What if you could perfectly time the stock market?

Actively managed investments can make sense in certain market sectors, but broad market indexes largely outperform actively managed funds. In addition to the difficulty of picking stocks that consistently beat the market, active managers must overcome higher expenses and fees and generating more taxable income from trading. Most active fund managers cannot accomplish these feats consistently over longer periods of time. The headwind to beat the market while charging higher fees is too much to overcome.

Your timing in and out of investments is key to beating the market. Even when you pick the “right” investments, if your timing is off (if you buy at the top of a bull market), you will find it very difficult to beat the market. The alternative to timing the market is just to invest consistently over time: no matter what the market is doing, you invest, and don’t try to time the highs and lows. You accept that timing the market is only possible through a combination of skill and luck (mostly luck) that you do not possess, and accept market returns. But what if you could perfectly time the market with incredible precision?

Can you time the market?

A common question we get from viewers and listeners of the show is whether or not they should stop investing and pull everything out of the market, or how long they should wait to invest. Their question usually looks something like this: “I believe the market is overvalued and will go down at any moment, and I want to know if I should pull everything out now or how long I should wait before investing.” They believe in keeping their money on the sidelines, for at least some length of time, because the market is too high (in their eyes).

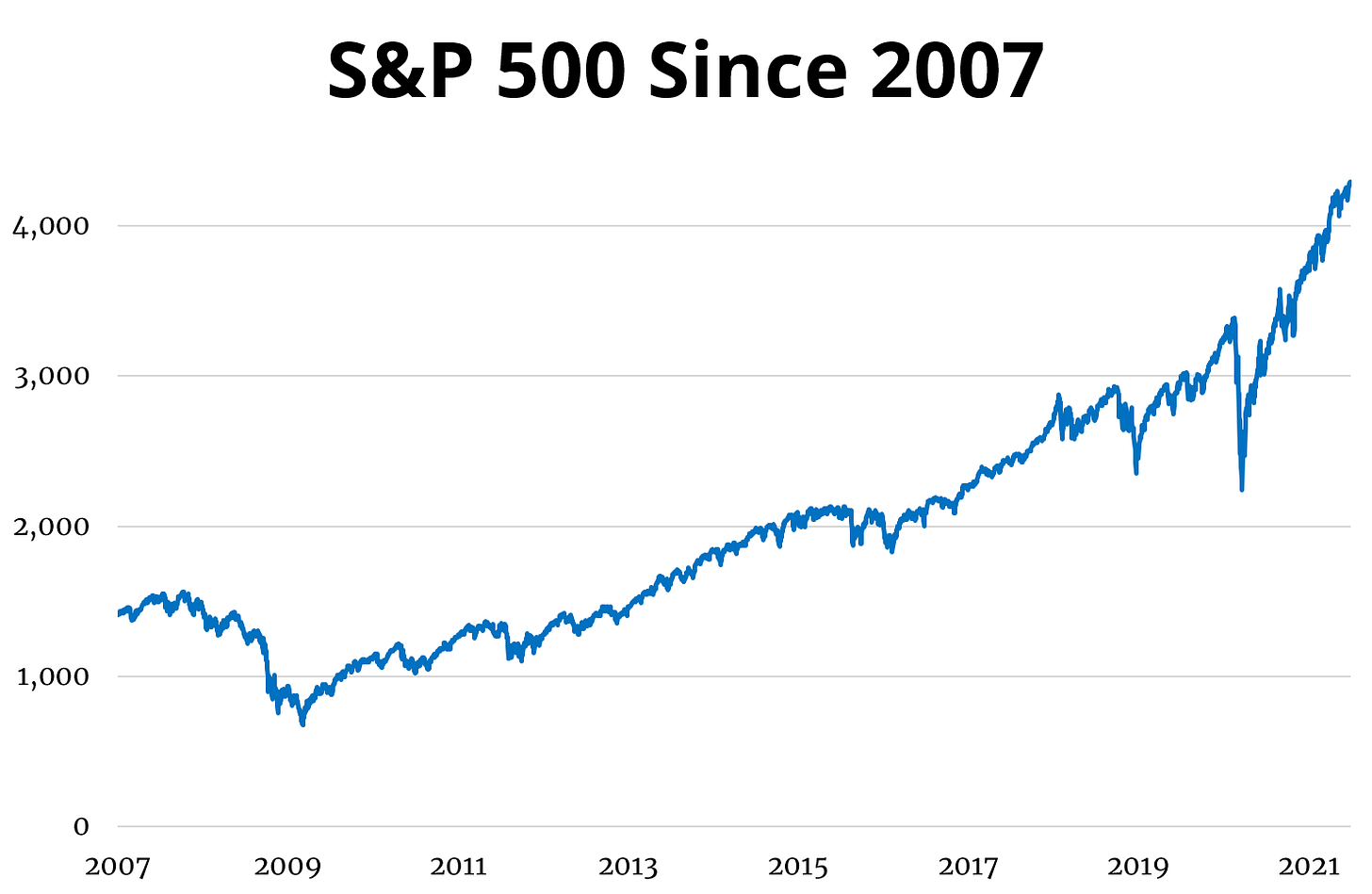

Over the last 12 years, throughout one of the longest bull markets in history (and a brief bear market, followed by another bull market),† the market was frequently believed to be overvalued by investors and the media. Check out the following chart of the S&P 500’s performance since 2007.

In 2014, when the index hit 2,000 for the first time, many thought it was overvalued. At the time we saw headlines like this, from 2011: “Time to Say It: Double Dip Recession May Be Happening,” and in 2014, “Economist Who Predicted Busted Housing Bubble Says Another Recession Is Coming.” Leading up to 2019, when the S&P 500 reached 3,000 for the first time, we saw headlines like “Why Soaring Assets and Low Unemployment Mean It’s Time to Start Worrying” and “6 Reasons Why Stocks Are Still Overvalued — Even After This Recent Correction.” Even more recently, we saw headlines last year during the market recovery like “Wall Street Thinks a Double-Dip Recession Is More Likely Than V-Shaped Recovery.”

What if you could time the market?

The above headlines show how bad the media is at predicting which direction the market will move next, and even economists are bad at predicting recessions. You might not be convinced, though. This time feels different. “Surely the market must be reaching a peak,” you think, “and if I pull everything out now and wait for the bottom to reinvest, I can avoid the imminent downturn.”

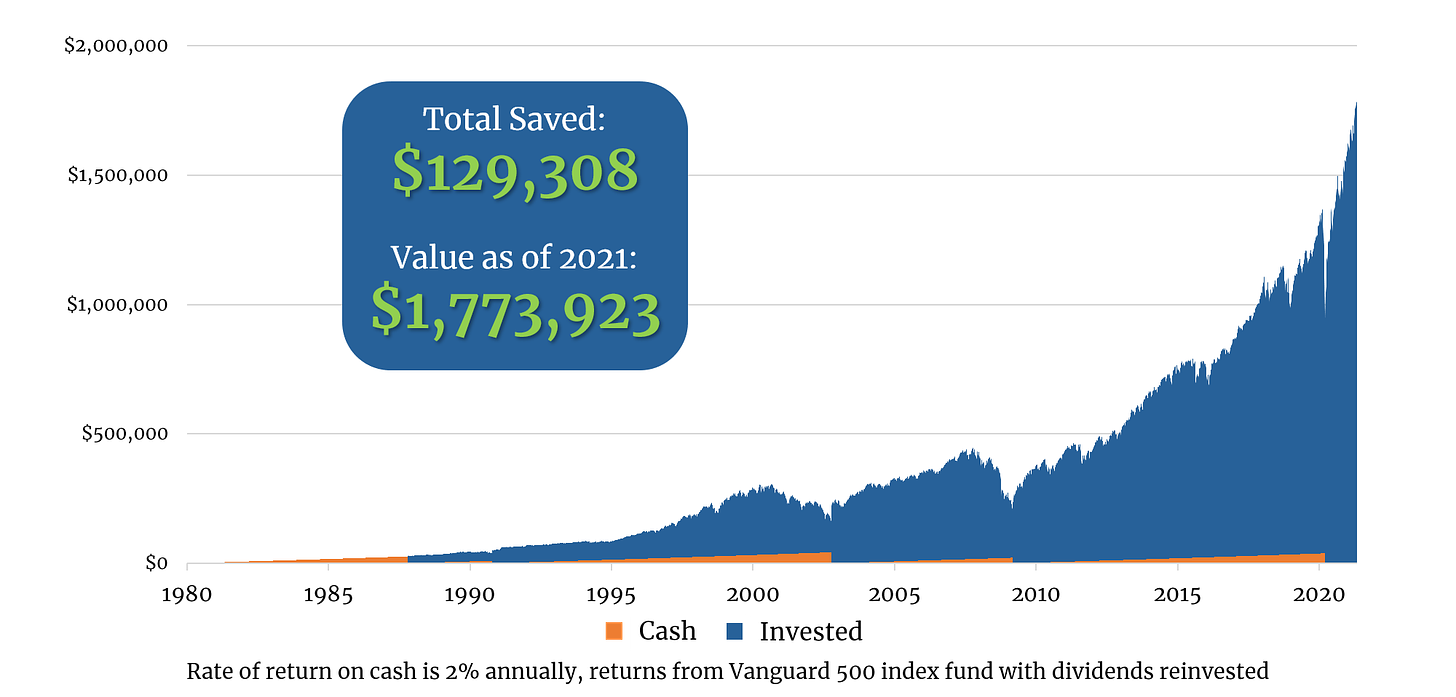

I’ll go ahead and give you the benefit of the doubt and assume that you are the best market timer the world has ever seen. You are better than economists, the media, and financial advisors at predicting the direction of the market. Let’s assume you’ve been the best investor for over 40 years; you started saving in 1980, making $12,513, the average income in 1980, and were able to save 25% of your gross income, or about $261 a month. To keep it simple we’ll say you never got a raise and just saved the same amount every month no matter what.

Since you are the world’s best market timer, you don’t invest every month. You diligently save until the absolute best time to invest, when the market has reached a bottom. You invest your savings in the market on Black Monday, October 17, 1987, again on October 11, 1990, in the midst of the Kuwait War, at the bottom of the Dot Com Bubble on October 9, 2002, during the housing crisis on March 9, 2009, and in the middle of the Covid Crash on March 23, 2020. Here’s how you would have performed.

Unsurprisingly, you end up doing pretty well for yourself. Over 40+ years you save and invest $129,308 total, and in 2021 your savings will have grown into $1,773,923 by investing at the bottom of the market on five separate occasions (1987, 1990, 2002, 2009, and 2020). Your cash stays on the sidelines until you find the perfect time to invest, but once you are invested you keep your money in the market.

What if you invest every month?

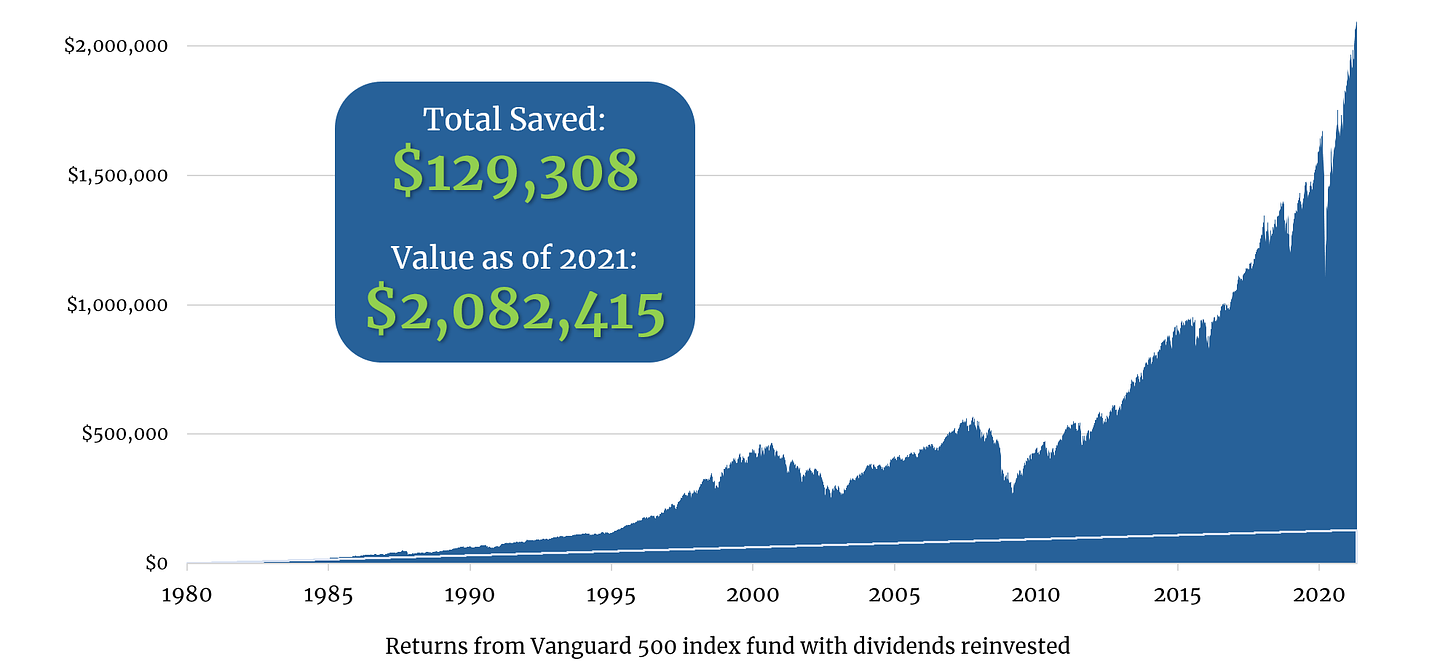

It is impossible to successfully time the bottom of every market, and many choose instead to invest consistently over time, no matter whether the market is up or down. How does this strategy compare to someone who can time the market perfectly?

We’ll keep all of our assumptions the same. Someone started saving in 1980, making $12,513 and saving 25%, or $261 a month, and never increased the amount they saved. The only difference is that instead of saving and waiting for a crash, they invest in the market every single month, no matter what. No matter how expensive or scary the stock market looks, their $261 is invested into the S&P 500. Here’s how they performed over the last 40 years.

The investor who doesn’t attempt to time the market at all, and invests when the market is sky-high, at the bottom, and everything in-between, ends up with over $300,000 more invested by 2021. How is this possible?

It’s about time in the market.

The old cliché about timing the stock market has some truth to it. The length of time you are invested in the market is more important than when you time your investments. The consistent investor beats the perfect market timer because they put their money to work years earlier, while the market timer was waiting on the sidelines for the perfect opportunity to buy.

We often hear from investors worried about putting money in the market at the wrong time because they believe a downturn is right around the corner (many pessimistic investors and those that pay more attention to the media might believe the next downturn is always right around the corner). You won’t know when the perfect time to invest is until the opportunity is already gone. The amazing thing is that by just investing early and consistently over time, you could beat even a perfect market timer who waits years to start investing. Push yourself to start investing 25% of your gross income as soon as possible, no matter which direction you think the market is headed in, as history shows the earlier you start, the better.

†The Covid-induced crash of February and March of 2020 was quickly followed by another bull market that began in April. While our long bull market ended in 2020, the current market does feel in many ways like a continuation of the earlier after just a brief interruption.