The SECURE Act 2.0 was recently signed into law as part of a spending package passed late last year that included aid for Ukraine, military spending, and banning TikTok on government devices, among many other changes. The portion of the legislation we will cover here represents less than 10% of the total text of the bill. We are focusing on the changes that will affect the most folks. Let’s start with the change everyone has been talking about: the ability to roll 529 assets to a Roth IRA tax-free.

Tax-free 529 to Roth rollovers

This is the change that caught the most attention because it sounds new and exciting, and it could be for parents worried about oversaving in their child’s 529 plan. However, for everyone else, this change is heavily restricted and has several big-time obstacles that will keep this opportunity limited. Rollovers count towards your Roth IRA contribution limit, and the beneficiary must have earned income, so there’s no opportunity to build extra Roth IRA assets other than what you’d be able to build through normal contributions or using the backdoor Roth conversion strategy.

The lifetime transfer limit to an individual’s Roth IRA is $35,000, and the 529 plan must be open for at least 15 years to be eligible for this special rollover. Funds can only be rolled into the 529 plan beneficiary’s Roth IRA, and it isn’t clear yet if changing the beneficiary on the 529 plan will reset the 15 year clock. Contributions (and growth on contributions) made in the last five years will not be eligible for rollover. There is no income limit to roll funds from a 529 to Roth IRA, as long as you meet all the other qualifications.

For parents concerned about overfunding a 529 plan and being penalized for withdrawing contributions not used for education, this change should offer some peace of mind knowing that some or much of that excess may be able to go to your child’s Roth IRA. It isn’t some secret strategy that everyone can use to build more Roth IRA assets, and funding a 529 plan still falls into Step 8 of the Financial Order of Operations. You can start rolling assets from a 529 plan to a Roth IRA as early as 2024.

Changes to required minimum distributions (RMDs)

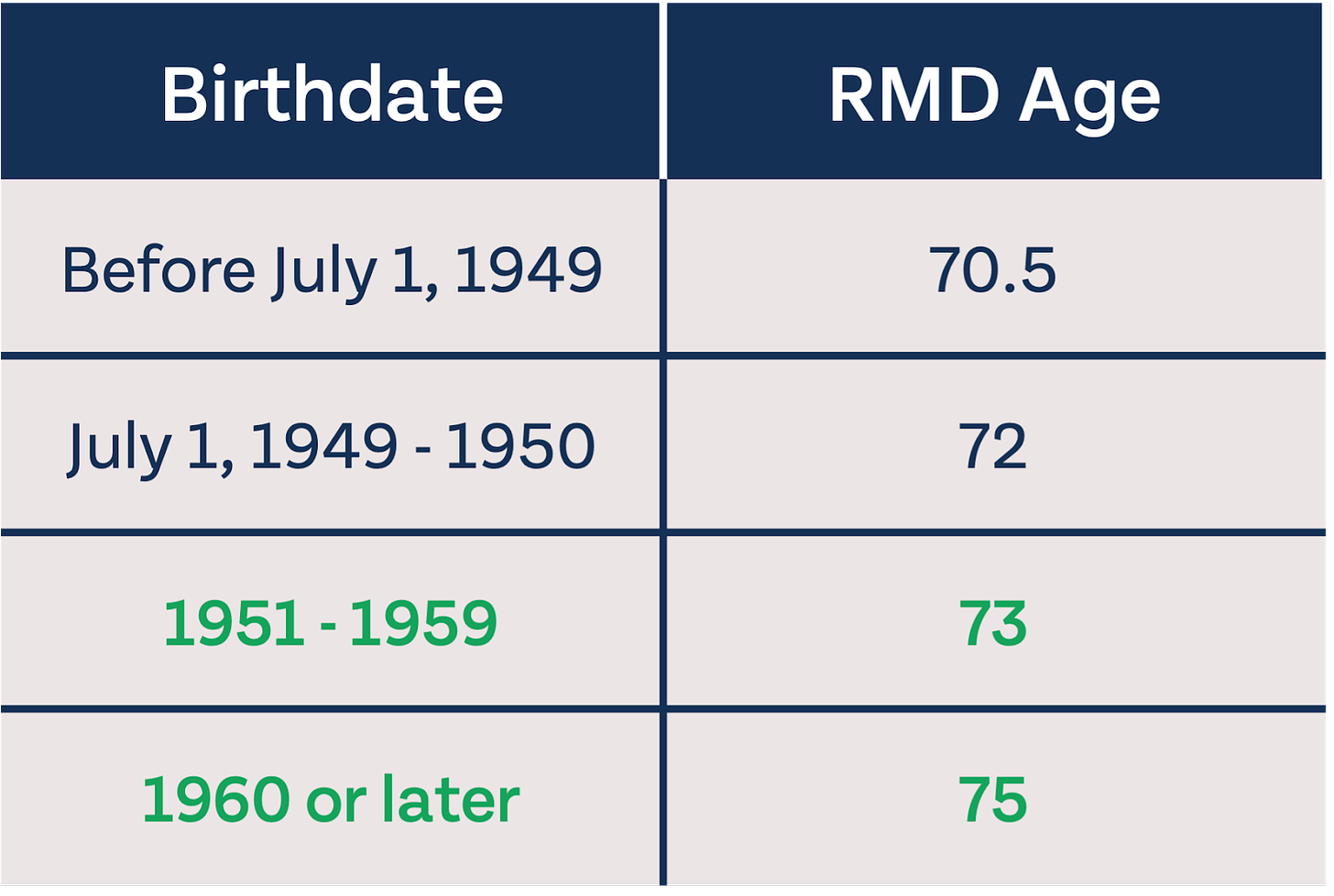

The biggest change to RMDs is the age you must start taking forced distributions increasing for many Americans. You can use the table below to determine your RMD age based on the current legislation.

It’s worth noting that RMD ages could change again, especially if you are further away from retirement. RMD ages increasing is great for anyone who has a significant amount of money in pre-tax accounts and the additional time maximizes long-term growth and planning opportunities. This change provides more time to convert pre-tax money to Roth going into retirement and could help keep Medicare premiums lower by keeping income down in those years that previously you would have been forced to take retirement distributions.

For those that forget to take RMDs or don’t take enough, your penalty is now reduced to 25% of the amount you didn’t take, and may be as low as 10% in some cases. It’s obviously better to take all of your RMDs and pay no penalties, but nobody’s perfect, and mistakes do happen.

In a welcome change for employer-sponsored plans, RMDs will be eliminated for employer Roth accounts including 457 plans, 401(k)s, 403(b)s, and TSPs starting in 2024. Pre-tax balances of employer plans will still be subject to RMDs. Before this change, many savers entering retirement would roll any employer-sponsored Roth dollars into Roth IRAs to avoid RMDs. This eliminates the need to roll Roth assets over to avoid RMDs, and means keeping employer-sponsored assets in your plan indefinitely becomes more viable.

Changes to catch-up contributions

The changes being implemented to catch-up contributions are a mixed bag, some great and some not so great, at least for high-income earners. To start with the good changes, IRA catch-up contributions (that you can begin in the year you turn 50) will be indexed to inflation next year instead of just a flat $1,000.

Catch-up contributions in employer-sponsored plans will be going up significantly in 2025, but only for those ages 60 to 63. Between those ages, you’ll be able to contribute the greater of $10,000 or 50% more than the standard catch-up contribution to your employer-sponsored plan. Here’s an example of how it would work, if limits were the same in 2025.

- Sandra, turning 50 in 2025, gets to contribute $22,500 to her 401(k) as elective salary deferrals and an additional $7,500 in catch-up contributions for a total of $30,000.

- Gertrude, turning 60 in 2025, gets to contribute the same $22,500; her catch up contribution is 50% greater than $7,500 or $10,000. It will be $11,250 (50% greater than the normal catch-up contribution). She can contribute a total of $33,750 to her 401(k).

They could have edited the bill and just changed it to 50% greater than the catch-up since it is highly unlikely that amount will ever be below $10,000. This part of the legislation was almost certainly written before we knew the catch-up was going up to $7,500 starting in 2023, so they probably put it in there just to cover their bases.

In not-so-great changes, at least for high-income earners ($145,000+ indexed to inflation), employer plan catch-up contributions must be Roth starting in 2024. There are some unique caveats to this rule, though, and it looks like those with over $145,000 in self-employment income instead of wages will still be able to choose to do a pre-tax catch-up contribution. There’s more gray area around switching employers; it appears that as long as you earn less than $145,000 in wages from your current employer in the previous year you can do pre-tax catch-up contributions. This means it might be possible to switch employers and earn over $145,000 total, but still do pre-tax catch-ups as long as you earned less than $145,000 from your current employer in the previous year.

To make matters more complicated, employers that don’t offer Roth options in their plans may not be able to offer catch-up contributions to any employees, if they have covered employees earning over $145,000. Here’s how that could look:

- Company X has a 401(k) plan with 50 eligible employees; 40 make under $145,000 and 10 make over $145,000. If they do not offer Roth contributions, none of their employees can make catch-up contributions. If they offer Roth and pre-tax options, those under the limit can choose either option for their catch-up contribution, but those over must do Roth.

- Company Y has a 401(k) plan with 50 eligible employees, all making under $145,000. All employees can make catch-up contributions regardless of whether or not Company Y offers a Roth option, and may choose to make pre-tax or Roth catch-up contributions.

Hopefully this won’t be much of an issue as more and more employers are offering Roth options in their plans. However, if you are one of the unlucky ones age 50+ in a plan without a Roth option, it could be worth keeping an eye on. It’s possible that you may not be able to make catch-up contributions at all starting in 2024. If you are in a plan without a Roth option, now is the time to advocate for a change. It’s usually very easy for an employer to offer Roth contributions in their plan, and if it isn’t easy, they can look for a new plan provider that makes it easy.

Changes to employer plans

Currently, employers can choose to automatically enroll employees in retirement plans when they become eligible for participation, unless the employee opts out. Starting in 2025, employers MUST automatically enroll plan participants when they become eligible (but participants can still choose to opt-out). Salary deferral upon automatic enrollment must start between 3% to 10% and increase 1% per year, to 10% to 15%. Again, employees can still opt-out of automatic enrollment, but employers must enroll employees who do not opt-out.

In a change intended to help employees prioritizing paying off student loans over getting their employer match, employers can now “match” an employee’s student loan payments by making contributions to their 401(k), starting in 2024.

Employer retirement plan contributions can also be Roth, if the employer offers the option to choose. If an employee elects to receive Roth employer contributions, they will pay the tax and contributions will be vested immediately.

Roth contributions will be allowed in SEP and SIMPLE IRAs starting this year, and SIMPLE IRA and SIMPLE 401(k) contribution limits will be going up by 10%, including catch-up contributions, starting in 2024.

Other changes

In great news for anyone with a disability now or that may become disabled in the future, anyone who becomes disabled before age 46 will be able to utilize an ABLE account starting in 2026. The current age is 26.

In great news for the insurance industry, but not-so-great news for many other folks, it is now easier to put annuities in retirement plans. An actuarial test that keeps more complex annuities out of retirement plans has been eliminated. This could be a positive for some retirees since interest rates are higher now, but we worry that some savers may end up with products in their retirement plans that are less than optimal.

QCD limits will be indexed to inflation starting this year, instead of just a flat $100,000. Unlike the RMD age, the QCD age has not gone up and is still 70.5.

Several FinTech start-ups offer paid services to help you find “lost money” in retirement accounts that have been lost or forgotten. They may no longer be needed next year, as the government is creating their own national database where you can search for any retirement accounts you may have forgotten about or left behind.

One of the more administratively complex changes is the end of the saver’s credit and beginning of the saver’s match, which doesn’t begin until 2027. Under the plan, those that qualify for the saver’s tax credit (phases out between income of $20,500 – $35,500 single and $41,000 – $71,000 married) will receive it as a government match in their retirement account instead of a tax credit. This government match must be repaid if it is withdrawn before retirement.

There are many other minor changes I wasn’t able to get to, so I encourage you to check out a summary of all changes in SECURE 2.0 if you are curious about a change I didn’t cover. We also broke down the legislation and answered questions in a recent Q&A episode. While nothing in the SECURE Act 2.0 is groundbreaking or will make or break your retirement, it is important to be aware of changes that could affect you and any planning opportunities that may be available.