My first experience with investing was not opening a Roth IRA when I got my first job. Like so many other young adults, my foray into investing began with downloading the Robinhood app. The median age of users on the app is 31 (if anything, that might sound a little high) and half of all Robinhood users are first-time investors. Robinhood, and other similar platforms that have followed in their footsteps, built businesses by targeting young Americans with no investing experience. It is probably not ideal for millions of young people to learn about investing on Robinhood, but there are some things they do right, and these platforms are here to stay for the foreseeable future. Is their presence a net positive or net negative to the world of smart investing?

What Robinhood is doing right

Robinhood was one of the first, if not the first, investing platforms designed for younger investors. Traditional brokerages like Charles Schwab, Fidelity, and Vanguard are slowly but surely moving into the digital age, but none have a platform as slick and easy-to-use as Robinhood. Primarily because they don’t need to; brokerages typically target higher net worth individuals, who are normally in their 40s or older and don’t demand the same level of digital integration.

Robinhood’s crowning achievement is introducing investing to the next generation. What young person gets excited about opening a Roth IRA or HSA with Fidelity, or increasing their 401(k) contribution? Hardly anyone, except for the true financial mutants out there. Robinhood excels at making investing, specifically trading individual stocks, exciting and addictive. They’ve also helped make commission-free trading the new industry standard. The ability to get young people excited about buying stocks and offering commission-free trading has been a great business model, and has likely done a lot of good, but can be a dangerous combination for some users.

Issues with Robinhood and similar platforms

Vlad Tenev, CEO of Robinhood, claims that most users “buy and hold;” while it may be technically true that the majority of Robinhood users “buy and hold,” that isn’t how Robinhood makes money. The majority of Robinhood’s revenue, more than 75%, comes from payment for order flow (PFOF). When a customer opens Robinhood and buys a stock, Robinhood isn’t the one filling the order; they essentially sell the order to the highest bidder. Wholesale brokers pay for the privilege to fill customer orders.

Why do they pay to do this? Wholesale brokers connect buyers and sellers, but they don’t give both the best price possible. Let’s say Joe Schmoe wants to sell a share of stock for $50. A wholesale broker might connect Joe to a buyer who wants to buy at $50. The broker then takes $50.01 from the buyer, gives $49.99 to Joe Schmoe, gives $0.01 to Robinhood for the privilege to fill the order, and keeps $0.01 for their trouble (it’s a little more complex than this, but you get the gist of it). Over time, these pennies add up. Robinhood isn’t the only brokerage that accepts PFOF, but there are those that don’t, and the practice is controversial (the SEC may even step in to ban PFOF). Customers may not get their orders filled at the best price if Robinhood is incentivized to route orders to wholesale brokers that pay more to fill orders.

Even more troubling than customers potentially paying a few cents more for a security is the incentive Robinhood has to encourage trading. Traditionally brokerages discouraged trading, in a way; buying and selling securities was not exciting or thrilling, and there was often a trading fee or commission to discourage investors from trading. Robinhood has made trading stocks exciting and addictive, from the first time you launch the app and scratch off what looks like a lottery ticket to claim your free stock (Robinhood has removed some elements from their UI, like the infamous confetti).

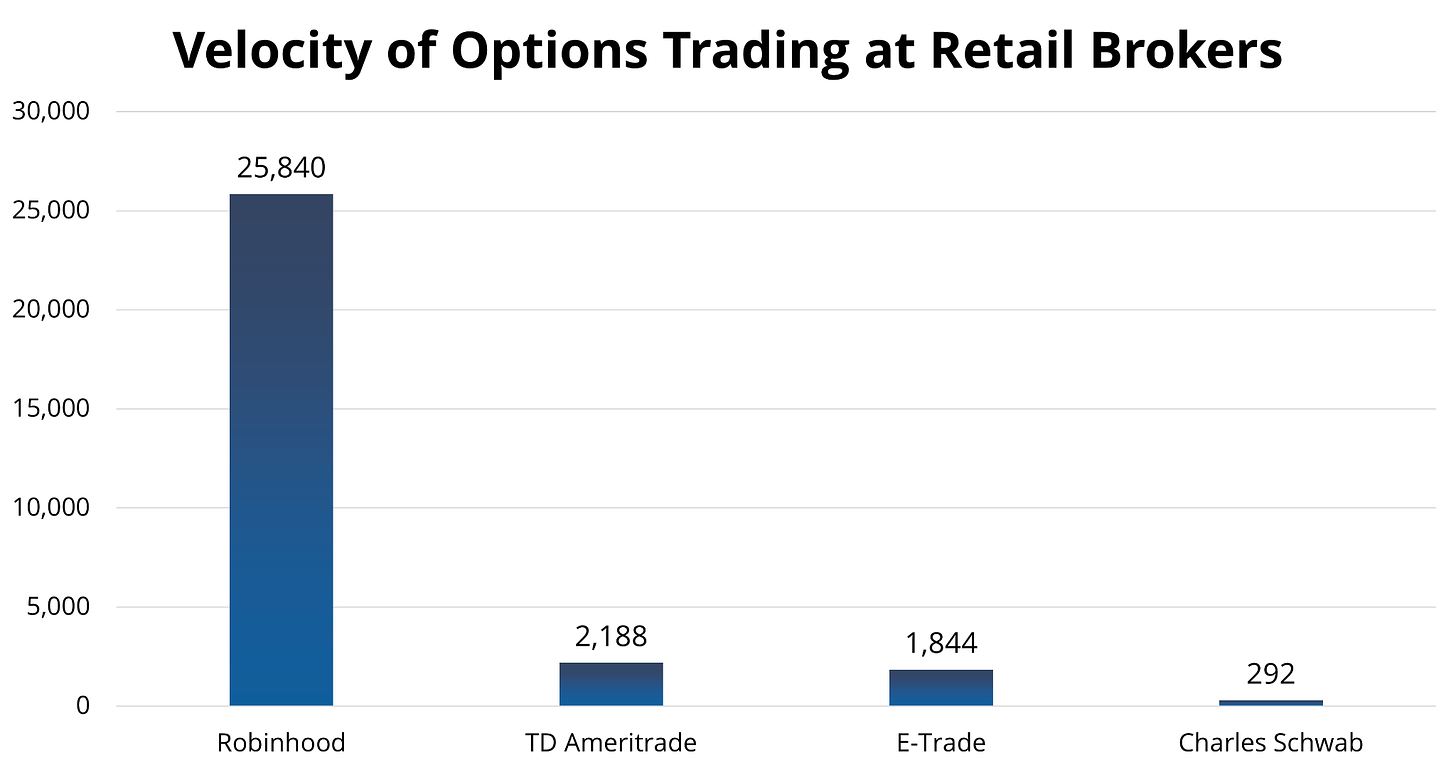

In the first quarter of 2020, Robinhood users traded securities exponentially more than users on other platforms. They traded 9 times as many shares as E-Trade customers and 40 times more shares than Charles Schwab customers. The chart below, showing data from Alphacution Research Conservatory, shows the amount of options contracts traded per dollar in the average customer’s account. Unsurprisingly, Robinhood users trade options much more often than other leading brokers.

When compared to traditional brokers, Robinhood users are the “dumb money.” Robinhood and wholesale brokers that pay for their order flow are able to make much more from Robinhood users because they trade so often. Trading securities and options more frequently isn’t inherently a problem. If retail investors were great at buying stocks and trading options, this would actually be a good thing! Unfortunately they are not. Several studies have shown that the more often smaller investors trade securities, the worse their returns. Customers that start trading options can expect even worse returns. Investing consistently over time is much easier and requires less effort than frequently trading stocks and options, but it isn’t as exciting.

Why do Robinhood users keep trading if they lose money?

Robinhood users trade more frequently than users of other brokers, which makes them more likely to have lower returns over the long-term. So why do they engage in behavior that decreases potential returns? For the same reason people buy lottery tickets. Lower-income Americans spend the most on lottery tickets, and the median account size at Robinhood is just $240. Robinhood users are gambling their small accounts on risky bets in hopes of getting lucky.

Even if Robinhood users could perfectly time the market, they would be better off consistently investing in the market over time. The median Robinhood customer is 31, and most 31-year-olds would probably be surprised to learn that they only need to invest $383 per month to become a millionaire at age 65. It’s not easy to build wealth, but it is simple: it just requires discipline (the discipline to buy and hold instead of frequently trading securities in an attempt to build wealth quickly), money (not much for a younger person), and time. If you are behind and don’t have much saved, the best thing you can do is focus on saving as much as possible instead of focusing on your rate of return. Chances are engaging in riskier investing behaviors could decrease your potential returns.

The future of Robinhood and similar platforms

Platforms like Robinhood have done some good by introducing a component of investing to younger people and pioneering commission-free trading, but ultimately encouraging riskier behavior from retail investors such as options and frequent trading is not good for the users of the platform. Robinhood has proactively taken some steps to get ahead of potential legislation, like removing confetti, but it is unlikely to significantly impact their bottom line.

Although it will likely never happen, I wonder how users would change their behavior if presented with factual statements upon opening the app (similar to cigarette warnings). Maybe something like, “Warning: Robinhood users trade more frequently and engage in riskier strategies than users of other brokerages, which may decrease future returns.” Or how about, “Did you know you could become a millionaire at age 65 by investing $383 per month in low-cost index funds? Consider opening a Roth IRA today.”

Investing in individual securities can be fun, and is often more exciting than investing in index funds. There’s nothing wrong with having fun on the side, but make sure to keep individual securities to no more than 5% of your investable portfolio, and work towards saving and investing 25% of your gross income for retirement. Building wealth is simple, but it isn’t easy, and there are a lot of distractions along the way. Don’t let apps like Robinhood, which encourage frequent trading and riskier behavior, distract you from building wealth.