Regardless of where you are in your wealth-building journey, you can learn a lot from the world’s best investors—and we’re going to uncover a lot of those lessons today. But when most people look to who they think the best investors in the world are, they’re actually looking in the wrong place.

But that begs the question: Who are the best investors in the world?

You might think it’s the guys you see on social media—you know the ones. The day traders that are up to their eyeballs in risky investments, hoping they’ll pay off big time. But in fact, 85% of young traders lose money in their first year of options trading.

You might think it’s someone who picked one stock, is holding on with their diamond hands, and posts their gains in Wall Street Bets. But for every Roaring Kitty, there’s an Intel guy. If you know, you know what I’m talking about.

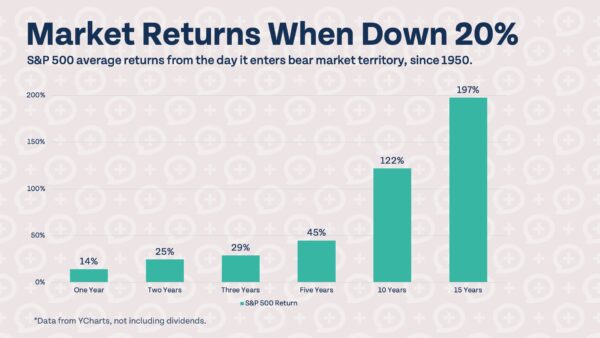

You might think it’s the hedge fund guys or the active fund managers on Wall Street going, “Sell, sell! Buy, buy, buy!” Considering they’re paid hundreds of thousands, if not millions of dollars, to do exactly that, that wouldn’t be a bad guess. And yet, nearly 90% of active large-cap funds underperformed compared to the S&P 500 over a 15-year window.

So who are the best investors in the world?

Drumroll… dead people.

Explain yourself.

Yep, you heard me right. But let me explain. This is well-worn territory in the financial space, and this whole idea goes back to a conversation on Bloomberg Radio between two men, Barry Ritholtz and James O’Shaughnessy. They referenced a study done by Fidelity, where Fidelity looked at its best-performing accounts, and they determined that those accounts belonged to people who were dead—or at least that was the claim.

It turns out that that study doesn’t actually exist. This was a story that these guys mentioned, where an employee told them about this phenomenon: that the best-performing investment accounts were the ones where people either forgot their login or forgot about their accounts entirely. But they took this logic one step further to say that if an investor had passed away, their account would remain untouched for a long time and thus perform better on average. Barry and James have actually clarified and made this distinction later on, but the original story still remains an urban legend in the wonderful world of finance.

Which makes sense—saying the best investors are dead investors has a lot more of that sexy sizzle to it than just saying “lazy investing.” And there’s actually decades of data that supports the actual theory behind this claim. 2024, for example, was a record-breaking stock market year, seeing several all-time highs and total annual returns over 25%. But the average private investor only earned about 16.5%, according to DALBAR’s annual report.

And a University of California study from way back found that high portfolio turnover reduced returns by about 6.5% annually due to trading costs and poor timing.

So why are people so bad at investing?

It can largely be boiled down to three key reasons. One of the biggest reasons people are bad at investing is loss aversion. A 2025 survey by eToro indicates that 56% of investors acknowledge that emotions and personal experiences influence their investment decisions. This emotional response to potential losses often leads investors to make irrational decisions—selling when they should hold, or waiting to enter when they should be buying.

The second major factor is market timing attempts. Many investors believe they can predict market movements and try to buy low and sell high. However, this strategy often backfires, as markets are inherently unpredictable—especially in the short term. Studies have consistently shown that investors who attempt to time the market typically underperform compared to those who maintain a steady long-term investment strategy.

In fact, if you were invested during the Great Recession and you had missed just the 10 best trading days during the period following the crash, you would have missed out on over 50% of the gains. Notably, seven of those 10 best days occurred within just two weeks of the 10 worst days, according to JP Morgan’s Asset Management 2023 Guide to the Markets. This highlights a key behavioral pitfall in attempting to time the market and avoid downturns. Many investors inadvertently miss the sharpest rebounds, which tend to cluster right around periods of extreme volatility—such as those seen during the depths of the Great Recession in March of 2009. This data underscores the importance of staying invested through market cycles, as the cost of being out of the market even briefly can be severe.

Finally, media frenzy plays a significant role in poor investment decisions. The 24/7 news cycle, social media, and lots of financial influencers create a constant stream of sensationalized market commentary and fear-mongering. This information overload can lead to reactive investing based on headlines, rather than staying the course and weathering the ups and downs of the market. When investors chase trending stocks or make decisions based on market noise rather than their long-term strategy, they often end up buying high and selling low—the exact opposite of what you want to do.

And so, as we look to learn from the best investors in the world, what should we take away? We know what not to do—but what should we do?

The answer is remarkably simple, and we have a little phrase to go along with it: set it and forget it.

This isn’t just a catchy phrase—it’s backed by an overwhelming consensus that time in the market beats timing the market. Historic data consistently shows that the longer a sound financial strategy remains untouched and allowed to work its magic, the better the outcome has typically been. This wisdom has been echoed by investing powerhouses and legends like Jack Bogle and Charlie Munger, who famously advised, “Don’t do something. Just stand there.”

Of course, there’s an important caveat. You need to make smart investment choices before you can forget about them. That’s the “set” part of “set it and forget it.” This is where proper research and strategic planning come into play. Once you’ve established your investment strategy, the key is to resist the urge to needlessly tinker with it.

This is particularly effective with certain types of investments that are specifically designed for long-term, hands-off management—such as an indexed target retirement fund. These funds automatically adjust their asset allocation as you approach retirement, requiring minimal intervention on your part. All you have to know is how much you want to save and when you want to retire. Once you’ve set it, you get to forget it.

This approach also allows you to take full advantage of another key component of long-term investing: always be buying, baby—or ABB. ABB is just an acronym for consistently investing at regular intervals over time, taking your emotions or market movements out of the equation. This kind of automated, emotion-free approach not only reduces the temptation to time the market but also helps you stay disciplined, focused, and on track toward your long-term goals. You aren’t always doing something—but your money is.

By following these principles of patient, disciplined investing, one day your money can work even harder than you do—with your back, your brain, or even your hands.

Remember, the best investors are the ones who let time and compound interest work their magic. They don’t constantly check their portfolios or make emotional decisions based on market fluctuations. They trust their strategy, stay the course, and let their investments grow steadily over time.

So take a page from the playbook of the world’s best investors: set up your investment strategy, automate your contributions, and then—here’s the hard part—step back and let your money do the hard work. Your future self will thank you as you keep building your great big beautiful tomorrow.