Change your life by

managing your money better.

Subscribe to our free weekly newsletter by entering your email address below.

Subscribe to our free weekly newsletter by entering your email address below.

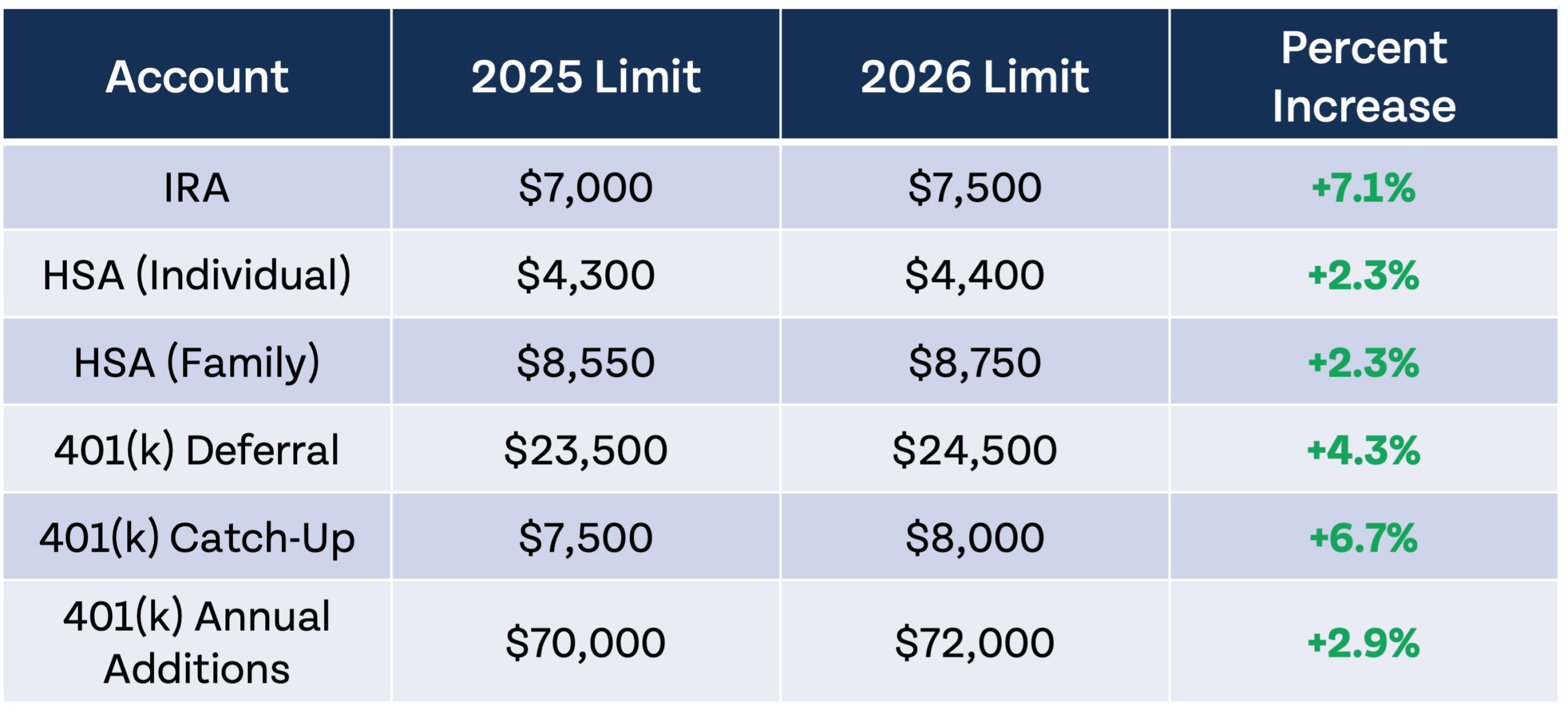

The IRS has released the official 2026 tax updates, bringing important changes to retirement contribution limits, tax brackets, and deductions that every saver needs to know. In this episode, we break down the numbers hot off the press, starting with retirement account increases: 401(k), 403(b), and 457 plan contribution limits rise to $24,500 (up from $23,500), while total contribution limits including employer matches increase to $72,000. Catch-up contributions for those 50 and older jump to $8,000, with one critical caveat: highly compensated employees must now make catch-up contributions as Roth contributions starting in 2026. IRA contribution limits increase to $7,500 with a quirky $1,100 catch-up amount (not the typical $500 or $1,000 increment), while HSA limits reach $4,400 for individuals and $8,750 for families, creating an unnecessarily complicated formula that’s no longer the clean “double for families” ratio.

Beyond contribution limits, significant tax law changes take effect across different timeframes. For 2025-2028, seniors gain up to $6,000 additional deduction per individual ($12,000 for couples), while the SALT (state and local tax) deduction cap quadruples from $10,000 to $40,000, which is a major win for high-tax state residents who itemize deductions. Eligible workers can deduct up to $25,000 of qualified tips and overtime pay, while a new car interest deduction allows up to $10,000 for qualified US-assembled vehicles. Changes effective 2025 and beyond include a permanently increased child tax credit of $2,200 (adjusted annually for inflation starting 2026), expanded 529 plan eligible expenses covering professional licenses and apprenticeships, and the phase-out of electric vehicle and energy credits. Starting in 2026, the child and dependent care credit expands to cover up to 50% of expenses ($3,000 per child, $6,000 for two or more), standard deductors gain a new charitable deduction ($1,000 single, $2,000 married filing jointly), and the controversial “Trump accounts” or child IRAs provide free government money despite being taxed like traditional IRAs. The Money Guy philosophy remains clear: tax avoidance (legally minimizing taxes through strategic planning) is highly encouraged, while tax evasion lands you in serious legal trouble. By understanding these changes and accessing free resources at moneyguy.com/resources, you can structure your financial life to keep more dollars in your army of dollar bills working toward future wealth.

Then, we answer your financial questions! These ranged from celebrating financial milestones (reaching $1 million net worth at age 38 and seeking advice for the journey to $2 million) to navigating the Financial Order of Operations with a new spouse at different FOO steps (Wikinator 21 dealing with $4,000 debt at 8.5% interest). We explained the Goldilocks rule for lump sum versus dollar cost averaging with a $20,000 HSA investment question, evaluated home equity loan strategies for a remodeling project while maintaining the 25% housing threshold, and shared the origin story of designing the Financial Order of Operations.

Subscribe on these platforms or wherever you listen to podcasts! Turn on notifications to keep up with our new content, including:

Brian: Tax updates you can’t afford to miss.

Bo: Brian, I am so excited about this because it is that time of the year where the IRS has finally let us know what we can expect next year when it comes to how much money we can save for the future, what tax opportunities are available to us. The numbers are in hot off the press and we get to go through them today.

Brian: This is always, you know being a financial nerd I have quirky times of the year I get excited for. You know we’ve in the past we’ve joked about that we love when Warren Buffett wrote the letters to shareholders. When I was writing Millionaire Mission I remember we had the book written but we couldn’t, we needed all the year-end updates. So now every November I get excited because it’s always around November the government tells us what are the changes they’ve made to all of our contribution limits, our tax brackets. So with that, this is stuff I’m hoping that I can turn this into your own nerdy tradition that you too can get excited about.

Bo: So let’s talk about what changed, some of the updates. And let’s start with maybe the exciting ones or the ones that people likely get the most excited about and these are contribution limits. As you know, for certain tax incentivized retirement plans, the government says, “Hey, these things are really, really good, but you can only put so much money into them. And every year those numbers change just a little bit.” Well, 2026 is no different. When we look at contribution limits for 401(k), 403(b), 457, employer sponsored plans and the thrift savings plan, in 2025 for salary deferrals, you could do $23,500. You now can do an extra thousand in 2026 with $24,500.

Brian: Well, and for all self-employed and those in the high comp area, if you’re trying to figure out total contributions, that includes your employer and you, it went from $70,000 to $72,000. For people who are in my age category, 50 and greater, we went from $7,500 on the catch-ups to now $8,000.

Bo: One little honorable mention on that one. If you are someone who’s qualified as a highly compensated employee and you are going to do catch-up contributions in 2026, it’s likely that your plan has now made the election where they now have to be Roth contributions. So, if you’ve not made that adjustment, if you’ve not had a conversation with payroll or HR about that, you want to make sure you navigate that before we get to January.

Brian: What a quirky little thing. I mean, I know why they did it is because they don’t want you to take the tax deduction for it, but oh no, don’t let me do more Roth. Okay. We’ll get more Roth assets.

Bo: And then if you are someone who is between ages 60 and 63, there’s an additional catch-up that you can do. There’s a super catch-up, which is $11,250. That number did not change. Now, here’s something that’s important to know. When you make your deferral election into your 401(k), oftentimes people will say, “I want to defer 5%, 10%, 15%.” Just because these numbers have increased does not mean that you will automatically max them out. So you want to make sure you do the math in your plan because maybe if you were saving 10% last year, you might need to save 11% this year, whatever that number may be, so that you can make sure you don’t leave money on the table. We see this all the time, Brian. We’ll review someone’s W-2 and we’ll notice the amount going into their 401(k) might have been the contribution limits from three years ago, four years ago because they never actually would update it. So, make sure you’re checking that so you don’t leave that tax deferred savings on the table.

Brian: Well, that’s a great segue because a lot of you have set up account builders on your IRAs as well. Let’s talk about what happened to contribution limits on that. If you think about IRAs for 2025, they were $7,000 a year. Now, they’re $7,500. Now, here’s the quirkiest. Even both of us when we were going through show notes, we were like, “Why did they do this?” Catch-up contributions for those 50 and greater, forever it feels like it’s been $1,000 or, you know, when you’ve had inflation adjustments, it’s been in $500 increments. Yeah, but for some reason, they made this year’s catch-up contributions in 2026 will be $1,100. That’s right. They added $100 to those catch-up contributions.

Bo: And look, they didn’t call and ask us for our opinion. But you know what’s super frustrating about this? We’re going to get to in a second. You’re like, “All right, $7,500 IRA plus $1,100 catch-up.” All right, that’s going to be $8,600. Oh my gosh, $8,600, that’s really close to HSA family max, but it’s not the exact same. It just is going to create some confusion. You know what? We’re smart. We’ll be able to keep it clear, but I don’t know why they didn’t make it a little bit easier to navigate. For additional IRAs, if you’re someone who’s contributing to a SEP IRA, they have the same section 415 limits that 401(k)s have. They’re going from $70,000 up to $72,000, assuming that you have enough compensation that 25% of the comp allows you to max out that SEP IRA. And then SIMPLE IRA contributions are also going up. Salary deferrals are going from $16,500 up to $17,000. Catch-up contributions inside SIMPLE IRAs are going from $3,500 to $4,000. And then the super catch-ups for those that are ages 60 to 63 are staying the same at $5,250 per year.

Brian: Let’s talk about health and education updates because these contribution limits have also been increased. If you think about health savings accounts now, but we were talking once again quirky things, things that make you go, hm, I wonder why they did that. It’s always been kind of interesting and a few years ago it separated from common sense.

Bo: Yep. Contributions between like individual versus family. It used to be like half.

Brian: Yeah. The individual is exactly half of the family limit. Easy to remember.

Bo: We’ve decided that didn’t make enough sense. So, we needed to make this more complicated because if you look at contribution limits for individuals, it’s $4,300 in 2025. 2026 will go up to $4,400. And then for families, it’s $8,550 in 2025, but in 2026, it’s going to be $8,750.

Brian: So, half minus $50.

Bo: Yep. Very, very frustrating. And then if you are someone who is above the age of 55, so this is a little bit different than 401(k)s or 403(b)s, catch-up contributions for HSAs trigger at age 55. And so, if you are eligible for that, you can do an additional $1,000 into your health savings account. And oftentimes there’s a little strategy where if you have two spouses that are both over 55, you can do a thousand for each if you open up a second HSA account. So a little bit way to squeeze a little bit extra tax savings in there.

Brian: And we can go through these others like the flexible spending accounts. Those have gone from $3,300 to $3,400. 529s, they’ve stayed unchanged because the gifting limits have not changed. $19,000. Same thing for ABLE contributions also stayed the same at $19,000.

Bo: All right. So that covers all of the contribution limits that have changed, but then some other tax changes as well that we want to make you aware of. And one of the things we know is that oftentimes the marginal tax brackets that we are subject to get indexed for inflation and they change. And so in 2026 that is no different. All of the tax brackets have shifted a touch. And so I’m just going to run through these very quickly, but this is a pretty easy thing to go out there and Google or look up if you want to know what bracket you fall into. But if you make married filing jointly below $25,000, in the 10% bracket. Up to $100,000 it’s 12%. Up to about $211,000, 22%. $400,000, 24%. $512,000, 32%. $768,000, 35%. And if you make over $768,000 married filing jointly, you’re in the top marginal tax bracket, 37% federally. Well done.

Brian: And I mean what y’all don’t know is in the content meeting I was trying to turn this into a TED talk on tax rate changes. Bo convinced me no, I’ve got a way I’m going to do this really quick. So, I give you kudos for making that happen.

Bo: There are some other changes and these are pretty big because this is on the deduction side. The standard deduction has continued to increase. So in 2026 if you are single or married filing separately, your standard deduction is $16,100. If you’re married filing jointly, you’re a surviving spouse, the standard deduction is all the way up to $32,200. And if you’re head of household, $24,150. And so, Brian, I think that the vast majority of Americans, even with some of the changes we’re going to talk about in a second, are likely still going to be standard deductors. So, they are likely going to benefit from this higher deduction they get to take.

Brian: So, I think just in kind of summary, we’ve just covered the contribution limit increases. We’ve covered the tax rates, but there’s also big tax news in the fact that we had the big beautiful bill that passed that a lot of this stuff kicks in coming into 2026. So, we wanted to make sure we brought you up to speed on what you need to be paying attention to for both this 2025 tax filing year, but also for the years to come.

Bo: Yeah. And it’s really again, most things when it comes to tax policy are not incredibly simple and straightforward. It’s almost like the CPAs sit around and make it super hard.

Brian: It’s not the CPAs. Don’t blame us.

Bo: All right. All right. That’s not them. It’s all those people we put up in DC. They make it a little bit more complicated than perhaps it needs to be. And so there are some distinct timelines you need to be aware of. So this first little tranche we’re going to talk about are changes that are going to take place between 2025 and 2028. These are period certain changes that have been adjusted. And the first one is pretty significant. It’s the senior deduction increase.

Brian: Yeah. This is getting you up to $6,000 of an additional deduction per individual. $12,000 for couples.

Bo: Exactly. And then here’s one I think a lot of people are going to be excited about. The local, the sales and local taxes. SALT. If you’re not familiar with that, these things got brought down. A lot of people who if you live in a high tax state both for property taxes as well as for state income taxes, you got capped at $10,000. This was a big change that a lot of people did not like. Well, now it’s gone from $10,000 to $40,000. That’s going to have a big impact on anybody who’s itemizing their taxes and lives in a high tax state. So, it’s one of those things. Obviously, there are some significant things changing as it relates to Schedule A on your tax return, your itemized deduction. So, if you are someone who maybe has been taking advantage of the standard deduction each year, make sure you double check to make sure that because of this SALT change, you’re not going to be an itemizer because once that happens, there are some other things that you can go look at like healthcare expenses, other miscellaneous expenses that you might incur that could fall on Schedule A. So, make sure you’re looking at that. Another change that’s going to happen between 2025 and 2028 is limiting tax on tips and overtime for these years. Eligible workers can deduct up to $25,000 of qualified tips or up to $12,500 for single filers, $25,000 for joint filers, and a certain amount of overtime pay. So, if you are someone who either earns overtime pay or part of your compensation is comprised of tips, make sure you understand how these changes could potentially affect you.

Brian: And then one, I can’t wait to see how they tell us we’re going to do this is the car interest deduction. You know, up to $10,000. But there is the caveat that the car has to be a qualified US assembled passenger vehicle for personal use. Man, where are they going to be handing out those stickers to let us know this vehicle qualifies for this? Can’t wait to see how that plays out. But it’s always fun. I’ll get my popcorn ready.

Bo: So, those are some of the changes that are taking place from 2025 to 2028. But then there are other changes that are happening that are going to go 2025 and beyond. The first of which, a lot of parents, a lot of folks in the messy middle. There is an increased child tax credit. With the new legislation, it permanently increased the child tax credit to $2,200 per qualifying child starting in 2025. And then that’s going to be adjusted for inflation annually beginning in 2026. And the amount that is going to be refundable of that credit will also be adjusted from $1,400 in 2025 and up and beyond in 2026 and beyond.

Brian: 529s, more eligible expenses. I mean, this is something, professional licenses, technical training, apprenticeships, other fees and supplies. Once again, it seems like 529s keep getting better and better. And then, of course, I don’t think a lot of people, you’ve heard about this, the news media covered it. A lot of your electric cars and the energy credits, they’ve been phased out and a lot of them even went away as of September 30th of this year.

Bo: So, then we’ve talked about 2025 to 2028, 2025 and beyond. And there are some changes that are going to take effect in 2026 tax year. One of those is the child and dependent care credit expansion. So what this is is parents and guardians can receive a maximum credit of up to 50% of their claimed child and dependent care expenses for $3,000 per qualifying child up to $6,000 if you have two or more children. These are expenses that you incur so that you can go out and do your job. That’s been expanded in 2026 and beyond.

Brian: This is one when I was doing taxes for those 16 years. This is one of those I kept in my back pocket. I’d pay attention if I had two working spouses or I had a spouse and the other one’s a, you know, full-time student. You can actually deduct those child, you take a credit for the dependent care expenses. Don’t sleep on that. A lot of people just don’t know about this credit. So, if you resemble what I just talked about, both spouses are working or both spouses are at least full-time students and working, then you ought to look into this.

Bo: Another change that’s happening is, as we’ve already stated, the standard deduction increased in recent years. And so, because of that, a number of folks were no longer itemizing their deductions. And one of the deductions that people often itemize is their charitable giving or their philanthropic giving. Well, one of the things that’s unique that’s happening in 2026 and beyond is even if you are a standard deductor, there’s now going to be a front page deduction for $1,000 for single individuals, $2,000 for married filing jointly for those who do not itemize. So, even if you take the standard deduction, but you are charitably minded, you can get a front page tax deduction even while you’re doing the standard deduction.

Brian: And then one that got a lot of press and there was a lot of misinformation out there on was these child IRAs or Trump accounts. Look, I think if you have a child that comes in this window of opportunity, take the free money. We were actually surprised because there was so much misinformation that came out on this is that these things are going to be taxed like IRAs though. So if you’re not, outside of the free money, there might be a better way if you’re trying to figure out what to do with your dollars for your children. But still definitely take advantage of just like we talk about free money for your employers, take the free money from the government when you set up these accounts.

Bo: And then there are some changes that are happening for student loans both in terms of the amount that you can borrow in the caps as well as the repayment plan. So if you’re someone who’s currently on a student loan repayment plan, there is a deadline of July 1st, 2028 where potentially you may have to make some adjustments or changes. Make sure you understand what’s going away, what’s no longer going to be available to you in regards to payment plan and how you need to adjust moving forward.

Brian: Boom. 15 minutes.

Bo: Look at that. Lots of tax changes. But here’s the thing that’s so interesting about taxes. We talk about all the time that you know in this country, tax evasion is illegal. It will get you arrested. The government will come and take your stuff. Tax avoidance however is highly encouraged. And so one of the best ways that we can avoid taxes is understanding what has changed, what laws have been adjusted, what limits have been moved so that we can take advantage of those so that we don’t have to pay any more in tax than we absolutely must. If you’re willing to do a little bit of homework, a little bit extra work to make sure that you structure your financial life in a way to minimize your taxes, that’s more dollars in your army of dollar bills that can grow for the future. Amen, CPA?

Brian: No, definitely be very proactive with your taxes so that you can take control and minimize tax payment as much as possible.

Bo: So, Brian, we love that we get to do this. We love that we get to read through legislation, compile the changes that are going to happen that affect you, but we also love that we can speak to the things that you guys care about. It’s why every single Tuesday at 10 a.m. Central, we are right here answering your questions because we believe that there’s a better way to do money. So, right now we have the entire team out in the wings collecting your questions. So, if you have a question you want us to weigh in on, make sure you get it in the chat right now. So, with that, Creative Director Rebie, I’m going to throw it over to you.

Rebie: Yes, I’ve got some questions queued up. The first one is from Hughbert171. It says, “Fun question for the guys.” Going to kick it off with a fun question. “Our household just passed $1 million net worth at 38. First of all, what are some fun ways they recommend celebrating this milestone and what advice do they give as we start the journey to $2 million?”

Brian: I love it. I mean, I’d plan a trip or something to, you know, either a big night out or a trip, you know, it’s really on what your family puts value on making those blossoming memories out of. But definitely celebrate. I think that’s sometimes I pick on my financial mutants and the fact that we’re so good at being disciplined that we forget how to have a good time. So, make sure that you’re building that skill set of celebrating these big moments in life and these milestones so that you can keep going forward and know the why and understand, you know, that money is only a tool and it’s not something that you’re supposed to idolize or put at the center of your life, but is definitely just a tool that you can use to maximize this moment that you’re building with your family and loved ones.

Bo: Yeah. But when I sit down with my wife when we’ve hit these kind of milestones in the past, one of the things I do is we like to go out to a nice dinner and I always ask her the remember whens. Hey, do you remember when we did this? Do you remember when we said we were going to, do you remember when we said, “Oh, one day we want to have our net worth go over a million dollars.” And it’s really fun to reflect on that moment in time. Do you remember back when that was the case? And then as you’re having that conversation and reminiscing, then I always say, hey, I want us to kind of mark down this moment right now. We are sitting in the moment that hopefully one day we will look back on and say, hey, do you remember when we had that conversation? And that’s how we begin to do some of our like goal casting, vision casting, dream casting of what are the things we want to be able to do 10 years from now. Obviously you know 10 years ago we said we want to be in this spot and we’re able to do it. What do we want to move forward? And so what that allows you to do is not only have this like future mindset where you’re looking towards future goals, but it also lets you kind of give yourself a pat on the back, celebrate for accomplishing really difficult things. You know, most millionaires don’t hit millionaire status until they’re what, like 47, 49 years old. You guys have done this at 38. That is no small feat. That’s something worth celebrating because it likely took a lot of hard work to get there. But I would have the question or would ask the question, okay, so now what? Right? What’s the goal? Why did we even want to have a million dollars? What did a million dollars mean for us? And what path are we moving towards? And okay, you said what does it take to get to $2 million? Why do we want to get to $2 million? What does $2 million do for us? What opportunities does that open up? What goals does that allow us to achieve that we’re not able to do now? And are the things that we think $2 million will allow us to do, are they only going to be available once we have $2 million or are there ways we can do that now? Meaning, a lot of people say, “Oh, man, I want to have more money in the bank so I can travel more.” Great. I love that. Are there ways that you could travel right now and maybe bedazzle your basic life and not break the bank so that way you’re not just waiting for your future self to be able to enjoy this? And I give my wife all kinds of credit for this because she used to say all the time, “Bo, I don’t know. You’re telling me how ballin’ we’re going to be when we’re 90. I don’t want to be ballin’ then. I’d kind of like to get to do some stuff now.” So there is, once you’re at this point, obviously you’re not at the very beginning stages. You’re in the middle of your journey. It is worth reflecting. Okay, are there things we’ve been neglecting or not been doing that maybe now we can loosen the purse strings and start doing?

Brian: Well, yeah. I mean, this gets to the element. There’s so many things, it’s going to be hard to pack it into just a few minute answer is that if you take like what 1% is on a million versus when you had $100,000, you start understanding why maybe you start doing vacations differently, why eating out might be viewed differently, even you know when you get into step eight and beyond of the Financial Order of Operations, even the cars that you drive can change in a responsible way. It’s okay to celebrate these things. And the thing I always try to remind people, it’s back to the point of what’s the why? What do you give value? What gives you enjoyment? Is because you need to understand is that reaching a certain number, whether it’s a million dollars, $2 million, $5 million, those numbers are empty if you don’t actually have the why or what gives these power as the tool of money because these are mile markers. These are not the end all goals that end your, that you get there and you find out, hey, this is much emptier than I thought. That’s why you have to pack it on with all the life elements so that it nurtures relationships. It nurtures things that bring you happiness so that you get to kind of celebrate but also know that this is a much bigger part of your impact or how you’re experiencing this journey of life because that’s really where you’ll find out it’s not the end. I want to reach $5 million and I think when I get to this pinnacle moment my life is going to be great. No, you have to make sure you’re strapping on all the life elements as you’re building these assets so that you look back, you know, when you’ve exceeded all these goals and you go, “Job well done.” Yeah. Everything here from a spiritual, from a relationship, and from a happiness and fulfillment factor seems to all be in line with each other.

Bo: Last little thing I’ll add on here. If you just said, “Hey, what are some tips and strategies for going from this million to the next one?” Don’t forget to dance with the one that brought you. The thing that got you to a million very likely can be the same behavior, same strategy, same kind of stuff that will take you to $2 million. Far too often, I feel like people hit this threshold. Okay, well now I got to do the complicated thing. Now I got to go do the private equity. Now I got to do rental properties. Now I got to go complicate my financial life.

Brian: The dumb doctor deals. Everybody hates it when I say that, but it’s the truth.

Bo: If I just saved and invested 25% of my gross income and I did that over the last 15 years or so and that got me to a million, I bet if I continue to do that moving forward and the fact that my portfolio is so big now that that snowball is just going to get rolling faster and faster and faster, bigger and bigger and bigger without having to change a whole lot of the behavior. So the things that you’ve done to get here are likely going to be the same things you continue doing to take you to the next phase and next stage.

Rebie: Love that. Well, congrats, Hughbert171. Very fun milestone and thanks for letting us have a fun conversation with you about what’s next for your journey and just celebrate for a bit. And also worth celebrating, it is Money Guy Tumbler Day. Look at that. So, Brian and Bo, you are my tumbler models today. So, Hubert, if you would like a Money Guy Tumbler, just email [email protected] and we would love to send one to you.

Rebie: Okay, TheWikinator21 is up next. The question says, “Hello, money guys. I am recently married. I was on step seven. Now I’m in step three with my wife. We have 8.5%—” Don’t laugh.

Bo: What? So much shade. He just, look at that. So much shade.

Rebie: Okay, this is a good question though because this is a real scenario, right? This certainly can happen to people. So, the details of that is it says 8.5%, I’m guessing that’s the interest rate and there’s $4,000 left on the debt there. He’s currently maxing out his retirement. Should I decrease my investing and put it towards debt? So, this is a guy who’s been following the FOO and now he is with somebody else who’s following the FOO, but they are at different points in the FOO. So, what would you say to them?

Brian: This is, but first I’d ask the content team, put up on the screen what people think the FOO is versus what the reality of what FOO is is because this is exactly right. This is what happens with life. You know the Wikinator fell in love and his spouse has come into the marriage with, by the way this is just going to be a speed bump because it’s $4,000. We’ve seen much more dire, worse situations than this. And if the fact you tell me you were at step seven, that means you had already fully funded your Roth, that means you had such a savings behavior that you were already reaching 25% of your income going into those retirement accounts to max out retirement. That’s pretty amazing. So, I got to think with you combining resources with your new spouse that $4,000 might just be a speed bump of a month, two months, three months. Yeah, I would like you to prioritize because 8.5%, that’s a pretty good clip. That would qualify as high interest debt. I didn’t get to see what type of debt it was and I didn’t see what their ages were. But still, I think that I would probably safely say, “Let’s knock it out quickly and then get back on track with the Financial Order of Operations.”

Bo: Yeah. One of the things I would think through, if you were on step seven, again, not knowing kind of the income disparity and what the expenses are between you and your spouse, one of the things I’d probably go investigate is, okay, if you were on step seven, that means that you had a fully funded emergency fund. How robust is that step four fully funded emergency fund relative to what the household needs? This is a great example of where maybe it’s time for you to take some of that step four to go extinguish some of that step three so you get out of that high-interest debt so that then you can not have to, while it’s a speed bump, maybe it can be even, you know, sometimes like in the neighborhood there’s like the big speed bump that’s real aggressive and it’s like jarring, but then sometimes in the neighborhood there’s like the little bitty speed bumps where they’re just like, da-dunk. If you already have an emergency fund, maybe this is something you can go ahead, knock out, get that debt gone, you don’t really have to shut down the retirement savings because you still have an emergency fund in place and you can continue moving with those goals. But I think one of the things that I would do first is I would talk with both of you about what your financial goals are, right? Like, hey, I was in step seven and now I got married and now I’m in step three or now she’s in step three. I would pose that differently. I don’t think that you’re in step seven and she’s in step three. I think that y’all are in step three. And you ought to arrive at, okay, hey, this is where we are. This is what we got going on. This is how we’re going to tackle knocking this out because this is a common goal that we both have. And I think if you can approach it that way, it’s not going to be about like my stuff and her stuff or my stuff and his stuff. It’s our stuff and what are we ultimately trying to accomplish with the decisions that we’re making.

Brian: Well, and that’s a great point is because just because you pay off the $4,000 debt doesn’t mean you immediately go back to step seven. What happens? Now you’re going to be in step four, but as a unit, meaning you look at what’s three to six months as a household. And then after we get through step four, now we’ll look at, hey, what should we do from a Roth, Health Savings account? As a couple, you’re looking at with brand new fresh eyes because you’re different. I mean, you were a single individual, now you’re a married couple. I would look at it as a household to figure out how you’re going to navigate getting back to step seven, but as a couple versus separate individuals. That’s one of the things that I always, when people come to me. Look, there’s nothing wrong with you having the way you manage your assets. Some of you come into marriages with like maybe had children from a previous marriage or there’s complications where you might have some separate accounts, but I definitely want you setting household goals to where you’re having to navigate these things together. I think too many people cordon off theirs versus theirs and we don’t actually get the that you’re in this together. And that’s the way marriage is, two becomes one. Let’s kind of get that mindset. Big team, little me.

Rebie: That’s good stuff. TheWikinator21. Great question. And if you would like a Money Guy Tumbler, we would love to send you one. Just email [email protected].

Bo: Rebie, you know what I loved seeing the other day?

Rebie: What’d you love?

Bo: I was scrolling through YouTube as I often do and I saw a little video of why Brian loves Disney. Did you see that one? And actually walking through why he loves Disney. And then I was like, “All right, this is pretty good. Let me check out this other.” And then I saw why I should not play the lottery.

Brian: I don’t think I said you should not. I just want people to know the odds. You said absolutely not. More than the adult population of the United States.

Bo: But you see the comments were like, “But you’re saying there’s a chance.” I was like, “Yeah.” If you have not checked out, what are we calling it? What’s the name of it? I mean, I think we’re calling it Tangent Time. Have you not checked out Tangent Time with Brian, you should go do that. YouTube Shorts, Instagram, all the socials. Make sure you’re doing that because it allows us to talk about some stuff that we often don’t get to talk about on here. But if you want to take a walk with Brian, it’s a great thing to check out.

Brian: You were too kind. But I will say what my biggest shock this week was because I was on a flight, a fun trip. I went out to Vegas with some Georgia buddies and on my flight I’m getting texts from Bo. I’m not getting because you know when you’re on the airplane they don’t let you get the actual charts or screenshots but I got him telling me we were the number nine podcast according to Spotify in the country, number one in business. You know when I landed I got to see the screenshots and I was like holy cow. So something just went on fire. Well, we know what it was now is that we got really promoted by Spotify for that show we did on what to do with your money in your 30s. What I want to know is because then once we had such success with this episode, like, hey, we want to reach out to our Spotify contact to just so we could, you know, make sure, hey, this was great, great moment in time. Appreciate you guys because we, you know, we have YouTube representatives. We have and we realize, you know, our Spotify, if you’re out there and you’re connected with Spotify, we’d love to because we had a great time with it. It was awesome. And I like to know that more eyeballs saw our content than probably any other time on Spotify. We like celebrating those moments. I’m worried because Matt was telling me, you know, behind the scenes that he ended up, they sent it to like a support ticket. I was like, I don’t want to make sure this doesn’t get shut down. This was not a bad problem. This was a feature. This is a benefit. It was something to be celebrated. Wanted to know why. Yeah. I mean, it was just a cool experience. So any of you guys if you noticed that we made it on the top of those lists because if you looked, I was looking around at all the other shows that we were ahead of and right there and I was like this is pretty cool air that we’re in right now on Spotify. So a big thank you from us.

Rebie: Yeah and thanks to everybody who watches and listens on Spotify because we have made some really fun moves like we added video on Spotify earlier this year so you can watch or listen and switch back and forth. So it was cool to see that y’all are liking that.

Brian: So here’s my promise. Spotify, if you keep putting us on the featured or promoted side, we’ll keep bringing this up during Q&As and all kind of other things, you know, we’ll make this a mutually beneficial relationship.

Rebie: Oh, I love that. It was pretty cool to see.

Brian: No, it was really cool. I mean, and then top of the charts. I don’t know. That’s one of those milestones that when things like that, cute, you know, quirky little things like that happen, you’re like, this is pretty cool what we get to do. I mean, I love—It came from a pure position of educator’s heart, you know, when this all started back in 2006, but it is amazing. Every time we’re doing studio tours or we’re doing other things, I’m like, “This is pretty wild that we get to do this for a living.”

Rebie: Yep. That’s awesome. All right. Want to do another question?

Bo: Of course. Let’s go.

Rebie: We got one from Derek-jg9vv. That’s a complicated username, but it says, “I have $20K in an HSA to invest. Should I invest it all at once or dollar cost average the money over time?” So, I’m wondering if he just discovered the power of the HSA. So, maybe you can talk a little bit about how to handle this.

Bo: So, we love HSAs because only 13% of Americans use it as a triple tax advantaged vehicle that it is because one of the things you can do is you can put money into an HSA and you get a tax deduction on the front end. You can then invest those dollars and they can grow tax deferred and then in the future you can use those grown dollars to either pay for current medical expenses or you can even reimburse yourself for past medical expenses which is awesome. That’s one of the things that makes HSAs absolutely unbelievable.

Brian: You need to pull that money out tax-free if you use it for those qualified expenses.

Bo: That’s exactly right. Completely tax-free. And so Derek’s question, okay, I got $20,000. Should I lump sum or should I DCA? Brian, I’m curious to know if our content team is good enough. Can they pull up the Goldilocks? Do you have our Goldilocks rule? Do you think they have the Goldilocks rule? Because sometimes we’re faced with this decision. Do we want to lump sum or do we want to DCA? Lump sum being invest it all today and DCA being hey I’m going to invest a certain amount every certain period for a certain amount of time to kind of smooth out the volatility and we actually have a metric to help you figure out which one you should do.

Brian: I’m not seeing it on the screen so here’s what I would like to share. The thing about everybody always tries to put these two against each other, it’s either going to be lump sum investing versus dollar cost averaging. We know statistically lump sum is better because markets typically go up 8 out of 10 years. So it’s hard to overcome that. So you know off the cuff you’re like well without a doubt we ought to just lump sum this. But then there are those moments where we know the intra-year volatility plus we know we hit those bear markets two times a decade typically that those years scare the heck out of you. So we’re like okay instead of putting these two concepts against each other, they ought to work together. Meaning that if this is not a huge portion of your investable assets, put it to work immediately because that lump sum stat is very powerful. I’m hearing that they actually can pull it up now. So, let’s go ahead and see it, guys. So, look at this. This is tying into what I’m talking about is it ties into how big is this sum of money you need to make this decision on compared to your total investable assets. If it’s a small amount, meaning it’s 10%. So for this example for Derek, if he already has over $200,000 working, then the $20,000, just put it to work immediately. However, if you’re brand new to your journey, maybe Derek just started investing, you know, four or five years ago and he’s only got $50,000 saved up and invested. Well, this $20,000 now, I mean, this could be 30 to 40% of his total investable assets. That would probably recommend, you know, that volatility could really derail you as a total household. Why don’t you DCA this over 6 months to kind of cut out some of that volatility? You see how well thought out this is? This is why we say there’s a better way to do money. It doesn’t have to be either or. I hate it when content creators try to say do this all the time. And we always say it depends. So much of money in personal finance is very personal to your situation. So, we try to load you up with free resources so you can navigate this in the best possible way. So, yes, I was leaving that because I felt guilty that I took all the answer. Moneyguy.com/resources is a great place if you want to go see that resource plus many others that we have.

Bo: I didn’t think you took all the answers.

Brian: Well, I did. I felt after they pulled it up, I was like, we ought to leave some meat on the bone for Bo.

Bo: That’s why I did the triple tax advantage. I was like, I’ll do triple tax advantage. Goldilocks. There was a little, I was trying to think about what dynamic duo we would be.

Brian: This is when you know I played basketball in high school and this is when I realized I was more benchwarmer basketball players because the really high caliber players were really good with those quick passes you know so they could do alley-oops and you know and do the trick plays. I just didn’t have the coordination. So that makes sense that I bundled that, messed that up too.

Rebie: I think you all did great. It was a good answer. Derek, we’re glad that you’re here and we would love to send you a Money Guy Tumbler since we answered your question today. Just email [email protected].

Bo: Round of applause for our content team pulling that up. So, man, if you’re impressed with the fact they did that, go subscribe right now to the channel so they know that you’re so impressed by them. For sure.

Brian: All right. Hey, if we were trying to get Spotify to reach out to us, I didn’t give an email address. Should we give an email address?

Rebie: No. Okay, never mind. Just message us.

Brian: By the way, you can tell. But if you ever want to know a clue that Brian’s out here in the wilderness all alone, it’s when stuff like that happens. Like, you had gamut, Brian, you weren’t supposed to say that on air.

Rebie: I don’t know if you even rounded it out. Our contact was on like maternity leave. That’s what happened. I don’t think we actually said that. So, I will round out the story. So, we’re just kind of like, oh, I don’t know.

Brian: No, Spotify has been great. I don’t mishear us. We just want to celebrate with somebody, but we also don’t want to get into somebody’s maternity leave while they’re doing that. It was just kind of a you know—Not that big of a deal. We are just the ninth largest podcast in the country. Number one in business.

Rebie: Number one in business. That’s right.

Rebie: All right. Chris W has a question next. It says, “Instead of moving, what do you think of using a home equity loan to remodel and add space as long as the combined loan and mortgage payment is below the 25% housing threshold? I have a 3.25% mortgage.”

Brian: Oh, man. I feel like I know somebody who might resemble this.

Bo: Yeah. What’s interesting, Chris, is you’ve asked a few different questions bundled into one. First I want to clarify a few things, right? Your mortgage is 3.25%. I like that. If you were to move, you’re likely going to have a higher mortgage rate than that. But as a reminder, likely when, well, I don’t want to be presumptuous here. When you take out a home equity line or a home equity loan, you don’t get the same rate that’s on your fixed mortgage. Oftentimes that’s a secondary line of credit that’s subject to some different rate. And it’s not going to be the fixed rate that your current mortgage is on. It’s going to likely be some sort of adjustable rate that again is going to be higher than that. So, I just want to clarify because I don’t want you to think that, oh, I’m going to—

Brian: I’ll give them a range because it’s typically tied to prime.

Bo: Yeah, I think right now home equity loans are somewhere between like 6.5 to 7.5% somewhere in that ballpark right now on home equity lines. But this is not an uncommon thing. I know a lot of folks, especially here in Middle Tennessee, they’re like, “Okay, I wanted to go look for, there’s some stuff I don’t love about my current home, so I’m going to start looking around.” And you begin doing the calculus and you’re like, man, if I’m going to go move into a new home, not only have home prices gotten a lot more expensive, not only are interest rates a lot higher, but man, it’s going to change the community in which I live. What if I love my neighbors? What if I’m close to the gym? What if I’m close to the school? What if I have close proximity to—

Brian: Gym was the very first one out there. Not the kids, not the kids school, but where I’m working out at. I literally work out in one of my neighbors’ garages.

Bo: Not church. Not the kids school. Where the gym is. That’s the reason why I’m staying right where I am. You may recognize that there are things that make it very very sticky. And so when you do the math, you start to say, man, it might actually be more affordable, more cost effective for me to turn the house I’m currently in into the house that we need or that we want rather than moving and going somewhere else. So that’s the thought process. This is what I want to weigh in on from a financial perspective. He’s like, “Hey, should I take out a home equity line to do this?” Right? And so oftentimes when it comes to home improvements, there are a number of different ways that you can pay for it. And in my opinion, I think that the type of home improvement and what it’s going to do for you in the home should dictate how you ultimately pay for it. Agree, disagree?

Brian: So looking and you seem to be tapped. Bo did a big improvement on his house. I don’t know if he’s trying to keep that secret. That’s why I say when he resembled because he had the exact same situation. You had a mortgage rate that was below 4%. Below 3%. I couldn’t, I didn’t want to be presumptuous but you had gotten to the point because houses are expensive around here that you had looked at this exact situation. Now I think the reason I’m adding this context is because, and look I’m not trying to throw shade, Bo put a swimming pool in his house. Now those are used assets that you know historically drown— No, I mean, historically they, buyers don’t always want a swimming pool. Now that’s post pandemic things are a little different but during pre-pandemic swimming pools weren’t always, you usually used the metric of like 10, maybe 15, 20% depend upon how nice the swimming pool was to add to the value of your house. So I agree with Bo that some improvements that you’re doing just for yourself, I think you ought to probably put yourself closer to how do I pay this off? Have the payoff period like think like a car, like 3 to 5 years. But for things like, you know, if you’re improving the kitchen, the master bedroom, bathroom, those things, you might be able to expand that out. Thinking about your home equity line for seven years, 10 years. I think you just have to have the context of what this actually adds value versus what is a used function that just makes it better for you to live in. And that way you keep the debt monster at bay because you just don’t want your eyes to get so excited because here’s the thing with construction. Everything I used to joke when I built my most recent house that it was all $2,000 here. Now I think it’s $7,000 to $15,000 here and there. Every upgrade because of inflation has gotten pushed up even higher. You just don’t want to get eaten alive by what the improvements you can do. You just need to have a why tied to it and then have a backbone to how that grounds it so you don’t get too much debt built up.

Bo: Yep. I love it. Agreed.

Rebie: Good stuff. Chris W, thank you for the question.

Bo: And again, I’m just going to throw this out there because I think a lot of people feel like shame and guilt when they invest, I’m going to say invest. Bad language when they spend money on their current home. But if this is the place that you’re going to have your family and where you’re going to spend, you’re going to do this. I tell people, hey, it’s okay. Money is nothing more than a tool that allows you to accomplish your goals. And one of the goals you may have is, hey, I want this house. You know, my kids are only going to be in this house for 18 years, and I want to be able to do this and create these memories and have these experiences. And so long as that decision is not inhibiting me from other goals like financial independence or being able to save for the future, whatever that may be, that’s okay. I see a lot of financial mutants that just really rail against that. There is no point in getting all the way to the end of this life with a big stack of money and no memories and not actually using it to accomplish the goals that you have. So, it’s something I think that financial mutants need to hear so they don’t turn into financial misers.

Brian: And hopefully I mean we had, y’all probably catch on. Bo and I actually really do like each other so we talk a lot and this is one of those things I was like put this swimming pool in your backyard. It’s not like you’re going to die broke. I was like, this is going to be one of those things when you look on the life meter. It’s going to be a rounding error. Yes, it’s a big sum of money to put this nice pool and outdoor living space in the back, but man oh man, you have three, you know, tricycle motors that now are soon to be, you know, bicycle and car motors. You ought to go ahead and, you know what I mean? They’re getting bigger. They’re these—You’re only going to get them in the house for this certain period of time. And you’re going to get old and sentimental like me and you’re going to be like, “What could I do?” And I know your wife, too. And I know y’all use this for hospitality. You entertain. It’s a good use of your resources. You know that money could have grown at 8%. Who cares if it doesn’t, if it doesn’t blow up everything else? That’s the whole thing about money as a tool only. And I think sometimes that’s why I love our content is because we give you the mathematics, but we also try to give you the quality of life stuff so that you can get to be my age and go, “All right, I navigated that okay and still didn’t turn myself into Ebenezer Scrooge.”

Bo: That’s right. Yeah, that was great stuff.

Brian: Misers versus mutants are completely different.

Rebie: It’s different. Chris W, that was a great question. Clearly, you got us into a good discussion. If you would like a Money Guy Tumbler, we would love to send you one. Just email [email protected].

Bo: I was just laughing because tricycle motor makes sense because they are the mechanism that—

Brian: Yeah. When they’re little, your kids are getting older, you only have one tricycle motor in the house. Car motor. There is a thing that is a car motor.

Bo: That’s why it was so funny. They push the accelerator. That’s hilarious. Or the brake, the brake pushers. The phrase tricycle motor always makes me giggle. Anyway, so I just, that whole thing. I liked it. I enjoyed it.

Rebie: Thanks for keeping things fun, Brian.

Brian: I do what I can.

Rebie: Speaking of the next username I have is called Laughhouse-2go. I don’t know. Okay. But that’s his username. That makes me think of like the jumpy houses. That’s what I like. Maybe he’s a jumpy house guy. I don’t know. Okay. It says, “What was the biggest breakthrough when you were designing the FOO that you feel sets it apart from alternative models?”

Brian: Oh, this is easy. I’ve actually, you know what’s funny is this is one of those tangents. I actually recorded one of these. I don’t think it’s gone out yet. There’s two, I want to give Bo credit because there’s multiple things. First of all, we were already doing what was called the 30-minute financial plan. This is going to mess up my tangent time, but that’s okay. We were already doing the 30-minute financial plan and then I remember I had seen something on LinkedIn where everybody was screwing up all these math problems because they didn’t know, please excuse my dear Aunt Sally with PEMDAS and how math has an order of operations. And I was like, Bo, when we do that 30-minute plan, we are doing our own version of PEMDAS with finance because I get so mad that there were systems already out there, but nobody was prioritizing get the free money from your 401(k). I was like, how in the world when your employer’s giving you 50% guaranteed or 100% guaranteed is that not on the front end of your system? And then the other thing that we were thinking is because look, if you tell somebody right out of the gates, and this is where Bo’s genius came in, that they need to be saving, they need to have 3 to 6 months before they even start investing or doing anything, I think a lot of people are going to get discouraged. They’re discouraged by that. And there are other systems that say, “Well, $1,000.” And I’m like, well, but $1,000 that just doesn’t feel like that’s necessarily the right amount, too. And so Bo and I were talking and he was like, I think we keep them from making the bad mistakes where the big things that can derail your life. And that’s where insurance deductibles came in. And so we came up with in step one is highest deductible covered because that is the catastrophic stuff that creates bankruptcy and never let you get started. And that probably should be the that is the first thing. I’m definitively now that we’ve had enough time to swim in these waters, I know that is what people need to do. And then I love that it transitions right into that free money because I don’t care even if you have credit card debt, you ought to get that free money because that’s going to be probably that lifeline for the excesses you screwed up in your 20s if you’re at least doing the employer match. And then the rest of this started just falling into place. And I’ll say the other thing that nobody was giving love to was Roth money. I mean, Roth, look, and I get it. A lot of these systems that everybody was using all were designed in the 90s. Roth assets didn’t even show up until like ’98 to the early 2000s, you know, when they started showing up on 401(k)s and things like that. So, there needed to be a new mousetrap built. And I love that we got to definitively show you what to do with your next dollar. And it kind of fell in. That’s why it was an absolute pleasure kind of writing down and that’s why the best most improved was also because we kind of had designed the system but then sitting down and actually trying to build a book around it made it even better. You guys are the beneficiary because a lot of mental horsepower went into shoring up all the system.

Bo: Yeah. I think for me the biggest breakthrough was, you know Brian started podcasting in 2006. So this is like two decades ago and we were managing money and financial advisors and we sort of intuitively were making really good financial decisions with our own finances and what ended up happening is the system was a product of the behaviors we had been implementing for decades at that point. I mean started podcasting in ’06 but the FOO in its current form wasn’t ideated until you know whatever year that we launched the FOO, right?

Brian: We have those dates though because we went and looked it up when we were locking down everything. Don’t quiz me now. Yeah, I’m not going to say that out loud.

Bo: So, what it was is it was the culmination of experience saying, “Hey, these are the things that we’ve seen work and these are the things that are kind of common sense or these are the things that really work in a very effective and efficient manner because we’ve actually lived it and we’ve made it through that. And so let us tell you how we were able to do that. How we’ve seen our clients do that. How we’ve counseled our clients.” And so it wasn’t a system that was built and then tried to be implemented. It was a system that was being implemented and then we just tried to like consolidate it down in a way. Oh, I get this. I can see it. I can crystallize this. Now that I have the FOO, I don’t have to go live it for 20 years to figure it out. I can take these guys’ experience and I can apply it today starting on day one. That was the unlock for me. Holy cow, man. How cool would it have been if in 2006 we could have started with the FOO. How nice would that have been?

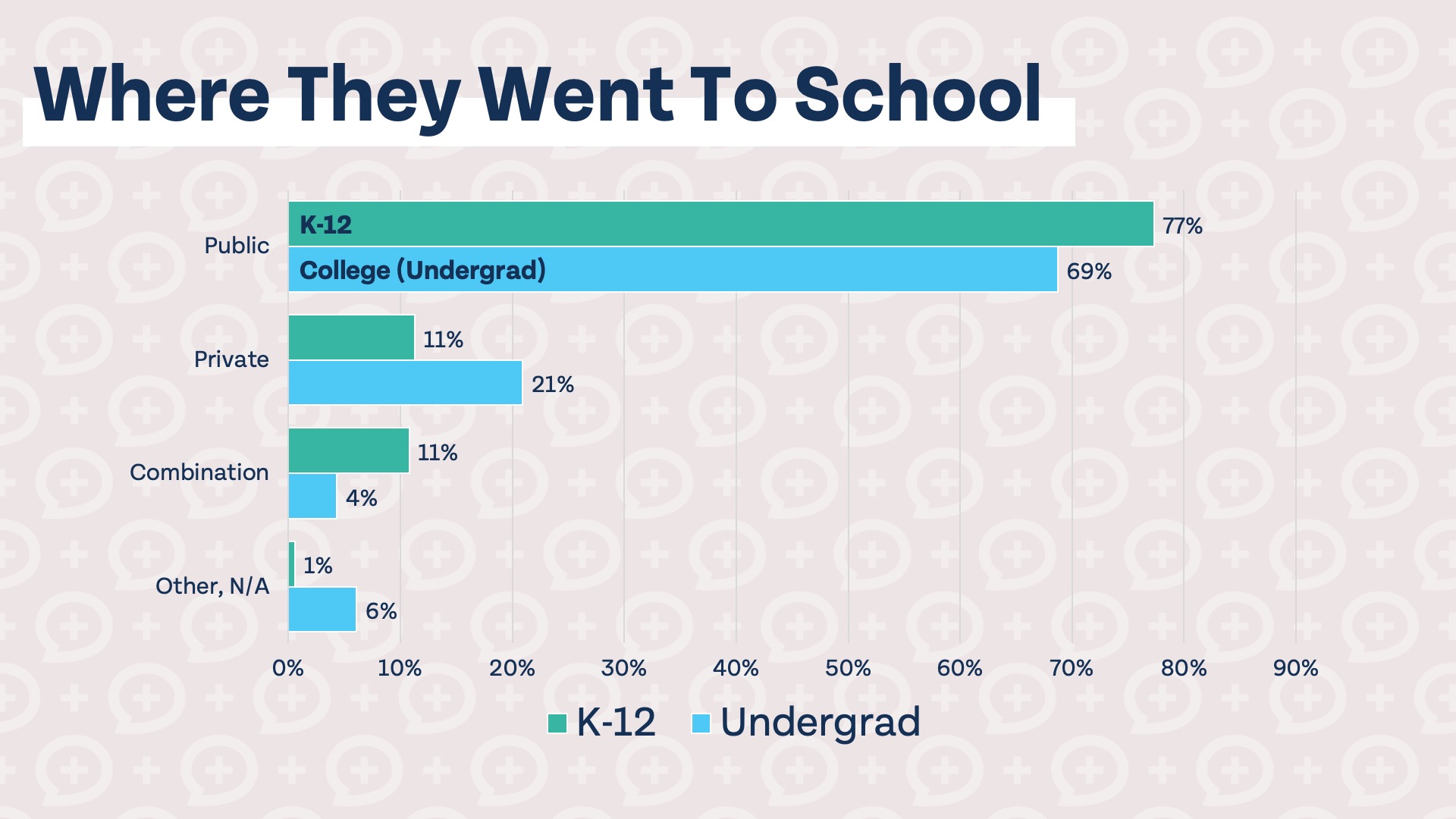

Brian: Well, and I’ll talk about manifesting where you want to be and it just happens in a beautiful way is that y’all know the books that influenced me in the beginning was like Millionaire Next Door. I loved when I got to see the data for what millionaires are actually doing with their money and how that’s so disconnected from the consumption society that we’re constantly being whispered in our ears. And then here we are now. We actually get to, we do surveys on our millionaire clients. We do surveys on our financial mutants in the audience. And it just, I feel kind of it’s really come full circle for me in the way that not only do we have the Financial Order of Operations, but we also get to share the data and do research every year and you guys get to be part of that data collection as well. So you’re content creators in your own right. It’s just that it gives me tingles. It makes me feel really cool that we’re doing something really bigger than all of us.

Bo: Love that. That’s awesome.

Rebie: Laughhouse-2go If you would like a Money Guy Tumbler, email [email protected].

Brian: You should get a tumbler. Man, that would, I feel like I should just go do a lap around the building right now just because it’s just it makes you feel good. You’re like, “Yeah.”

Bo: That’s great. That’s great. What would you do if you came to downtown Franklin, you saw Bo and Brian just running laps around the building just getting—

Brian: Well I mean like even we got out of our content meeting this morning and Will was, you know, because we’re right in downtown Franklin and Will goes “It is so cool we’re in downtown.” I was like yeah we’re in downtown Franklin. It is, especially on Thursday and Friday when all the tourists show up. I mean it’s just it’s fun being there.

Rebie: I don’t think they’ll see you running though. Walking maybe. You never know. You could be seen walking on the streets of—

Brian: Yeah. By the way, Charles, everybody knows Charles. You probably see him. He’s probably in the audience right now. But Charles is like, “Brian, these walking videos, you got to be careful about your safety. People are going to know where you are. They’re going to be able to tell from the background.” I’m like, “I’m in downtown Franklin.” You know, probably already going to see me in downtown Franklin anyway. Yeah, it’s true. Big shocker if you see me out and about walking around downtown Franklin.

Bo: It’s hilarious.

Rebie: All right, got another question for you from RJT135. “I’m 37 and almost entirely invested, about 97% in equities. How should I approach rebalancing my portfolio over time? Just change what I buy or reinvest what I already have invested.” So, it sounds like he’s been doing it a certain way, maybe found us, maybe sees that there’s a better way. What should he do now?

Bo: Well, the answer is it depends, RJT, because we don’t exactly know your unique situation, right? You’re 37 years old, you’re 97% equity heavy. Well, if you have a $2 million portfolio and you’re 97% equity heavy, that’s different than if you have a $60,000 portfolio, you’re 97% equity heavy. So, if it’s a smaller portfolio earlier on in the wealth building phase, it’s not incredibly difficult to save into your allocation. Meaning, okay, I’ve got my 401(k) contributions. I have 100% going here. Maybe now I want to do, you know, 60% here, 20% here, 20% here. And I can diversify through my dollar cost averaging, through my savings. I can grow into that. If, however, you’ve got a $2 million, $3 million portfolio, depending on your income, depending on your savings rate, it might be difficult for you to do meaningful adjustments on your savings to impact your overall allocation. So it might make sense to do a rebalance and look at your total allocation. How much should I have in risk on? How much should I have in risk off? How do I want to navigate the risk off? In the risk on, what type of risk on do I want? And to answer those questions, you have to do an even deeper dive. Okay, when do I want to use these dollars? What kind of accounts do I have? What’s my savings strategy look like? What’s my risk tolerance? Is there another party involved in this, like a spouse, who has a different risk tolerance and a different risk capacity than I do? Once you begin to answer all those questions and kind of formulate those ideas, then you can decide, okay, what’s the appropriate and accurate way to begin implementing the rebalance?

Brian: I mean, you pretty much, I was just going to put a little kind of structure in there is because tax implications is going to drive a big part of this because a lot of people show up. We have prospects show up all the time and we’re all different. We all have different fingerprints. You have different account structures because people will show up. Somebody might have $2 million that’s all in retirement accounts. So, you can make adjustments on that without triggering taxes very easily because the taxes are either tax-free if they’re in Roth accounts or tax deferred. And those, you know, you deal with the taxes later when you take the distributions. But if it’s an after tax account, we don’t want to trigger a bunch of taxes. So, we have to kind of work with what you bring to us. Then I think about goal dynamics. You know, if somebody’s retiring within the next five years, the urgency of that, I need even with the taxes, I might need to go ahead and make changes because the need is going to be, you know, I don’t want to get caught in a market volatility moment and have to sell at the world’s worst time. So I’ll ratchet up when we need to do the change, but if you’re 37 years old, so you might be 20 years, I don’t feel the urgency to go trigger a bunch of taxes because it might be more that we change how your future investments are getting invested plus how we structure the account so that we go where you’re going to without creating a big apple cart turnover moment from a tax standpoint. There’s also the account, you know, I mentioned account structure. There’s goal dynamics. There’s also intersection with time. All those things. This is the magical moment. People are, you know, what’s funny is we’ve had people ask us like with Roth conversions, how long does it take you to figure out somebody’s Roth conversion and we always say something like 20 minutes and 15 years of experience, you know, and people like, what do you mean by that? I’m like, well, I can look at your situation and I can clean this up in 15, 20 minutes, but there’s all kind of things that went into the wisdom of knowledge. It’s kind of the same thing on even the asset allocation. This is why when we create content, I can give you tons of free advice on all the things you need to be thinking about, but it’s, and relatively everything on wealth building is somewhat simple, but it gets complex when you stack them on top of each other and you start creating more and more success. All of a sudden, all these simple things become very complicated when taken into as a complex system at that point. And that’s why we always say this is the abundance cycle is when your life gets so complicated that you go, man, I’ve only done this once and now I’ve got this seven-figure portfolio. I don’t want to screw it up. I just don’t know what I don’t know. That’s where, you know, multiple decades of experience and doing this over and over again for other successful people is going to bear fruit for you and create a win-win situation with the abundance cycle. So, consider working with us.

Bo: Love that.

Rebie: That’s great. If you want to consider working with Abound Wealth, just go to moneyguy.com and click on become a client and you can start that conversation.

Bo: Can I say one other thing?

Rebie: Of course.

Bo: I don’t know why this came to me. Just worth noting, RJT, 97% in equities is different if it’s 97% S&P 500 mutual fund versus I got 97% and it’s across Nvidia and Palantir and Apple. Also, the type of exposure you have will dictate the strategy that you should employ. Sorry, that part was, complex question.

Brian: When you do a live show sometimes, you know, I’m sure in the comments if you had not picked that up, people like, “Yeah, we should have said that.”

Bo: But this is the thing about because it’s truly a live show. We don’t see these questions. We’re seeing this—We’re seeing a lot of folks reach out right now like, “Hey, I bought this stock this many years ago or I work for this company and it’s gotten big. What do I do?” And we try to design some well-thought-out strategy of how to do that. That is where it gets more nuanced.

Brian: Well, I mean, I don’t mind sharing, you know, I have, I’ve hit a few home runs on some equities. I don’t, I typically practice what I preach with you guys. I do index funds, but I have had a few stocks that, you know, like I don’t want to give the specific brands, but I had one that was a technology stock that got really on the down and out, but I was like, this stock is going to be fine. This is a moment in time. I bought that in my taxable account. Well, it boom. So, I’ve given that to charity. I mean, that has been over my charitable giving for the last two years is the huge run-up on that stock. But then I have another one and you’re like, “I’m surprised you’ve never gotten rid of any of that stock.” And I’m like, “It’s in my Roth account.” And that one is much easier because I just watch it tax-free. So, the account structure and then the type, all this stuff even comes into play for us when we’re looking at our own investments.

Rebie: No, it’s a complex question. You gave a good answer and it is kind of part of what y’all do every day with Abound. So, I love the answer. Thank you. RJT135, if you would like a Money Guy Tumbler, just email [email protected]. And we’ve talked a lot about Tangent Time with Brian. And we know that you’re here for our live stream Tuesday every Tuesday at 10 a.m. Central. And that’s why be sure to subscribe on YouTube so you can see that content and continue to get notified.

Brian: And Spotify.

Bo: Also, woo, we love some Spotify now. Number nine in the country. I was about to say more platforms. So yeah, follow us on Spotify and also follow on Instagram, TikTok, Facebook, whatever your preferred platform is, we will be there and Tangent Time will be there. So be sure—

Brian: And platforms can keep lobbying us. I mean, if you want to push us out there to more people, we’ll definitely be willing to be influenced. I’m not supposed to say that much.

Rebie: No, you’re doing great. You’re doing great. Oh, this is when you guys, thank you so much. I get so excited having just fun.

Brian: And by the way, thank y’all for putting up. I’ve got a little stuffiness going on. I don’t know if it was change of season. I didn’t take my Zyrtec-D on purpose because I wanted to keep the machine working full. So, if you saw me being a little stuffier than the normal, that was, I did it for you guys because I’m all about the art, the craft, and what we get to do for you.

Bo: We didn’t get a sneeze like last week.

Brian: But no, everybody’s going to be like, “Oh, every time Brian sneezes,” he hadn’t done it in like 15 years. So, it shows that he’s getting sick. No, I’m just change of seasons. I’ll be fine. I’ll be all right. Glad we’re doing this today. But guys, we have a blast creating this type of content. I’ll get it back on track. I’m your host, Brian, Bo, Rebie, and the rest of the content team. Money Guy team out.

Free Resources

Here are the 9 steps you’ve been waiting for Building wealth is simple when you know what to do and the order in which to...

Free Resources

If you want to set yourself up for future success, find out how much you need to save every month to become a millionaire.

Free Resources

Here’s how you can buy a dependable car that won’t break the bank. Our free checklist walks you through the 20/3/8 rule and strategies to...

Articles

Health insurance premiums may make up a significant portion of your budget. How can you find more affordable health insurance? Is it ever worth going...

Articles

Each year, the IRS adjusts retirement account contribution limits, standard deductions, marginal tax rate brackets, and more for inflation. I’m happy to announce that it...

Articles

Each year we conduct an annual survey of our millionaire clients. Some of the data is not too surprising. Yes, they have much higher than...

How about more sense and more money?

Check for blindspots and shift into the financial fast-lane. Join a community of like minded Financial Mutants as we accelerate our wealth building process and have fun while doing it.

Free Resources

Here are the 9 steps you’ve been waiting for Building wealth is simple when you know what to do and the order in which to...

Free Resources

If you want to set yourself up for future success, find out how much you need to save every month to become a millionaire.

Free Resources

Here’s how you can buy a dependable car that won’t break the bank. Our free checklist walks you through the 20/3/8 rule and strategies to...

It's like finding some change in the couch cushions.

Watch or listen every week to learn and apply financial strategies to grow your wealth and live your best life.

Episodes

Are you a Gen Z or Millennial discouraged about retirement? Discover how the vast majority of millionaires got there as regular savers, plus our new...

Episodes

Think your rental barely breaks even? We reveal the shocking math when this couple asks if they should sell their duplex to reclaim their time...

Episodes

Big changes are coming to 401(k)s! And, 595K hit 401(k) millionaire status in Q2 2025, but 41% cash out when changing jobs. Watch now to...

Subscribe to our free weekly newsletter by entering your email address below.