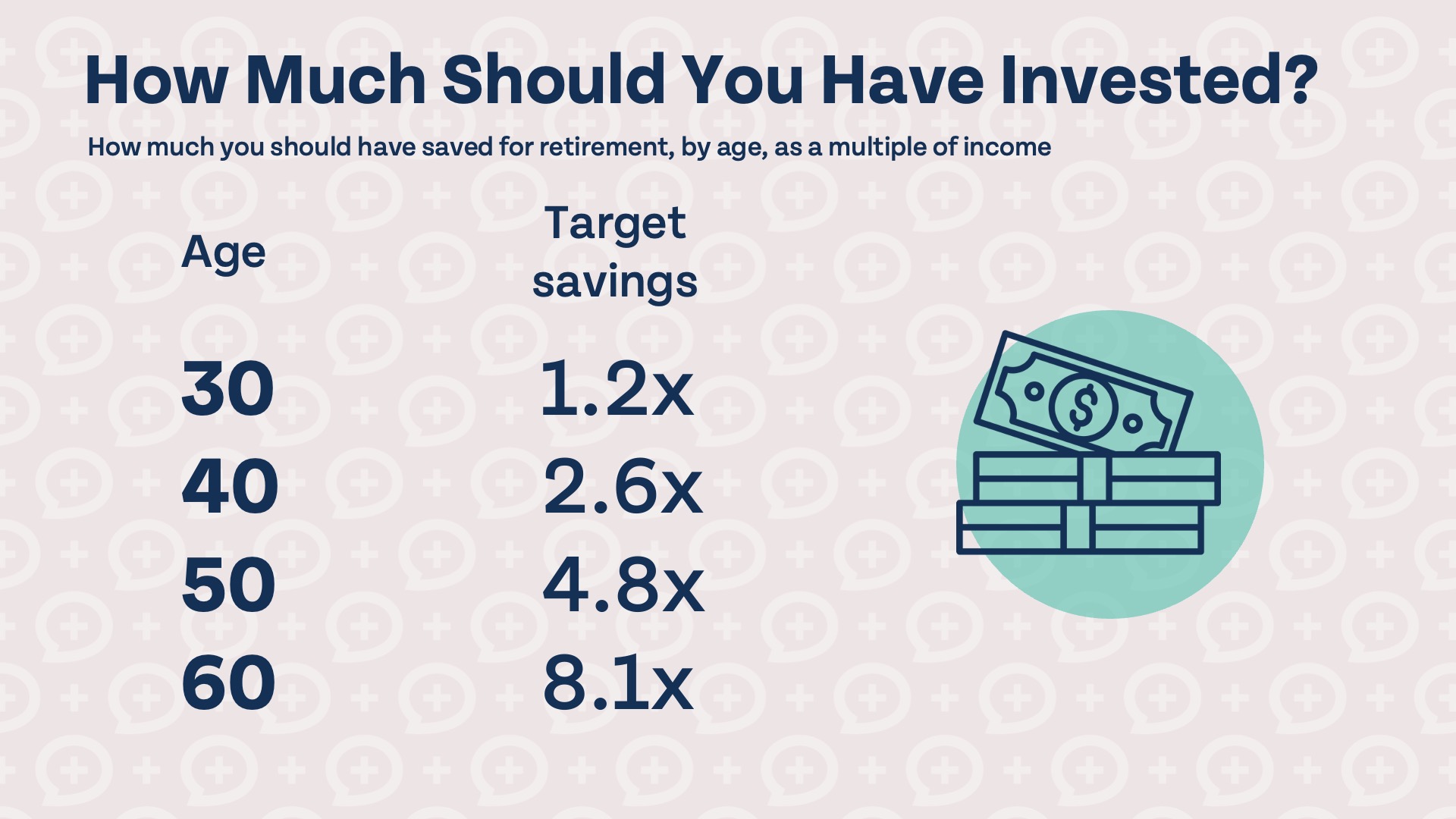

Retirement needs are different for everyone, but we have created general guidelines to give you an idea of how much money you should have invested for retirement, by age, as a multiple of your income. Assuming you will receive income from Social Security and you will be spending about 60% of your pre-retirement income in retirement, you should aim to retire with around 10x your income saved in retirement accounts.

To be on-track to reach that amount by age 65, here’s how much you should have invested by age.

Share image

Know Your Number – Calculating Retirement Needs

Copy link to this section: Know Your Number – Calculating Retirement Needs

Copied the URL to your clipboard!

Knowing if you are on-track for retirement based on the chart above gives you an idea where you’re at for retirement, but everyone should calculate their own retirement number based on their individual needs, goals, and income to get a clearer view of what you should be saving for retirement.

If you could know with certainty every factor affecting your retirement, such as how long you will live, the rate of inflation before and during retirement, your investment rate of return before and during retirement, every single expense you will incur during retirement, and exactly how much you will invest for retirement, it would be possible to determine your exact retirement “number,” or the amount you need to have invested to ensure a successful retirement.

Understanding your net worth statement is crucial for tracking your progress toward retirement goals.

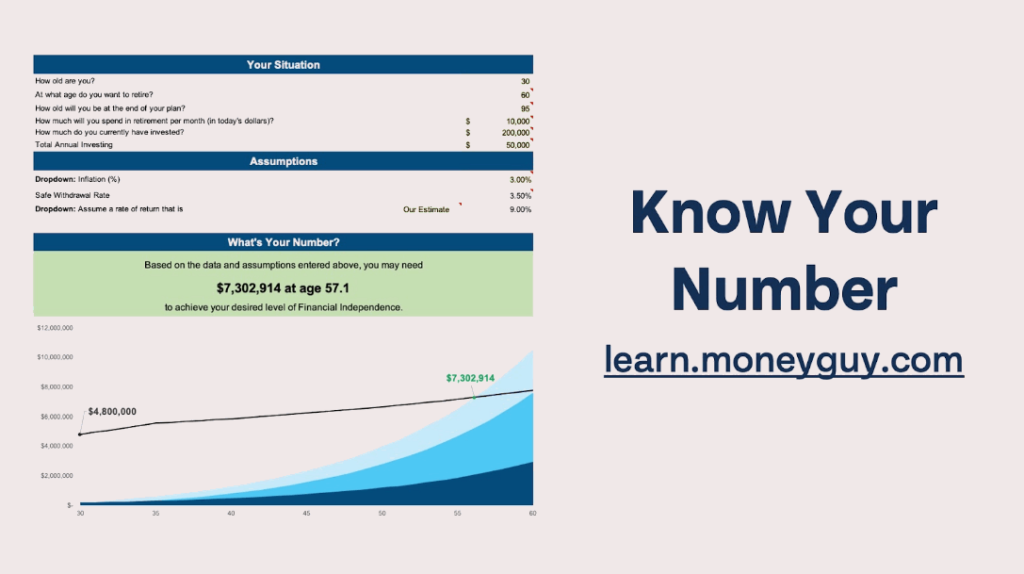

Of course it is impossible to know all of the factors listed above, but it is possible to make as educated of a guess as possible and use those estimates to calculate your own retirement number. We created a course called “Know Your Number” that helps you do exactly that. The course includes video lessons and homework to help you determine how much you’ll spend in retirement, your goals for a successful retirement, and, most importantly, a tool to calculate your own number. This tool, pictured below, allows you to choose your own retirement date, adjust variables like inflation, how much you plan to save and spend, and more to calculate your retirement number.

Get Money Guy’s Know Your Number Online Course at learn.moneyguy.com/know-your-number-course

It’s important to note that the Know Your Number estimate is only as good as the inputs it receives. To help counteract the danger of inaccurate estimates, the tool errs on the side of caution and uses reasonable estimates for life expectancy, rate of return, and inflation. This helps ensure your number is accurate while not underestimating your retirement need.

Investing For Retirement

Copy link to this section: Investing For Retirement

Copied the URL to your clipboard!

There are SO MANY different ways to invest for retirement. This is a double-edged sword; the sheer number of options available can be overwhelming and confusing, but having so many options is great for those that want to optimize where they invest for retirement.

For many investors, target retirement index funds provide an excellent balance of growth potential and automatic rebalancing.

The first place many Americans start investing for retirement, outside of Social Security, is through a workplace retirement plan such as a 401(k). Not only are there many retirement accounts, after you select where to invest you then have to choose what to invest in. Here’s a quick rundown of some of the most common types of retirement accounts and investment options you will see.

Types of Retirement accounts

Copy link to this section: Types of Retirement accounts

Copied the URL to your clipboard!

401(k)

As noted earlier, many Americans only ever invest in their 401(k) and it’s easy to see why. If your employer offers a 401(k) or similar retirement plan, you may become automatically enrolled upon eligibility and even start automatically contributing. 401(k)s are a powerful tax-advantaged retirement account, and getting the “free money” employer match is Step 2 of the Financial Order of Operations.

Roth IRA

We’ve called the Roth IRA the apex predator of retirement accounts, and for good reason. Every dollar you contribute to your Roth IRA will grow tax-free and all money in your account can be withdrawn tax-free in retirement as long as it’s in the form of a qualified distribution. Contributing to a Roth IRA is Step 5 of the Financial Order of Operations. If you want to learn more about Roth IRAs, check out our Roth IRA Guide, Everything You Need to Know About Roth IRAs.

HSA

We’ll forgive you for not thinking the HSA, or health savings account, is a great retirement account – but it is! Contributing to an HSA falls into the same step of the FOO as contributing to a Roth IRA, and HSAs could even be considered a little more powerful. Contributions to an HSA are tax-deductible, accounts grow tax-free, and qualified withdrawals are entirely tax-free. The only catch is withdrawals are only tax-free when used for eligible medical expenses, but after you turn 65 you can use an HSA like a regular retirement account (which means pay tax on distributions, but no penalty if not used for medical expenses).

Taxable account

Just like the rapper Eminem sometimes goes by Slim Shady, Marshall Mathers, Slim, or Em, you may have heard a taxable brokerage account being referred to as a brokerage account, taxable brokerage account, taxable investment account, or even just an investment account. No matter what you’ve heard it called, at the end of the day the account works the same. Contributions to the account are taxed and the account receives no special tax treatment, but long-term capital gains are subject to more favorable long term gains tax rates. Contributing to this account is at Step 7 of the FOO, Hyperaccumulation.

Pensions

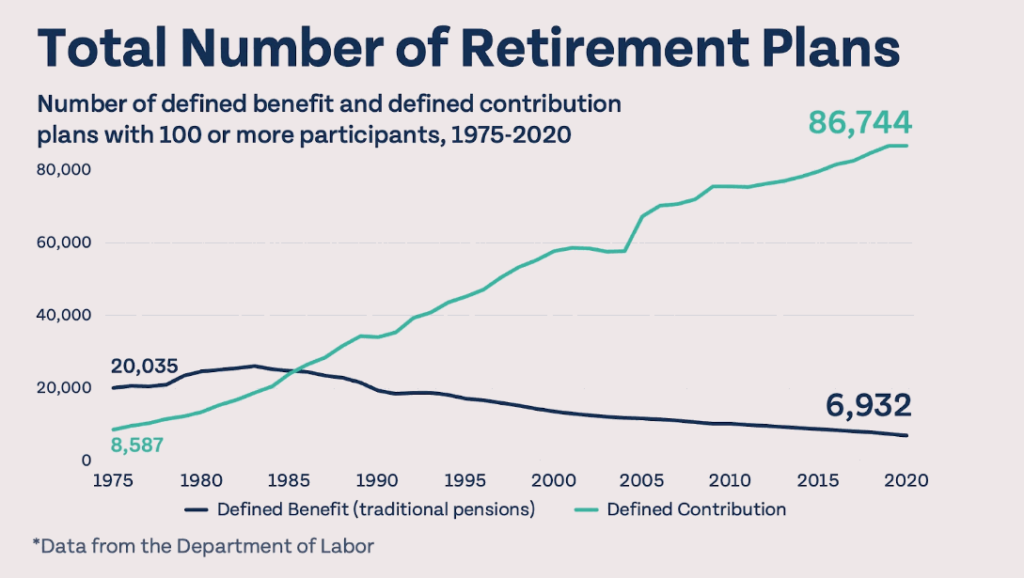

Not many privately employed Americans have traditional pensions anymore, but they are still prevalent among government employees. The number of traditional pensions, also known as defined benefit plans, have been on a steady decline since the 1970s. If you are one of the fortunate Americans with a defined benefit plan, this means if you meet the eligibility requirements, such as years of service, to receive benefits, you’ll receive a fixed monthly pension in retirement. To learn more about pension plans, check out this Beyond Basics article, How To Save for Retirement When You Have a Pension.

Your Retirement Account Investment Options

Copy link to this section: Your Retirement Account Investment Options

Copied the URL to your clipboard!

It’s not easy to determine what investments you should hold in your retirement accounts. In some accounts, you may have thousands of investments to choose from. Where do you start? For younger investors, consider looking at a target date index fund. The date of the fund will be the year you’d like to retire. The allocation of the fund will gradually shift over time to become more conservative as you get older. Target date index funds can be great “set it and forget it” investment options, but if your financial situation is more complex it may make sense to reach out to a fee-only financial advisor for a more personalized investment strategy.

Retirement & Tax Strategies

Copy link to this section: Retirement & Tax Strategies

Copied the URL to your clipboard!

If you follow the Financial Order of Operations, before retirement you would first maximize your Roth IRA and HSA, then maximize your 401(k), and later contribute to a taxable account. Your withdrawal strategy in retirement may involve drawing from the accounts in reverse order, which means using your taxable assets first, then pre-tax accounts, and saving tax-free accounts like your Roth IRA and HSA for last. This allows those assets that won’t be subject to taxation anyways to grow even longer, and using your taxable assets earlier means you will theoretically owe less taxes on your distributions since the amounts are less.

Contributing to tax-advantaged retirement accounts is a retirement tax strategy in and of itself, but there are more advanced strategies for high income earners that could allow you to invest even more in these tax-advantaged retirement accounts. The backdoor Roth strategy may allow you to build Roth IRA dollars even if your income exceeds the maximum allowed to contribute directly, and the mega backdoor Roth strategy could allow you to invest even more dollars in a Roth account using your 401(k) plan.

Retirement Hacks – Thinking outside the box

Copy link to this section: Retirement Hacks – Thinking outside the box

Copied the URL to your clipboard!

There are so many different paths to a successful retirement and many retirement “hacks” for those that may not take a traditional path. For those considering leaving the workforce early, understanding how to structure a bridge account for early retirement can be crucial.

Retirement is very rarely investing the same amount each year, working a steady job until retirement, and retiring at exactly age 65. You may unexpectedly lose your job and have to adjust retirement expectations. You might want to retire at 45. Maybe you plan to spend significantly less in retirement and won’t need to invest as much while you are working. Or maybe you want to spend much more in retirement and will save even more while you are working.

Everyone’s retirement will look different and so will the path you take to get there. There is no straight line to retirement. Your path will have many twists and turns, zig zags, and starts and stops. The important thing is to know what your retirement goals are, know what it will take to achieve those goals, and if anything knocks you off-track, getting back on-track as quickly as possible.

Tools & Resources

Copy link to this section: Tools & Resources

Copied the URL to your clipboard!

We have prepared a host of resources to help you reach your retirement goals, from free PDF guides to in-depth retirement calculators. Check out a rundown of our most popular retirement tools and resources below.

The Money Guy Guide to Retirement

The Money Guy Guide to Retirement breaks down the most important factors of a successful retirement into 9 easy-to-understand insights. No matter whether you are decades away from retirement or plan to retire next year, review this guide to make sure you are checking all of the boxes before you retire.

- Get the Money Guy Retirement Guide

https://moneyguy.com/resource/the-money-guy-guide-to-retirement/

How Much Should You Save?

This handy download shows exactly how much you should invest to replace a certain percentage of your income at different ages. Are you 30 and investing 25% of your income for retirement? You’ll be able to replace 119% of your income in retirement, assuming you retire at 65 and earn a real rate of return of 6%. The chart includes ages 20 to 60 and savings rates from 10% to 40%, so make sure to check it out to see what you should be saving for retirement.

- Money Guy Resource: How Much Should You Save?

https://moneyguy.com/resource/how-much-to-save/

Got An Old 401(k)?

Deciding what to do with an old 401(k) plan isn’t always straightforward. Depending on your old plan and new plan, it could be better to leave your old 401(k) where it is, transfer it to your new plan, or even transfer it to an IRA. Download this handy guide to help determine what to do with your old 401(k).

- Money Guy Resource: What To Do with Your Old 401k

https://moneyguy.com/resource/got-an-old-401k/

Are You a Prodigious Accumulator of Wealth?

How good of a job have you done saving and investing for the future? This interactive calculator can give you a Prodigious Accumulator of Wealth score, which gives you an idea of how much you’ve done with the resources you’ve earned over the years.

- Money Guy Tool: Wealth Accumulator Calculator

https://moneyguy.com/tool/are-you-a-prodigious-accumulator-of-wealth/

Know Your Number Course

Our Know Your Number course is your ultimate retirement toolkit. The course includes video lessons, homework, and a sophisticated spreadsheet to help you determine what your retirement “number” is. Your retirement number depends on when you’d like to retire, how old you are, how long you expect to live, how much you want to spend in return, how much your investments will increase over time, and much more. This course puts all of those factors together and helps you determine your personal retirement number.

- Money Guy Online Course: Know Your Number

https://moneyguy.com/products/know-your-number/