Investing when the market is going down doesn’t feel good. In periods when the market is steadily declining, you probably don’t look forward to logging into your investment accounts. It just isn’t fun to feel like your contributions aren’t working for you (and that investing is actually working against you, when your accounts are going down in value). We often say that dollars invested when the market is down will be some of the most powerful dollars you ever invest, which is true, but doesn’t always make prolonged bear markets more palatable. Although it doesn’t feel like it, you can make a lot of money investing when the market is down and flat.

Why you should be optimistic about the future

We are often asked about worst-case stock market scenarios. What if the stock market doesn’t make any money for the next decade? What if we experience another Great Depression? We know that the S&P 500 has annualized nearly 12% per year since 1950, but if you aren’t a natural optimist, it can be hard to imagine the next 10, 20, or 30 years will be just as good.

Part of this pessimism about the future comes from a survivorship bias. We don’t think past events, economic or political, were that bad because we made it through to the other side. Imagine the Cold War when nuclear attacks on U.S. soil were a very real possibility and children participated in “duck-and-cover” drills in school. The 1970s and 1980s were a very scary time economically with the oil crisis and out-of-control inflation. Although I was in grade school, I still remember the day of September 11th, 2001 extremely vividly. I’m not sure many were optimistic about the future in the days following the attacks. Even more recently, we experienced a global pandemic. I remember how afraid we all were in those weeks and months in the spring of 2020 because we just didn’t know what to expect.

The future seems scary because of the unknowns. We don’t know what hardships we will experience in the future, so how great (or terrible) the future will be is limited only by the bounds of your imagination. We don’t know what the next 10 years, 20 years, or 30 years will look like. But we do know we’ve experienced difficult times in the past and we will experience hard times in the future. The progress of humans and the United States has not only not been slowed, it has accelerated. There is great reason for optimism about the future, with the accelerating rate of technological innovation in almost every sector of our lives and the economy being near the top of the list.

What if I invest during a “lost decade”?

So what if there’s reason to be optimistic about the future of our world and the economy? That doesn’t mean we will never experience another Great Depression, or a “lost decade” of stock investing. Here’s exactly how you can make money even when markets are flat: by investing consistently through good times and bad.

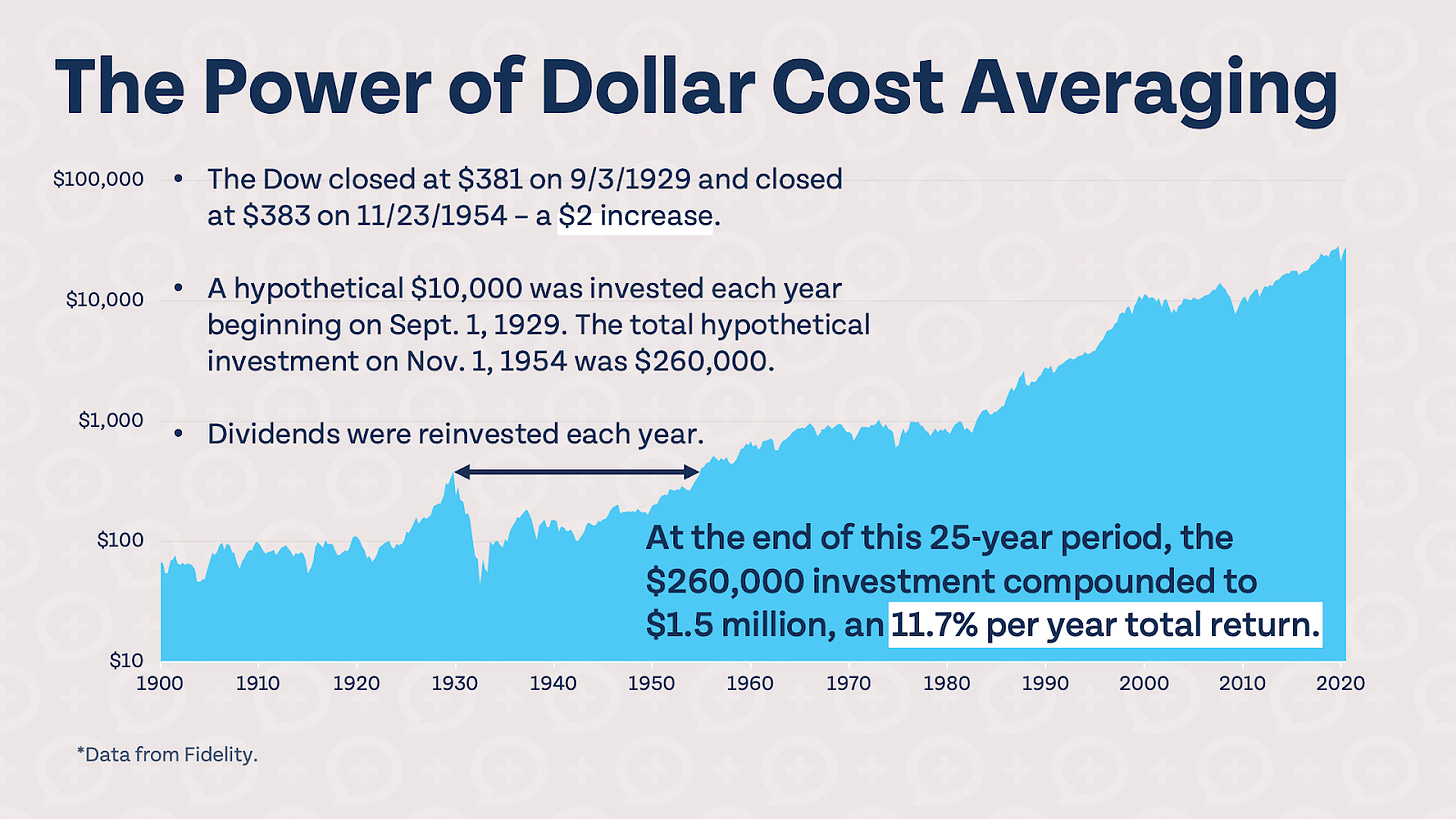

The following case study, using data from Fidelity, shows the power of dollar cost averaging during the 25-year period following the Great Depression.

The Dow was flat for 25 years. That sounds like a horrible time to be an investor! But if you were consistently investing in the market every year, you would have actually made nearly 12% per year – even though overall, the market made nothing from the beginning of the period to the end of the period.

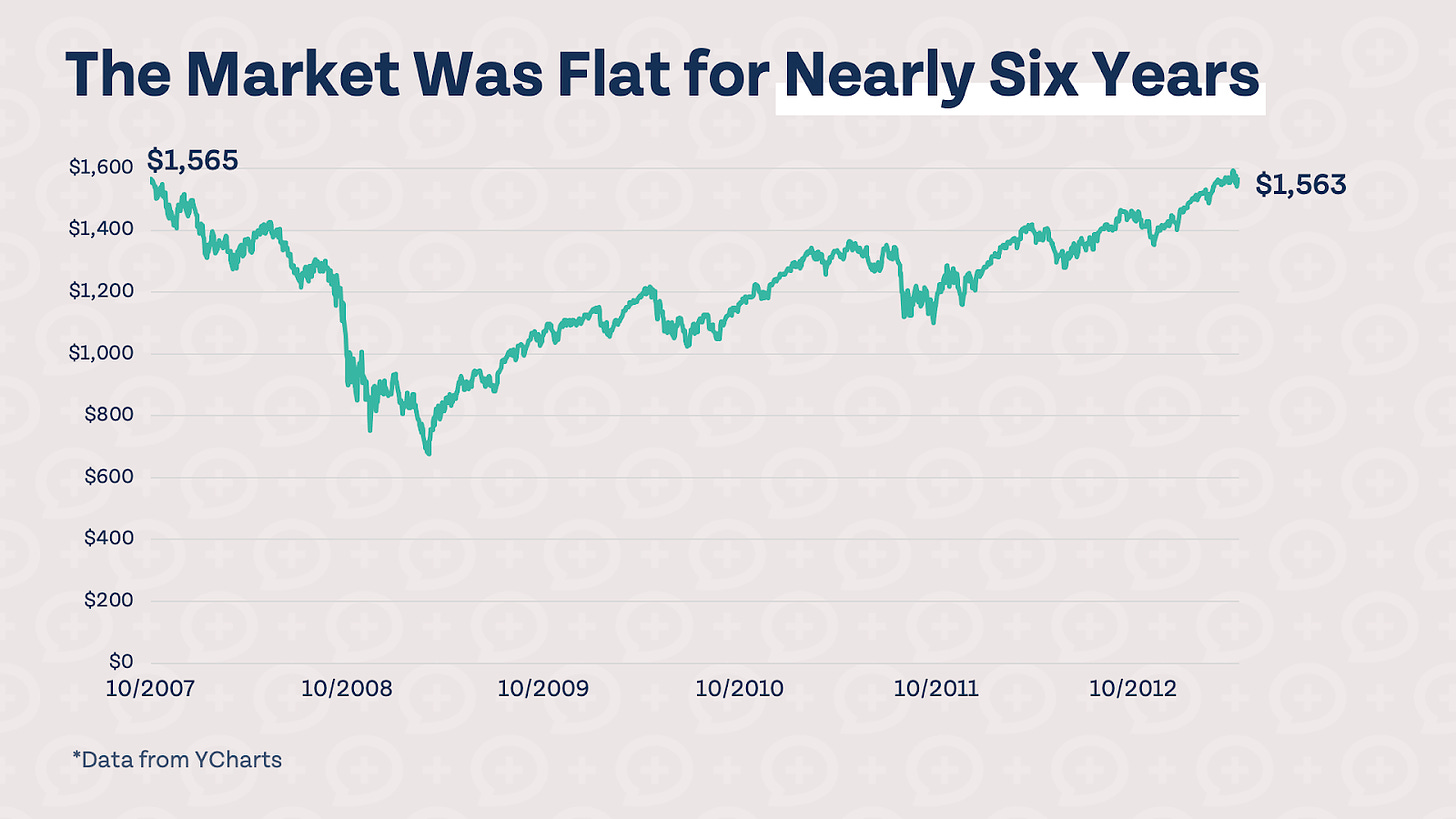

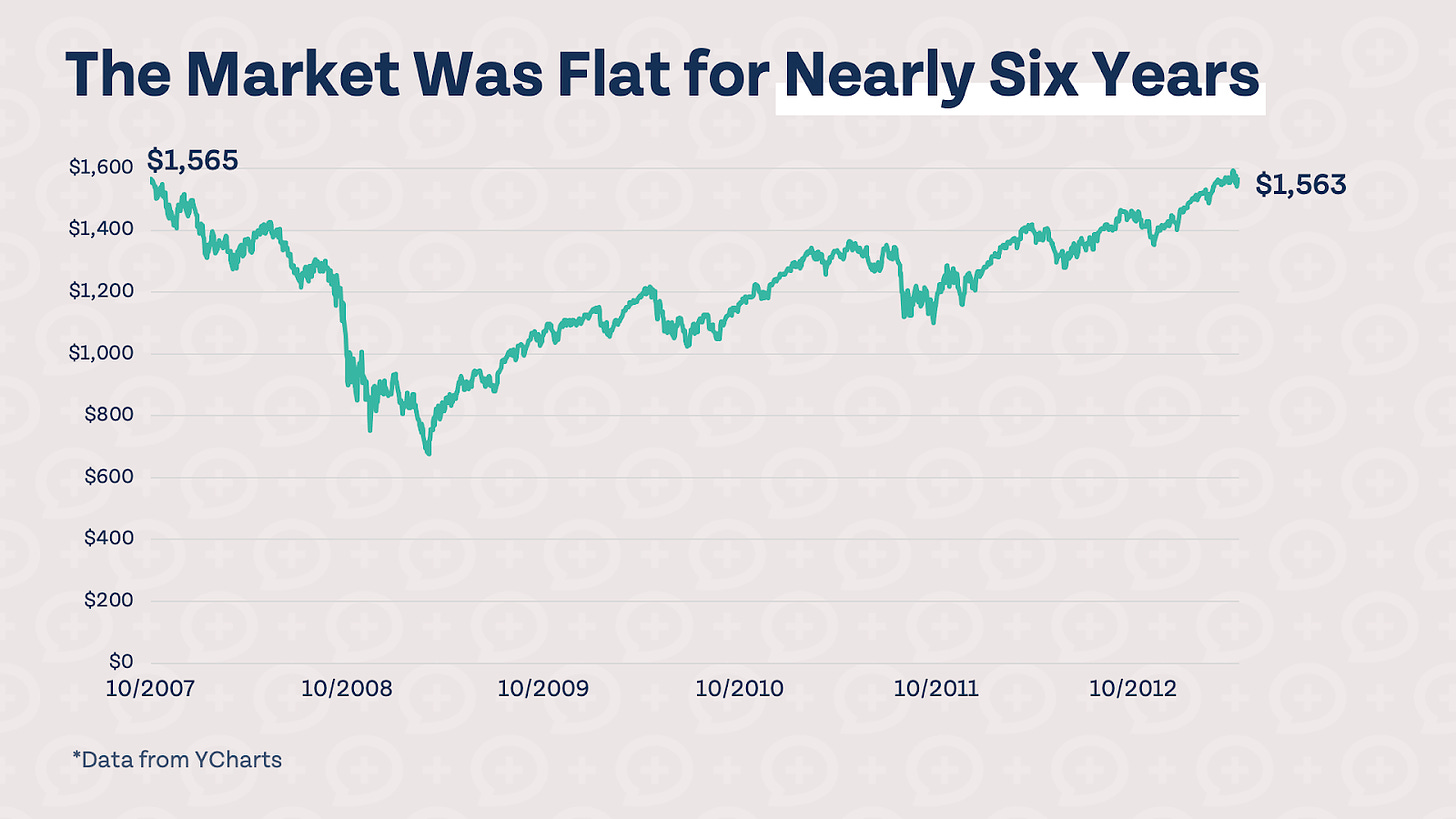

For a much more recent example, check out the chart below showing the S&P 500 from October 9th, 2007 to April 22nd, 2013.

The market was flat for five and a half years. If you started investing in 2007 and saw the market at the same level it was at in 2013, you would probably be tempted to give up entirely and put your money in a savings account.

If you invested consistently during this period, though, you would have made money even though the market did not. Someone investing $500 per month during this time would invest a total of $33,000 over five and a half years. On April 22nd, 2013, even though the S&P 500 was down from where it was when they first started investing, their total $33,000 invested would be worth $46,327. That works out to an annualized return of 11.9% over those five and a half years. (All numbers calculated using YCharts S&P 500 Total Return (SPXTR)).

Fast forward to today, and that $46,327 is now worth $144,225 (without contributing another dime). The return over the last nine years from April of 2013 to today is 211% total or 13.5% annualized.

Down markets benefit savers

Talk of a “lost decade” or a looming recession are scary because the future is unknown. Looking back at history, though, we can see that consistent investors made money even during the period of time following the Great Depression and in the years after the Great Recession of 2008. A period of time where the market is “flat” will never be completely flat – the chart I used earlier is anything but flat – and all these dips and valleys allow investors to make money in periods where the market may not (at least when measured from start to finish).

While checking your accounts may not be fun when the market is down, dollars invested are extremely powerful. It’s possible to make money when markets are “flat,” even over longer periods of time lasting years or decades. The best thing you can do during periods of market volatility is focus on your savings rate instead of being overly concerned with day-to-day fluctuations in the market.