Each year, the IRS adjusts retirement account contribution limits, standard deductions, marginal tax rate brackets, and more for inflation. I’m happy to announce that it is once again the most wonderful time of the year: the IRS released their annual inflation adjustments. Let’s take a look at what changed and get a head-start on setting your retirement account contributions and tax planning for next year.

Changes to retirement accounts

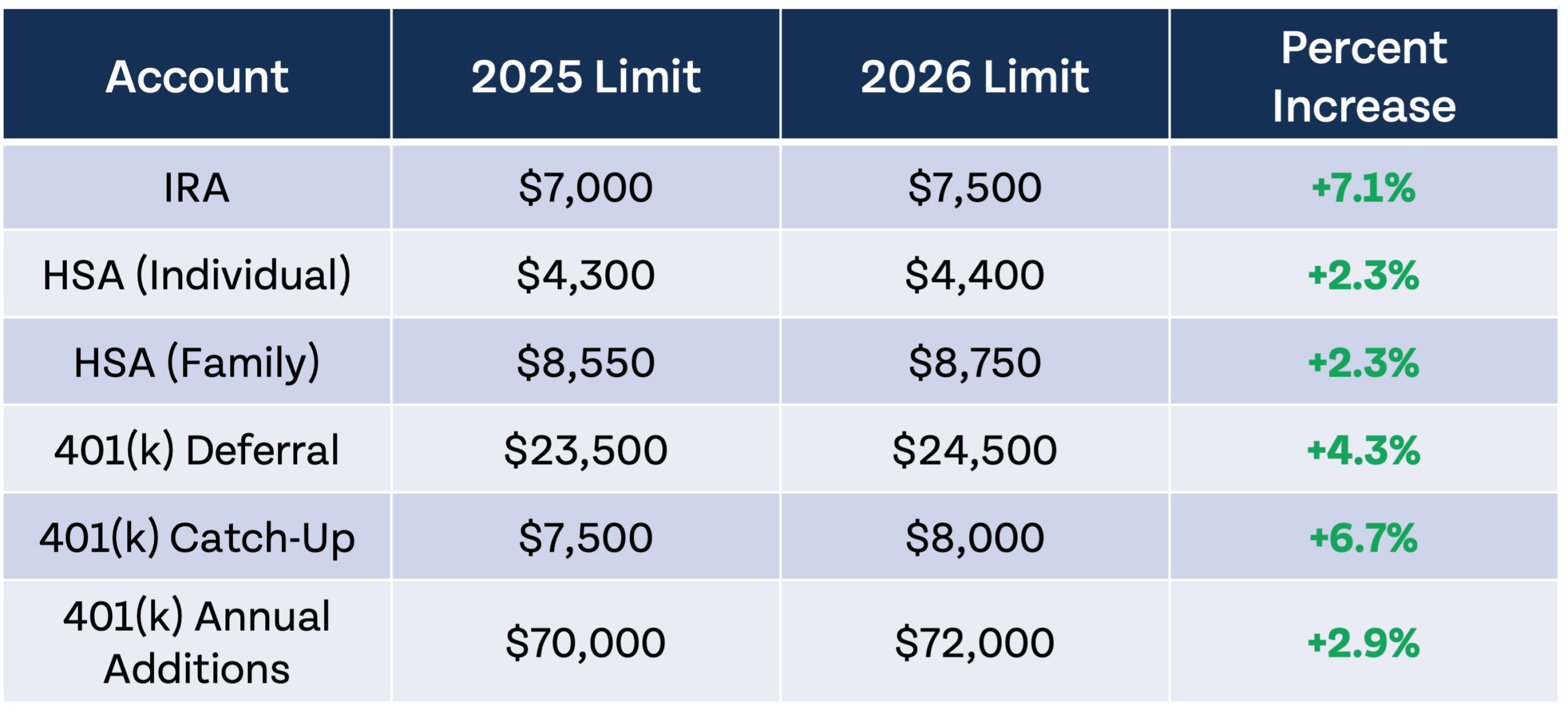

The Consumer Price Index, the preferred measure of inflation in the US, has risen by 2.9% over the last 12 months (compared to 2.4% this time last year). This means retirement account limits are increasing modestly, and in some cases a bit more than they increased last year.

IRA limits didn’t change at all last year, so a $500 increase is welcome. For those of you contributing to your Roth IRA every month, you will need to invest an even $625 every month to maximize your account. If your New Year’s resolution is to max out your 401(k), you’ll need to contribute a little over $2,000 every month to do so.

One Money Guy metric I like to keep an eye on is the gross income someone needs in order to complete Step 6 of the FOO without contributing more than 25% of their income. Assuming you can’t make catch-up contributions and have a Roth IRA, individual HSA, and a 401(k), in 2026 you would need an income of $145,600 to complete Step 6 of the Financial Order of Operations. This essentially means if you make under that amount, contributing to a 401(k), Roth IRA, and HSA will meet the 25% investing goal. If you make over that amount, you may need to utilize a mega backdoor Roth strategy and/or contribute to a taxable brokerage account.

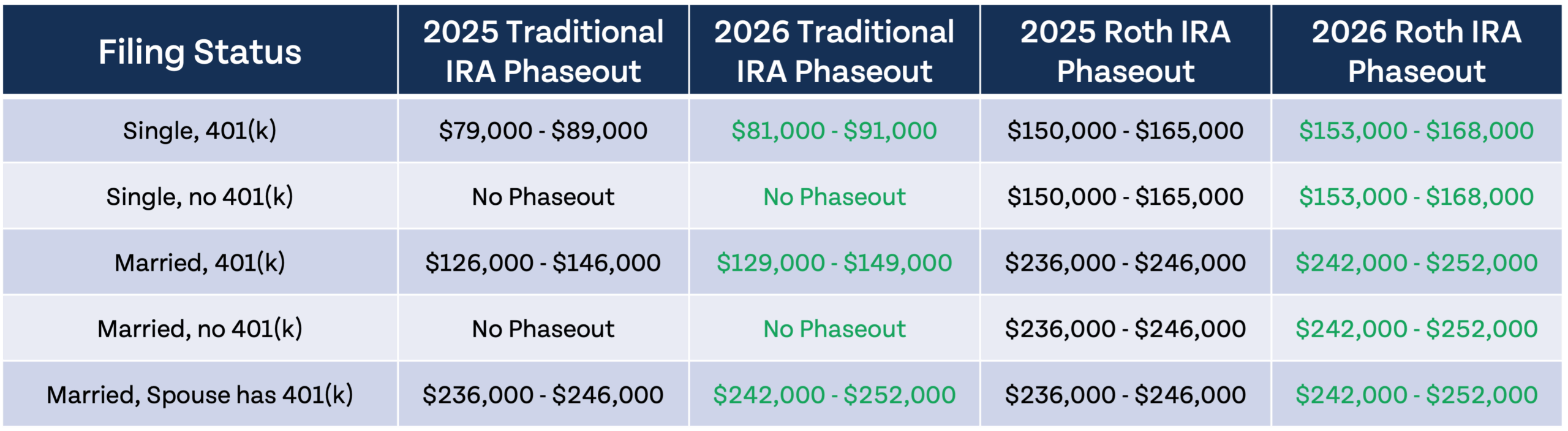

The income phaseouts for retirement plans are also adjusted each year for inflation. If you are expecting your income to stay the same or decrease next year, you could potentially now qualify for Roth IRA contributions without using the backdoor Roth strategy. If you think your income may be higher than these phaseout limits, it is worth planning ahead and utilizing a backdoor Roth if necessary.

Standard deductions and marginal tax rates

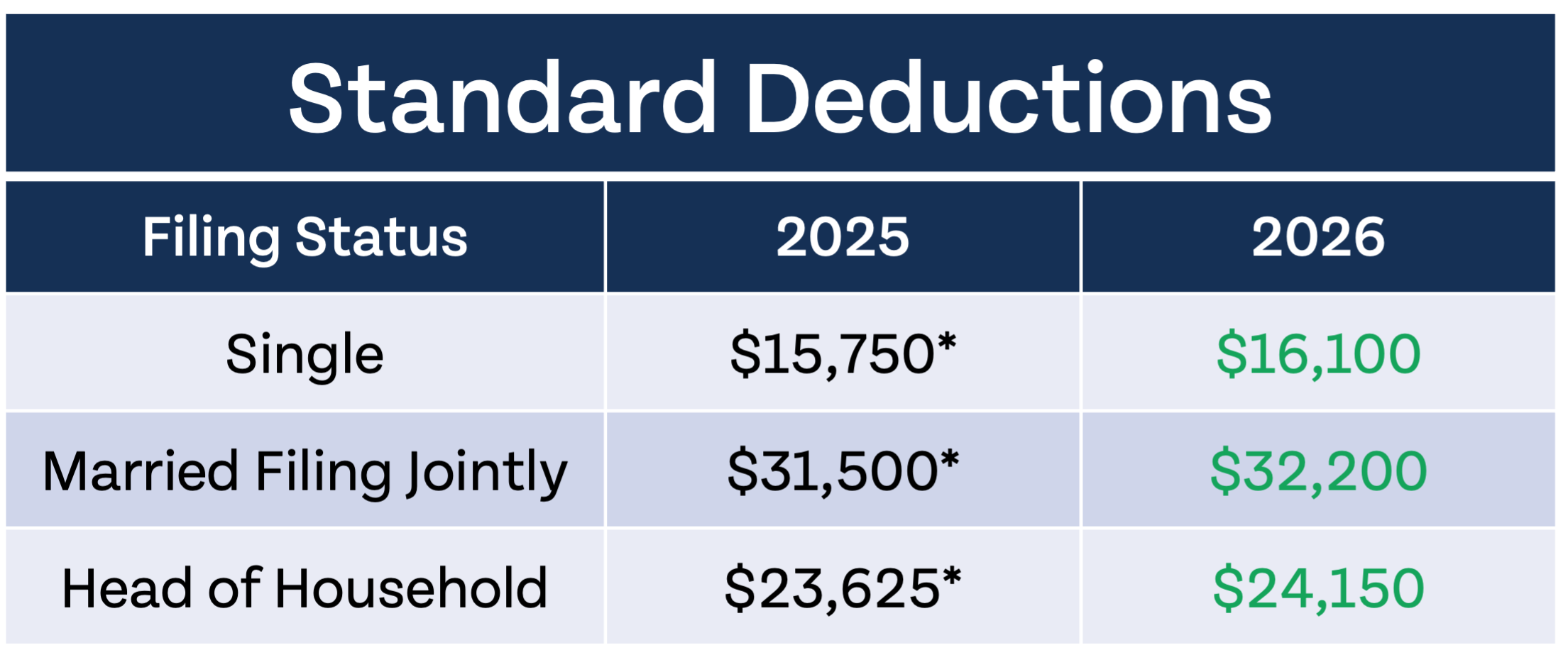

This is a weird year for the standard deduction. Legislation passed in July modestly increased the standard deductions for 2025 (by 5% across the board), so when you file taxes in a few months you can expect to get a little extra back than you would have otherwise. About 91% of taxpayers take the standard deduction instead of itemizing.

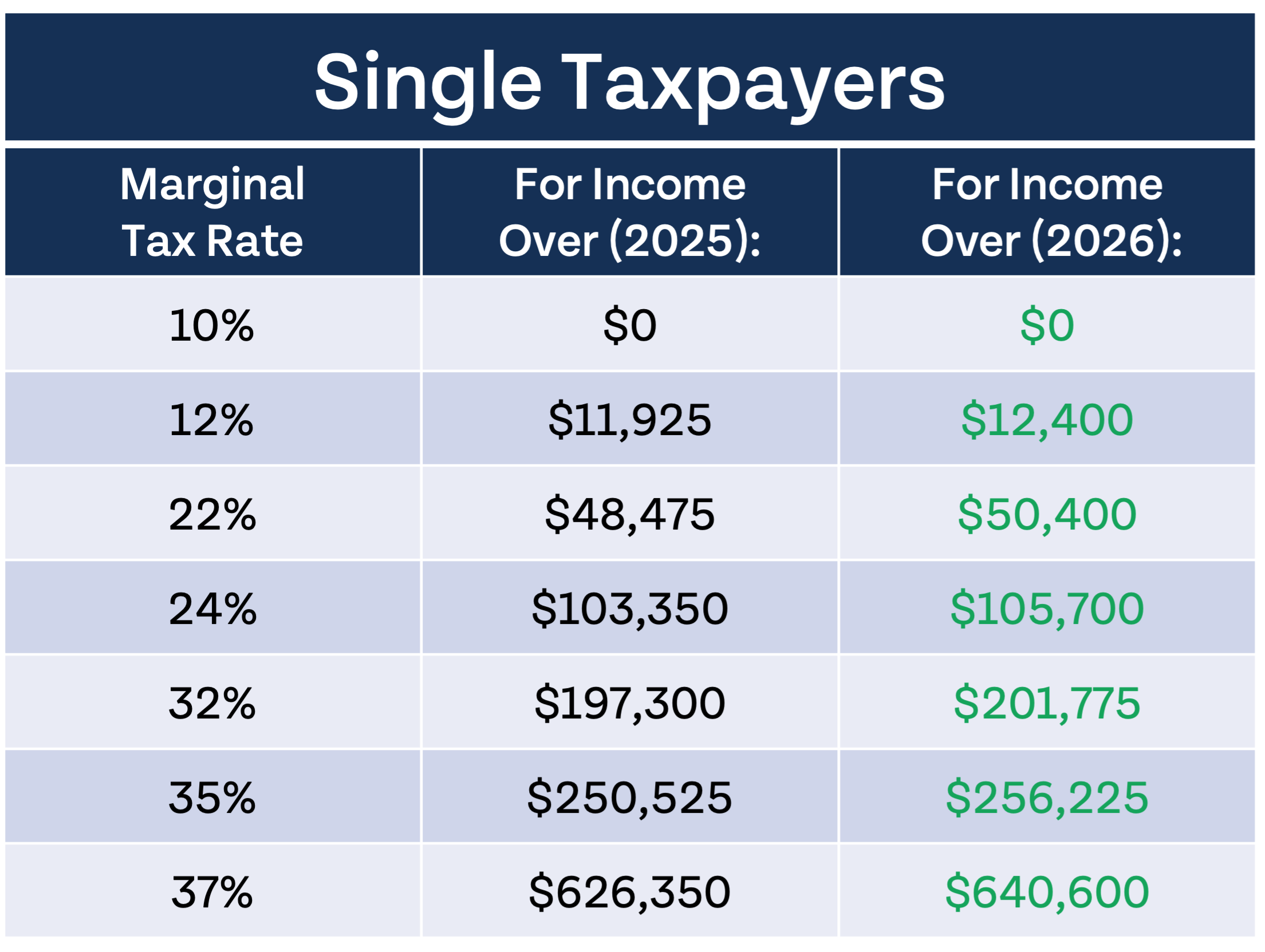

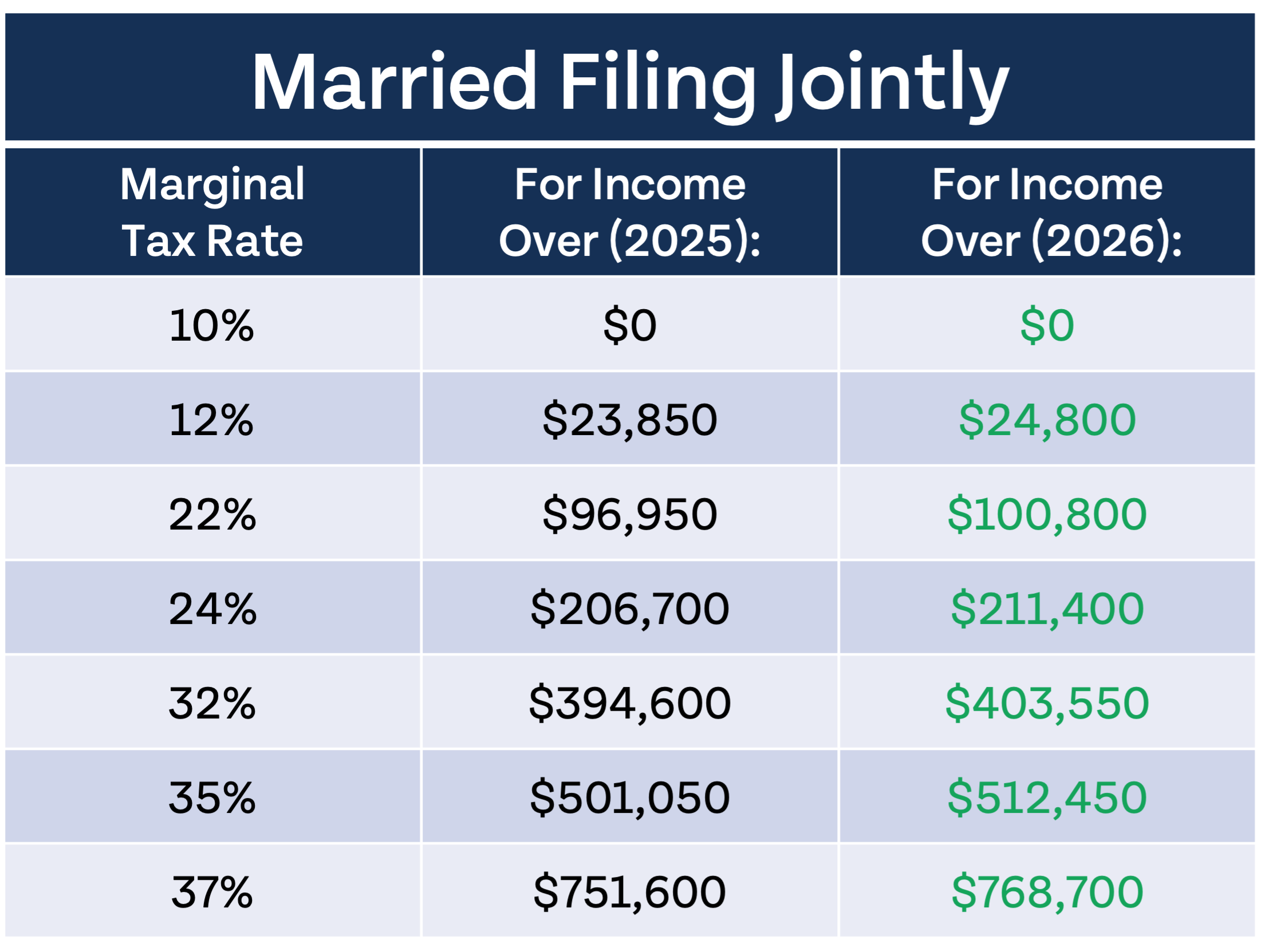

Marginal tax rates remain unchanged, but income thresholds are also subject to annual inflation increases. Again, if you are expecting your income to decrease or remain the same next year, this means you will be paying a bit less in taxes, all else being equal.

If you are an accountant or tax enthusiast, you can review the full IRS release of changes next year and their separate release detailing changes to retirement accounts. Make sure to download our 2025 Tax Guide as you prepare your taxes next year, and be on the lookout for our 2026 Tax Guide with all of the changes mentioned here and more.