Last Updated

September 24, 2025

Read Time

Share

Is Budgeting For Everybody?

Budgeting is not about living like a miser.

It’s not about restricting your spending to only the necessities or finding the best budgeting tools. It’s not even about spending less, necessarily. The goal of budgeting is to build financial discipline, allowing you to save money, which grows with time.

These are the three ingredients of wealth creation:

- Discipline

- Money

- Time

No matter whether you have never created a budget before or have been sticking to a budget for decades, “budgeting” probably isn’t fun or something you look forward to.

Budgeting is a means to an end, and that end is creating wealth (i.e., your more beautiful tomorrow). Now that probably sounds more exciting than creating a budgeting spreadsheet. To build wealth, and reach your more beautiful tomorrow, though, it’s important to live below your means. For many people, this means budgeting.

Not everyone needs to budget forever. You may be able to transition to a cash flow management plan where your spending and savings are on autopilot and you don’t track every single expense. This guide is for those who currently budget or would benefit from budgeting. You do prefer to stick to a plan and track what you are spending and where. More importantly, you are able to save and invest more money by budgeting.

Money Guy Budgeting Resources

Personal Budgeting Basics

Copy link to this section: Personal Budgeting Basics

Copied the URL to your clipboard!

Why Budget?

Saving money doesn’t come naturally for everyone. While some are able to live below their means without keeping a close eye on their spending, others thrive by tracking all of their expenses and allocating money according to their financial priorities. At its core, budgeting is a tool to help you save and invest more to achieve your financial goals. This includes investing for retirement, going on vacations, saving for college, or whatever other goals you could achieve with extra cash flow.

When to Budget and How Often?

Budgeting is not limited to a certain age range or phase of life.

You may go through times in your financial life where budgeting is very helpful and other times where you may not need to budget. If budgeting will help you save and invest more money to reach your financial goals, it may be a good idea to budget. The hardest part of budgeting is getting started; once you have a plan in place, regularly reevaluate your spending and make changes to your budget as necessary.

About Budgeting Categories

Just like fingerprints, no two budgets are the same and nor should they be.

Your budget is as unique as you are, and that means what you choose to spend money on and how much you spend in certain categories may look vastly different from others. What’s important is that you are paying yourself first and invest off the top of your paycheck, not what’s left over after spending.

All budgets have some overlap. We all have to eat food, have a place to sleep, and transportation costs (whether that is driving, riding a bike, or public transportation).

Beyond investing for retirement and spending on the necessities, the rest of your budget is up to you and there isn’t a right or wrong way to spend your money.

How to be a successful budgeter

- Be Disciplined and Consistent

The key to being successful budgeting is sticking to it. Some months may be more difficult than others, especially if you are hit with unexpected expenses. To be a successful budgeter you don’t need to have everything go as planned, but you do need to have the ability to adapt to changes and stick to your budget as closely as possible. - Be Realistic

When crafting your budget, it may be tempting to slash excess spending to create plenty of room in your budget to invest and save for your other financial goals. While it is great to have excess money available to allocate in your budget, in order to be successful, your budget must be realistic. Your budget should not be a pie-in-the-sky aspirational goal based on what you wish you could spend, but a realistic plan based on your unique spending habits and lifestyle. - Understand priorities & the big picture

The goal of creating a budget isn’t to spend less than $500 on groceries every month. Or, to limit your transportation spending to no more than $200 per month. The important part of budgeting is to allow yourself to save and invest a little bit of today for your more beautiful tomorrow. If you are investing what you know you need to be for retirement and your other financial goals, it frankly doesn’t matter what you spend the rest of your money on. Successfully budgeting isn’t defined by how well you stick to your allocated spending every month, but how much your budget allows you to invest and save for your financial goals.

Popular Budgeting Strategies

Copy link to this section: Popular Budgeting Strategies

Copied the URL to your clipboard!

Share image

The 50/30/20 Rule

Share image

The 50/30/20 rule is a simple budgeting guideline under which 50% of your net income is spent on needs, like housing, food, and transportation, 30% is spent on wants, and 20% is saved or used to pay off debt.

In theory a simple rule like 50/30/20 is a simple way to effectively budget, but it doesn’t work for everyone. Some may not be able to spend less than 50% on necessary expenses, or as much as 30% on wants.

We believe everyone should invest 25% for retirement, so allocating 20% to both saving and paying off debt may not be enough.

50/30/20 Budget Allocation in a Nutshell:

- 50% – Needs

- 30% – Wants

- 20% – Savings or Debt

The 70/20/10 Rule

Similar to the 50/30/20 rule, the 70/20/10 rule is a guideline for what percentage of your net income to spend on needs, wants, and savings.

Following the 70/20/10 rule, 70% of your income is spent on needs, 20% on savings, and 10% on wants. This rule may be easier to follow for those who need to allocate a larger portion of their income to necessary expenditures, but fixed percentage rules can be rigid and may not be right for everyone.

70/20/10 Budget Allocation in a Nutshell:

- 70% – Needs

- 20% – Savings

- 10% – Wants

Pay Yourself First

How most think of budgeting traditionally is prioritizing bills and necessary expenditures first, and saving (or spending) what is leftover.

Under the “pay yourself first” method of budgeting, saving and investing is prioritized along with necessary expenditures like housing, food, and transportation. Reprioritizing saving and investing as a necessity instead of on the same level as frivolous spending or fun money can be a great way to build financial discipline and invest more for the future.

PYF in a Nutshell:

- Savings, investments, and essentials first

- Fun second

Zero-Based Budget

Zero-based budgeting, also called the envelope system, is a method of budgeting where every single dollar of income has a job.

Under zero-based budgeting, all the money you make is allocated to where it will be spent or saved. If you made more money than you expected in one month, or have money left over after budgeting, you would still need to assign that leftover money to savings and give it a job.

The magic of zero-based budgeting is that you feel like you have no excess money every month once all of your income is assigned a job. Many proponents feel it makes it easier to control spending and live below your means without extra income to spend.

Zero-Based in a Nutshell:

- Give every dollar a job.

Loud Budgeting

The idea of loud budgeting has become popular in recent years and the idea behind it is to not be afraid to say no to spending money.

For many of us, a significant portion of the money we spend every month is, in part, caused by some sort of social pressure. This social pressure isn’t always bad, but it can become a problem if you are spending money on things you don’t value or are living beyond your means.

While it can be very difficult and even embarrassing to cite your budget as a reason for avoiding spending money with friends or family, setting boundaries with your spending will help you stick to your budget and focus on your true financial goals.

Loud Budgeting in a Nutshell:

- Communicate your financial boundaries in social situations.

Popular Personal Budgeting Apps

Copy link to this section: Popular Personal Budgeting Apps

Copied the URL to your clipboard!

Share image

YNAB

Share image

YNAB, a budgeting software based on zero-based budgeting, is one of the more popular budgeting tools and has been around for over 20 years now. It offers integration with most major banks and credit card companies to automatically track your expenses, and apps for most major devices so you can budget on your phone, computer, or tablet wherever you go (exciting, right?). YNAB is great for those looking to use a zero-based budget with premium software. YNAB is currently priced at $109 per year or $14.99 per month.

- Website: https://www.ynab.com/

Monarch Money

Monarch Money increased in popularity after the popular budgeting app Mint shut down in 2024. Users praise the UI and design of Monarch, and Monarch is flexible enough for power users to tweak settings to their liking while user-friendly enough for beginners. It’s priced at $14.99 per month or $99.99 per year.

- Website: https://www.monarchmoney.com/

PocketGuard

PocketGuard is a slick budgeting app with all of the features you’d expect: add financial accounts, budgeting categories, create custom financial goals and debt payoff plans. Some users report experiencing bugs or issues in the app, but it is a more price-friendly alternative to some of the big names. It offers a free version and a paid version called PocketGuard Plus at $12.99 per month or $74.99 per year. For those who dislike recurring subscriptions, there is a lifetime license available (but the price is a mystery).

- Website: https://pocketguard.com/

Goodbudget

Goodbudget uses the envelope-based budgeting system like YNAB and EveryDollar. The UI and design of Goodbudget is more basic than other apps, so it would be good for beginners but might not work for power users. It offers a free version and a premium version at $10 per month or $80 per year. Premium users receive access to additional features including unlimited envelopes, automatic bank sync, support for multiple devices, and 7 years of transaction history.

- Website: https://goodbudget.com/

EveryDollar

EveryDollar, created by Ramsey Solutions, is another envelope-based budgeting app. The interface and design are sleek and modern and it offers most of the features you’d expect out of a budgeting app. However, users report issues with adding some credit cards and importing transactions, so it may not be the app for you if you are a credit card user. The basic version is free, while the premium version costs $79.99 per year or $17.99 per month.

Empower Personal Dashboard (formerly Personal Capital)

The Empower app is mainly a financial tracking tool, but it does include some budgeting features, which users say are lacking.

This app may be worth checking out if you are more interested in tracking your financial accounts than budgeting, but isn’t a good choice for users looking primarily for budgeting software. The app is free to use.

Emma Budgeting App

Emma launched in the UK and later became available in the US and Canada, but the app still appears to be mainly geared towards those in the UK. The app has a very modern interface and offer budgeting and financial tracking. Emma has a three-tired pricing structure, offering Emma Plus at $4.99 per month, Emma Pro at $9.99 per month, and Emma Ultimate at $14.99 per month.

- Website: https://emma-app.com/

Simplifi

Simplifi is a great budget option (see what we did there?) if you are looking for an affordable budgeting app with a minimal but modern interface. The price of Simplifi for personal use starts at $3.99 per month, billed annually.

Want to learn more about the Money Guy take on budgeting apps? Check out the video below!

Budgeting Pro Tips

Copy link to this section: Budgeting Pro Tips

Copied the URL to your clipboard!

Savings Automation

Make investing and saving money as easy as possible and set up automatic contributions to your retirement account(s) and savings account each month. Don’t be afraid to start small with as little as $20 per month.

The important part is to rewire your brain to believe that saving and investing is just as important as paying your mortgage or buying groceries.

Curb Impulse Spending

You can’t control every unexpected expense that impacts your budget, but you can control impulse spending. We don’t want you to never spend money on a whim again, but before you do, take time to evaluate how it will impact your budget and your savings goals.

If you know you struggle with spending impulsively, there are some psychological tricks you can employ to spend less. Instead of buying something you want immediately, write it down and tell yourself that if you still want it just as strongly in a month, you can consider buying it.

More often than not, your desire won’t be nearly as strong in a month’s time. If it is, the expense is likely important enough to make its way into your budget.

Psychology of Budgeting

Everyone has to choose how to allocate their financial resources, whether they budget or not, but the goal of budgeting, to live on less than you make so you can save for the future, isn’t natural. We live in a world of instant gratification, where we expect to reap the benefits of earning money as soon as possible, often before even earning the money in the first place (like with spending on credit cards).

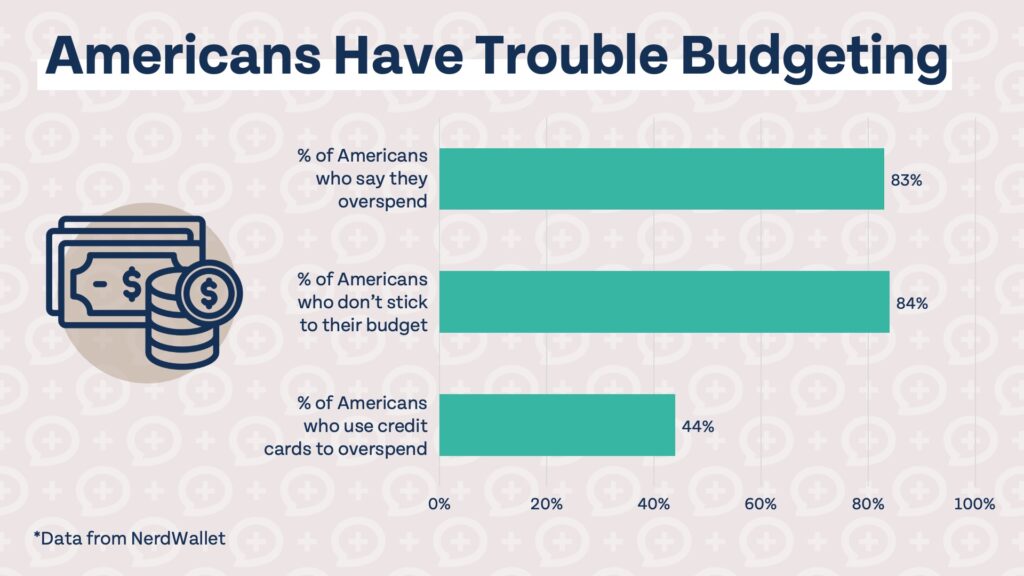

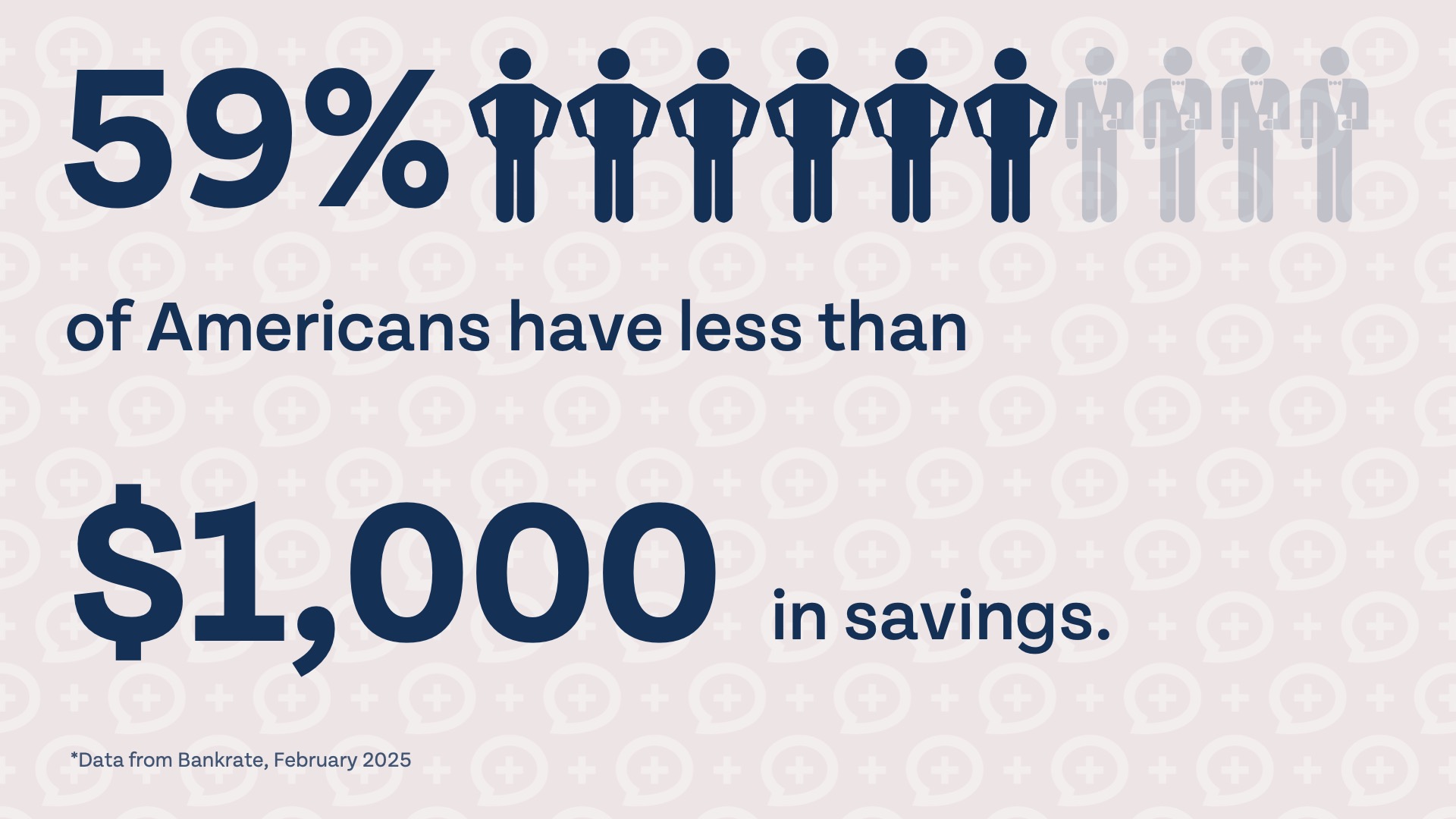

Budgeting is countercultural, especially in the US where over half of the population has less than $1,000 in savings. Don’t expect budgeting to come naturally or be easy, but if you have the discipline to stay committed and find a way to make it work, the rewards will be immense.

Share image

Get Budgeting & Personal Finance Tips Weekly

Stay inspired. Connect with others on the wealth-building path.

How To Budget The Money Guy Way - A Step by Step Guide

Copy link to this section: How To Budget The Money Guy Way - A Step by Step Guide

Copied the URL to your clipboard!

How does one actually start budgeting? Whether you’re a student that just started their first job looking to start off on the right foot with your first real income or haven’t used a budget in decades, use this guide to get started budgeting and building your more beautiful tomorrow.

- Choose a Personal Budgeting Tool that Works for You

Pick a tool to start budgeting with that you believe could work for you. Old school? Maybe a spreadsheet would work for you, or even pen and paper if you’re feeling froggy. Like technology and slick software? Try out some popular budgeting apps, most of which offer free versions or trial periods. You don’t have to pick one and stick with it, so feel free to try as many different tools as you need until you find the perfect budgeting tool for you. - Where your Money is Going?

Before you can allocate where your future dollars should go, you need to know what you are spending and making now. When it comes to spending habits, past financial behavior is a pretty reliable indicator of future behavior. It’s always possible to change how you spend money, but smaller and incremental changes are much more likely to stick than drastic, unrealistic changes. For this step, download all of your bank and credit card statements for the last month and use your budgeting tool to analyze your spending and income. Does anything surprise you or stick out? Are there areas where you anticipate or desire change? - Plan your Budget

Now it’s time to actually budget! We believe paying yourself first allows you to prioritize saving and investing, and our guidance is to consider investing 25% or more of your gross income for retirement.While you can’t immediately change what you spend on big expenses like auto loans, your mortgage, or student loans, keep our Money Guy rules in mind when deciding how to budget going forward:- Keep your total car payments below 8% of your gross income

- Total housing expenditures below 25% of your income

- Total student debt below your expected first year salary after graduation.When planning out your budget and prioritizing investing and saving for the future, big changes to your current spending habits may or may not be required. If big adjustments are required, it may be easier to implement (and stick with) incremental changes rather than trying to make drastic changes instantly.

- Track your Progress

An often overlooked part of budgeting is monitoring how you are doing and making adjustments as necessary. If you overspend in the same categories every single month, look for expenses that can be reduced to allocate more to those overspent categories instead of hoping next month will be different. It’s important to be proactive when it comes to fixing problems in your budget instead of waiting for issues to resolve themselves (which may never happen). - Automate your Financial Life

You may reach a point where it isn’t necessary to track every single expense and budget every dollar you make. If you can save and invest adequately without following a strict budget, a cash flow management plan may be more appropriate for your financial life.

Budgets for Different Life Stages

Copy link to this section: Budgets for Different Life Stages

Copied the URL to your clipboard!

Young & Getting Started

Getting off on the right foot with money when you get your first job likely means starting a budget.

Open a Roth IRA and start investing for retirement at a young age, even if you don’t have much to save. Although your income is probably relatively low when you are younger, you may also have fewer expenses if you are single and living with your parents. If you can successfully build the habit of budgeting at a young age, your future self will thank you.

The Messy Middle

In the messy middle, the days are long and the years are short.

It’s not uncommon to also be short on money, which makes budgeting all the more important. No matter how disciplined you’ve been budgeting in the past, it is never too late to implement and stick to a budget.

In Retirement

Budgeting your money in retirement can be trickier than when you were working.

Unlike your working years, you no longer have much control over your income and may have to make tough decisions about what you’d like to prioritize in your budget. If you haven’t already, it may be a good idea to meet with a fee-only, fiduciary financial advisor to get a professional’s opinion about where you stand financially and how much you can sustainably spend in retirement.