Housing prices have been skyrocketing across the country with no end in sight. Are we in a real estate bubble ready to burst or is this only the beginning?

If you’ve been in the market for a home in the past year, or have paid any attention to the real estate market, you know that home prices across the country are skyrocketing. The market is great for sellers. To remain competitive, many buyers are forced to waive inspections and appraisals, offer all cash, and come in above listing price. Everyone in the market is anxious; sellers aren’t sure if now is the time to sell or if they should wait, and if they do sell, it may not be easy to purchase a new home. Prospective buyers are contemplating whether or not to buy in a red-hot real estate market. Those who choose to buy a home are concerned the market is at a peak and their home will decline in value, and those staying on the sidelines risk prices going up even more over the coming months and years (not to mention historically low interest rates potentially increasing). Buyer or seller, everyone in the market wants to know: are we in a real estate bubble that is about to burst or is this recent increase in prices just the beginning?

Why are prices going up?

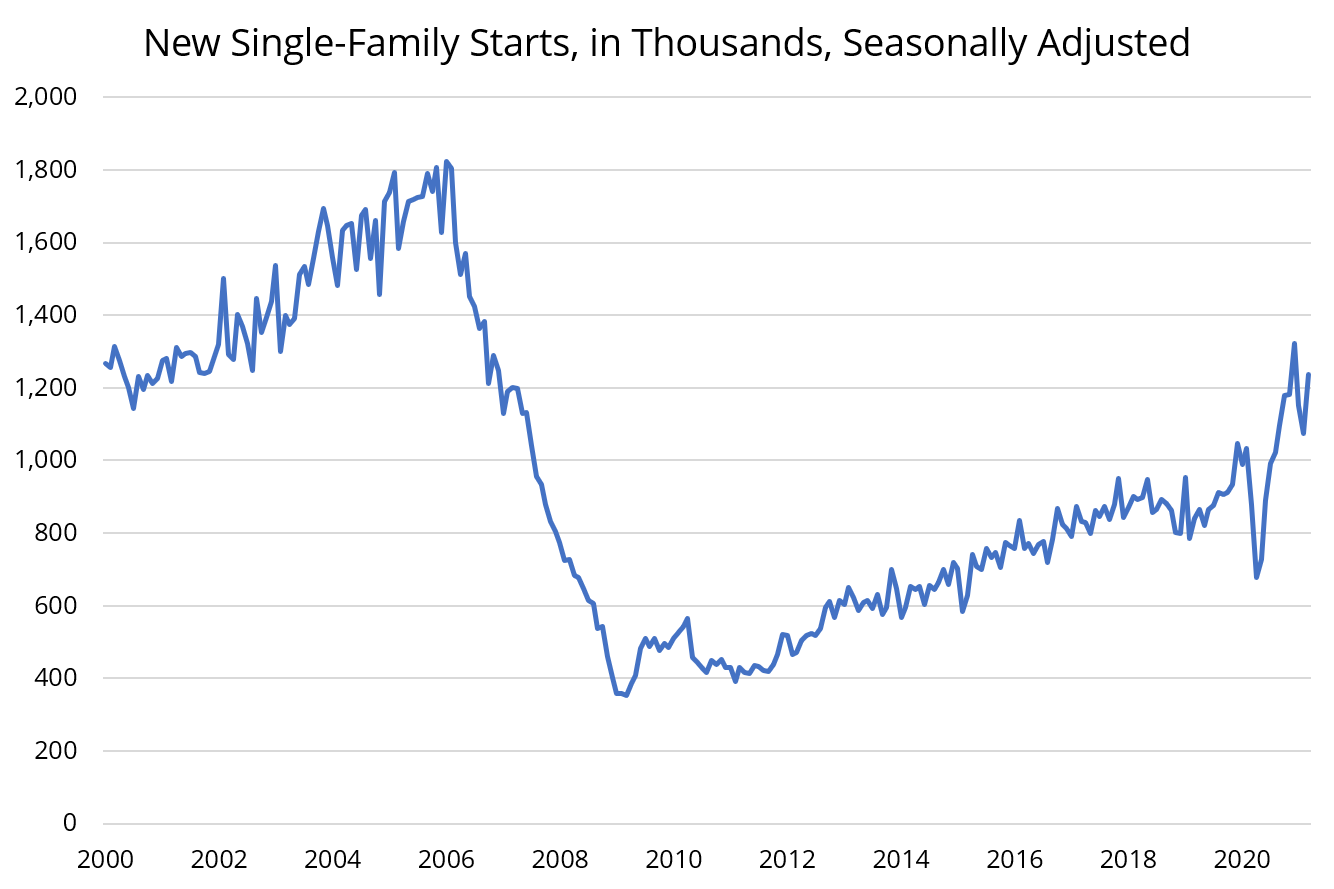

Home prices were increasing nationwide before Covid-19 rocked our world and economy, but the recent sharp increase in prices has been likely caused by the pandemic. Below, FRED data shows how steeply new housing starts declined in the spring of last year, hitting a low in April before rebounding strongly later in the year.

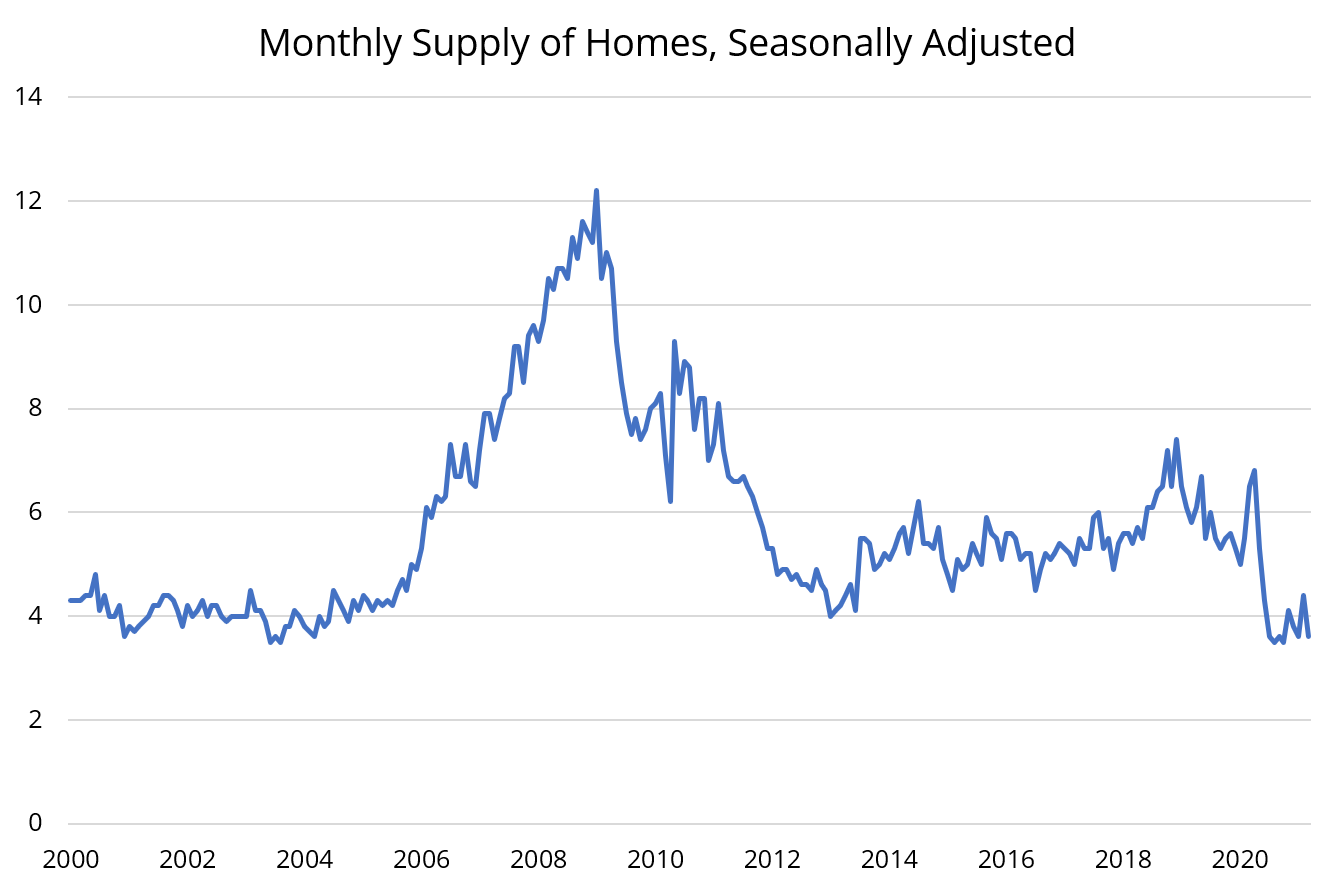

Unfortunately the rebound we’ve seen in new home construction hasn’t yet spilled over into the amount of homes available. Data below, again from FRED, shows how many months the current supply of homes available would last if no additional homes were built.

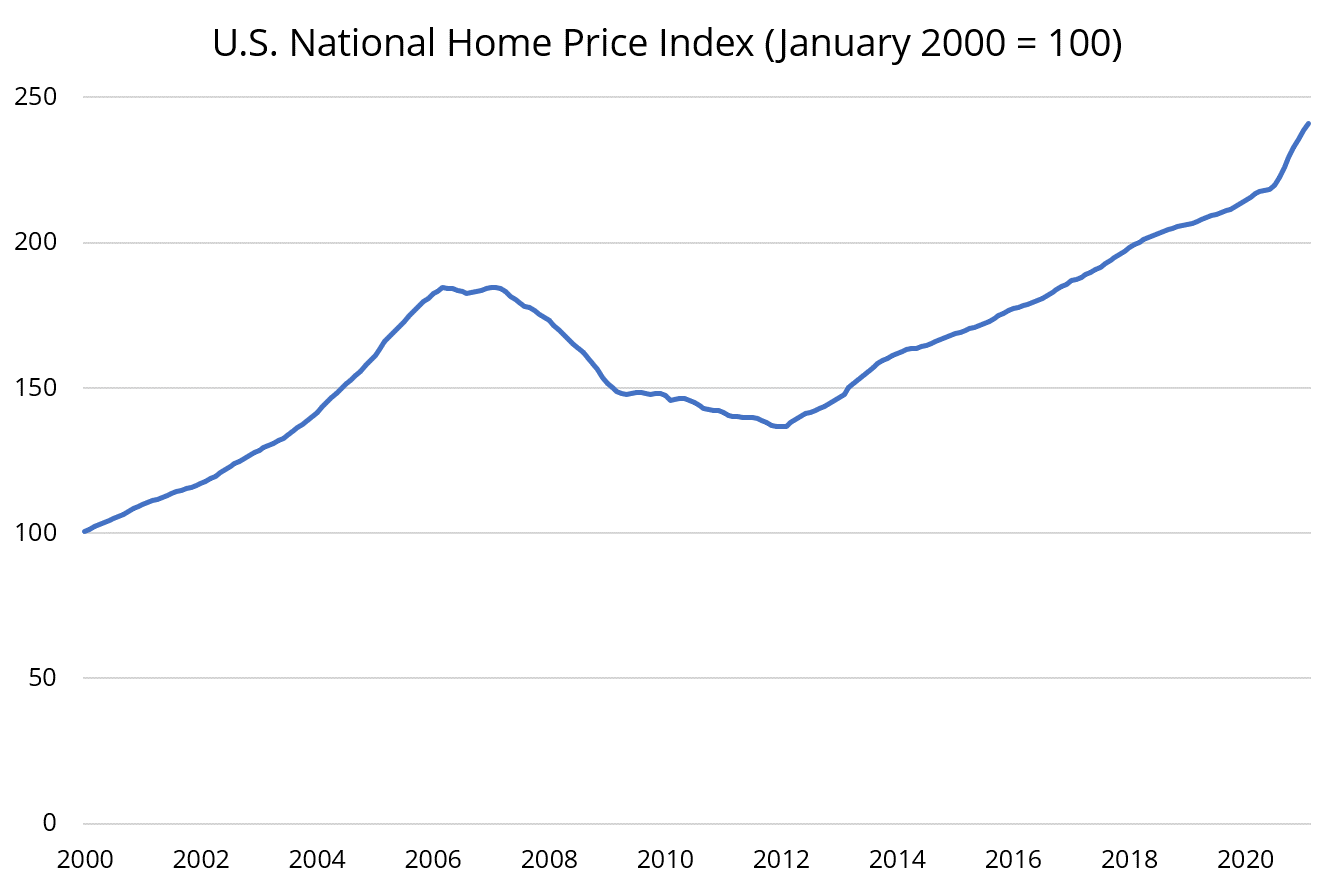

Right now the supply of homes is near an all-time low, due to historically low interest rates, pent up demand, a lumber shortage, and other factors, which is why prices are at all-time highs. Interestingly enough, the amount of homes available didn’t really tighten up until the summer of last year. Supply began declining in May, and reached a low in August. Unlike new home starts, the amount of homes available has not rebounded at all from its low. We can see the drop in supply reflected in seasonally adjusted U.S. home prices. (The index begins at a base of 100 on January 1 of 2000.)

Like the decrease in supply, the sharp increase in home prices didn’t begin until summer of last year. In the spring, sellers and buyers were more apt to staying in place. During the initial stay-at-home orders and lockdowns, moving to a new home probably wasn’t the first thing on many people’s minds. As the summer dragged on, working from home for the long-term became a reality for many Americans. Of those whose job can be done from home, over half said they would want to continue working from home either all of the time or most of the time when the pandemic is over. With working from home permanently now a real possibility, those with the option to move took a closer look at where they lived. The increased appetite for housing starting last summer was not met with a strong enough increase in supply, and home prices have continued to soar across the country.

Are we in a real estate bubble?

The current real estate market may feel like a bubble. Home prices are skyrocketing and buyers are acting in ways that don’t seem rational (forgoing inspections, offering above listing). However, it is unknown if the rapid rise will also result in a rapid decrease in prices. Due to inflationary pressure of goods and services and the population changes impacting supply and demand of specific markets, a better word for what we’re seeing in real estate might be unsustainable. As home prices go up, construction of new homes is further incentivized. New single-family starts in the U.S. are already higher than we’d expect them to be had the pandemic never happened, and will likely continue to increase as the supply of homes remains low.

As the supply increases to meet demand, prices should stabilize. However, they could continue to rise; builders might not want to reach the number of new home starts seen in 2006 and 2007 for obvious reasons, and could be wary of flooding the market (after the crash the housing market was oversaturated with inventory, and builders don’t want to be left holding the bag again if the market drops). We might see an increase in the amount of first-time home buyers if a proposed home buyer tax credit becomes reality. There is an unknown amount of pent up demand from those who postponed relocating or buying their first home because of the pandemic; that demand may be satisfied in the coming months or it may last for years. All of these factors combined – or even just one of them – could continue to push home prices higher.

While the sharp increase in home prices has led to some warranted concern about whether or not we are in a bubble, there are few other signs that something is amiss. Home buyers remain very qualified, based on credit score; leading up to the housing crisis of the 2000s, roughly half of all home buyers had a credit score under 720. Now, less than 20% of home buyers have a credit score under 720. In fact, while mortgage originations have gone up due to historically low interest rates, buyers are even more qualified than those of just several years ago. Delinquency on outstanding debt has dropped, meaning that Americans, for the most part, aren’t having trouble making their monthly mortgage payment (this is not to say that no one is struggling). Home prices may be high right now, and they very well could slow down, especially if interest rates go up, but there is currently little evidence of a bubble like we saw 15 years ago in the housing market.

The decision to buy a home is often not based on the current real estate environment, but on a personal need: shelter for your family. No matter where the housing market goes from here, thinking for the long-term and following a few key guidelines can help make the decision to buy a home (or rent) that much easier.

How to buy a home

Buying a home in a seller’s market can be very discouraging, especially for first-time home buyers. Purchasing that first home feels next to impossible when home prices are going up faster than you can save and you are competing with out-of-state buyers offering all cash. If you are buying your first home, we have a few guidelines to follow to make the experience easier and less stressful.

1. Put at least 3% to 5% down.

Putting 20% down is ideal, not only to avoid PMI (private mortgage insurance, typically required when putting less than 20% down) but also to protect yourself in case your house goes down in value. For first-time home buyers, though, 20% may not be feasible without saving for years. By the time young home buyers save 20%, their future home might have increased in value by tens or even hundreds of thousands of dollars. We give grace with your initial down payment – aim to put down at least 3% to 5% – but be prepared to put down 20% on any subsequent primary homes.

2. Don’t buy if you are planning on moving in the next few years.

3. Keep total housing costs below 25% of your gross income.

To avoid buying more home than you can afford, aim to keep your total housing expenditures below 25% of your gross income. Buying an affordable home helps ensure there’s enough left over for living expenses, saving, and whatever else life throws at you. If you live in a high cost-of-living area, spending 25% or less of your gross income on housing may not be realistic, and that’s okay. If you do need to spend more than 25% on housing, though, you will need to cut back in other areas (and make sure you are aiming to save 20% to 25% of your gross income for retirement).

4. Don’t be afraid to rent.

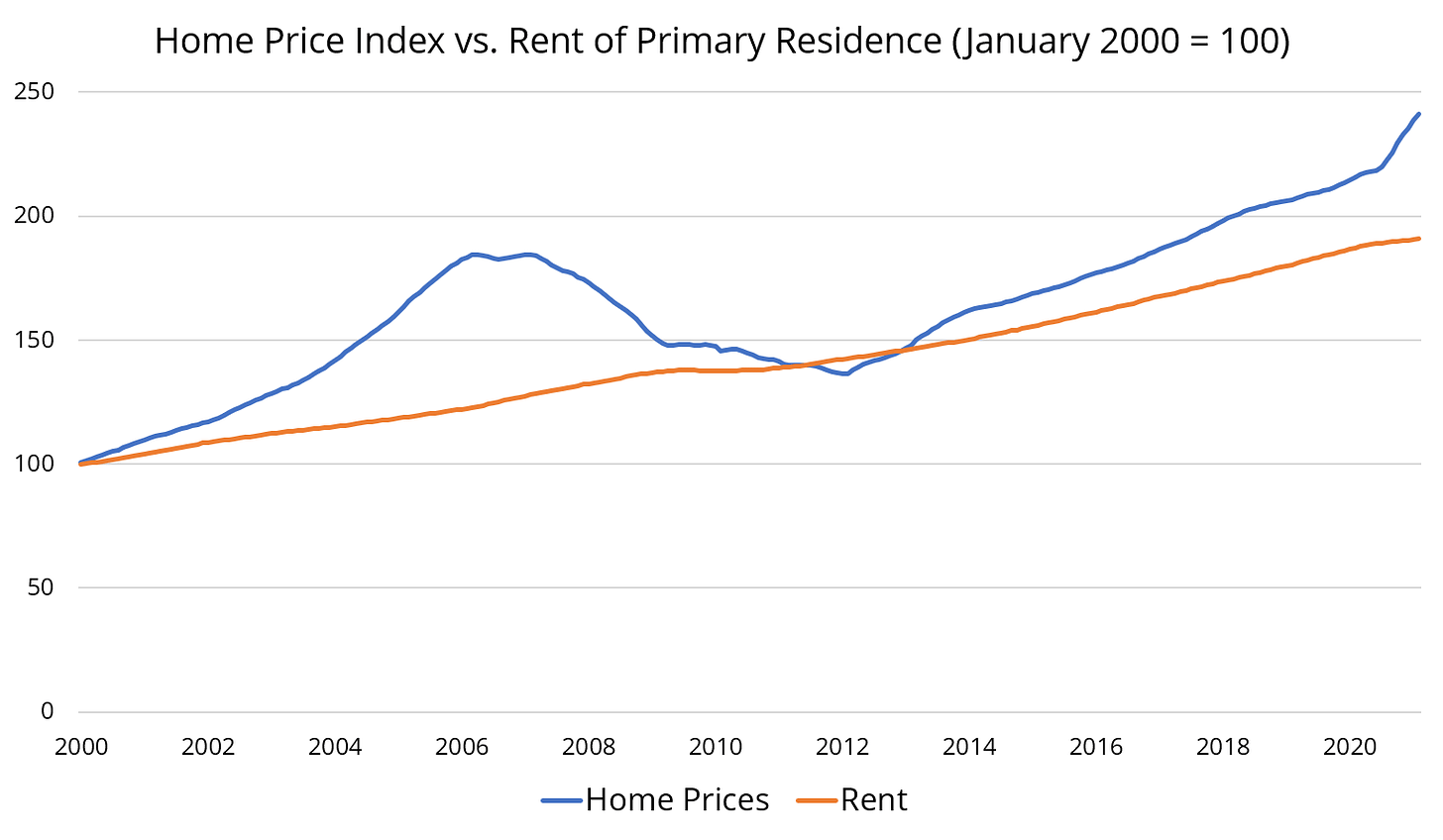

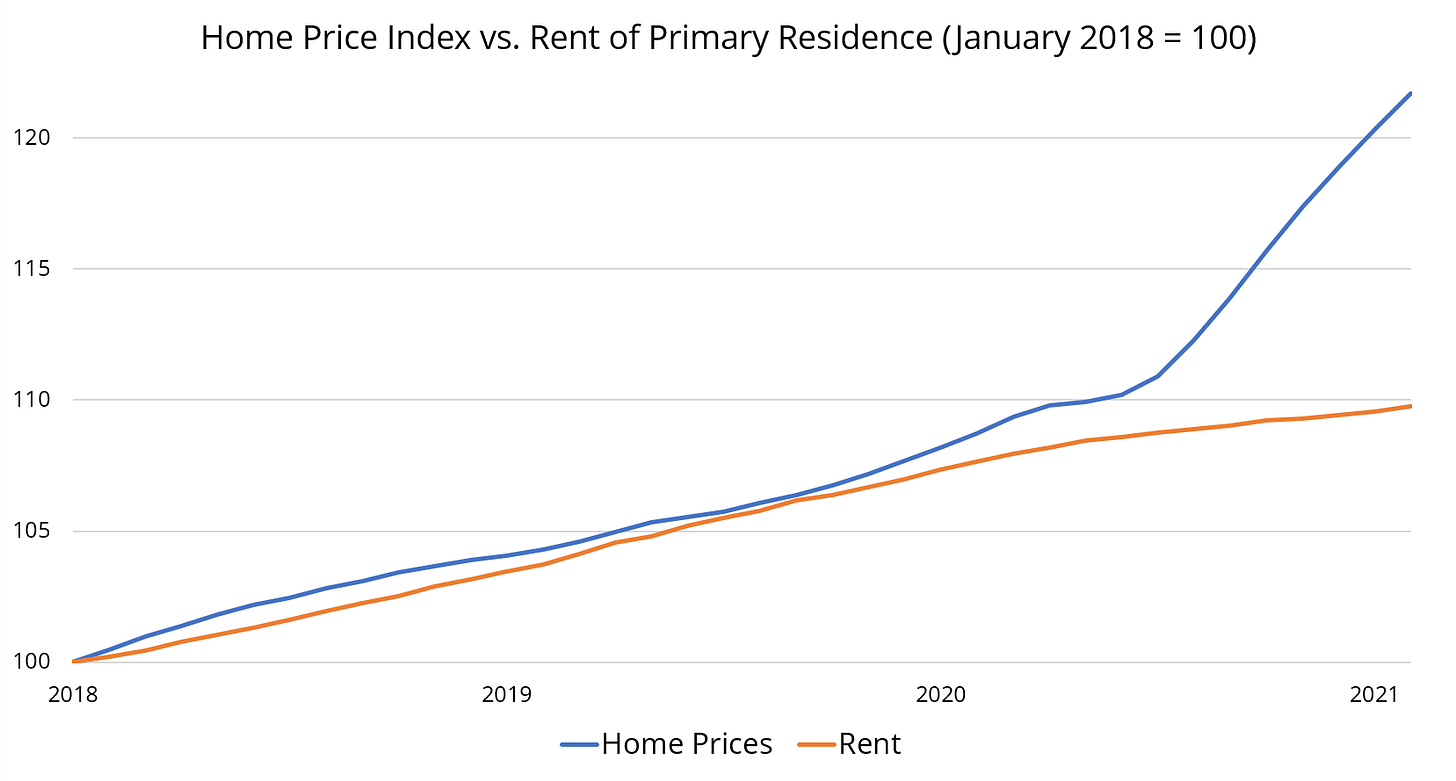

Rent and home costs typically go up together, although rents are less volatile. Over the past year, though, home prices have sharply increased while rent prices have flattened. Zooming in on the last three years below shows this sharp divergence.

That’s the picture nationally; in bigger cities the trend is even more pronounced. Rent is going down and home prices are skyrocketing. If you aren’t sure how long you’ll be in an area, are still saving up for a down payment, or simply can’t afford a house, renting is not a bad option right now.

What if I’m not a first-time home buyer?

If you already own a home and are looking to move, you should have an easier go of it than first-time home buyers on the outside looking in. Aim to put down 20% on any subsequent home purchase (this shouldn’t be too difficult if your home has been appreciating and you’ve lived in it for five to seven years) and follow the other home buying rules above (plan to live in the new home at least five to seven years and keep housing costs below 25% of your gross income). Even if you are selling your home and looking to buy again, don’t be afraid of renting temporarily to get to know an area.

The housing market is very hot right now, and uncertainty and anxiety abounds for both buyers and sellers. It’s impossible to know where the market is headed; it may continue up, go down, or flatten out. If you stick to our housing rules and approach home buying with a long-term mindset instead of worrying about what the next few months or years will bring, it will be easier to focus on what really matters, which is finding the perfect home for yourself or your family.