If you are trying to buy your first home right now, you are probably not having a great time. Mortgage rates are low, but buying a home has rarely been more difficult, especially for first-time buyers. Low inventory and high demand has caused home prices to skyrocket over the last year and a half, frustrating buyers and causing more investors to enter the market. Why is it so hard to buy a home and how can you make it easier?

Why it’s so hard to buy a home

It’s obvious to anyone even remotely paying attention to the housing market that there is a severe lack of supply, particularly for entry-level homes. The shortage of housing units nationwide has reached 3.8 million, and only 7% of homes constructed in 2019 were entry-level homes (homes 1,400 square feet or less). In 1980, 40% of homes constructed were entry-level homes.

The lack of entry-level homes on the market can partially be explained by a change in consumer preferences to favor larger houses, but the increased cost of building materials and labor have also played a significant role. It simply isn’t as profitable to build smaller houses, and while the demand may be there, the demand is also very strong for larger houses. Developers have no reason to focus on smaller homes when medium- to large-size homes are more profitable.

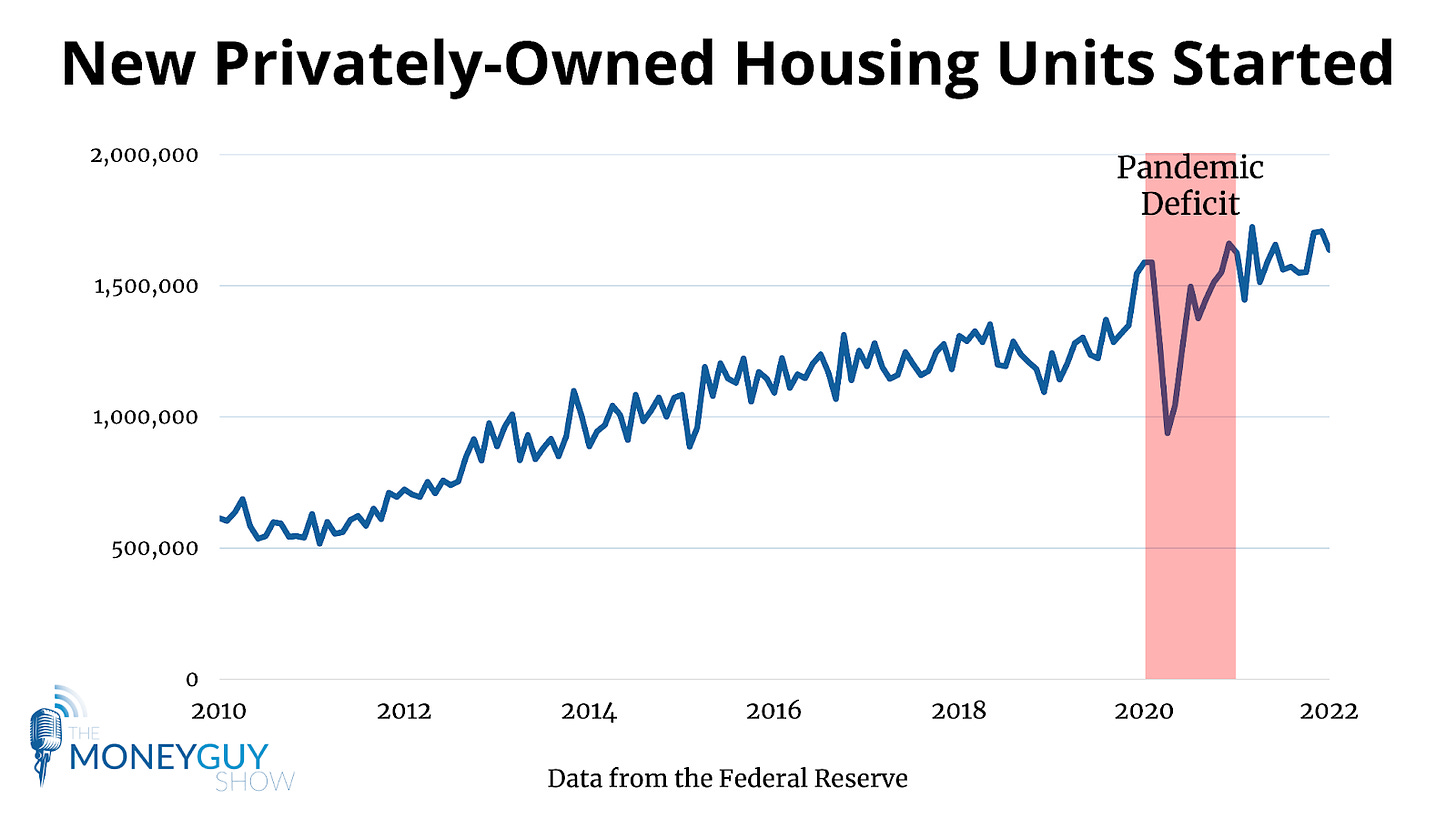

While there is a big shortage of entry-level homes, it isn’t like those searching for larger homes are having an easier go of it. Although new housing starts have approached pre-pandemic trends, the deficit created during the pandemic has not been made up.

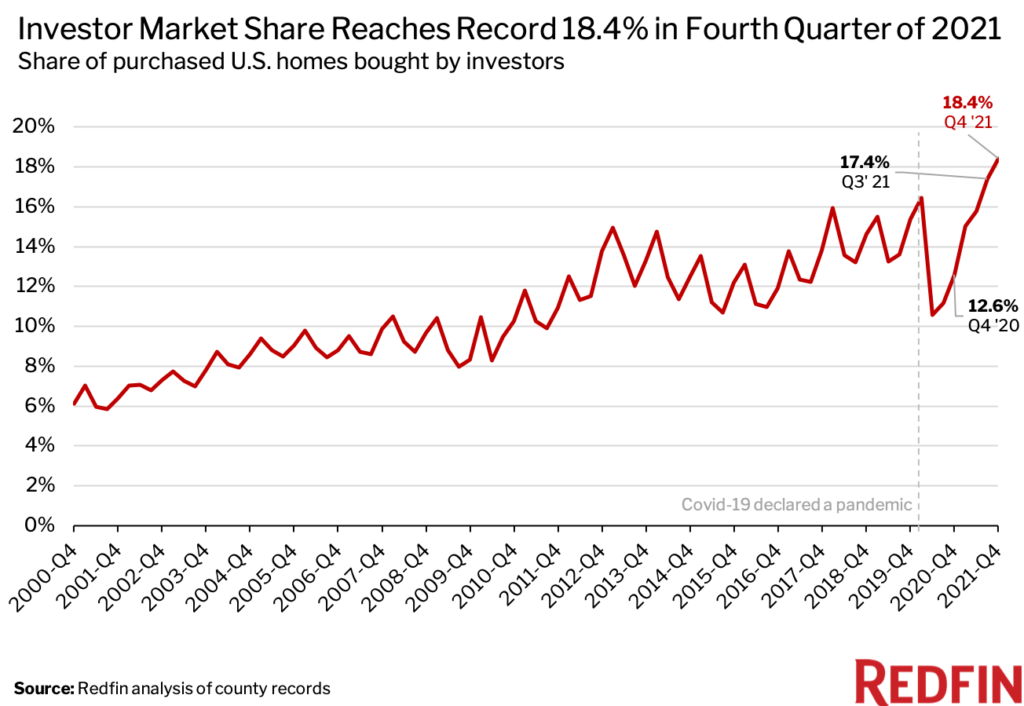

Making matters worse are investors swooping in at record numbers to buy homes. 18.4% of homes in the U.S. sold in the fourth quarter were purchased by investors, the highest percentage ever recorded.

What is bad news to those looking for a home for their family – rapidly increasing housing prices – is seen as an opportunity for investors. Investors are able to receive more in rent, which is also skyrocketing, and many look to “flip” homes for a quick profit. Over 75% of investor home purchases were paid for in cash in the fourth quarter, something other homebuyers will find difficult to compete with. Low-priced homes are still the most popular for investors, but mid- and high-priced homes have surged in popularity since the beginning of 2020.

The United States was experiencing an affordable home shortage before the pandemic, and it has only gotten worse since. The number of new home starts dropped off a cliff, and that deficit has not been made up. Americans stuck working from home suddenly had the freedom to live anywhere they wanted, and many began migrating to different states that did not (and do not) have the housing supply to meet their demand. Investors saw rising housing prices and rents as an opportunity to increase their cash flow or make a quick buck flipping a property. How exactly can you buy your first home the right way when there’s a housing shortage and a record number of homes being bought by investors?

How to buy a home the right way

Patience and flexibility are key when searching for a home. You may not be able to find the perfect home in the perfect location with everything you want at a price you can afford. Sacrifices come in all shapes and forms; maybe you look for a smaller home, or one a little farther away from work. Or maybe you choose to wait a little longer before purchasing your first home. While build times may be longer, constructing a new home could potentially be less expensive than buying from existing inventory if you live in a hot housing market.

One of the worst things you could do while searching for a home is become impatient and make a mistake. Buyers now are waiving inspections, getting into bidding wars, and buying homes without ever stepping foot on the property. The lack of supply can create a frenzy among buyers; don’t get caught up in the madness and make any housing mistakes. Unlike some other financial mistakes, making a mistake when buying a home could cost you hundreds of thousands of dollars.

There are some ground rules you should aim to follow when buying a home. It is very important to make sure you plan to be in the home for at least five years, especially if you are buying your first home and putting less than 20% down. Fluctuations in the housing market could make it impossible to move if you became underwater on your mortgage. Aim to keep total housing expenditures below 25% of your gross income; in our current environment, that may be impossible in certain markets. It is okay to go over 25%, but you may need to cut back in other areas in order to continue investing for retirement.

Buying a home is a fantastic way to build wealth and “own” more of your life, but there is nothing wrong with renting. If you are planning to be in an area for a shorter period of time, or are in a unique situation where renting is much more affordable than buying a home, it is worth considering. It is often said that renters are just throwing their money away, however homeowners spend money on interest, taxes, maintenance, and repairs, none of which increase the equity in their home. This is not to mention the required downpayment to buy a home, which could be invested elsewhere.

If you are buying a home in these unique times, know what you can afford and what sacrifices you are willing to make. Don’t get caught up in the madness and settle for less or spend more than you can afford. Check out our recent episode, “How to Build Wealth During High Inflation!”, where we discuss how to purchase a home and make other financial decisions during these unique inflationary times.