The Federal Reserve slashed interest rates to effectively 0% at the beginning of 2020 to combat the sharp drop in demand and sharp rise in unemployment caused by the Covid-19 pandemic and shutdown of businesses across the country. Before 2020 rates had risen to just over 2%, but for the better part of the decade interest rates have hovered at and around 0%.

Earlier this month, in the midst of rising inflation and difficulty filling job openings, the Federal Reserve announced that it was accelerating plans to remove monetary support from the economy. This monetary support includes purchasing and holding securities, such as Treasury securities and mortgage-backed securities, and keeping interest rates low to encourage borrowing and increase consumer demand.

How do low interest rates help the economy?

The benchmark interest rate set by the Federal Reserve determines what consumers and businesses pay to borrow money. If interest rates are low, money is cheap; borrowing is encouraged and demand for goods increases. In times when the economy slows down, the Federal Reserve lowers interest rates as a way to spur consumer demand and economic growth. If people can borrow money cheaper, they’ll buy more houses, cars, and TVs.

At a certain point, the supply of cheap money outpaces the supply of goods and services that consumers want. We’re all seeing this happen across the country and across the globe. People are having trouble buying the goods they want, from houses to cars to consumer electronics and even household staples like cream cheese. Part of the supply problem is caused by well-documented supply chain issues, but others are simply caused by an increase in demand due to the availability of cheap money. More homes are forecast to be sold in the United States in 2021 than in any year since 2006 (and this isn’t solely due to consumers who put off buying a home in 2020 because of the pandemic buying homes; more homes were sold in 2020 than in 2019). The price of gasoline, which reflects the increased “demand” by consumers to travel and go on vacations, is at its highest level since 2014.

How inflation can hurt the economy (and consumers)

In the second quarter of this year, inflation was at its highest rate since the early 1980s – prices were up 2.05% from the previous quarter, or 8.19% annualized. Inflation came in at 1.62% last quarter, or an annualized rate of 6.47%. The Federal Reserve officially retired the word “transitory” and acknowledged inflation, or price changes, could no longer be considered short-term. This doesn’t necessarily mean we will be experiencing higher inflation for years to come, but it does mean prices likely aren’t going down anytime soon as some had hoped.

Earlier in the year, the belief was that as factories and workers resumed normal operations everything would begin to return to normal; supply of goods and services would increase enough to meet consumer demand and prices would moderate. We are still seeing shortages in many areas of the economy, and higher prices are no longer restricted to PlayStation 5s and used cars. Everyone in the country is feeling the impact of inflation, from the gas pump to the grocery store.

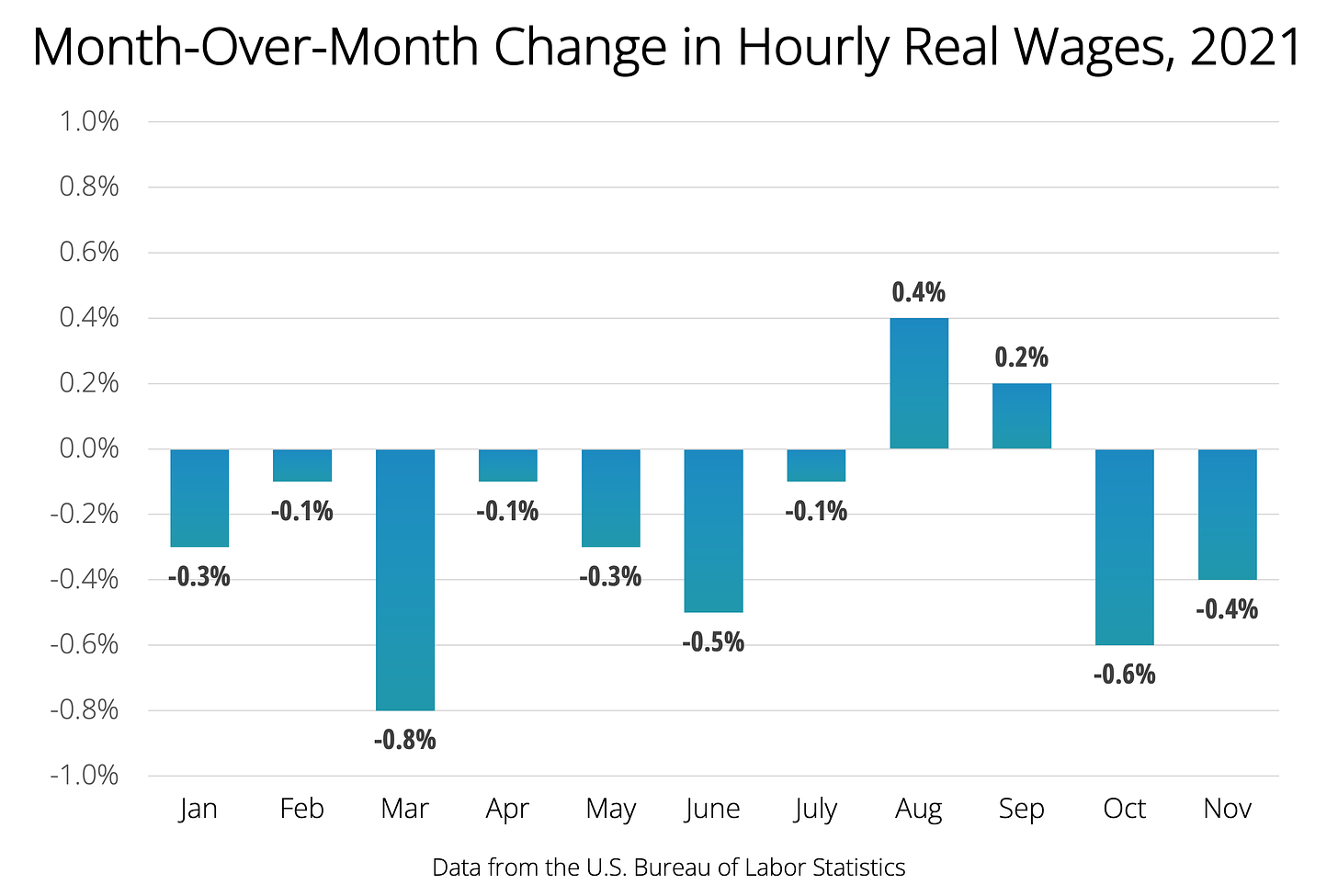

Almost nobody likes inflation. Workers that haven’t received raises in a year might essentially be receiving a 6% to 8% pay cut courtesy of inflation. Workers that have received raises might still be getting a small pay decrease, after inflation, or might be getting just enough to keep up with inflation. Across the United States wages are “rising,” but after accounting for inflation, real wages are actually going down month after month. The chart below shows the month-over-month percent change in real hourly wages since the beginning of the year. Overall, real wages are down 2.62% so far in 2021 (data for December is not yet available).

Will the Federal Reserve be able to rein in inflation?

The Federal Reserve expected inflation to self-moderate to a degree this year, but instead they will be forced to deploy measures to combat inflation sooner than expected. The majority of Federal Open Market Committee (FOMC) members recently projected three interest rate hikes in 2022. Some predicted less and one member predicted four hikes. Raising rates three times in 2022 would bring the baseline interest rate range to 0.75% to 1.00%.

Raising interest rates three times in 2022 is a drastic shift in the position of the majority of board members from earlier this year. In March, 14 of 18 FOMC members projected rates to remain at the same level through 2022; 11 of 18 members projected rates to remain unchanged through 2023. Most members did not project rates rising until 2024. Now every single member of the FOMC projects rates rising next year, with most foreseeing three hikes.

The need to raise rates is not necessarily a bad thing; it means the Federal Reserve is able to withdraw support from the economy earlier than expected. They are withdrawing that support, however, to moderate inflation. Will raising interest rates help bring down inflation?

Higher interest rates mean consumers will be able to borrow less and will have less to spend on goods like cars and houses. When making a purchase, many consumers only consider the monthly payment. Let’s assume an average American wants to buy a new car. They might take out a 72 month loan, the average auto loan term for new vehicles (our rule of thumb for new car purchases is to put 20% down, pay the loan off in 3 years or less, and keep all of your car payments to 8% of your gross income or less).

The price of the car might not be that important; they just know they can spend $500 per month. If they are able to get an interest rate of 2% on their new car, they can borrow $33,897. If the lowest interest rate available to them goes up to 4%, they will now be able to only take out a loan for $31,959. This hypothetical consumer (that’s representative of how many Americans spend and think about money) will have 5.7% less to spend on a new car because interest rates went from 2% to 4%.

Substitute cars for houses, student loans, or almost anything; as interest rates rise, consumers are able to spend less on goods and services they are borrowing to pay for. As the cost of borrowing increases, Americans are forced to cut back. Maybe they purchase a smaller car, a smaller house, or chip away at their credit card balance since the interest rate has gone up. This helps moderate inflation: if money isn’t as cheap, demand and price increases should slow down.

Raising interest rates also encourages saving. Consumers are more likely to deposit money in a savings account rather than spend it if they are making 2% instead of 0%. Holding cash when savings accounts and cash-equivalent vehicles are paying near 0% doesn’t seem very prudent; when interest rates rise, saving in cash-equivalent accounts becomes more attractive, and when consumers choose to save rather than spend, this also helps moderate inflation.

What can a Financial Mutant do about rising interest rates?

Rising interest rates hurt borrowers; you can help protect yourself from rising rates by eliminating consumer debt like credit card debt. In the next few years, interest rates on cars and houses might get higher. If you own a house already but haven’t looked at interest rates in a few years, now might not be a bad time to consider refinancing and locking in a low interest rate (you can grab our free refinancing guide on our website). If you don’t have a house yet but are considering buying, the potential of rising interest rates doesn’t necessarily mean you need to run out and buy a house so you can lock in low interest rates; higher mortgage rates could hurt demand for housing and stabilize home prices.

So much about inflation and monetary policy has changed and evolved throughout 2021. The only thing we know for certain is it will continue to change and evolve with the economy next year. Experts don’t know exactly what will happen – remember, at the beginning of 2021 the consensus was that interest rates would remain at 0% until 2024, and now the consensus is rates will rise next year – and projections and opinions are certainly subject to change.

The uncertainty surrounding inflation and interest rates can be frustrating. We like control of our lives and especially of our money. Spending more and more on gasoline and groceries each month doesn’t make one feel in control of their money. To keep yourself sane, it’s important to focus on what you can control. We know one of the best hedges against inflation is owning things, like stocks and real estate. Getting rid of any consumer debt will help protect you from rising interest rates. While inflation and monetary policy might be beyond your control, your financial future is firmly in your own hands. Focus on that instead of what you can’t control.