The Free Application for Federal Student Aid, or FAFSA, determines how much you or your child may receive in financial aid, but not many understand how it works. What exactly affects how much financial aid you or your child will be eligible to receive? How is it calculated? Perhaps most importantly, how can you maximize your chances at receiving the proper amount of federal aid?

What is FAFSA?

Students seeking aid for college, including federal grants, loans, and work-study, are required to fill out FAFSA annually to determine eligibility. In addition to determining eligibility for federal aid, many states and colleges use FAFSA information to determine eligibility for state and school aid, and some private lenders may use FAFSA to determine eligibility for loans. Almost everyone who attends college needs to fill out a FAFSA.

When can I submit FAFSA?

The application becomes available on October 1st of every year for students attending college the following calendar year. For students attending the 2022-23 academic year, they are eligible to fill out FAFSA as early as October 1, 2021. The federal deadline for submitting the application, for students attending 2022-23, is June 30, 2023. Deadlines for states and colleges vary.

The generous timeframe doesn’t mean you should wait until the last minute to file. The earlier you file, the more grant money you or your student are likely to receive (so do it now!). It is best to file as early as possible every year, so if you have a student in college, go ahead and mark your calendar for October 1st every year.

What do I need to submit FAFSA?

Speaking from experience, the most important thing students need to complete their application are their parents. The following information must be provided, from both students and parents (independent students may file with only their own information):

- Your Social Security number (or alien registration number if not a citizen)

- Federal income tax returns and W-2s (if you have an IRS online login, you may use their data retrieval tool to transfer data automatically)

- Bank statements and records of investments

- Records of untaxed income

- An FSA ID to electronically sign the application

What are the different types of need-based financial aid?

Need-based financial aid includes the following:

- Federal Pell Grants

- Direct Subsidized Loans

- Federal Perkins Loans

- Federal Work-Study

- Federal Supplemental Educational Opportunity Grant (FSEOG)

How is aid calculated?

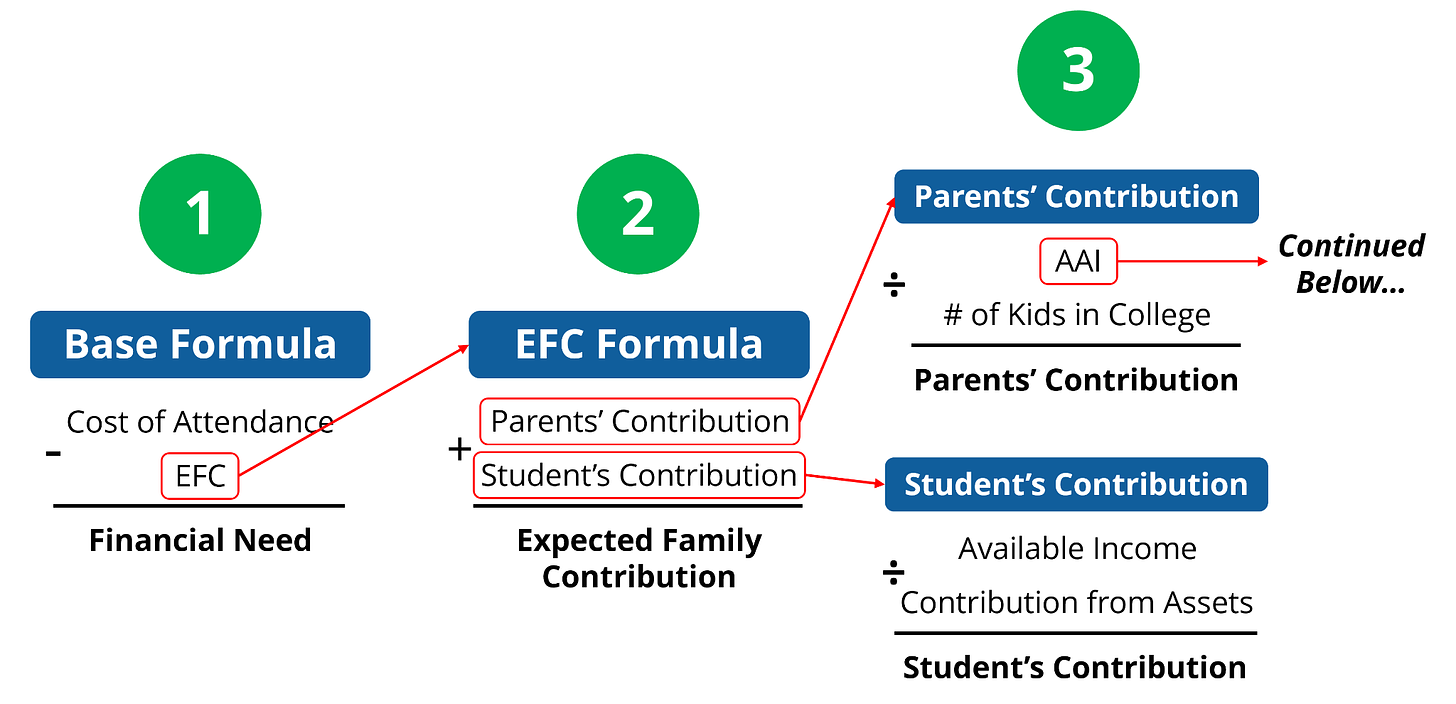

The formula for determining the amount of need-based financial aid a student is eligible for is Cost of Attendance (COA) ? Expected Family Contribution (EFC) = Financial Need. The cost of attendance is provided by the college you or your child will attend, and the expected family contribution (EFC) is the mysterious variable that not many families understand completely.

What is EFC (expected family contribution) and how is it calculated?

The EFC determines how much need-based financial aid you or your child will receive, or if you will receive any at all. For dependent students, the expected family contribution is how much the students and parent(s) are expected to be able to contribute towards college costs. The Department of Education releases a detailed breakdown of the EFC formula every year (it can change slightly from year-to-year, but usually doesn’t change much). The formula to determine the parents’ contribution (the parental half of the EFC number) is Adjusted Available Income (AAI) ÷ Number of Children in College = Parents’ Contribution.

The simple formula for determining the student’s contribution is Available Income + Contribution from Assets = Student’s Contribution. To get the EFC, you simply add up the parents’ contribution and student’s contribution. Like an onion or an ogre, the FAFSA formula has many different layers, and right now we’ve only scratched the surface. The next layer down is available income.

How is available income determined?

Parents’ total income includes taxable income, untaxed income, and benefits. If the parents’ taxable income is less than $27,000 (2021), and they meet one of three conditions (filed taxes, eligible to file taxes, or not required to file taxes), the EFC is automatically $0. Allowances against parents’ income include federal income tax paid, state and other taxes, Social Security tax allowance, income protection allowance, and employment expense allowance. Total Income – Total Allowances = Available Income. To get adjusted available income (AAI), just add the parents’ contributions from assets to their available income.

The student’s total income includes taxable income, untaxed income, and benefits. The student allowances include federal income tax paid, state and other taxes, Social Security tax allowance, income protection allowance, and an allowance for parents’ negative AGI. Total Income – Total Allowances = Available Income.

What assets are included in the “contribution from assets” number?

The big question that everyone wants to know: what assets are included in calculating the parents’ contribution from assets? Assets included are:

- Cash, checking, and savings accounts

- Net worth of investments*

- Adjusted net worth of business/farm

*Investments include but are not limited to real estate (excluding primary residence), trust funds, mutual funds, CDs, stocks, bonds, and commodities. 529 plans and Coverdell savings accounts are included in investments. Life insurance, pension funds, annuities, and non-education IRAs do not count as investments.

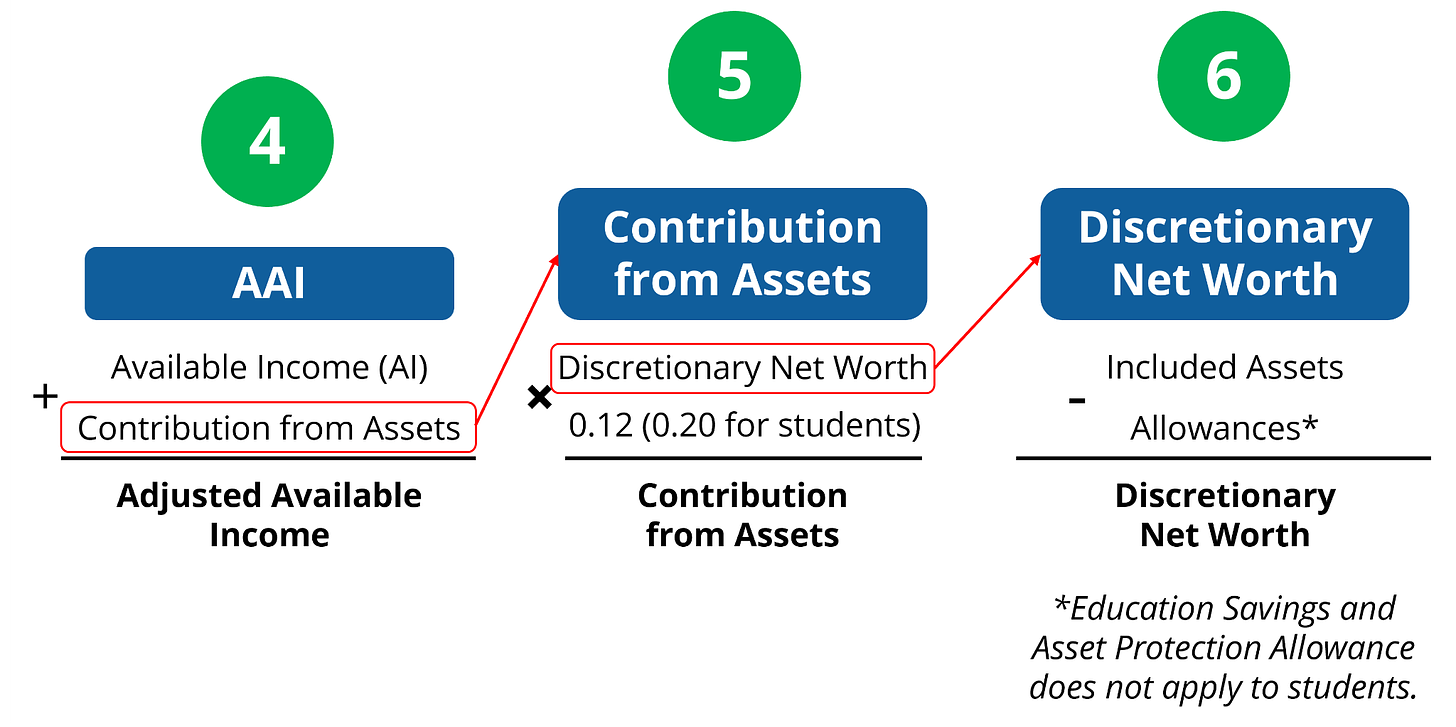

The formula for determining parents’ contribution from assets is Discretionary Net Worth × 0.12 = Contribution from Assets, where Discretionary Net Worth = Included Assets – Education Savings and Asset Protection Allowance.

The student’s contribution from assets is determined using the same formula, with a few minor differences:

- The student can not take an education savings and asset protection allowance, and

- The asset conversion multiplier is 0.20 instead of 0.12.

The following illustration shows how FAFSA and the EFC is calculated. If you’re a visual learner, this illustration will be much easier to understand than the paragraphs above.

Other factors that affect need-based financial aid

Enrollment status, maintaining satisfactory academic progress, and year in school also affect need-based financial aid. Students must be enrolled or accepted into an eligible degree or certificate program, and for direct loans students must be enrolled at least half-time. Other conditions may apply in different states or at different colleges.

Knowing exactly how FAFSA is calculated, what documents you need, and when deadlines are should make applying to college and for financial aid that much less stressful and scary. Remember, apply as early as possible every year to get the best chance at receiving more aid. For more information about how to best save for college, check out this article: “The Best Ways To Save for Kids” and this episode of the show: “The Best Ways to Save and Pay For College.”